In the next coming weeks, the recently introduced Goods and Services Tax Regime (GST) will have to face the most critical test. The date of filing first returns had been extended by the Government in order to provide some more time to taxpayers as well as get their processes in place.

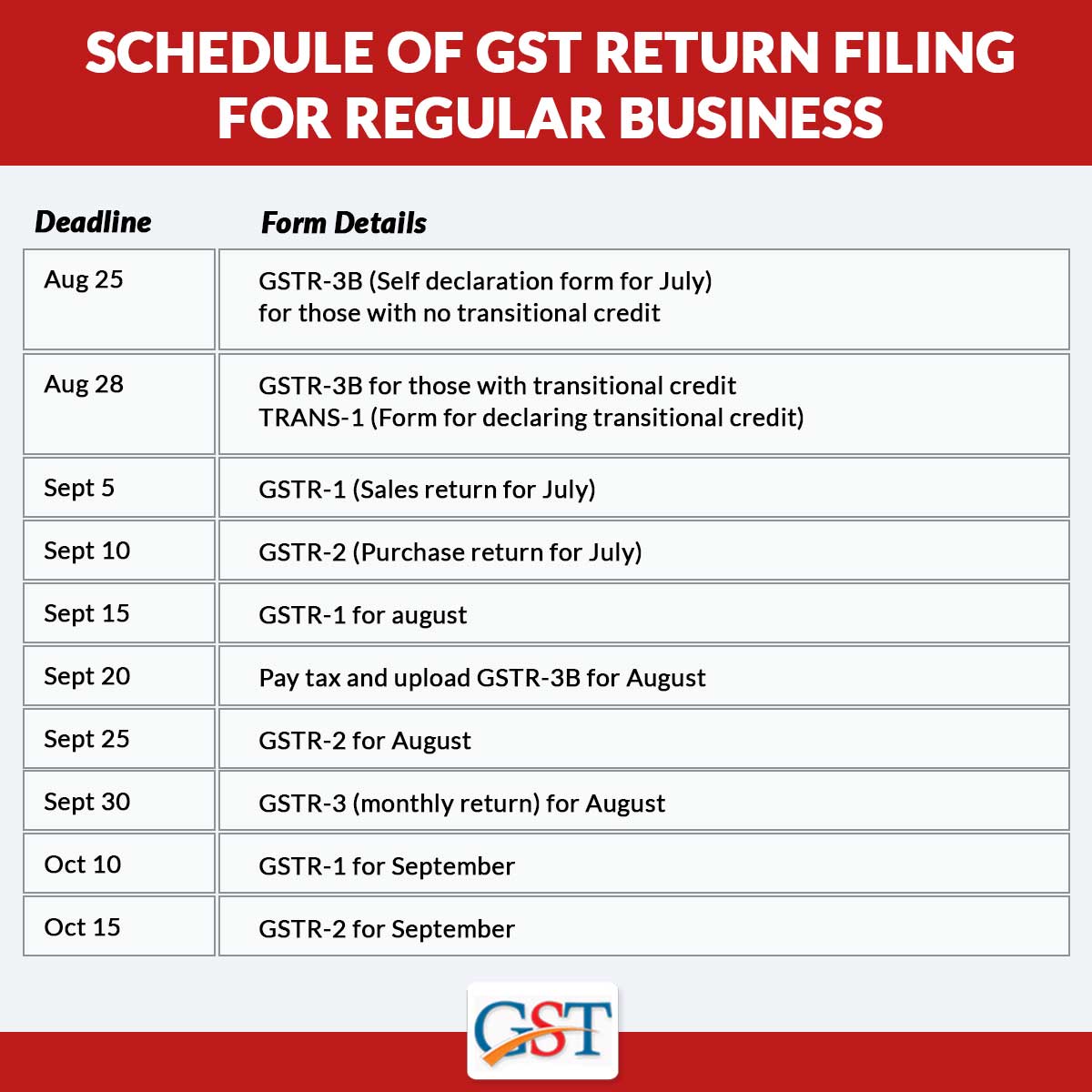

Several business stakeholders including businesses, government officials, consultants, and tax- payers will have to face some challenges in coming two months as they have to file several GST returns. The dealers who have transactions done for the duration of July and August along with the invoices will have to file GSTR 3B Return by 25th August.

Recently, the Central Board of Excise and Customs (CBEC) had extended the deadline for filing the first return- a self-assessment tax return for the month of July, GSTR 3B Return will be filed by 25th August earlier it was 20th August. Those who opted pre- GST tax credit or TRANS 1 Form for this month will have to file the GSTR 3B Returns by 28th August.

Businesses who opted GST at regular intervals will have to file three returns in a single month which includes GSTR- 1 for outward supplies, GSTR- 2 for inward supplies and GSTR- 3 which contains details of the net- tax payable based on inward and outward supply. July and August Forms will have to file in the duration of 25th August 2017 and 30th September 2017.

Small companies are facing issues with the new rules, tax consultants have expressed concern over the small companies.

Pritam Mahur, Pune- based Tax Consultant said, “In the next 60 days, the taxpayer has to file 10 returns, which translate to one return every six days. Large companies can handle this and are gearing for it, but smaller companies with the turnover of a few crore rupees do not have the manpower to handle this.” He further added that “Also this is for the first time that people are filing returns, so the problem is going to be compounded. Even tax consultants do not know what kind of problems can crop up.”

Till now more than 70 lakh registrations have been enrolled at the GSTN portal. If these taxpayers will upload approximately 10 invoices in a day, then it is expected that it will generate nearly 200 crore invoices at GSTN portal in each month.

The invoices of July and August will be uploaded in the month of September. During that month, GSTN portal will have to handle nearly 400 crore invoices.

However, Tax Experts feel that the fear of filing returns in the new indirect regime is overdone. An individual tax payer actually has to file only GSTR- 1 Return. The GSTN system automatically updates the fields for GSTR-2 and GSTR-3 form returns.

G Ravindranath, Commissioner of Service Tax, Chennai region, said “As a taxpayer, you have to file only GSTR-1 for outward supplies. Your supply is some other entitys inward supply. Now, the system has the data for the entire country. Based on that, the system will give you GSTR-2 that contains inward supplies. You have to check it and add any item that is left out, such as imports. Based on GSTR 1 and 2, the system will give you GSTR-3. The tax-payer will have to check the numbers in this and validate.”