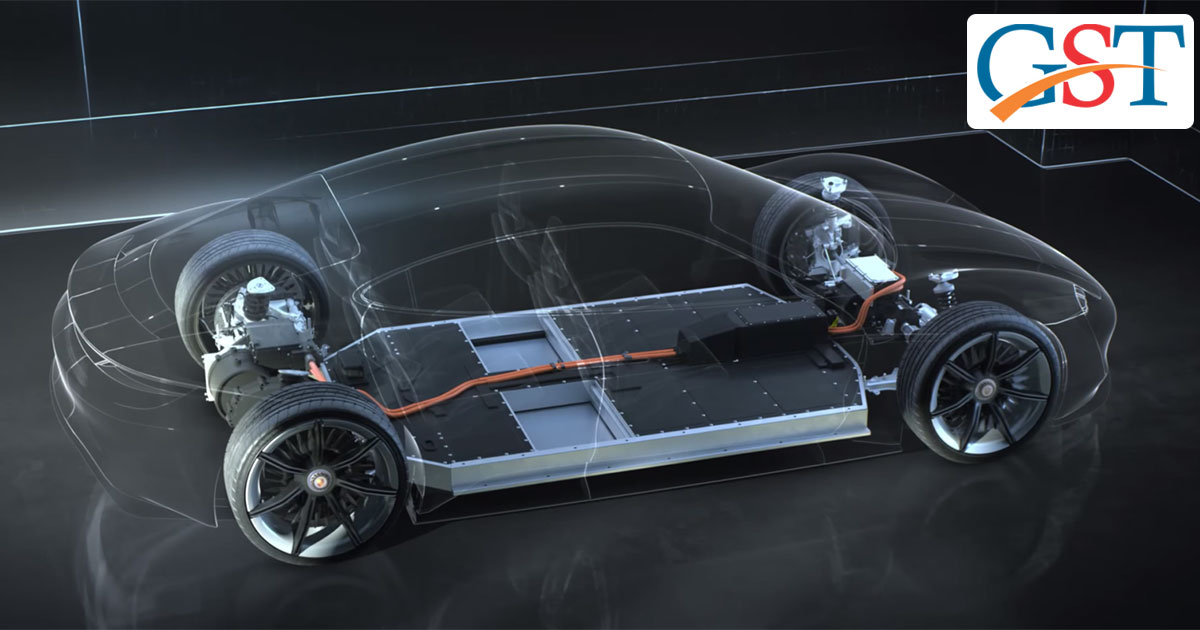

In a proposal put forward by the government, it has been suggested that the GST rate on electric car batteries should be reduced from current 28 percent to 12 percent – the same rate which is applicable to electric cars. The step is aimed at reducing the manufacturing cost of electric cars thus increasing their demands in India.

The proposal came as a part of the range of proposals brought by the Ministry of Road Transport to increase the popularity of e-vehicles in India.

Proposals by Road Transport Ministry to Promote e-Vehicles

Other proposals include:

- The proposal to use green number plates on electric vehicles

- To allow 16-18-year-old youth to ride e-scooters without a license

- To scrap the need of a permit for running commercial e-vehicles

- And the proposal to give preference parking for e-vehicles

However, the proposal to lower the rate of GST on the batteries of the electric cars seems like a real deal. It is expected to lower the cost of manufacturing of electric cars thus boosting their demands in the Indian market. The current GST rate on electric cars is 12 percent, however, the tax rate on batteries that are used in these cars is 28 percent, which increases the overall cost. The move to reduce the GST rate on batteries may help bring the manufacturing costs down for companies like Mahindra and Tata Motors, which are making e-vehicles in India.

Read Also: Scrapped Vehicles May Attract GST Now Onwards

This will, in turn, boost the production of electric cars in India and reduce the cost for the consumers. The move is also expected to help other related systems such as the concept of battery swapping in electric cars will become popular with the drop in the cost of batteries for these vehicles.

The batteries used by the manufacturers of electric cars in India are mainly imported from countries like China or the US. A lower GST rate on batteries will reduce the cost of car manufacturing, however, this may have no impact on the import of complete electric cars. As of now, the Indian market doesn’t have any CBU (Completely Built Up) electric cars.

The electric battery used in an electric vehicle is the most costly and probably the most important part of it. The cost of an electric battery depends on its power (kWh). As of 2018, the cost of electric car batteries per kWh is in the range of $225-$250. The goods news is that the cost has come down considerably since 2010 when it was around $1000 per kWh. It is expected to go further down and reach the $100 mark by 2026, which will eventually reduce the cost of electric cars.

The adoption of electric cars in India can only be increased by reducing the cost of these vehicles to bring them in the range of the price as their petrol/diesel equivalents. The move to lower taxes on the batteries of e-cars definitely seems a step forward in that direction.

One side Government is promoting e-vehicles, GST on the battery of e- rickshaw has been reduced from 28% to 18% on the other hand GST on tyre and tube has been increased up to 28%, beyond imagination.