For Advance Ruling (AAAR) of Gujarat recently, the GST Appellate authority made a ruling in the matter of Wago Private Limited. The same ruling concentrated on the eligibility of input tax credit (ITC) for expenses made on air conditioning and ventilation systems utilized in the establishment of a new factory.

The very ruling furnishes clarity on the application of Section 17(5) of the Central Goods and Services Tax (CGST) Act, 2017, and the Gujarat Goods and Services Tax (GGST) Act, 2017, specifically concerning works contract services and immovable property.

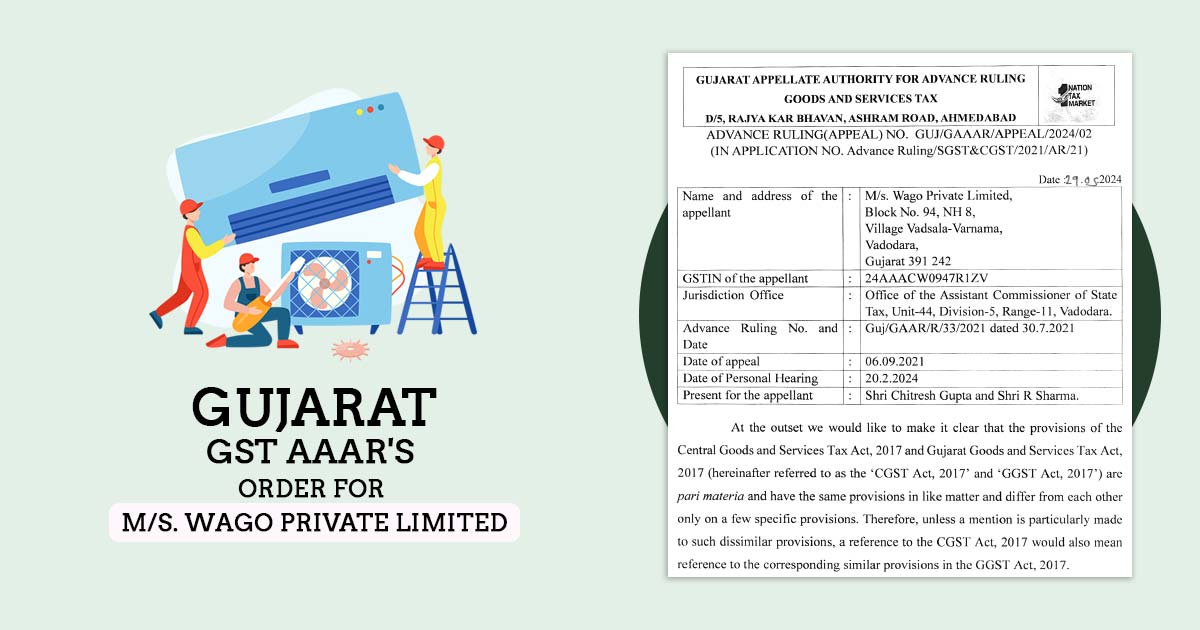

Court Order for Wago Private Limited

Wago Private Limited, located in Vadodara, Gujarat, asks for a ruling from the Gujarat Authority for Advance Ruling (GAAR) to define the admissibility of ITC on the GST paid for procuring and installing air conditioning and ventilation systems in their new factory.

Against the company, GAAR ruled stating that such expenses fall under the blocked credits under section 17(5) of the CGST Act, 2017. Aggrieved by this ruling, Wago Private Limited appealed to the AAAR.

Lawful Framework and Provision Under CGST

Section 16 of the CGST Act, 2017: The very section emphasizes the eligibility and conditions to claim the GST ITC, specifying that ITC could be claimed for goods or services utilized in the course of furtherance of business.

Section 17(5) of the CGST Act, 2017: Specifies the conditions under which ITC is restricted, specifically:

- Subsection (c): ITC is not available for works contract services when supplied for the construction of immovable property, besides where it is an input service for further supply of works contract service.

- Definition of Plant and Machinery: The act does not include land, buildings, and other civil structures from the definition, concentrating on apparatus fixed to the earth that is used for making an outward supply of goods or services.

Gujarat GST AAAR Results and Justification

Whether the air conditioning and ventilation systems installed by Wago Private Limited can be categorized as “plant and machinery” or whether they formed immovable property, AAAR reviewed. Facts included in AAAR’s analysis are-

Nature of the Systems:

- The systems were discovered to be integral to the building, making it an immovable property once installed.

- According to the CBIC’s Order No. 58/1/2002-CX, systems like refrigeration and air conditioning plants are regarded as systems instead of standalone machines and therefore are not excisable goods once installed.

Contract and Installation Details:

- The contract granted for the installation was comprehensive and covers supply, installation, and commissioning, indicating a works contract service.

- The systems, on installation, became part of the building structure and lost their identity as individual machines.

Relevant Judgments and Precedents:

- The AAAR directed the ruling of the Supreme Court in the matter of Globus Stores P. Limited, which categorized air conditioning plants as immovable property.

- The immovable property concept was clarified via definitions from the General Clauses Act, 1897, and the Transfer of Property Act, 1882.

Conclusion on ITC Eligibility:

- As the air conditioning and ventilation systems were considered immovable property, they were not authorized as “plant and machinery” under the CGST Act.

- U/s 17(5)(c) ITC on these systems was blocked since the expenditure was pertinent to the works contract services for constructing an immovable property.

Closure: In the case of Wago Private Limited AAAR’s ruling stressed the strict interpretation of ITC provisions under the CGST and GGST Acts. The AAAR by classifying the air conditioning and ventilation systems as immovable property, reaffirmed that these expenditures are not eligible for ITC.

Recommended: Exploring GST Section 16(4) with Court Rulings on ITC

The same ruling is an important reference for businesses to comprehend the constraints of ITC claims, especially for works contract services and construction of immovable property. Companies embarking on identical projects need to consider these legal interpretations to ensure they comply with GST statutes.

| Applicant Name | M/s. Wago Private Limited |

| GSTIN of the applicant | 24AAACWO947RI7,Y |

| Date | 20.02.2024 |

| Applicant | Shri Chitresh Gupta and Shri Il Sl.ralrna |

| Gujarat GST AAR | Read Order |