Some of the passive incomes are said to be the income from Youtube, blogging, money from sharing video apps, and others. The same is essential to note the tax treatment from both the income tax and the GST point of view in India. The taxability of GST on YouTube and blogging income-earning shall be discussed in this article.

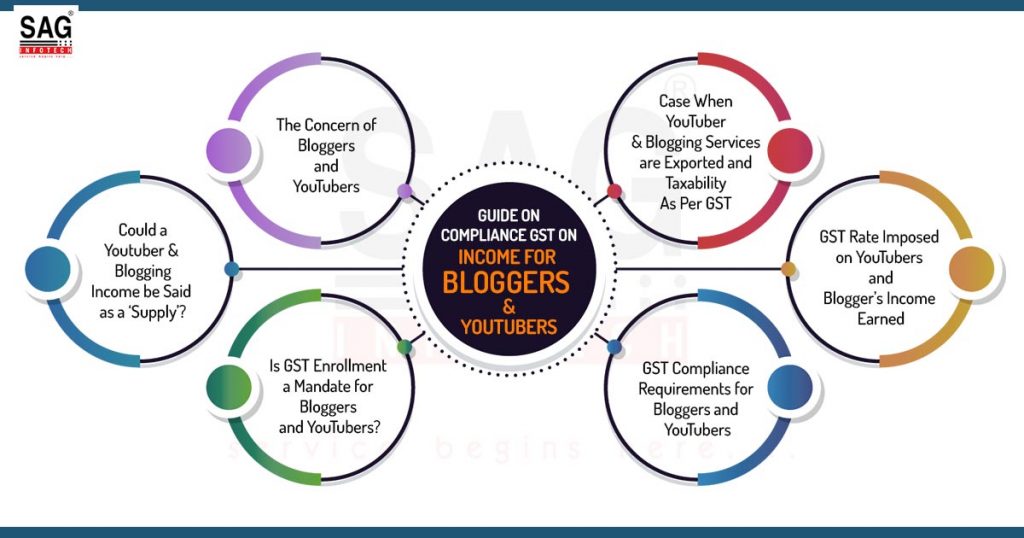

The Concern of Bloggers and YouTubers

The YouTube platform is a subsidiary of Google, the company is located in the USA and permits people to open a channel and post the videos. The company earns through the advertisements as well as the promotional videos hosted on it.

A YouTuber is a person who runs a channel on youtube. He will earn money from the platform when their channel attains a specific number of subscribers and when views on the videos would exceed the mentioned limit according to the policy of youtube.

Additionally, a blogger is said to be a person who issues space for the brands to place their advertisement. To work as advertising channels, facilitator agencies mediate between the bloggers and brands.

Bloggers use advertising portals like Google AdSense to earn income when advertisements seated on their blogs get clicks. Google AdSense acts as a medium, and bloggers will not know the advertisers behind the system.

Could a Youtuber & Blogging Income be Said as a ‘Supply’?

Section 7 of the CGST act mentioned the supply beneath the GST. Any transaction would arrive beneath the GST if it is covered beneath the supply definition. Moreover, the supply of goods or services with the consideration to executing the business would be a supply.

The service is also described beneath the CGST act to mean anything excluding goods, money, and securities. The same includes the activities along with money, or its conversion is charged individually for some consideration.

Youtubers supply services by posting the videos and the content on their channel with the monetization and furnishing the platform for advertising. The bloggers supply services by furnishing the platform to the advertisers to show their advertisements with monetization. Thus, YouTubers and bloggers are to be acknowledged as the suppliers of services.

Services through the bloggers would be acknowledged as online data and database access or retrieval services. Under section 2(17) of the IGST act, online Information and Database Access or Retrieval (OIDAR) services are said to be the services in which the information technology is used to supply the information through the internet or through an electronic network, along with the online advertisement services. The kind of supply is automated, engages low human interference, and is not possible to share without any information technology.

Is GST Enrollment a Mandate for Bloggers & YouTubers?

The GST registration is needed by the bloggers or YouTubers, in which the total PAN-based turnover exceeds Rs.20 lakh for a financial year. The same threshold is Rs 10 lakh for the mentioned class.

You must remember that when the service is furnished to the recipient enrolled in a state varied from the supplier, YouTuber, or blogger the supply is then said to be the interstate supply and is responsible for the enrollment irrespective of the whole turnover.

For example, when Mr. Akshay, Delhi, writes blogs about food and poses Rs 5 lakh. He has contracted a devoted space on his blog to Pinstorm, advertising the agency enrolled in Mumbai, for kitchen appliances ads on pay-per-impression grounds.

If the turnover of the YouTuber and blogger is Rs 50 lakh and if they meet the conditions they might indeed choose the composition scheme available for the service providers.

Moreover, when they do not want to choose the composition scheme, they would choose the quarterly return filing and monthly payment of taxes (QRMP) scheme with a low compliance load.

Case When YouTuber & Blogging Services are Exported and Taxability As Per GST

The export of the services is being acknowledged as the supply beneath the GST when the supplier is located in India while the recipient and supply place is outside India. The supplier and the recipient should not be two establishments of different individuals and the recipient of the consideration should be in the convertible foreign currency.

Moreover, since a blogger’s services are of the kind of OIDAR services, the supply place should be the recipient’s location, either Google Inc or Google Adsense, both are the outsiders of India.

The same conditions are satisfied in the bloggers who post the content on Google and would qualify as export of services. Since the recipient and the supply place do not count under the tax, no GST is imposed. Moreover, under section 16(1)(a) of the IGST act, a zero-rated supply comprise exporting the goods or services or both.

Additionally, a YouTuber directed the zero-rated services to Google Adsense in running the advertisements on the youtube video. Thus the Youtuber and the bloggers rendering services to recipients outside India, like Google, Youtube, and others, pose 2 options.

Youtuber either needs to export service beneath the cover of a bond or Letter of Undertaking (LUT) in Form RFD-11 excluding furnishing the GST or should furnish the GST and after that claim it back as a refund.

GST Rate Imposed on YouTubers and Blogger’s Income Earned

The GST rate subjected to apply towards the services rendered by the YouTubers and bloggers is 18% (that is, CGST of 9% and SGST of 9% or IGST of 18%). This GST rate applies only when the YouTuber is responsible for GST registration or is GST enrolled.

Wherever the YouTubers or bloggers are exporting services these will be recognized as zero-rated supplies and no GST is imposed.

GST Compliance Requirements for Bloggers and YouTubers

A GST invoice is required to be provided for all the services given and the invoice should write the invoice number, invoice date, value of services offered, and the GST rate, among others.

Despite there being no mentioned format for asking for a GST invoice by the Youtubers or bloggers, the law would mandate that some items must write on all the GST invoices.

The information of all the invoices is needed to be mentioned in the GST return in Form GSTR-1. All invoices should be asked under the GST rules.

A YouTuber or blogger should furnish the GSTR-1 and GSTR-3B similar to any other regular assessee.

Should I register for GST immediately when I make my channel, or when I start to monetize my videoes or only when my income exceeds the limit.

You shall obtain GST registration when your gross receipts(PAN based) crossed threshold of 20 lakhs for Services.