The proper officer gives the Form GST REG-20 order which drops the cancellation of GST registration. Under Act 22(4) of the Central Goods and Services Tax Rules, 2017 an issuance of an order in form GST REG-20 is regulated.

This article specifies the grounding of revocation proceedings by the proper officer replying through the assessee with respect to cancellation proceedings as well as the issuance of an order abandoning the cancellation of GST registration

The revocation measures by the proper officer

Section 29(2) of the Central Goods and Services Tax Act, 2017 puts down the circumstances where the proper officer can start the cancellation procedures. Following are the conditions prescribed below are:

- For 3 continuous years, the assessee enrolled in the composition scheme has not filed the returns.

- Excluding the composition scheme dealer

- The assessee has broken any rule any of the procurement of the CGST act 2017 along with the rules initiate under.

- The assessee has voluntarily taken GST registration

- The assessee has obtained GST registration through bogus methods.

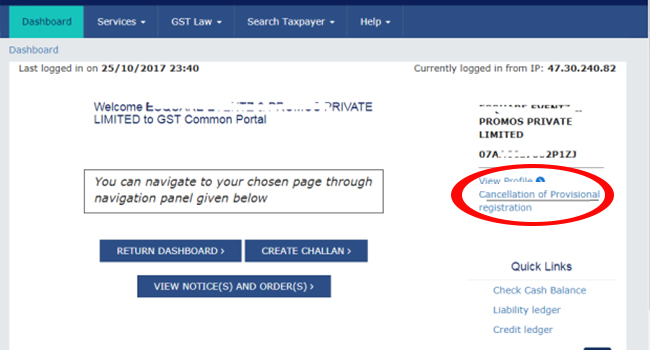

A proper officer can cancel the GST registration if the above circumstances arise. In form, GST REG-17

Furnishing of Response by the Assessee

The assessee if feels angry from the notice given by the proper officer then he is needed to furnish an effective reply. The reply is then to be furnished within the duration of 7 days from the notification date.

Relinquish of Cancellation Procedures by Allotting an Order in Form GST REG-20

The answer is given by the assessee for Form GST REG-18 is to be checked by the proper officer. Post checking by the proper officer if he is satisfied then he will cancel the proceedings. In Form GST REG-20 the proper officer will provide an order which states about the laying of cancellation proceedings in context to the assessee. The order in Form GST REG-20 consists of information such as:

- Reference Number and Date

- Show Cause Notice Number and Date

- Analysis Relies on which the Cancellation Proceedings are Abandoned.

If once the order for form GST REG-20 is collected by the assessee then the cancellation proceedings will be mentioned as laid off. Then following the rule the assessee will be needed to obey the guidelines stated in the Central Goods and Services Tax Act, 2017, and the regulation made beneath.