Covid-19 has influenced people all across the world in a bigger way. It produces an effect on the financial state of the people living in the world. Towards the medical treatment for those who get influenced through covid-19. Here, we have mentioned all details about income tax refund of TDS deducted on medical treatments for salaried and non-salaried by employer or others.

There are 2 kinds of individuals who are relied upon the income grounds:

- Salaried

- Non-salaried (like professionals, businessmen, housewives, etc)

Income Tax Refund in Case of Salaried Person on COVID-19 Expenses

Towards the concern of the salaried individual, there are various employers who practice reimbursing them medical expenses

Before the Financial year 2018-19, the medical expenses of Rs 15000 were privileged from tax. But this has been withdrawn from the Fiscal year 2018-19. The stating outcome that any amount furnished through the employer to an employee for the medical expenses shall be without tax beneath the administration “Income from salaries”.

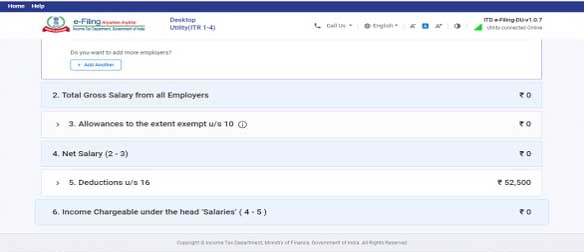

While the employees become subject to the expenses beneath hospitalization/home isolation for COVID treatment and any amount shall get compensated through their employer gets free from tax beneath the administrative salary and their employer have previously cut down the Tax Deducted at Source upon the reimbursement and furnished with Govt for FY 2019-20 and 2020-21 correspondingly.

The mentioned has made the tough procedure for the concerned individual as if he has to compensate Rs 2 lac then he beads to bear the tax of Rs 60,000 (approx) (assuming 30% of the rate of tax).

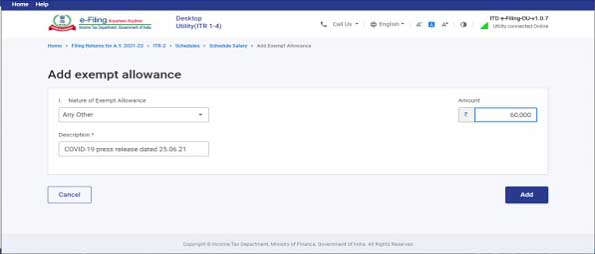

So as to address the Ministry of Finance who has provided the press release on 25th June 2021 through the title “Government grants further extension in timelines of compliances. Also announces tax exemption for expenditure on Covid treatment and ex-gratia received on death due to Covid” for the clause A (ii) full privilege shall be provided for medical compensation furnished through the employer for the treatment of COVID 19.

But the amount is provided through any individual (rather than employer) then the same privilege shall get limited to Rs 10 lacs. The mentioned privilege will be valid for the Financial year 2019-20.

This effect of the press release dated 25th June 2021 is that the start of the employer shall previously be deducted and furnished TDS through the government exchequer, thus during filing the return the employee is required to claim the refund of additional TDS cut down on covid concerned medical reimbursement (if any).

It will be in the interest of the employee to take the certificate or some additional credentials as evidence for the same amount shall get paid through the employer upon the grounds of COVID-19 treatment to prevent any future prosecutions.

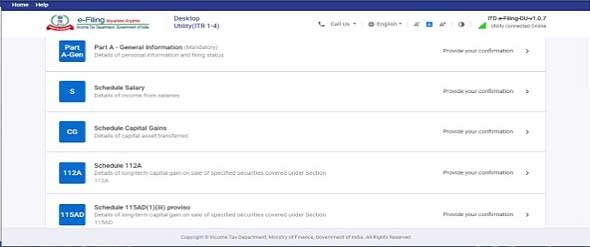

“Schedule salary”→ “Allowances to the extent exempt u/s 10” → Add another → Nature of Exempt Allowance → Any other → Description (COVID-19 Press release dated 25.06.2021) → Amount of exemption claimed. The related screenshots are given below:

- The provided method can be followed for the case TDS was deducted in FY 2020-21.

- But if the TDS shall get deducted in the Fiscal year 2019-20 then upon the date the return for the financial year 2019-20 shall not get amended (since return for FY 2019-20 is time closed presently and in the majority of the cases the assessment shall previously have been furnished).

- Thus the employee can avail of the exemption for the current FY 2020-21 for the compensation implemented in FY 2019-20. But the mentioned is subject to litigation in the absence of clear guidelines by the income tax department.

Tax Refund in Case of Non-Salaried Person on COVID-19 Related Expenses

From the example mentioned below towards the concern of the non-salaried individual, the impact is mentioned.

Say Mr. X is a social worker. He got an infection from covid. His relatives and friends support him financially so as to overcome the disease.

He has obtained the mentioned amount (non-refundable i.e Gift)

| Money Received | Amt Rs |

|---|---|

| Mr. Y (Relative) | 200,000 |

| Mr. Z (friend i.e not relative) | 300,000 |

| – | 500,000 |

It is known that according to section 56 of the income tax act any gift obtained from the relative gets privileged from tax. But if the amount obtained from the non-relative is under Rs 50000 then no tax is to be applied, however, the moment it is Rs 50,001 or exceeds the whole amount of Rs 50,001 or more gets fully taxable.

Read Also: Section-Based Income Tax Saving Tips For Salaried Person

Thus for the mentioned case in the hands of Mr. X Rs 2,00,000 is not taxable (since taken from a relative). However, the complete amount of Rs 3,00,000 is fully taxable.

Post to the press release on 25th June 2021 now gift obtained from non-relative up to Rs 10 lacs for COVID-19 practice is excused from tax from FY 2019-20 onwards.

For the case of the non-salaried person and despite the salaried individual obtaining the amount from the individual other than the employer the amount obtained from any well-wisher such as a friend, students, or others up to Rs 10 lacs gets privileged from tax.

There is no statutory procurement for deducting TDS on the amount of gifts. But for this case TDS has been deducted through the provider then this can be claimed as the refund through the receiver of the gift given that the gift is for the case of covid-19 treatment.

At this point, it will be an advantage to repeat that any amount obtained from the medical insurance company with respect to the medical insurance scheme obtained is not handled as the income in the hands of the receiver since the receiver shall not make any profit or earn income from them.