The Goods and Services Tax ( GST ) ecosystem from January 2025 will see a significant update with the rise in the GSTR-2B Excel module.

The making of GSTR-2B an auto-drafted ITC statement is for furnishing clarity to the taxpayers for their eligible and ineligible ITC. The same documents are generated monthly for the normal taxpayers based on the data provided via the suppliers in their GSTR-1/IFF, GSTR-5 (non-resident taxable persons), and GSTR-6 (Input Service Distributors). The newly added tables are for the rejected ITC classifications to allow the taxpayers to determine the ineligible credits efficiently.

Below are the 6 new ITC rejection classes introduced in the GSTR-2B module:

- B2B-Rejected: ITC rejected for taxable inward supplies from registered persons.

- B2BA-Rejected: ITC rejected amendments incurred to earlier filed invoices by suppliers.

- B2B-CDNR-Rejected: ITC rejected for debit/credit notes (original).

- B2B-CDNRA-Rejected: GST ITC rejected for amendments to previously filed debit/credit notes by particular suppliers.

- ECO-Rejected: ITC rejected towards the documents notified via e-commerce operators (ECOs) under the reverse charge mechanism (u/s 9(5)).

- ISD-Rejected: ITC rejected for credits distributed via Input Service Distributors (ISD).

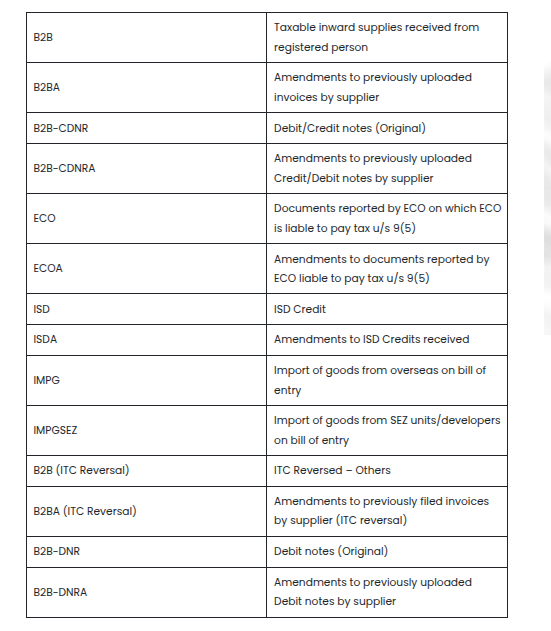

The existing tables are as follows:

After the implementation of the GST IMS (Invoice Matching System) these classes have been integrated to ease the ITC verification procedure. The same is anticipated to improve the precision of the taxpayer filings reducing errors and misreporting.

The GSTR-2B module carries on to show both the ITC availability and non-availability, classified document-wise based on the filings incurred by suppliers.