The Gujarat Authority for Advance Ruling (AAR) has announced that activities related to planting and caring for trees by a Trust in places that aren’t classified as forests can be exempt from GST. This includes areas like empty land, along roads, in the middle of lanes, on private property, and other suitable spots that the Trust can access.

Mr Vishal Malani (Member- Central Tax) and Ms Sushma Vora (Member- State Tax), in a ruling, have held that Entry No. 1 of Notification No. 12/2017 applied to tree plantation and maintenance by the petitioner as a charitable activity and was exempt from GST.

Read Also: Gujarat GST AAR: Vendor Duped in Fraud, But Tax Liability Still Applies on Supplied Goods

Petitioner is a sister arm of Manav Charitable Trust, which had been selected under the ‘Harit Van Path Yojna’ initiative of the Gujarat Forest Department, for evolving Tree Cover and providing ecological and environmental protection in 2025-26. The project of Rs. 113.65 crores entrusted the Applicant with planting and maintaining 7,62,712 trees.

The petitioner asked for an advance ruling on whether plantation and maintenance of trees by a Charitable Organisation registered under Sections 12AA/12AB of the Income Tax Act for charitable objectives were exempt from GST.

The Gujarat AAR perused the National Forest Policy and stated that the Harit Van Path Yojana of Gujarat was with the motive of environmental protection. From Policy, one of the strategies for expanding the forest cover was to motivate the planting of trees alongside roads, railway lines, rivers and streams and canals, and on other unutilized lands under State/Corporate, Institutional or Private Ownership, which will check erosion and desertification and improve the microclimate.

Therefore, it held that the activities (planting/maintaining trees in non-forest areas, roadsides, barren lands, etc.) of the applicant come under the “preservation of the environment.”

The petitioner’s given Memorandum of Association, the Gujarat AAR inferred that all the norms under Entry 1 of Notification No. 12/2017 – CTR stands fulfilled with the petitioner’s one of the purposes being clean environment by undertaking tree plantation activitiesIncreasing tree cover in the country via huge afforestation and social forestry programmes entitle as charitable activities, In the same way, the Gujarat AAR relied on a 2023 advance ruling in case of Vikas Centre for Development where mangrove plantation was held exempt.

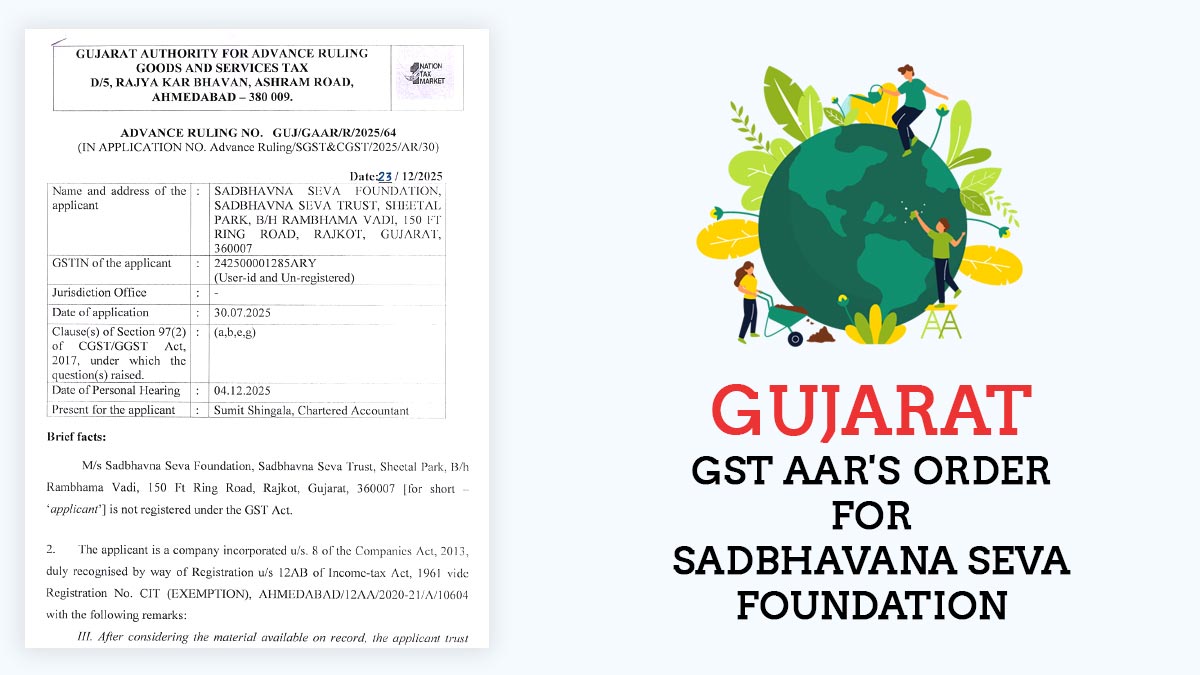

| Applicant Name | Sadbhavana Seva Foundation |

| Advance Ruling No. | GUJ/GAAR/R/2025/64 |

| GSTIN of the applicant | 242500001285ARY |

| Gujarat GST AAR | Read Order |