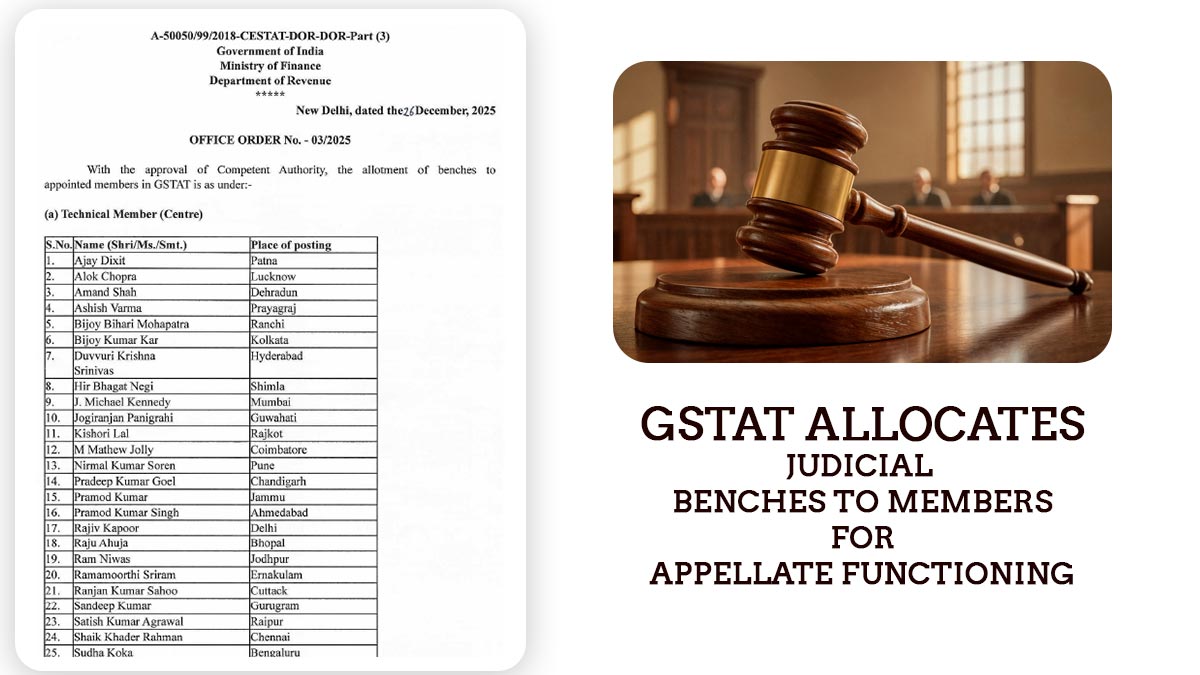

The GSTAT has given an order setting up courts for all its associates, representing a noteworthy administrative advancement in the implementation of the national appellate framework under the GST regime.

The same allocation specifies the distribution of judicial and technical members across different benches, furnishing clarity on jurisdiction and bench composition.

The decision has the motive to ease the operation of GSTAT and ensure uniform management of indirect tax disputes in the nation. With appeals under the Central Goods and Services Tax (CGST) Act, 2017 expected to rise, the bench allocation is seen as crucial for enhancing access to justice and lowering pendency in GST litigation.

As per legal experts, the structured allocation of members shall bring predictability to appellate proceedings, especially for taxpayers and professionals awaiting clarity on the availability of a forum. It shows the readiness of the Tribunal to hear cases once procedural and administrative formalities are completed.

Read Also: No GSTAT Setup Yet: Delhi HC Pauses GST Recovery Proceedings with Pre-Deposit Condition

The order on the allocation of benches is anticipated to ease the listing of appeals and efficient disposal of cases, supporting the role of GSTAT as the final fact-finding authority under the GST law before cases arrive constitutional courts.

Stakeholders with bench assignments now in place expect quicker resolution of GST issues and a stringent appellate procedure in the evolving indirect tax world.

Read Order