The Goods and Services Tax Network (GSTN) has announced that the launch of a new feature allowing detailed reporting of invoices in Form GSTR-7 has been delayed. This postponement is due to some technical difficulties they are experiencing while developing and testing the system.

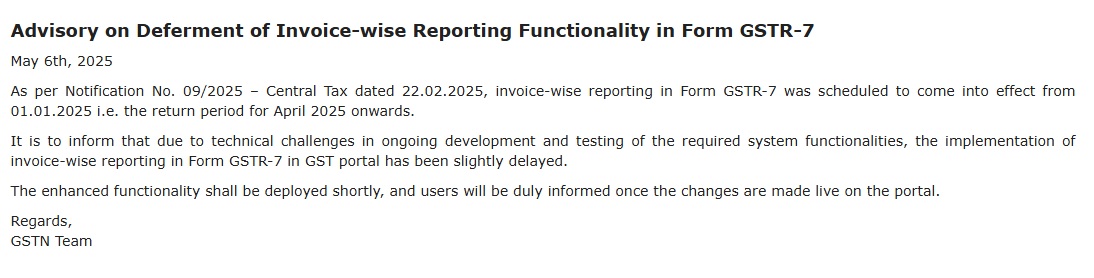

According to the official advisory on postponement of the invoice-wise reporting functionality in Form GSTR-7 released dated May 6, 2025, the GSTN mentioned that the invoice-wise reporting, which was scheduled to come into force from the return period of April 2025 (filed in May 2025), will now be postponed.

Through Notification No. 09/2025 – Central Tax dated 22.02.2025, the legislation was reported, which obligated that all the deductors under GST shall be required to report the tax deducted at source (TDS) information on an invoice-wise basis in Form GSTR-7. The same procedure is for the objective to rectify the transparency, improving reconciliation between deductees and deductors, and lessening mismatches in tax credits.

The GSTN advisory stated that “due to technical challenges in ongoing development and testing of the required system functionalities, the implementation of invoice-wise reporting in Form GSTR-7 in the GST portal has been slightly delayed.”

GST ensured the stakeholders that the improved operation would be deployed soon and that the users would be notified once the amendments proceed live on the portal.

Read Also: All About GST E-Invoice Generation System on Portal with Applicability

In context, Form GSTR-7 is a monthly return submitted by people who need to deduct tax at source under GST. It secures the TDS deducted, the liability payable, and the payment of such liability information. At present, the deductors report the overall TDS numbers without linking them invoices.

For the invoice against which tax has been deducted, the forthcoming amendment shall require them to furnish the information. The same is anticipated to ease the compliance and simplify the procedure to match TDS credits for deductees.

Businesses, along with tax professionals, acknowledged the transparency from GSTN and asked the authorities to furnish enough time for transition after the introduction of the feature, provided that companies require time to edit their accounting and ERP systems.

The postponement may provide temporary relief for the businesses, but the move of the GSTN for the invoice-wise reporting is a crucial measure for effective accountability and easier tax administration.