The government authorities have started many of the help desk and support services which have increased the overall credibility of the government authorities in the matter of goods and service tax. This time the government have come up with the self-service portal meeting requirement of demand and supply of GST related queries and issues.

Also, the email id is not operational anymore as taxpayers can register there issues and complaints on a single platform on the new Self Help portal. On the platform, there will be an open invitation to all the concerned people who can solve the queries accordingly. All this solves the major GST issue over a single platform.

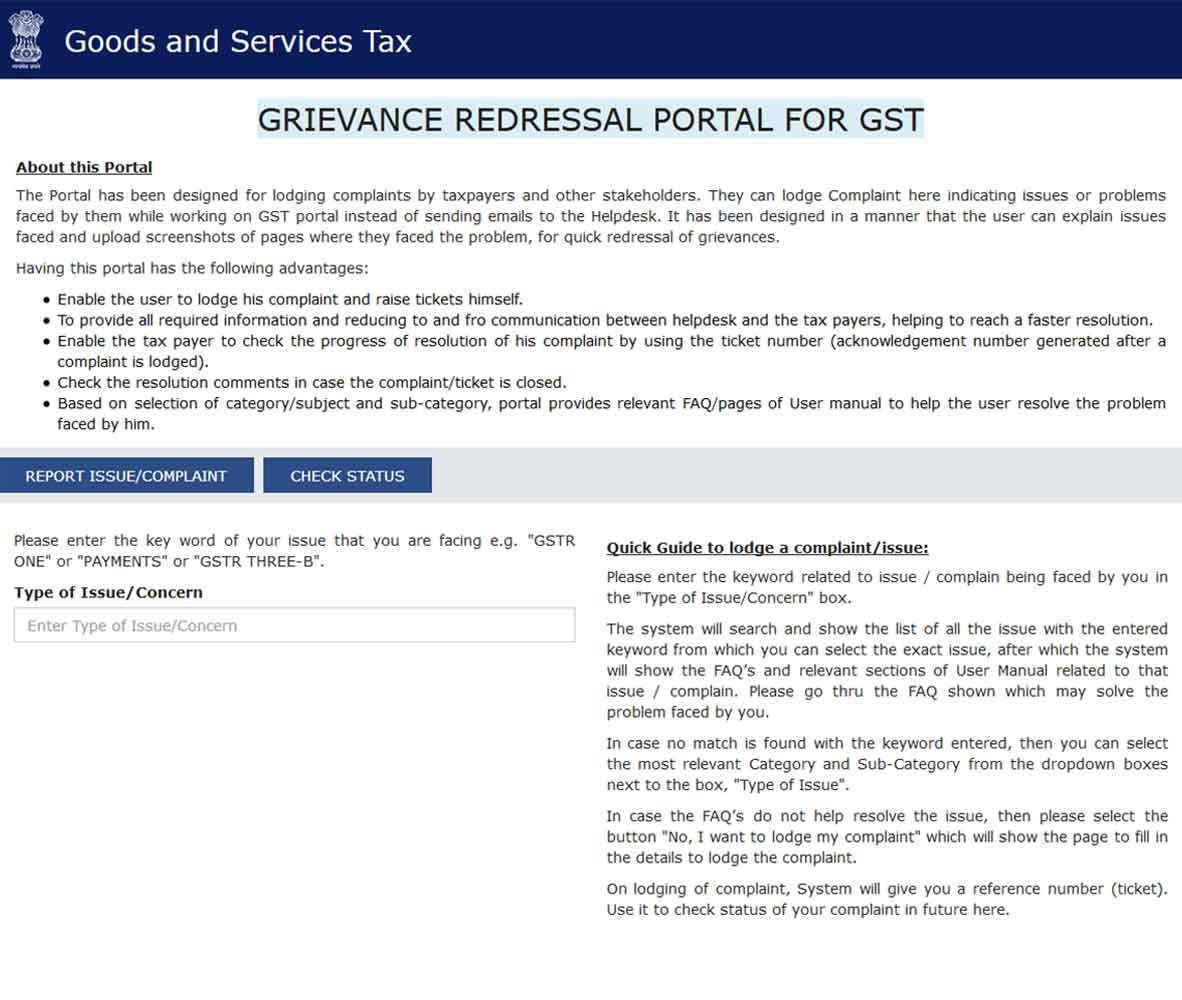

The query registration needs some steps to be performed like one have to first go to the Grievance redressal portal: Selfservice.gstsystem.in, where the taxpayer will have to raise a ticket. The question will be solved according to the audience present including the help of an expert. The Self Help portal is live now.

There are multiple services offered on the portal including:

- Complaint/Report issue

- Status check of the Complaint/Report issue

A Quick Procedural Guide to Raising GST Related Issues/Query:

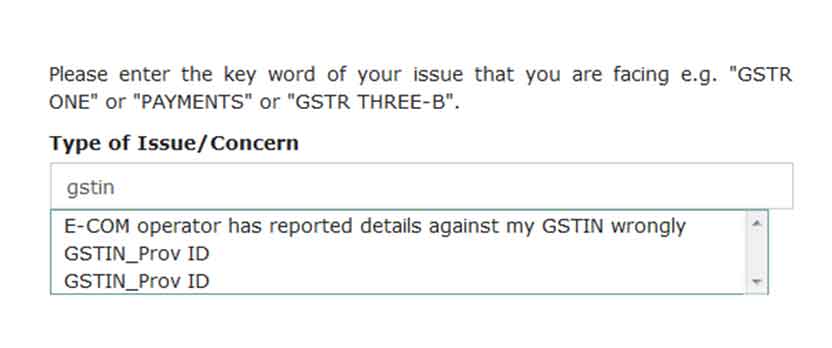

Step 1: Tell the keyword of the problem faced by you in the ‘Type of Issue/Concern’ box

A Drop-down list will appear based on the keyword one entered

For ex: For a Query on ‘How to get GSTIN?’, the keyword is ‘GSTIN’.

Step 2: Choose the most relevant query type from the drop-down that appears

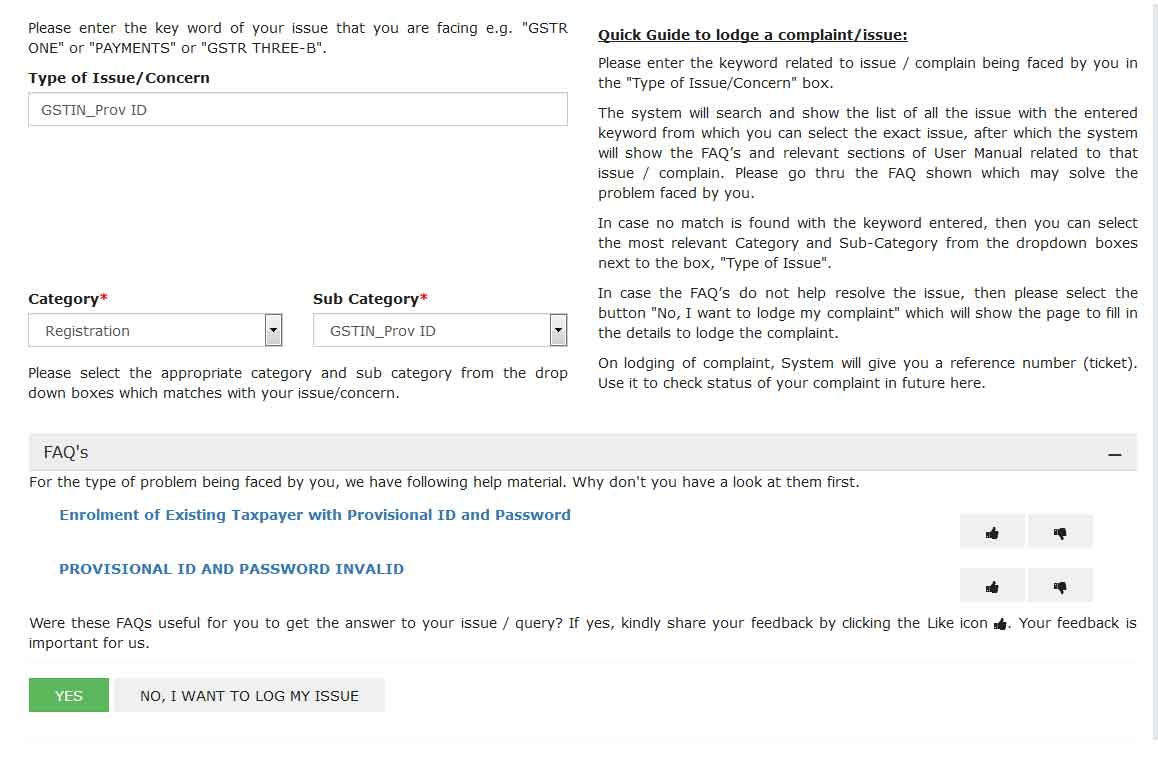

Following two points will get displayed. Relevant Category and the sub-category the keyword belongs:

One can Re-select here from drop-down more relevant sub-category

FAQs (Frequently asked questions) concerned to the keyword entered

Step 3: Check out issue answered in the FAQs section

If taxpayer finds Query under FAQs, then please click the concerned FAQ and have a look at the answer that comes in a new tab

If the FAQ solves the query/issue, one can provide feedback and Click on ‘YES’ button at the end of the portal homepage stating that the issue was resolved

Step 4: If in case the query was not satisfied at Step-3, then one can Raise Tickets for the Issue

If there are no suggestions appears under Drop-down for the query type or if the FAQs do not help, click on ‘NO, I WANT TO LOG MY ISSUE’ button at the end part of the homepage

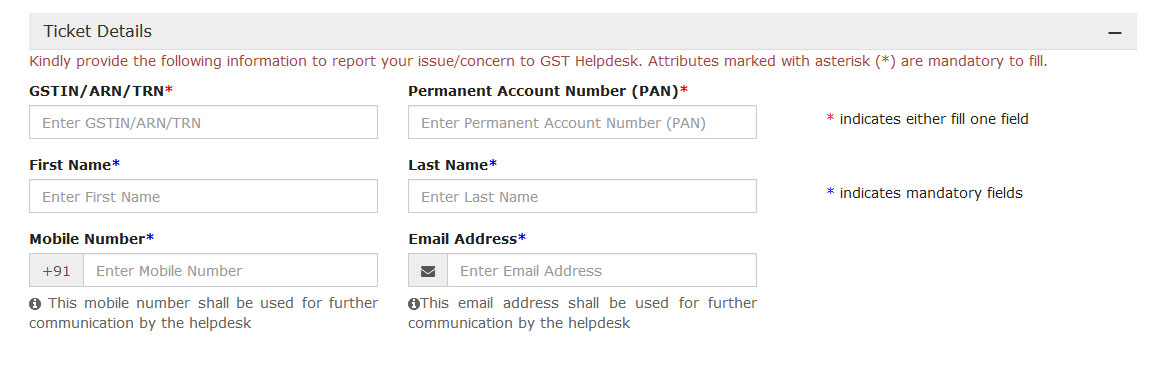

One has to mandatorily input either the ‘GSTIN/ ARN (application ref number)/ TRN( Ticket ref number)’ or the ‘PAN number’

Mandatory fields: First Name, Last Name, Mobile number and Email-address (relevant for the PAN number or GSTIN Number entered earlier)

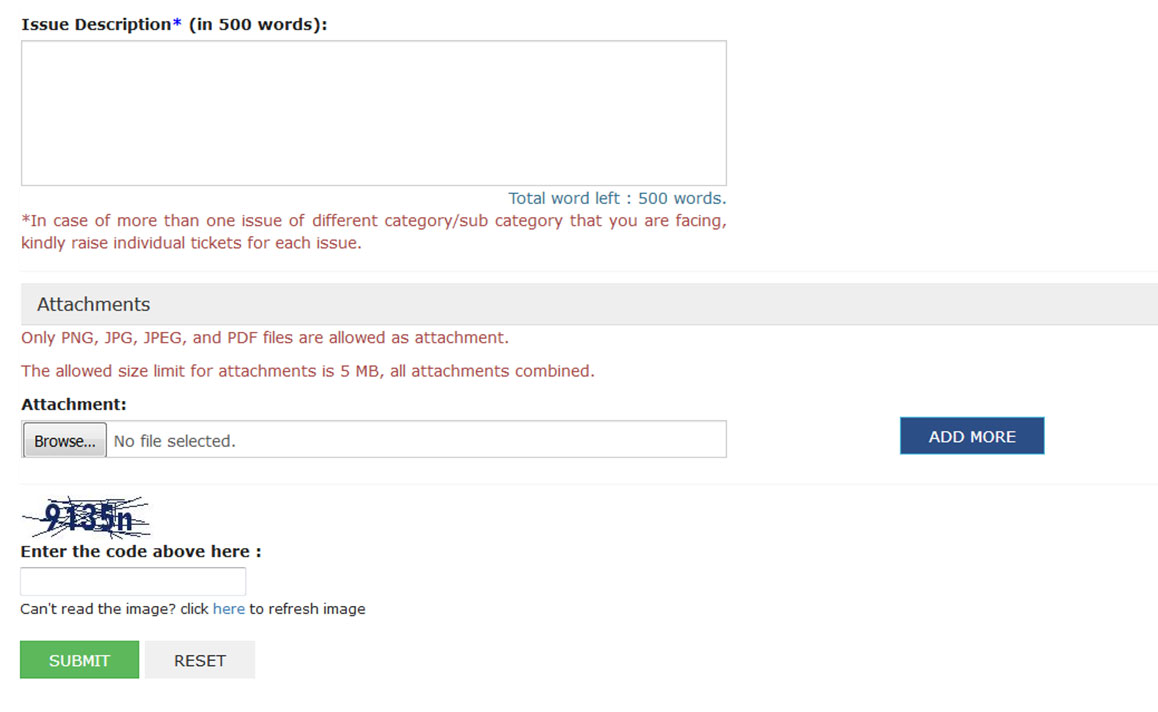

Enter the Issue/ Complaint/ Query in less than 500 words in the Description Box

The taxpayer can also attach any screenshots/reference files in PDF/ JPEG/ PNG/ JPG format. Then click ‘Choose file’ button and select the file you want to upload. If one wants to attach more than one file, use ‘ADD MORE’ button

Note:

- 1. Maximum files size is 5 MB (all attachments together). One can compress files and then upload

- 2. In case of taxpayer have more than one issue or query falling under different category/sub-category, ticket has to raised for each particular issue

Now enter the captcha code and Click on ‘SUBMIT’ button

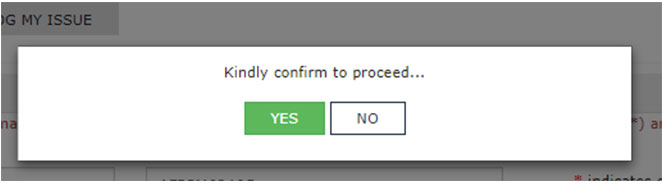

Then on the dialogue box that appears, Click on ‘YES’ to proceed

Further, a confirmation dialogue box appears providing a 15 digit Ticket Reference Number. One can ‘Save as PDF’ or ‘Print’ to acknowledgement it for future reference.

Then click ‘OK’. Meanwhile, a detailed mail will be sent to the email address taxpayer provides at Step 4

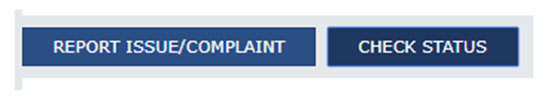

A Quick Guide to Check out the Status of Complaint/Issue

One can check the status of ticket whether resolved/pending anytime from the portal

For this, Select CHECK STATUS on the homepage of the website

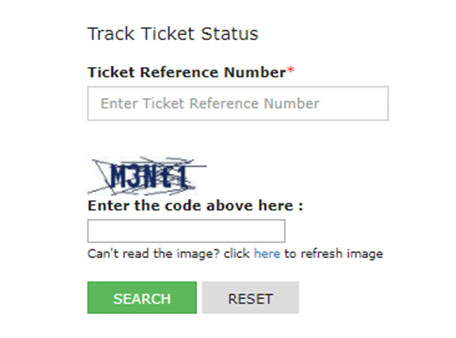

Now Enter the Ticket Reference number allotted at the time of registering in the box

Now Type the Captcha code and Click on ‘SEARCH’

Following which the details of Status of the ticket will be sent to the registered email address used at the time of raising the ticket.

Various Benefits of the Government Official Self Help Portal:

- The Self Help portal provides an efficient and effective user interface

- The portal also provides a single platform to register all your issues and get it resolved through a direct channel of interface

- The taxpayer can also track the status on its own. When the ticket is resolved, one can check the provided resolution

- General FAQs states time-saving points to many of the common errors

Grievance redressal cell forwarding a mail saying that reply to “helpdesk@gst.gov.in” with no subject changed and attached screenshots.

Helpdesk says they have closed this mail I’d so go to grievance redressal. self-service.gstsystem.in

Too free 01204888999 says call CBIC 18001200232

Visa verse.

Worst no proper answer from any of the call center people.

I have sent 10mails with attachment still they keep on sending the same message.

Call center people are saying send mail along with the attachment.

Nothing else further

Pathetic-Pathetic-pathetic

Toll-free 1800 120

what we have to do if the compliant Status in GST grievance portal is: AWAITING CUSTOMER INFORMATION

You might have received mail from the department demanding certain information or documents. You have to submit the required information to the department.