The Central Board of Direct Taxes (CBDT) has issued an order, as per notification F.No.225/132/2023/ITA-II dated December 01, 2023, concerning the validity of electronically filed income tax returns with refund demand as mentioned in Section 143(1) of the Income Tax Act, 1961, past the specified timeline in cases not subject to scrutiny.

The CBDT has been made aware that due to technical glitches or other grounds not applicable to the taxpayers, many returns files for assessment years (AYs) 2018-19, 2019-20, and 2020-21, which were accurately filed following Section 139 or 142(1) or 119 of the Income Tax Act, 1961, failed to carry out per sub-section (1) of Section 143 of the Act.

Accordingly, intimation concerning the processing of such returns could not be filed within the prescribed timeframe under sub-section (1) of Section 143 of the Act. As a result, taxpayers are facing difficulties in receiving their rightful refunds as per the provisions of the Act, even though the delay is not their fault.

To address the grievances of these taxpayers, the CBDT had previously released guidelines/instructions/orders under section 119 of the Act, relaxing the prescribed timeline for carrying out accurately filed returns with refund claims in cases not subject to scrutiny.

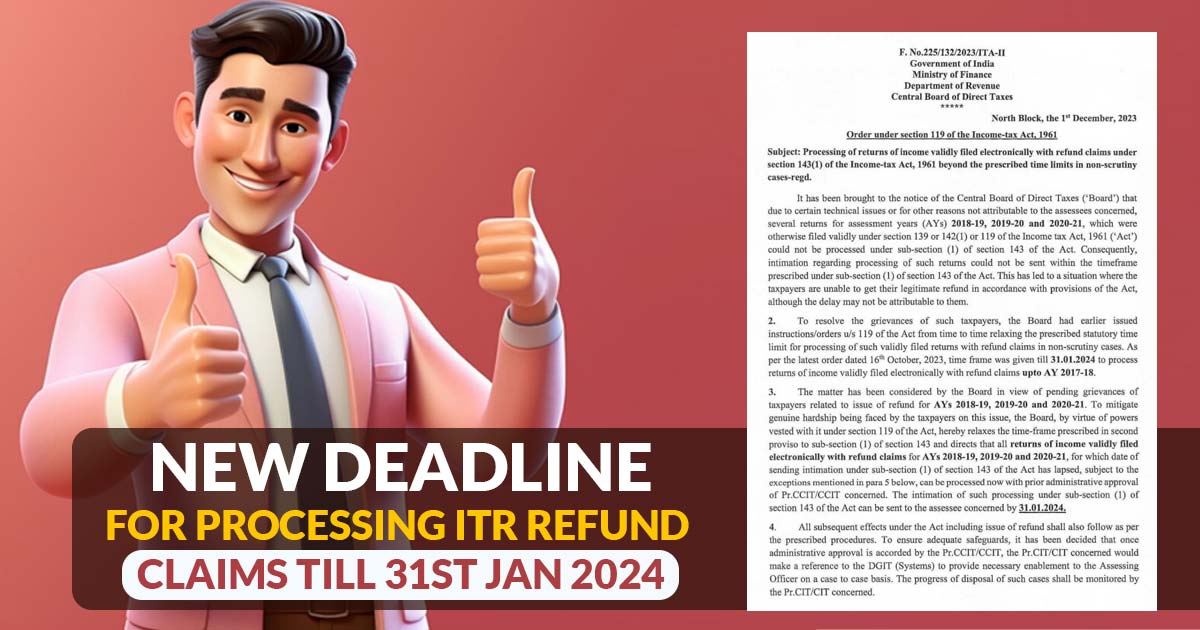

The recent order, dated October 16, 2023, provided a timeframe until January 31, 2024, to process electronically filed income tax returns with IT refund claims up to AY 2017-18.

Considering the pending grievances of taxpayers regarding the issuance of refunds for AYs 2018-19, 2019-20, and 2020-21, the CBDT has examined the matter. To alleviate the genuine hardship taxpayers face in this regard, the CBDT, using its powers under section 119 of the Act, thus gives relief in the timeframe specified in the second proviso to sub-section (1) of section 143.

It directs that all electronically filed income tax returns with refund demands for AYs 2018-19, 2019-20, and 2020-21, for which the issuing date of intimation under sub-section (1) of section 143 has been released, can now be processed with prior administrative permission from the Principal Chief Commissioner of Income Tax (Pr. CCIT)/ concerned CCIT. The intimation of such processing under sub-section (1) of section 143 will be sent to the respective taxpayer by January 31, 2024, subject to the exceptions mentioned in the paragraph below.

All subsequent actions under the Act, including the issuance of refunds, will follow the specified procedures. To ensure satisfactory safeguards, it has been concluded that once administrative permission is granted by the Pr.CCIT/concerned CCIT, the Principal Commissioner of Income Tax (Pr. CIT)/concerned CIT will request the Directorate General of Income Tax (Systems) to enable the Assessing Officer on a case-by-case basis. The progress of the disposal of such cases will be observed by the Pr. CIT/concerned CIT.

The relief mentioned above will not apply to the following returns:

Return picked for examination.

Returns that have yet to be carried out, where either there is an indicated payable demand in the return or a potential demand is expected to arise after the processing. Returns that have yet to be carried out due to reasons applicable to the taxpayer.