As the sources confirm, India’s defence budget will soon witness a hike of more than Rs. 60,000 crore all thanks to the exemptions from the customs duty and contributions from goods and service tax that escalated from October 1.

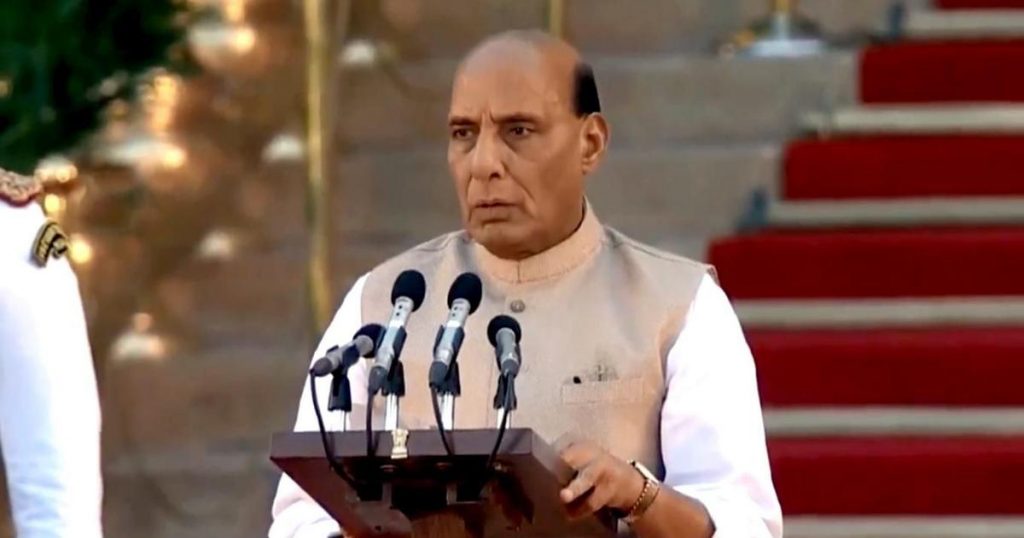

Defence Minister Rajnath Singh claimed this to be a game-changer for defence ministry as this will significantly impact the budget and eventually pave the way for modernisation and advancement of equipment.

Though the imposition of tariff on customs duty in 2016 led to a downfall in imports and the next was the implementation of GST in the following year. Both the levies made their debut for promoting indigenous production but soon the government realized that there they still don’t have enough capabilities to locally produce defence spare parts.

Read Also: Budget 2019: Tax Proposals and Its Impact on Taxpayers

Heavy tariffs on imports led to defence segment throw a large chunk of their budget on importing the defence items along with the twin taxes which hindered the availability of modernised budget. The situation altogether urged the armed forces to cut on plans to acquire new systems.

Sources say “It was proposed by the defence ministry to restore the exemptions on imports as well as exempt GST slab on items that are currently not capable of domestic production”.

The exemption is on the selected defense items which are required by the defense forces of the country for a period of five years till indigenous production boosts. With this, the Indian industry of arms and equipment will roll up there sleeves to prepare for the alternatives after the five year period.

Officials have claimed that the lump sum of Rs. 25,000 Crore will be rescued on account of the rollback of tariff on the imports of arms and equipment that is not manufactured in India. While GST exemption will save the budget by Rs. 35,000 crores.

Recommended: Exporters are at Risk to Get a Notice by DRI for Availing Invalid GST Exemptions

Though the exemption on customs duty and GST will improve the cash flow in the Indian arms market the services are still short of resources to take forward their modernisation plans.

The budget allocation for the defense this year is locked at Rs 3.18 lakh crore, with capital expenditure of Rs 1.08 lakh crore. The low capital gain means that the armed forces will fall short of almost Rs 18,000 crore on their committed liabilities to pay for equipment already purchased.

This gap could mean delayed payments to public sector units and a further delay in purchasing equipment.