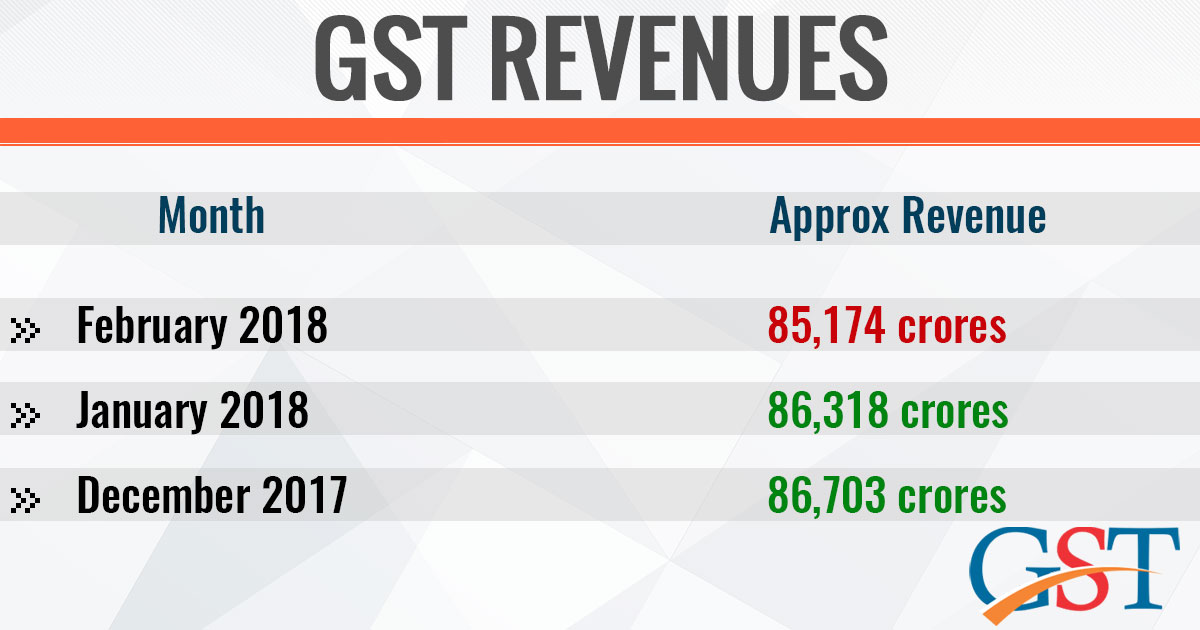

GST collections witnessed a slow down for the second consecutive month in the last quarter of the current financial year. The collections for the month of February stood at Rs 851.74 billion. Only 69% of the registered taxpayers filed returns. The total GSTR 3B returns filed till March 25 were around 5.951 million.

The same has been confirmed by the Central Finance Ministry. In a press release, the Ministry informed that the total revenue received under GST for the month of February 2018 (received up to March 26) has been Rs 863.18 billion

Compare this to the last quarter data and a contrary image appears. In January, the revenue from GST stood at Rs 863.18 billion. The figure for December and November was Rs 889.29 billion and Rs 837.16 billion respectively. Hence, we can see that Tax Revenue has decreased in the last quarter of the current FY.

The Rs 851.74 billion GST revenue for the month of February can be further broken down as per the following table:

| Type | GST Revenue (February Only) |

|---|---|

| Central GST | Rs 149.45 |

| State GST | Rs 204.56 |

| Integrated GST | Rs 424.56 |

| Compensation Cess | Rs 73.17 |

| Total | Rs 851.74 billion |

Out of the total IGST revenue of Rs 424.56, settle amounts adding up to Rs 255.64 billion are being transferred from IGST to CGST/SGST account. Hence, considering transfers by way of settlement, the total collection of CGST and SGST up to 26th March (for February) is Rs 255.64 billion and Rs 338.8 billion respectively.

There are about 10.5 million registered GST taxpayers. Composition dealers comprise a tiny fraction of these taxpayers. A total of 181.7 million composition dealers are required to file returns every quarter. The remaining 863.7 million taxpayers file monthly returns under the new taxation system. As per data shared by the Finance Ministry with the Lower House of the Parliament, GST collections were Rs 935.9 billion in July, Rs 930.29 billion in August, Rs 951.32 billion in September and Rs 859.31 billion in October.