A new feature has been launched by the Income Tax Department on its e-filing portal to allow rectification requests to the AO for incorrectly filed ITRs. This option enables taxpayers to submit rectification applications for assessment orders issued by the AO under Section 154 of the Income Tax Act, 1961, directly to their Assessing Officer (AO) online.

Currently, the Income Tax portal provides provisions to request rectification of past orders via CPC and CIT(A). By implementing the online rectification process, the assessment order issued by the Assessing Officer helps taxpayers avoid submitting rectification requests manually or raising a grievance. However, this also reduces unnecessary measures.

Section 154 of the Income Tax Act permits taxpayers to request the correction of errors stated in the records of their income tax orders. Such errors might comprise clerical mistakes, calculation errors, or other discrepancies that require correction. Earlier the rectification process comprised various steps and manual interactions directing to the delays and inefficiencies.

Now the taxpayers can submit the rectification requests to their AO via the income tax portal. The taxpayers via introducing the update can ask the Assessing Officer(AO) to correct the mistakes or errors in the assessment order at the first phase itself online.

Steps to E-file Rectification Request Online

The updated system permits the taxpayers to submit the rectification requests online irrespective of who carries the access rights:

- Go to the Income Tax e-filing portal and log in with your credentials.

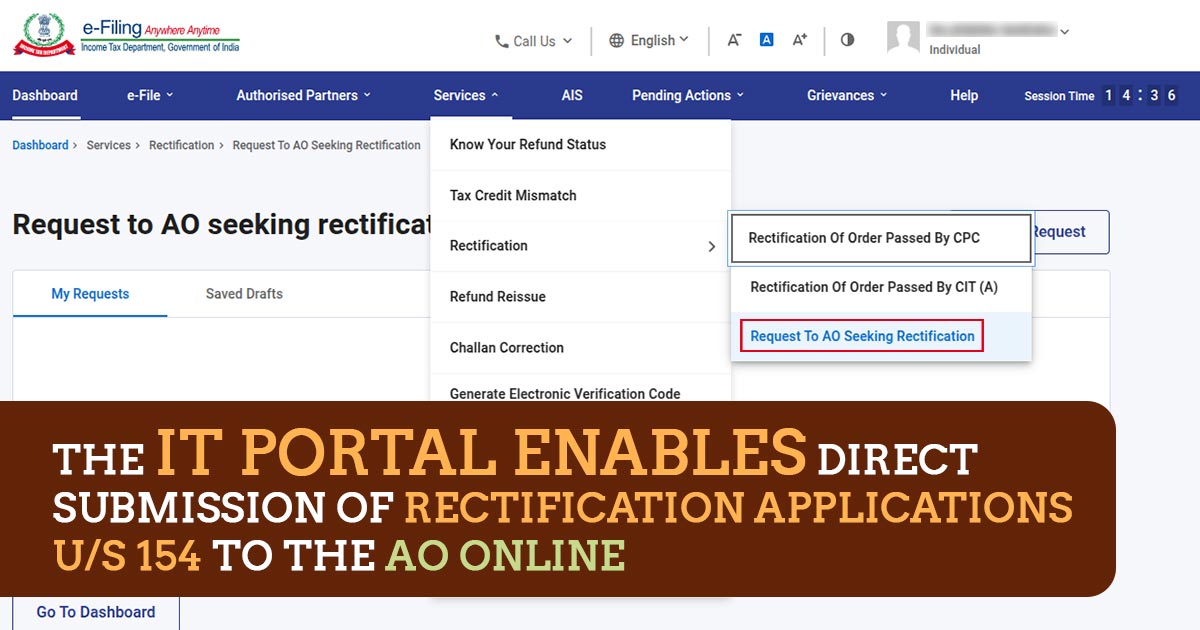

- Proceed to the ‘Services’ tab and select ‘Rectification’ from the dropdown menu.

- Select ‘Request to AO Seeking Rectification.’

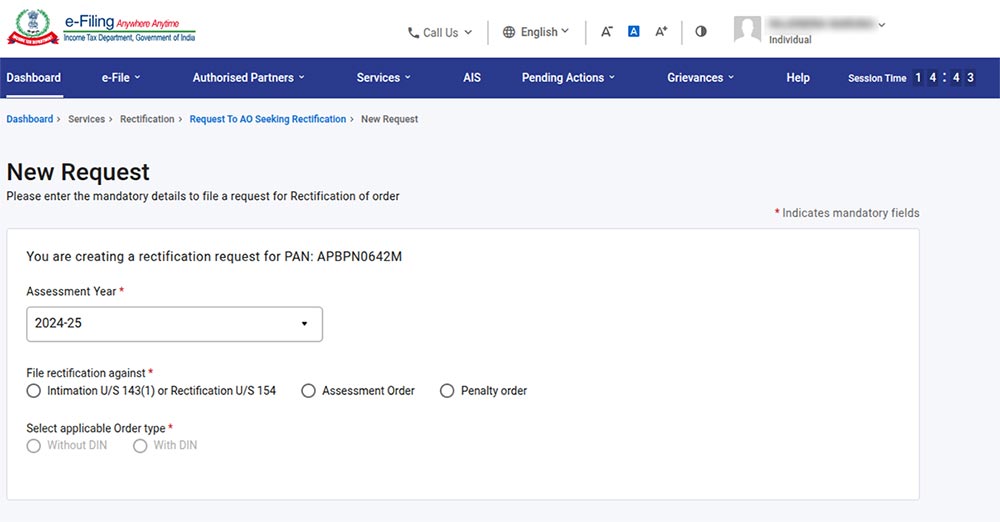

- Tap ‘New Request’ and furnish the critical details to complete your rectification application.

Advantage of Rectification Request Online

The updated feature is assisted to solve the problems like-

- Income mismatches: Differences between the income reported and tax records.

- Errors in tax credit: Missing or wrong Tax Deducted at Source (TDS) credits.

- Exemption omissions: Apart from the eligible deductions or exemptions.

Most Important FAQs to Rectify Tax Filing Errors

Q1. When am I required to file a rectification request?

On the e-filing portal, a request for rectification can be submitted if there is any mistake apparent from the record in an Intimation issued under section 143(1) or in an order under section 154 passed by the CPC. Merely for the returns a rectification request can be submitted that is processed by CPC earlier.

Q2. My e-filed Income Tax Return has been processed by CPC raising a demand / less refund, for rectification whom should I approach?

If CPC processed your ITR for the related Assessment Year then you can submit online rectification with CPC post logging in to your e-filing account.

Q3. What sort of errors can be corrected by filing a request for rectification?

A rectification request for errors can be filed by you in the processing of your ITR by CPC. For rectification only the mistakes apparent from the record are acknowledged.

Note- Do not use a rectification request for any other mistake of yours which through a revised return can be corrected.

Q4. What are the different request types for income tax rectification available on the e-filing portal?

On the e-filing portal, 3 types of rectification requests can be filed

- Tax Credit Mismatch Correction

- Return Data Correction (offline)

- Reprocess the Return

Note: Taxpayers for Return Data Correction (Offline), need to upload XML generated in the offline utility till AY 2019-20 but can upload JSON and submit rectification online from AY2020-21.

Q5. When can I submit Reprocess the return request?

It is recommended to choose this option if you have provided the precise particulars in the income return and CPC has not regarded it during processing.

Examples- For the below cases the return request reprocess could be submitted-

Deductions could be claimed by the taxpayers in the original/revised return and it has not been permitted at the time of return processing.

The taxpayer has performed the correct claim of TDS/TCS/Self-assessment tax/Advance tax and it has not been authorized while return processing.

Q6. When can I submit the return data correction request?

Re-enter all the entries in the schedules. All the corrected entries along with the left entries cited in the income tax return (ITR) submitted before are required to be entered. Perform the significant corrections in the data. Undergoing corrections ensure no declaration of any new source of income or declaration of other deductions.

Instances- For the below cases the return data correction request could be submitted-

- The taxpayer can make amendments to any additional information given that such amendments do not consequences in a variance in gross total income and deductions.

- If erroneously the taxpayer has declared the income in the wrong income head.

- In this type of rectification request taxpayer is not authorized to do below mentioned amendments-

- Fresh claim and/ or Additional claim and/ or Reduction of carry forward losses.

- Fresh claim and/ or Additional claim and/ or Reduction of brought forward losses.

- Fresh claim and/ or Additional claim and/ or Reduction of MAT credit.

- Fresh deduction/Additional claim/ Reduction of deduction under chapter VI A.

Q7. At what time do I submit the tax credit mismatch correction?

It is recommended to utilize this option if you wish to edit the details in the TDS/TCS/IT challans of the processed return. In the schedules re-enter all the entries. All the corrected entries along with the other entries cited in the ITR submitted before are to be entered. Do the required corrections in the data. At the time of performing corrections ensure not to claim credits which is not part of the Form 26AS statement.

Instances- For the below circumstances tax credit mismatch correction request could be submitted-

- Taxpayers can add a new Self-Assessment tax challan which has been paid to nullify the demand raised in the original return.

- If the taxpayer has wrongly given any Self-Assessment tax/Advance tax challan details such as BSR code, Date of payment, Amount, Challan number while filing the original return, they can rectify the error in this sort of rectification.

- If the taxpayer has wrongly given any TDS/TCS information like TAN, PAN, amount, etc.

- Taxpayers can just Edit/Delete TDS/TCS entries.

Q8. I like to file a rectification against an intimation u/s 143(1) from 5 years ago. Why is the system not authorizing it?

You are not permitted to submit the rectification request after the expiry of 4 years from the finish of the FY in which the intimation under section 143(1) was passed.

Q9 Do I need to e-verify my rectification request?

No need to e-verify the rectification request is there.

Q10. Can I correct my earlier filed ITR using the rectification request service?

If you discover a mistake in your submitted ITR and it has not been processed via CPC, then you can submit a revised return. You also can use the rectification request service on the e-filing portal merely against an order/notice under section 143(1) from CPC.

Q11. My earlier filed rectification request has not been acted upon at CPC processed till now. Can I submit or file another rectification request for the same request type?

No. you are not able to furnish a rectification request for an assessment year unless an earlier filed rectification request has been acted on via CPC.

Q12. Where can I locate my rectification reference number?

You shall get a mail or a message reporting you a 15-digit rectification reference number once you submit your rectification request. Also, you can discover your 15-digit rectification number under Rectification Status after logging in to your e-filing account.

Q13. Is it possible to check my rectification status offline?

No, you could not view the status offline. You shall need to log in to the e-filing portal to view the status of rectification.

Q14. Who can apply for a rectification request?

Only these parties who obtain the order/ notice u/s 143(1) from CPC can apply for a rectification request on the e-filing portal:

- ERIs (who have added client PAN)

- Registered taxpayers

- Authorized Signatories and Representatives

Q15. On e-Filing Can I submit a rectification request in case of manual / paper filing of the return?

No, Rectification requests in paper form are NOT accepted at CPC. Every communication to the CPC has to be performed merely in electronic form in the manner provided by the CPC.

Q16. Is it feasible to submit a rectification request on the e-filing portal if rectification rights are transferred to AO?

No, at present the Rectification Request service on the e-Filing portal does not include the rectification in case of rights transferred to AO. In the same case, you are required to communicate with your AO with the rectification application.

Q17. Can a rectification request be withdrawn or filed again, once submitted?

During filing a rectification request you are not authorized to claim new exemptions/deductions.

Q18. There is a modification in my income/bank/address details, which I am required to update in my ITR. Should I file a rectification request?

For a change in income / bank / address details request for rectification is not applicable. through a revised return your income/Bank/Address can be updated.

Q19. Up to which AYs in the past can a rectification request be filed online?

No particular AY is there till when the rectification can be submitted online, it is laid on the specific case. The request for the rectification could be submitted within 4 years from the finish of the fiscal year in which the order asked to be revised was passed.

Q20. I am needed to be audited u/s 44AB. Is DSC obligatory for me when filing a rectification request?

For filing a rectification request, no Digital Signature Certificate (DSC) is not obligatory.

Q21. How do I rectify the incorrect uploaded information in my rectification request?

You could not submit a revision of the rectification request nor can you withdraw the same. You on submission can file the additional rectification request after the submitted one is processed in CPC.

Q22. I have filed the demand raised by CPC. To cancel the demand do I need to file a rectification request?

You are enable to submit the tax credit mismatch correction request with the paid challan information.

Q23. I filed my original ITR after the deadline (belated return). I ought to revise the submitted ITR. Can I file a rectification request?

No, the Rectification of ITRs is distinct from filing a revised return. You can revise your belated return (applicable only from FY 2016-17 onwards) either before the finish of the following FY or before the ITR processing via the tax authorities, whichever comes first. A request for rectification could merely be submitted in answer to the notice/order/intimation from CPC for a precise e-filed return.

Q24. I originally filed ITR-1. Can I use ITR-2 when replying to the CPC notice with a rectification request?

No, you shall not required to use the ITR-1 if that is what you submitted originally.

Q25. Can against a rectification order an appeal be filed?

Yes, you are allowed to submit a plea to the CIT(A) against an order furnished via CPC.