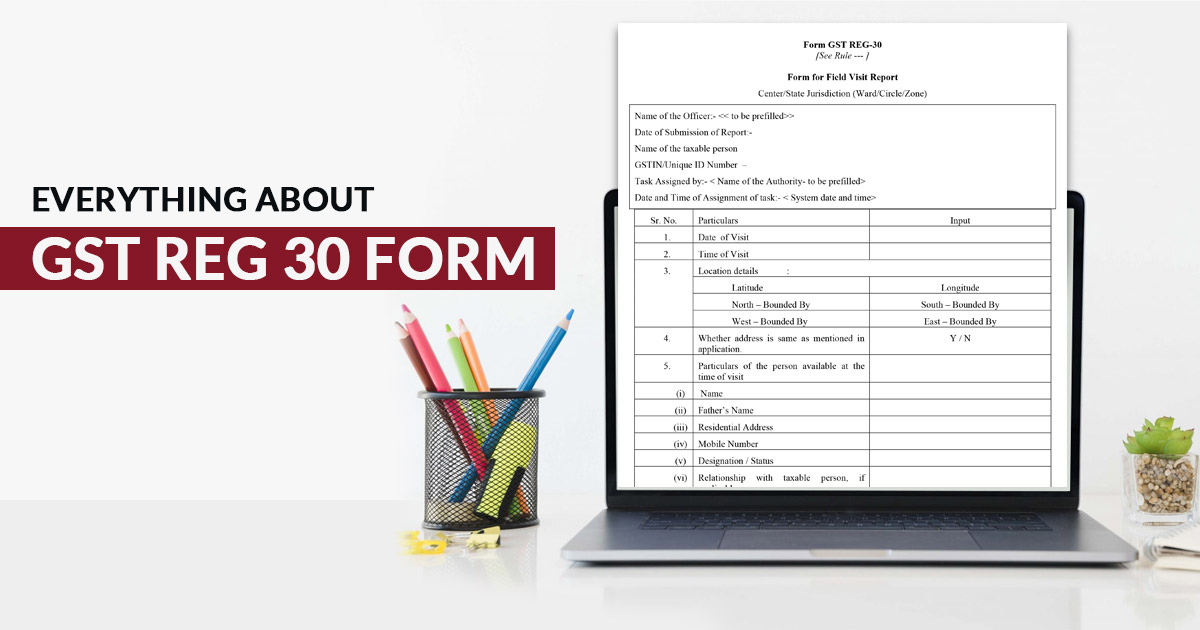

Form GST REG-30 gets submitted or uploaded by the proper officer, it is actually a verification report that contains all the details of the physical verification under Goods and Services Tax (GST) conducted of the person’s place of business. This article shed light on the provisions relating to filing of a report in form GST REG-30 and all the details form REG-30 covers.

Provisions Related to Filing a Report in Form GST REG-30

All the requirements for filing a verification report or field visit report by the Proper Officer in form GST REG 30 were mentioned in the provisions of Rule 25 of the Central Goods and Services Tax Rules, 2017.

The Central Goods and Services Tax (Third Amendment) Rules, 2020 were introduced with notification no. 16/2020- Central Tax dated 23rd March 2020 and it entirely substituted rule 25 of the Central Goods and Services Tax Rules, 2017 which was stated just above.

The Provisions of Substituted Rule 25 Provided as Follows:

- The proper officer should be satisfied that physical verification of the person’s place of business is necessary, based on any of the following:

- Due to failure of Aadhaar authentication

- Due to some other reason after granting of GST registration.

- Due to failure of Aadhaar authentication

- The place of business will be verified in the presence of the person.

- After verification, it is necessary to upload the following on the general GST portal by the Proper Officer:

- Verification report in Form GST REG-30

- Any other document (if any)

The Proper Officer will have to upload the above documents/ details along with the verification report in Form GST REG-30 within fifteen working days from the date of physical verification.

Read Also: Complete GST Registration Via Authentication of Aadhaar for a New User

Verification Report in Form GST REG-30 Consists of the Following Details

The following details are included in the verification report uploaded by the proper officer in Form GST REG-30:

- Officer’s Name (pre-filled)

- Date of submission of the report

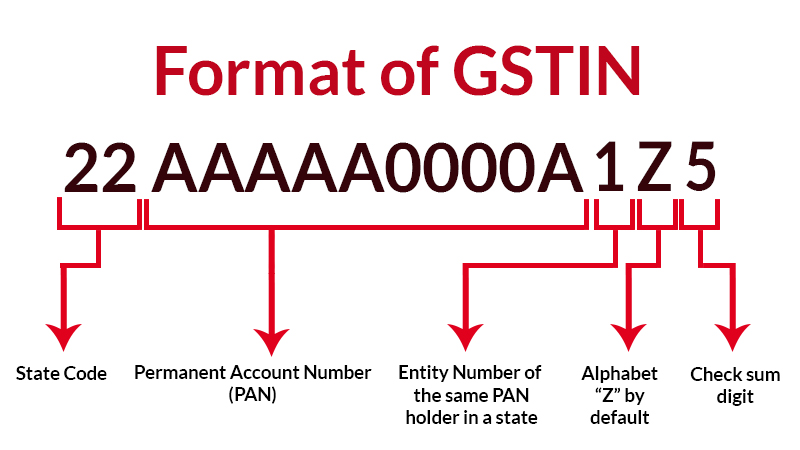

- Name of the taxable person

- GSTIN

- The task assigned by (pre-filled)

- Date and time of the assignment of the task

- Date and Time of visit

- Location details

- Details of the person available at the time of the visit:

- Name

- Father’s name

- Residential address

- Mobile number

- Designation/ status

- Relationship with the taxable person (if applicable)

- Details of the premises/ place of business:

- Open Space Area

- Covered Space Area

- The floor on which business premises are located

- Details of uploaded Documents

- Photograph

That is everything about the Physical verification report in Form GST REG-30, This report needs to be submitted or uploaded by the Proper Officer within 15 working days after the conduction of physical verification.