As per the recent update, the government is planning a beneficial step for companies undergoing resolution process under the IBC. IBC is an acronym for Insolvency and Bankruptcy Code.

There is some talk going on between the Ministry of Corporate Affairs and Department of Revenue (DoR) and a framework is expected to be revealed soon. A senior officer said that “The issue is under discussion… a procedure will be worked out,” The other person said that to finalise the contours, a meeting between officials is gonna organized this week.

As per updates, They are planning to allow companies undergoing resolution process to pay current levies of GST without the mandatory payment of past dues. This step will eliminate the obstacle in the bankruptcy resolution process.

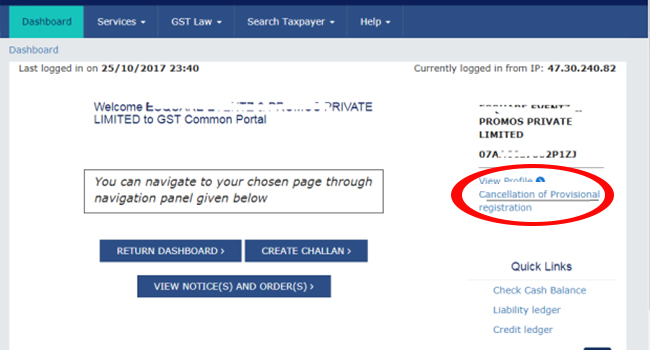

At present, a firm is not allowed to file current tax dues if it has some past dues under the GST framework. Penal action has also been initiated for noncompliance in such cases where the GST registration has been cancelled

Thus it comes in the way of efforts to revive a company under the IBC process and also delaying the resolution process. Many Industry organisations have lobbied the government and this step, asking it to accept current GST without the mandatory payment of past dues.

Many experts also stated that GST and IBC need to be aligned which is now initiated indirect taxes

MS Mani, partner, Deloitte India said on the same issue that “There is a need to recognise the fact that there could be several cases of default in GST filings/payments due to genuine reasons, Such defaults should be condoned, possibly with a small penalty and the focus should be to avoid business disruptions.”