The state of Jammu & Kashmir has been bifurcated into two Union Territories – Union territory of Jammu and Kashmir and Union territory of Ladakh.

According to the Table II, in column (3), in serial number 51, of the concerned notification by the government of India, dated 19th July, 2019, the words “State of Jammu and Kashmir” shall be replaced by the words “Union territory of Jammu and Kashmir and Union territory of Ladakh”.

The Jammu and Kashmir Reorganisation Act, 2019 of Indian Parliament contains provisions regarding the reformation of the state of Jammu and Kashmir into two union territories on 31 October 2019.

According to this Act, the state GST Act will continue because without this the issues related to enforcement of the indirect tax on the two union territories will spawn out and also J&K has the assembly of its own. GST Act for union territories will have to be made for Ladakh for which law will have to be passed.

Read Also: What is Union Territory GST (UTGST) and Why It Is Implemented

The government shall exercise the powers specified under section 5 of the Central Goods and Services Tax Act, 2017 (12 of 2017) along with section 3 of the Integrated Goods and Services Tax Act, 2017 (13 of 2017).

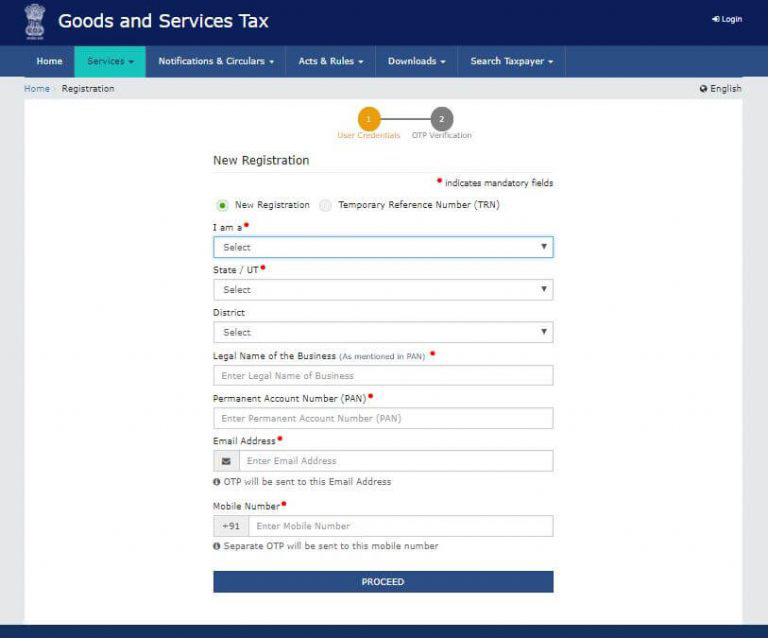

Besides, the government will simultaneously have to hammer away other issues for the smooth execution of the GST regime. Both the Union Territories, as well, will need to acquire separate registration under GST