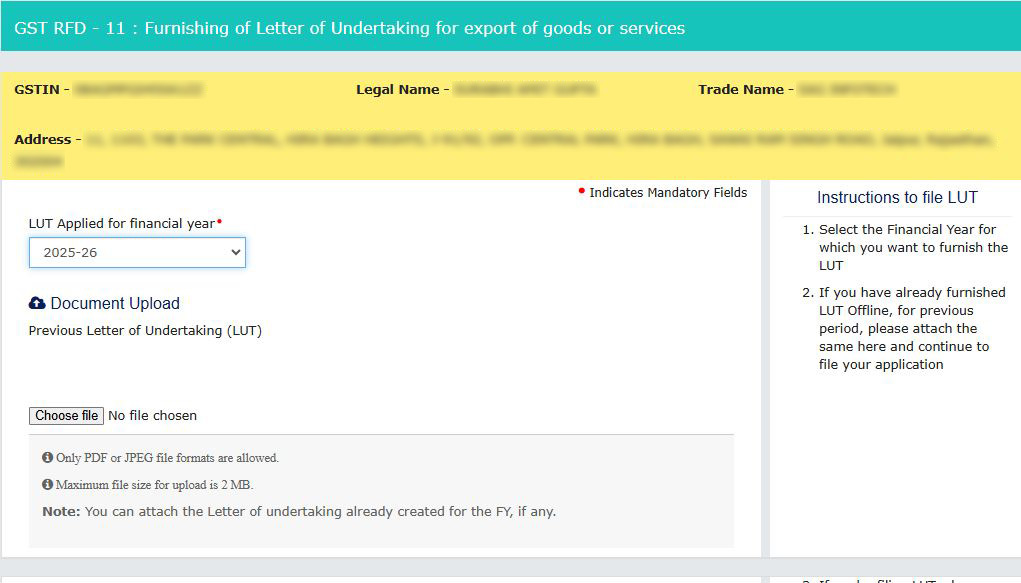

The Goods and Services Tax Network (“GSTN”) has allowed the operation to file a Letter of Undertaking (“LUT”) for the FY 2025-2026 on the GST Portal.

Under rule 96A, the letter of Undertaking or LUT would specify to be filed via form GST RFD 11 in which the exporter shows that he or she will complete all the needs as per the GST specified during the export excluding any IGST payment.

The functionality can be performed at Dashboard > Services > User Services > Furnish Letter of Undertaking> Select FY & apply

In What Way Does LUT Affect GST?

- Beware of Defaults: But difficulty is there if you do not satisfy the conditions of LUT, like obtaining export proceeds within time, the government could ask for the GST you avoided, including interest.

- Better Cash Flow: As you are not filing taxes upfront therefore your money stays where it belongs in your business. For small businesses or startups where cash flow is not fluent, this could be a game-changer.

- Tax-Free Exports: After LUT filing your exports are deemed as zero-rated supplies. The same directed that you are not required to file the Goods and Services Tax (GST) upfront and could export without the annoyance of refunds thereafter.

- Less Red Tape: LUT filing reduces the paperwork and delays in claiming the refunds, facilitating exporters’ lives.

Under GST LUT is effective for businesses and the government. It boosts exports by reducing tax burdens while ensuring accountability.

For the exporters, it is the method to maintain their operations and stay competitive in the global market.