A report by the task force is out and recommends the revamp of income tax rate slabs and implementation of capital gains tax system to increase the revenue for the government by Rs 55,000 crore and beyond.

The information about this suggestion of task force especially appointed to track inefficiencies in indirect tax system & to recommend measure for revenue addition has been given by two individuals who are in the know of the report’s content. One of them said, “There could be an overall gain in revenues if the recommendations are implemented in full.”

The report prepared by a task force with Akhilesh Ranjan, member of the Central Board of Direct Taxes member, as convenor and K Subramanian, chief economic advisor, as a member, was submitted on 19th August 2019. Government has started reconnoitring the report by the task force and it is also anticipated that some of the proposals will be hypostatized in the forthcoming budget.

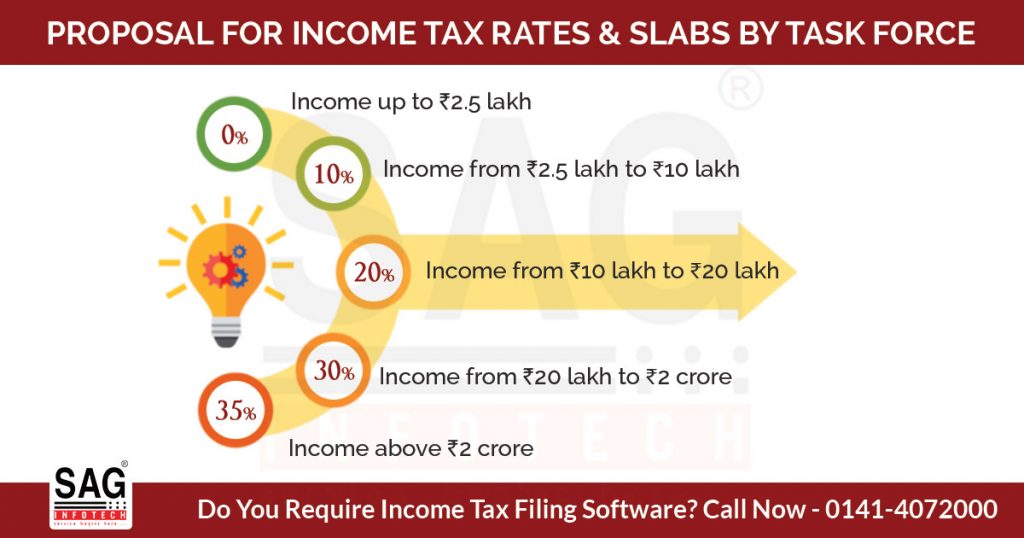

According to the task force’s suggestions, income up to Rs 10 lakh should under the tax rate slab of 10%, however that of between Rs 10 lakh & Rs 20 lakh and Rs 20 lakh & Rs 2 crore should come under the tax rate slab of 20% and 30%, respectively. They recommended the income above Rs 2 crore to be kept under a tax rate of 35%.

No word of advice has been made for the existing threshold of income exempted from tax. Changes have been recommended only for the income that currently attracts taxes. The existing income tax rate for income

Besides, other proposal knocks off the litigation and resumption of assessment for assessees who have declared & paid higher income tax along with interest & 50% penalty for at least 6 years in the past. This step has been proposed to increase the revenues as “It has been seen that taxpayers do not pay higher taxes for a past period for fear of reopening of assessment and prosecution,” stated by the second person with knowledge about the content of the report.

Recommendation to rip out the surcharge that varies between 15% to 37% has also been made in addition to the proposal to confine the deductions present for the individuals on the provident fund, housing loan, charity and expenses related to medical & education.

At present, many deductions are available for individuals in place of interest in equity-linked savings, Fixed Deposits savings, insurance, etc. Such deductions shall be removed as per the suggestions of the task force. Suggestions to curtail and remove deductions have been made to boost the revenue for the government.

The taskforce has implied three categories – equity, non-equity financial assets and all other assets including property under the capital gains tax mechanism while restricting Indexation benefits to the last two kinds of assets only.

Proposals have been made for levying 10% long-term capital gains (LTCG) tax and 15% short-term capital gains tax on profits made by selling equity assets owned for more than a year and a shorter period of less than 12 months, respectively.

However, 20% LTCG tax with indexation has been suggested on gains from selling non-equity financial assets possessed for over 2years. For all other assets, tax @ 20% with indexation on sale on sale of assets held for 3 years, has been proposed.

Under the current scenario, equity-based mutual funds, preference shares, equities, zero-coupon bonds, Unit Trust of India units held for over one year; Real estate held for more than 2 years; jewellery, debt-oriented mutual funds held for over 3 years, comes under the category of long-term assets.

Tax on employee stock option plans to motivate the startups is also a recommendation by the task force

Other suggestions by the task force include 25% tax for foreign companies, 15% branch profit tax for foreign companies if they shift back to their own country, removal of dividend distribution tax & its replacement with tax dividends for the recipient, extension of the presumption taxation to broaden the tax base.