The Uttarakhand High Court has ruled that if a request to reopen a tax assessment under Section 148 of the Income Tax Act is rejected by the appropriate authority, then submitting the same request multiple times is not permitted and lacks legal basis.

A division bench including Chief Justice G. Narendar and Justice Subhash Upadhyay analysed whether multiple submissions of a proposal by the Assessing Officer (AO) to seek sanction u/s 151 are authorised under the Act. Section 148 authorises the AO to reopen assessments where income has escaped assessment, while Section 151 acts as a mandatory safeguard requiring prior approval from a higher authority.

An investigation is underway involving a man named Amit Sharma, who is reportedly a contractor for a government construction company in Uttar Pradesh. The authorities claim that Sharma misused his official position to gain benefits from contracts given to him by a person in charge of a development organisation. During the investigation, documents were found that indicate large transactions involving gold, silver, and cash amounting to 16 crore rupees, which are believed to have favoured this official.

Under Section 151, the competent authority refused sanction marking that the reasons recorded by the AO were unable to corroborate the seized documents and did not have supporting material. Even after the same AO has initiated proceedings u/s 147 grounded on the same material. The appeal of the taxpayer has been permitted by the tribunal, keeping that the loose sheets were not considerable proof and that the obligatory provisions of sections 148, 149, and 151 were not complied with.

The department, before the HC, claimed that the act does not restrict multiple presentations of a proposal for sanction. The bench rejecting the same claim noted that orders granting or rejecting the sanction u/s 151 are neither appealable nor reviewable, highlighting the mandatory and final nature of the sanction process.

The court, while applying a stringent interpretation of norms applicable to taxing statutes, ruled that in the absence of an express provision allowing repeated proposals, like actions, could not be assumed. The bench concluded that repeated presentation of the proposal and the following grant of sanction after initial rejection were without jurisdiction. Therefore, the High Court dismissed the appeal of the revenue.

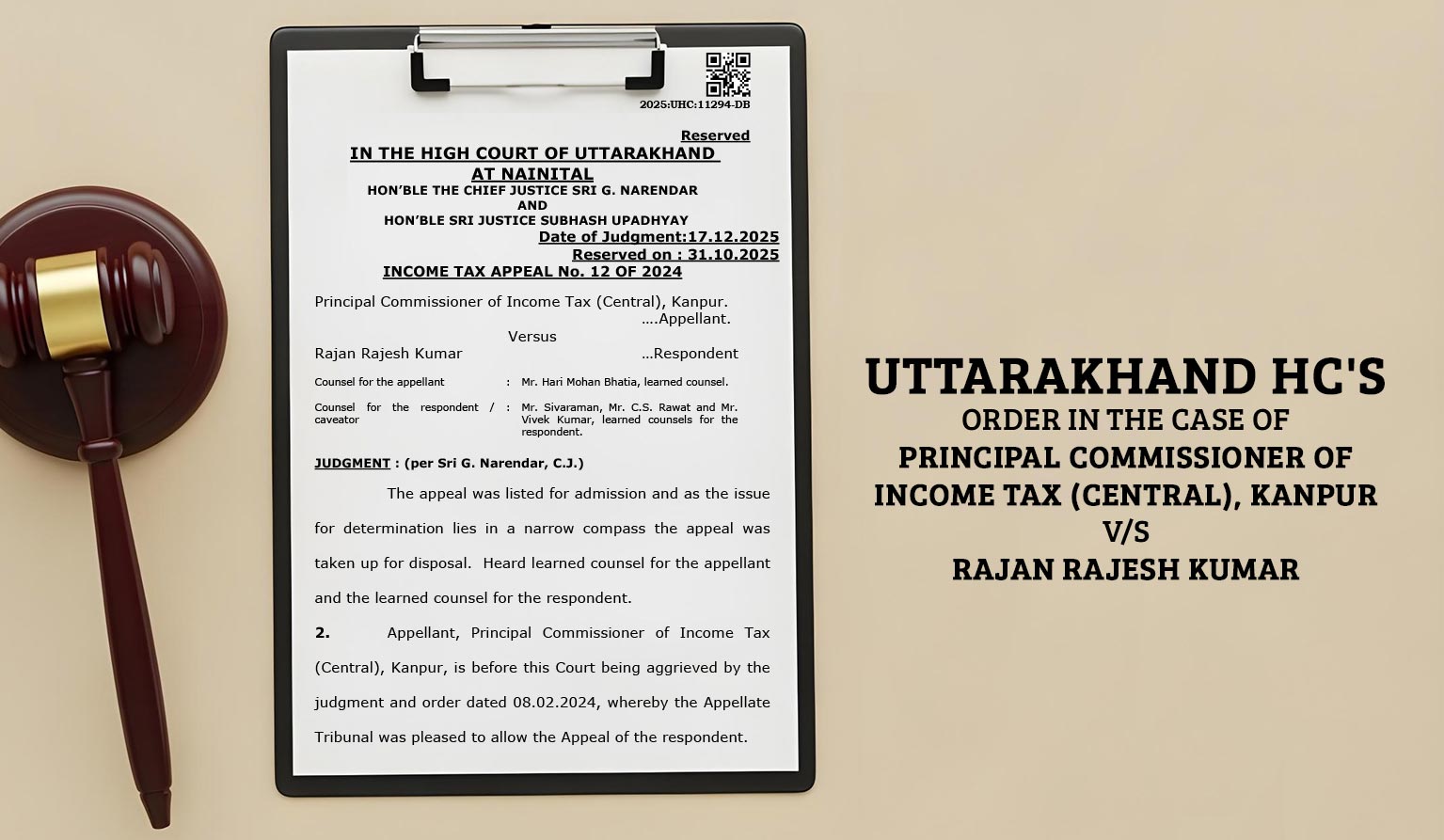

| Case Title | Principal Commissioner of Income Tax (Central), Kanpur vs Rajan Rajesh Kumar |

| Case No. | Income Tax Appeal No. 12 of 2024 |

| For Petitioner | Mr. Hari Mohan Bhatia |

| For Respondent | Mr. Sivaraman Mr. C.S. Rawat Mr.Vivek Kumar |

| Uttarakhand High Court | Read Order |