Cancellation of GST registration is not a hard work as the Indian government GST Portal has provided a simple and easy step-by-step procedure to finally cancel the GST registration of migrated taxpayers through the newly implemented feature. Goods and services tax, which was implemented recently and to be exact on 1st July 2017 with a lot of promises and work in progress tagline, is known to be subsuming all the indirect taxes into one. All the business units are exempted from paying GST which are under the turnover of 20 lakhs annually and all the business units above this exemption limit have to be registered under the GST.

The registration part has been discussed everywhere and has been understood manifold by guides and articles, but now there comes a chance to cancel the registration under GST by the taxpayer itself or by any governing authorities. The cancellation option is for migrated taxpayer only who wants to cancel their registration on GST.

By far we have got the confirmation that the business organisation can cancel their registration by the means of the recently popped up feature on the GSTN portal, but the cancellation feature is limited to only 3 entities who can initiate the cancellation of registration:

- The taxpayer himself

- GST officer

- A legal heir of the taxpayer

The cancellation of the registration can be initiated in some cases like the death of the taxpayer. While the registration can also be done voluntarily but only after one or more years are elapsed starting from the date of GST registration.

Latest Update Under Cancellation of GST Registration

- GST registrations that have been revoked under a new procedure have been introduced. Applicants must file the application by June 30, 2023, after filing all returns with tax payments up to that date. Read Notification

- The Orissa HC has allowed an assessee to file GST returns previous to the cancellation of registration and directed the Government to modify the portal accordingly. read order

- “The CBIC has added the advisory about the new functionality of restoration of cancelled registration under GST via REG-21.” Read More

- “The GSTIN has enabled new features for the taxpayers to easily withdraw the application of GST registration cancellation.”

- The High Court of Gujarat has stopped the cancellation of registration under the GST regime on grounds of vague show cause notice (SCN) without any material particulars. read order

- The Rajasthan High Court issues an order for the petitioner, M/s. Avon Udhyog related to the cancellation of GST registration due to failure to file a reply within time. Read Order

GST Authorities Cancelled 1.63 lakh Registrations

Goods & services tax (GST) authorities have cancelled over 1.63 lakh registrations in October and November of taxpayers who have not filed their GSTR-3B returns for more than six months. The council started serving notices to taxpayers who did not file their GSTR-3B returns for the past six months or more and then cancelled their registration as per the procedure.

Conditions, When a Taxpayer Can Cancel the GST registration?

- Discontinuance or closure of the business

- Taxable person ceases to be liable to pay tax

- Transfer of business on account of amalgamation, merger, de-merger, sale, leased or otherwise

- Change in the constitution of the business leading to a change in PAN

- Registered voluntarily but did not commence any business within the specified time

- A taxable person not liable any longer to be registered under GST act

Who All Cannot File the Cancellation of GST Registration?

- Taxpayers registered as Tax deductors / Tax collectors

- Taxpayers who have been allotted UIN

Steps for Cancellation of GST Registration Online on GST Portal

The GSTN portal is live with the cancellation of GST registration for the migrated taxpayers. All the taxpayers who have not issued any invoice after registration can opt for this service. The individual can fill out form GST REG 16 in case he has filled any tax invoice.

Steps for cancellation of GST registration for the migrated taxpayer:

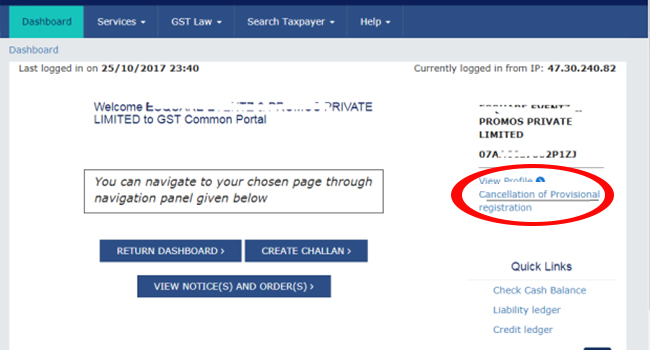

- Login with username and password on the GST portal

- Then click on the tab ‘Cancellation of provisional registration’

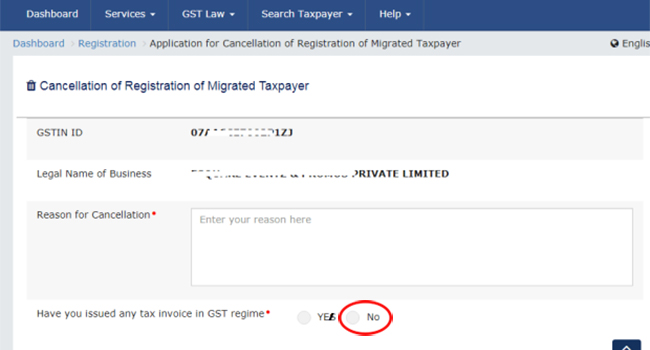

- After which a popup will ask that if a taxpayer has raised any tax invoices in the period of GST

- Select ‘No’

- After the selection, the taxpayer will have to go through verification and have to submit all the form-related details along with the digital signature/EVC

Forms used to cancel GST registration:

GST REG 16: The forms are applicable only when the taxpayer himself applies for the cancellation of registration and there is no consideration for the application other than the taxpayer’s application, which has elapsed one or more years after the GST registration.

GST REG 17: An authorised GST officer can provide the notice of show cause/cancellation to the registered taxpayer and its business entity by using the REG 17 form. The cancellation of registration by the authorised officer can be initiated after issuing the GST REG 17 form to the taxpayer, and he can ask for a show cause as if why the registration should not be cancelled.

GST REG 18: The show cause notice can be replied to by means of the furnished GST REG 18 form under the specified time period stated in the sub-rule (1). The taxpayer or the concerned party must reply to the notice within 7 days of issuance of the notice, giving an explanation of safeguarding the cancellation of registration.

Read Also: Goods and Services Tax (GST) Forms for Registration & Cancellation

GST REG 19: The GST REG 19 form is for the usage of GST officer for issuing a formal order for the cancellation of GST registration. The order for sending the notice must be under 30 days from the date of application or the response date in GST REG 18 form.

GST REG 20: The show cause notice when satisfied by the GST officer can direct for the revoke of any proceedings towards the cancellation of the registration and he should pass the order in the Form GST REG 20.

Application for Revocation of Registration on GST Portal

I want to cancel my current GST registration under Proprietorship as I have registered under the Partnership Form under valid PAN of Firm. I can not see any option on the website on the main page as well as under User Service for cancellation of GST under ” on change of constitution on change of pan”.

Kindly advise as it has been stopped now or I am not eligible as an individual for online cancellation.

contact to department.

Regarding: Cancellation of my Registration

I am unable to cancel my Registration in GST portal as “Cancellation of provisional registration” is not visible in my dashboard page.

Kindly guide me in cancelling my registration.

The same shows in registration column under user services.

I have stopped doing business from apr 24 th 2018, till then i have issued taxable invoices in the current financial year also

what is the procedure to cancel the registration.

You need to file Form REG-16.

Regarding Refund:

How an exporter of services can claim refund of ITC, if during the relevant period he was not having GSTIN and hence has not filed any return?

Regarding Refund:

How an exporter of services can claim the refund of ITC if during the relevant period he was not having GSTIN and hence has not filed any return.

As he was not having regd. at the time of availing input services so no ITC can be claimed on that.

I want to cancel my GST. I am not enabled for GST.

You can cancel your GST registration by filing GST Reg-16 or Reg-29 (as applicable) online through GST portal.

After Cancellation, do we have to file returns? Till it shows “Pending for processing”

Got migrated from service tax to GST . Rental Income from Commercial Property. But Less than 20 Lakhs. Want to cancel GST registeration. Query:

1. Which form to use REG – 29 or REG – 16 ( For the month of May we have issued tax invoice in which GST has been Charged.)

Regards

Karan

How long does it take to cancel the GST… Mine (Cancellation) is already pending for over a month now..after submission

Generally the GST officer is required to verify application and issue FORM GST REG-19 within 30 days of date of submission of application. Contact department’s help-desk regarding your issue.

The form cancellation has been submitted online. The scheduled completion date was 8-5-2018. today it is 25/5. The firm is in Gujarat. Is there any number or link I can get

You have to contact on GSTN helpdesk.

Hello,

I had registered for GST in Sep 9th 2017 when it was mandatory. But I never did any transaction or made any business outcome from this. I want to cancel the GST Registration number as I do not need this or have never used it, hence not required, I need help on this.

You can file REG-29 for cancellation of registration.

There is no time limit prescribed under the Act, for a department to cancel the registration after application by the assessee. So what assessee shall do, to continue file returns after application or stop after application.

The date of application will be deemed to be the date of cancellation in this case. You need to file GST returns till the date of application.

I have applied for cancellation of MY GST number on 26 Jan 2018, from GST panel login. after that, I never file a return, because I applied for cancellation. My cancellation request is still pending on GST panel. Is it necessary to file the return after cancellation request? will I have to pay penalty? How many penalties for late filing. I closed my business in January. Please help me with this issue.

GST returns are required to be filed till the date of filing an application for cancellation of registration i.e. till 26.01.2018. Date of filing of the application will be deemed to be the date of cancellation of registration.

There is no time limit prescribed under the Act, for a department to cancel the registration after application by the assessee. So what assessee shall do, to continue file returns after application or stop after application.

I have a new gst registration.

My business is new n a start up, it was registered under “composition”.

We want to put our product online on Amazon as we are in a rural area …

Amazon says that they need a regular gst registeration.

How do we switch over from composition to regular at the earliest as my business depends on this …

We have not sold anything so far …

HELP !!

You need to file form CMP-04 online to opt out from composition scheme.

Namaskar Ji,

I have closed my business engagement w.e.f.01-01-2018. I have filed NIL rated GSTR-3B & GSTR-1, ROR JAN, FEB AND MARCH-2018. I have applied for cancellation of registration on form REG-16 ON 10-04-2018. I HAVE NOT RECEIVED ANY REPLY SO FAR. What shall I do? DO I need to file nil rated GSTR-3B AND GSTR-1 for APRIL-2018?

Kindly advise. THANKS, AND REGARDS.

Dr.M.L.Dhar. 02-05-2018

Date of filing of REG-16 will be deemed to be the date of cancellation of registration, and you need to file all returns till the date of cancellation.

We APPLIED FOR CANCELLATION OF RC Officer called me and ask to file subsequent months 3B. If file it is liable to late fees .. whether we still require to file gstr3B & Gstr 1

You need to file the returns till the date of application for cancellation of registration. The late fee will be levied as per normal provisions only.

I have migrated from VAT and Service tax & was issuing GST invoice till 31.03.2018. Since my Turnover is below 20 Lac I want to submit GST for cancellation. Submitted Both GSTR-3B & GSTR-1 till 31.03.2018. What is a procedure for Applying GST cancellation as there is no option for cancellation of the migrated dealer?

I have migrated from service tax & was issuing GST invoice till 31.03.2018. Since my Turnover is below 20 Lac submitted GST Reg – 16 for cancellation on 22.04.2018. Submitted Both GSTR-3B & GSTR-1 till 31.03.2018. Can I proceed with raising Non-GST invoice or need to wait until a formal cancellation order is received?? any time period within which AO should accept or reject my cancellation application.

Filing of REG-16 will be deemed to be the date of cancellation of registration, and you need to file all returns until the month of cancellation.

Hello Sir, I had cancelled my GST because my turnover was less than 20 lacs but I want to reactivate the old GST is it possible and please tell me the procedure.

You have to take new GSTN.

Hi,

We took GST number as we were doing Export of services. We have filled all returns in time. Now our contract with the client has ended so we want to de-register for GST. What is the procedure for it?

Regards

Yogesh

I am a medical shop dealer. I wind up my business on 17.01.2018 and started a new business on next month.I filed my GSTR3B for the month of January on March 2018. I want to cancel my old GST registration and take GST registration for the new firm. For this what can I do?

I have a doubt. My grandfather is registered in GST as a composition taxable person. But in last month he passed away. Now I want to apply for cancellation of GST registration. while applying it is asking the details of Inputs and ITC on inputs. but as registration was as a composition dealer. There is not ITC availed. so I want to know which details to be given in this. and output tax to be a pain on what basis.

As assessee is a composition dealer, so no ITC details will be required and tax is to be levied on Total turnover.

so how to pay the tax as the return for Jan-Mar will be filled in April. can I fill GSTR 4 for of Jan-Mar in the march itself? and due date to apply for cancellation is 30 days from the event of cancellation. so if I file the return in April then that timeline will pass.

Dear Sir,

You mentioned that tax is to be levied on Total Turnover. Should I pay the tax on stock held on cancellation date? though I have not claimed any ITC?

As you have not availed any ITC on closing stock so you do not need to pay tax on the stock.

I have registered GST under regular type in November 2017 now I have opted to do no business from GST but since registration for the month of November, December 2017 January 2018 I have filed NIL return GSTR 3A and presently a week back I have also filed NIL return GSRT 1 will I attract any penalty for late NIL filing of GSTR 1

Now as a new resistor of GST is there any option to cancel the GST registration because in the login portal of GST provision for cancellation is not showing to me.

And what is the time limit to commence the business after New GST registration?

can anybody reply please I am tense of paying the heavy penalty if charged?

Hello,

I’ve got a GST registration done but now my business plan got cancelled and the business never started. If I do not file a nil return on time, I am being charged a penalty too! I want to go for cancellation but it says I can’t go for cancellation before 1 year of GST registration! Why is this rule for 1 year? Is there any way I can cancel my GST? Also, do I need to pay those penalties charged because of non-filing of nil return on time?

As per decisions are taken under 25th GST council meeting, now taxpayer can cancel their registration before 1 year. So you can cancel your registration now but for cancellation, you have first to file all the returns with penalty till the month of cancellation.

What is the procedure for Cancellation of GST registration, Still Portal shows “Voluntary registration can’t file cancellation within 1 year of registration”?

We want to cancel our GST Registration (Composite Dealer) in February. How can we file the return until Feb where the form for filing return is not available.

As for composition dealer, the return is to be filed quarterly and as you are cancelling your reg. in Feb month so you need to show details up to Feb month in Jan-Mar qtr return, which will be available after the march.

We are a migrated taxpayer and applied for cancellation of registration under form reg 16 on 1/2/18 and file returns till December so till the time the order of officer comes do we have to file a return for the month of January.

As you applied for cancellation in the month of February, and you have opt for form REG-16 so you have to file the returns until February month.

I want to cancel my GST. I am not enabled for GST.

You can cancel the same by option available on the portal.

To register the new company (provide services in real estate ) & the open current account. I had registered for service tax 10 months back. I was given GST no as I had registered for service tax. I had tried myself to migrate to GST portal but could not do. During last 9 month, I have not done any business.

I want to cancel GST no as I came to know if I do not file return I will be charged Rs 50 day. Please advise what I need to do for GST no cancellation

Dear Sir,

I am newly registered in GST but my turn over is less than 20 lakh. Now, I want to cancel my GST registration. so how can I cancel it?

Cancellation of registration can be made by filing an application online on the GST portal.

When an online portal is not updated in another way not working w.r.t. cancellation of GST registration than what steps to be taken for cancellation of regular GST registration.

Contact to department.

My turn over under 20 lakh please cancel GST registration,

Cancellation of provisional registration can be done by filing the application online. Facility for Cancellation of registration for new registrants, yet have not been provided by the department.

Dear Sir

If I want to move with your team for the cancellation of my Gst what is the process please guide me.

“Cancellation of provisional registration can be done by filing the application online. Facility for Cancellation of registration for new registrants has not been provided by the department.”

When will they announce ? Any Idea

Contact to the department.

I want to close my GST registration and tax invoice issued in gst…plz help can I surrender my GST registration…

Cancellation of provisional registration can be done by filing the application online. Facility for Cancellation of registration for new registrants has not been provided by the department.

How can I cancel my GST registration if I am not a migrated GST registration holder? I am a fresh GST registration Holder.

You can apply for the cancellation of provisional registration. Login GST website and click on “cancellation of provisional registration” available on the dashboard. No such option is available for the new registrations.

I GOT GST NO. BUT MY TURN OVER UNDER 20 LAKH.SO I COULD NOT WORK UNDER GST. I WANT CANCELLATION OF GST. I COULD NOT KNOW MY PASSWORD AND ID.

Contact to the department for assistance.

I have by mistakenly created 2 different GST registration as the 1st one was taken to a long time to get created, so I applied for the 2nd time but ultimately both registration got created and I am not getting any option to cancel the registration.

Can anyone help with the process of cancelling any one of the registration

Thanks

You can file GSTR REG-16 for cancellation of registration.

but the REG-16 filling is not online, Is it can be done via offline mean only

Till now, facility to file REG-16 is not available on the portal. You can file it once it is available online.

Sir, I am a composition dealer and filed my Gstr 4 for July to September. My turnover is below 20 lacs. I want to cancel my registration. In cancellation of provisional registration there is question asked that issue tax invoice or not. But in composition case there is only bill of supply issued. So can be click on NO and cancel our registration.

As in case of composition tax invoice is replaced by a bill of supply, so the basic principle considers both, so you need to mention it as yes.

One has migrated & issued tax invoice in GST regime now wants to cancel the registration. How to cancel the Registration with tax invoice issued in GST Regime?

Registration in GST taken after July 17 can be cancelled due to the closure of a business. Please advise.

Application for cancellation has to be made in FORM GST REG 16.

I am holding provisional registration under GST by virtue of migration from my Service Tax registration. My annual turnover is far below the taxable limit of Rs. 20 lakhs and would like to cancel my registration. The GST System has only recently introduced online cancellation of provisional GST registration, which did not seem to be available earlier. I cannot avail of it since I have issued an invoice in August 2017 and have claimed Input Tax Credit against it. I have therefore to submit an online application for cancellation under form GST REG-16, which I do not find when I log into my GST Account. Can you please enlighten and guide me on the navigation to access the form GST REG-16 and procedure for online submission of the form for cancellation of my provisional GST registration? Have I to wait for 1 year for the cancellation of my provisional GST registration and keep on filing GST returns etc. till then?

I want to cancel or surrender my GST no but cancel option not showing to me. Please send me following procedure.

I am able to cancel GST registration. Thanks.

I cannot find the link ‘Cancellation of provisional registration’ below profile do you know what might be the reason.

Thank you

The link of provisional registration is given on dashboard itself the very first screen after GST login. If it is not appearing then you can contact the department.

Good update. I have a query related to the GST system which still does not have an answer for my problem.

We are small export Prop company and had a VAT No and Service Tax registration no in Haryana. Sales Tax was handled by a Sales Tax Consultant and Service Tax by our CA, independent of each other. Our migration to GST was handled by our Sales Tax consultant and due to oversight, Service Tax was not included in the list of input services. Now we are not able to take credit for our Service Tax balance in TRAN 1 form and don’t know if there is a procedure to migrate Service Tax registration in GST or add it.

Shall appreciate your advice on above.