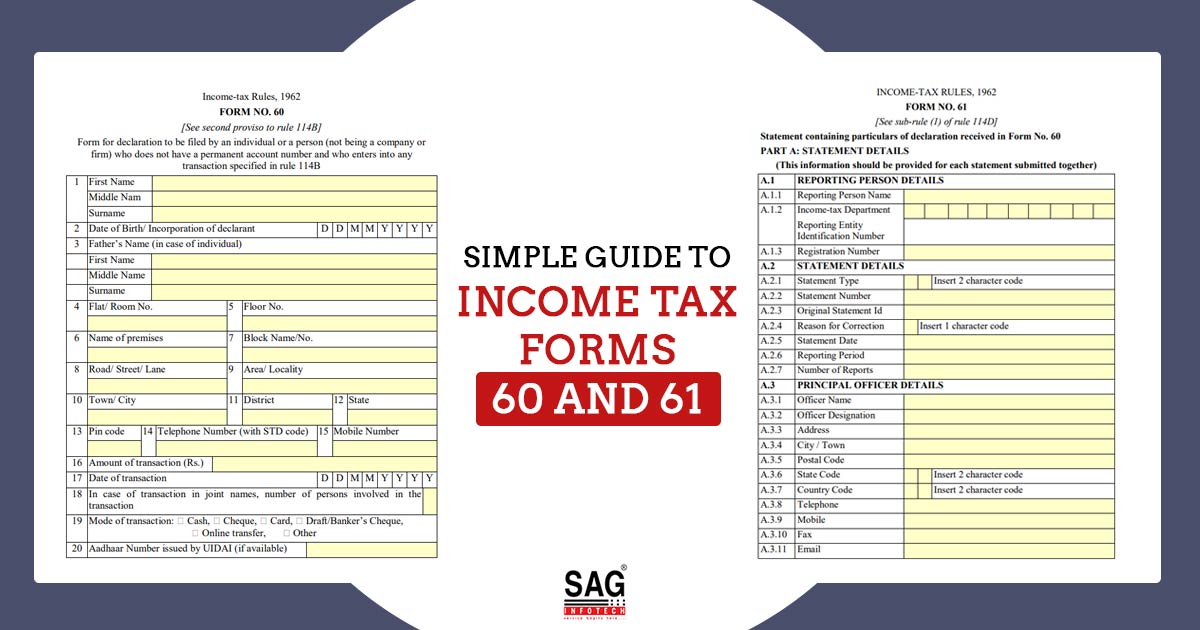

In India, Income tax forms 60 and 61 serve specific roles in financial transactions. Form 60 is utilised when an individual lacks a Permanent Account Number (PAN) and engages in specific transactions necessitating a PAN. It functions as an affirmation of identity and location.

For instance, if someone intends to open a bank account without possessing a PAN due to a lack of taxable earnings, Form 60 becomes essential. This entails furnishing personal particulars like name, address, and a statement confirming the absence of a (PAN) Permanent Account Number due to non-taxable income. The purpose is for the bank to adhere to the regulatory mandate of procuring PAN information from account holders.

Conversely, Form 61 is a declaration for individuals earning income but not having a PAN. It’s mainly employed by non-resident individuals to report their earnings within India.

To illustrate, if an NRI earned income from investments in India and lacked a PAN due to residing abroad, they’d use Form 61. This document encompasses personal data, income particulars, and a statement about the absence of a PAN. Its objective is for the bank to report the income while adhering to PAN-related reporting obligations.

Also Read:- Calcutta HC: CGST Superintendent Doesn’t Have the Authority to Issue an SCN Under Section 61

Both forms function to uphold tax regulations and deter tax evasion. Misrepresentation can result in legal repercussions. Form 60 and Form 61 advantages in India comprise.

Main Advantages of Income Tax Form 60

Helpful for Documentation: Form 60 functions as a legitimate substitute for PAN in particular transactions, guaranteeing that individuals aren’t barred from financial engagements due to the absence of a PAN.

Financial Transactions: Form 60 provides a solution for individuals lacking a PAN to participate in specific financial transactions that typically demand a PAN. This proves beneficial for those without taxable income yet requiring certain financial tasks, such as initiating a bank account.

Tax Compliance: It aids financial establishments in meeting regulatory obligations by collecting essential details for dealings involving individuals without a PAN.

Related: How DTAA Can Give Benefits to NRIs on Double Taxation in India

Main Advantages of Income Tax Form 61

Helpful for NRIs: NRIs, who might lack a PAN due to their non-residential status, can effectively meet their tax reporting obligations through the utilisation of Form 61.

Legal Tax Compliance: Financial establishments can relay NRI earnings to Indian tax authorities using Form 61, bypassing the requirement for PAN details. This guarantees adherence to tax reporting rules.

Income Reporting: Form 61 serves as a means for Non-Resident Indians (NRIs) who have garnered earnings in India to disclose their income even in the absence of a PAN. This enables them to meet their tax responsibilities without necessitating a PAN.

Read Also: Essential Tips for NRIs While Filing Income Tax Returns in India

In both instances, these forms have a significant role in upholding openness, deterring tax evasion, and allowing individuals to engage in financial transactions and income declarations even in the absence of a PAN. Despite their essential functions, the utilisation of Form 60 & Form 61 comes with specific concerns and factors to consider.

Current Problems with Income Tax Form 60

Insufficient Data: The absence of a PAN could result in challenges verifying the person’s identity precisely, potentially resulting in incomplete or incorrect information being supplied on the form.

Limited Transactions: Form 60 is restricted to certain transactions and cannot be utilised for all financial undertakings, potentially causing inconvenience for those needing to perform transactions necessitating a PAN.

Misuse: Given that Form 60 is employed by individuals lacking a PAN, there exists a potential for misuse or fraudulent behaviour. Individuals might furnish inaccurate data on the form to evade taxes or partake in illicit financial dealings.

Problems with I-T Form 61

Manual Validation: The process of reporting income through Form 61 could encompass extended processing periods due to the necessity for manual validation of data, potentially resulting in delays concerning tax-related affairs.

Conditions: NRIs might find themselves requiring supplementary documentation to substantiate their income declaration when utilising Form 61, contributing to administrative complexities.

Tax Complexities: Although Form 61 aids NRIs in declaring income without a PAN, the taxation regulations applicable to NRIs can be intricate. Navigating accurate tax responsibilities and adhering to reporting mandates can prove to be demanding.

Recommended: Easy TDS Deduction Guide If You Bought Property from an NRI

In both situations, these forms are chiefly crafted to handle particular instances wherein individuals lack a PAN but still require involvement in financial activities or income declaration.

Nevertheless, to alleviate the concerns linked with these forms, it becomes crucial for individuals to furnish precise details, and for financial entities and tax authorities to establish efficient mechanisms for authenticating and handling the provided data.

auditor