The Madras High Court has addressed the GST (Goods and Services Tax) demand that arose due to discrepancies in the Income Tax Return (ITR) Form 26AS, inconsistencies in the Input Tax Credit (ITC) shown in GSTR-2A, and ITC reversals resulting from received credit notes.

The court has directed the petitioner to seek resolution from the designated appellate forum, noting that there is an effective statutory remedy available.

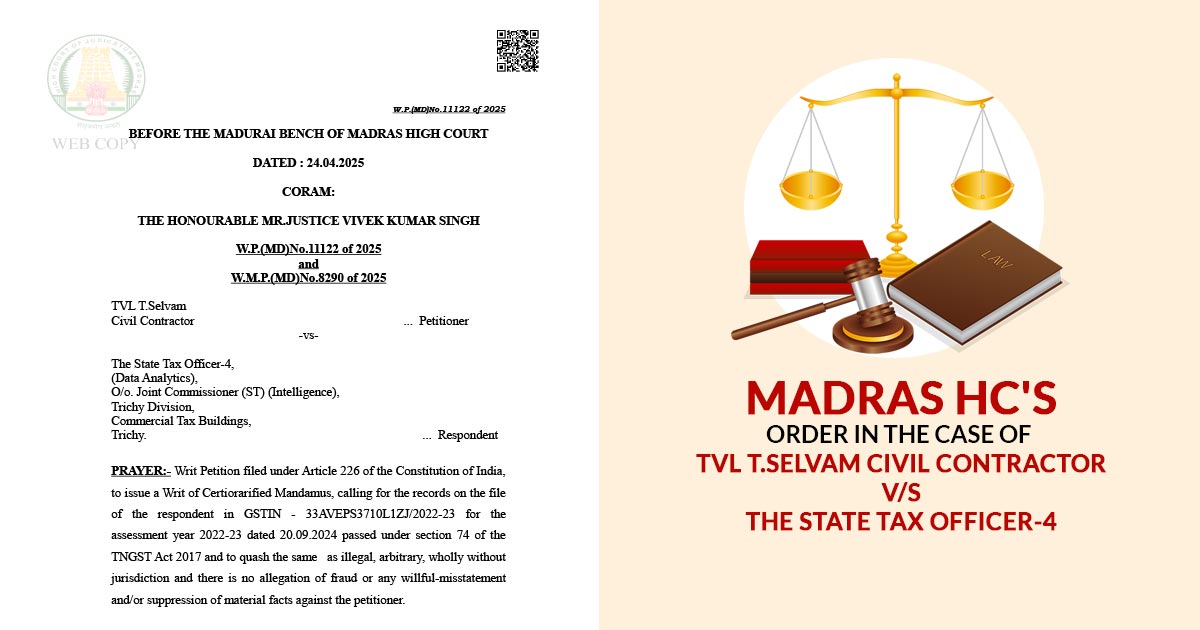

A writ petition has been filed to dispute an assessment decision dated September 20, 2024, issued under Section 74 of the Tamil Nadu Goods and Services Tax (TNGST) Act, 2017, for the assessment year 2022-2023. The court resolved, with the permission of both parties, to approach the case for final disposition at the admission stage.

On grounds of ITR Form 26AS mismatches, Input Tax Credit (ITC) reflected in GSTR-2A, and ITC reversals arising from credit notes received, the applicant asked for relief.

The counsel of the applicant Mr. N.Sudalai Muthu claimed that the assessment order was fundamentally flawed, claiming that the mismatches and reversals had been incorrectly interpreted, making the substantial interest and the levying of a 100% penalty excessive and unwarranted. For the quashing of the impugned assessment order, the applicant prayed.

Mr. J.K. Jayaselan, the Government Advocate, informed the court that an inspection was carried out from October 11, 2023, to October 13, 2023, which discovered various anomalies. On March 18, 2024, an electronic intimation notice was issued to the petitioner pursuant to Section 74(5) of the Act. On April 16, 2024, the petitioner’s response was reviewed, and a show cause notice was served.

As per him, the applicant secures an alternative statutory remedy through the way of an appeal to the Appellate Deputy Commissioner (ST), GST Appeal, u/s 107 of the TNGST Act, 2017, but instead of pursuing this appellate route, the applicant approached the High Court.

The Madras High Court bench, led by Vivek Kumar Singh, decided not to intervene in the assessment ruling at the writ stage. The court dismissed the writ petition but granted the petitioner the right to seek the appellate authority and present all of the issues stated in the writ petition before that forum.

The court asked if, within 2 weeks from the date of receipt of the order, the applicant submit an appeal, the appeal must be entertained by the appellate authority and disposed of as per the law within 3 months. The court did not make any order as to the costs and closed the related miscellaneous petition.

| Case Title | TVL T.Selvam Civil Contractor vs. The State Tax Officer-4 |

| Case No. | W.P.(MD)No.11122 of 2025 and W.M.P.(MD)No.8290 of 2025 |

| For Petitioner | Mr.N.Sudalai Muthu |

| For Respondent | Mr.J.K.Jayaselan |

| Madras High Court | Read Order |