The migration of old existing Telangana VAT Dealers has been started. The time period for the migration is 01/01/2017 to 30/04/2017. In upcoming details, we divided Telangana migration process for VAT dealers. In the first step, we explain how to get the provisional Ids. In the second step, we explain that how to convert the provisional Id’s in the GST Id and password. In the last step, we explain what the mandatory requirements while filling GST registration form are.

Here we are explaining the overall process of migration to the GST structure in easy to understand way.

Step 1: Steps to get Provisional ID – Telangana

GST Migration starts From 01 January 2017 for Telangana State, Once Dealer will log in on Telangana Commercial Tax Department Portal, open Telangana vat site i.e. https://www.tgct.gov.in/tgportal/

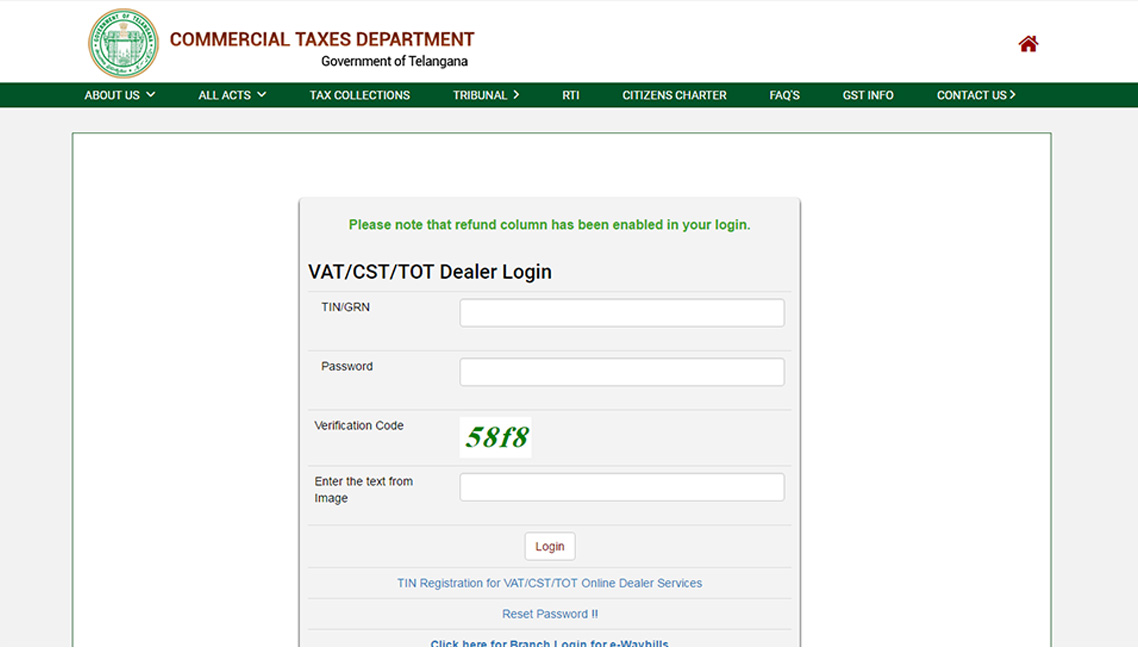

Enter user id and password of the client

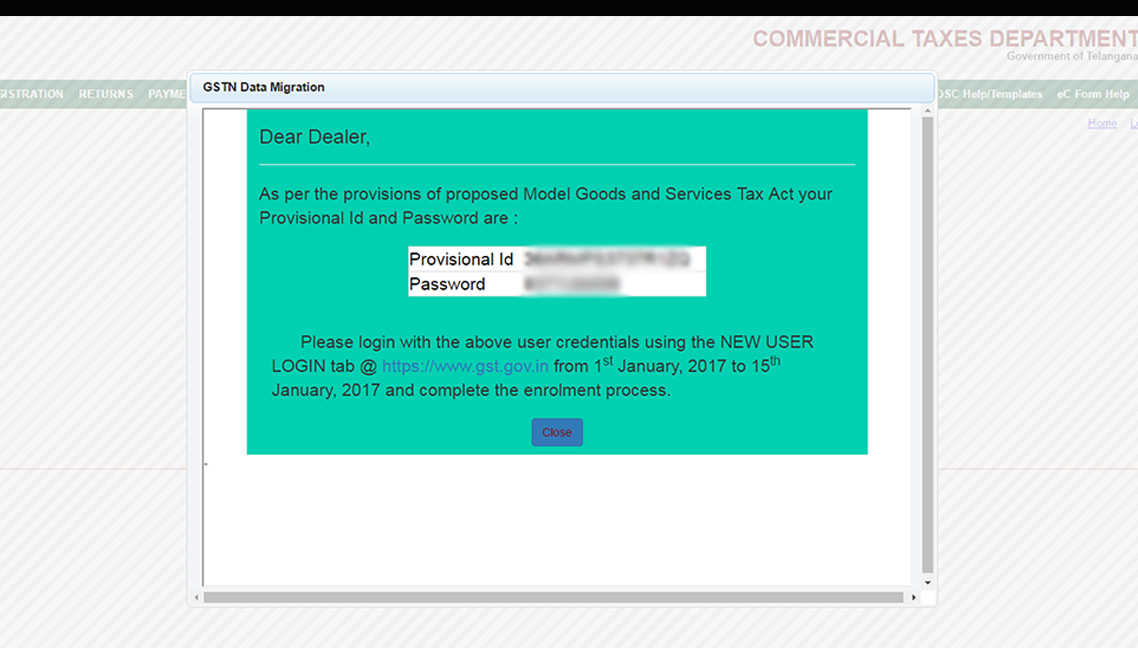

It will show pop-up window which will show details of GSTN Provisional Id and Temporary password on screen to enroll on GSTN Portal

Step 2: How to Convert Provisional ID into GST User ID and Password

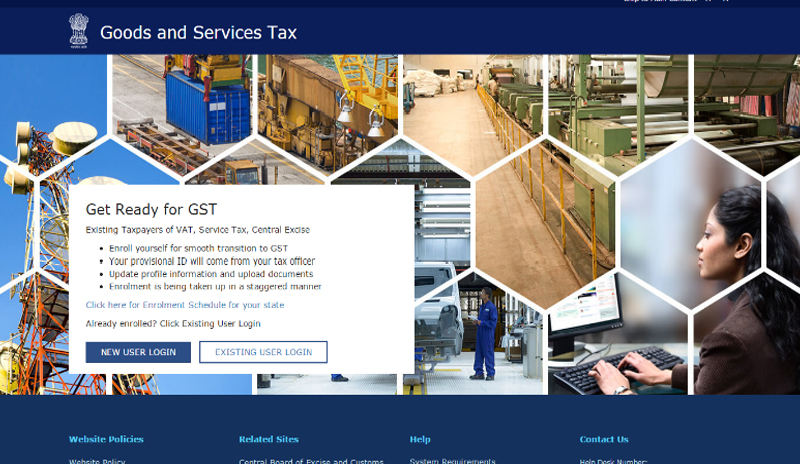

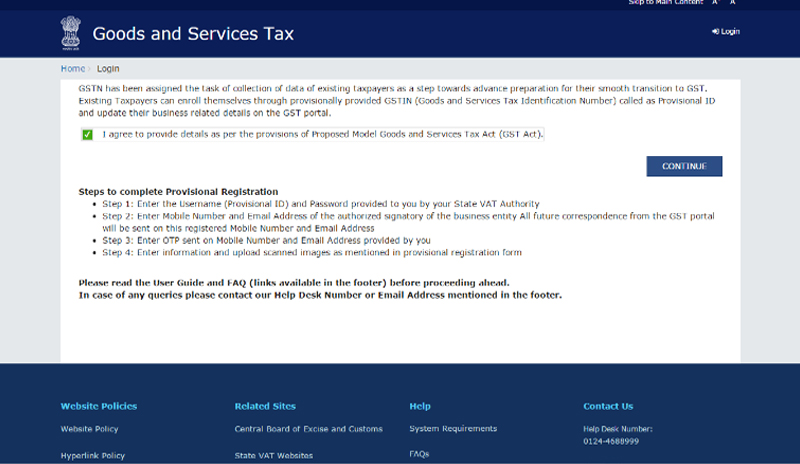

Go to www.gst.gov.in site

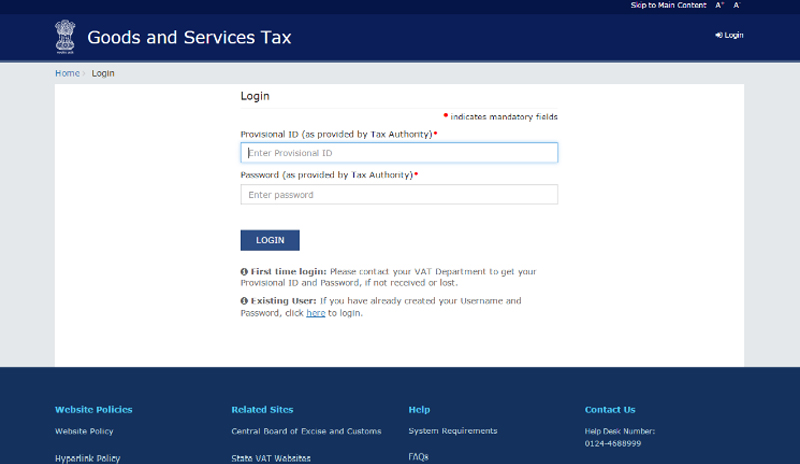

After Clicking on Continue button, enter provisional ID, and password:

After entering the details, enter mobile no. and email address

An OTP will generate and enter the same.

After that make a user id and password of your choice for the GST.

Step 3: Mandatory Requirements for Filling GST Registration Form

- Have your PAN card, Name, Address, Passport Number, Aadhar No available for updating them on the portal for the owner, authorized signatory, partners, proprietors, Karta of HUF, directors or partners of LLP.

- Keep handy of bank account number, IFSC code and bank address ready as well.

- Pick out all your required documents in soft copies as pdf / jpeg with each file size up to maximum 100 kb, ready for the quick migration process.

- Fill up the required details W.R.T. each page for registration. On successful updating of details, each page will show a right click mark

- Get the DSC of the applicant verified / registered beforehand on the GSTN portal.

- On complete updating of all required pages, the application shall be verified using the DCS of applicant or E-signature. As of date, there is no clarity on e-signature.

Recommended: Gen GST Registration Utility: Easy Way for GST Migration & Registration

Hi,

One of my friends is engaged in the business of Paddy, fertiliser, pesticides and petrol & diesel. his consultant filed the return of gst from july to Mar’18. he has shown petrol&diesel under non gst goods and he did not file vat returns and not paid vat amount to the government. whether my friend is required to file vat returns and which form and whether he is required to pay the vat to the govt. kindly do need full assistance.

As petrol & diesel is kept out of the purview of GST, so that will be considered under the previous tax laws, so you need to pay VAT on that and also need to file the return.

Very Good Question,Thank You

I am articles student my client is expired 23rd September my sep month ITC is sgst 145000 tax payable cgst 80000 sgst 80000 this time what I can do?

You can adjust ITC for payment of SGST for Rs. 80000 and make the balance payment of CGST for Rs.80000 since ITC of SGST cannot be adjusted against CGST.

I HOLD STOCK OF 14.50% month of june -17 how should convert gst and gst % are difference ie. 5%,12%.18%.*

You have to charge GST at the rate applicable to the product i.e.(5%, 12% or 18%) at time of sale then you can take credit for the tax which you have paid at the time of purchase.

For GST centers in Telangana call me on 9959929788

TELANGANA my office at 32-77/29, S.R 218, SITHA RAM NAGAR COLONY, SAFILGUDA, NEREDMET, SEC – 500 056. I JUST WANT TO KNOW CIRCLE OFFICE CODE, COMMISSIONERATE CODE, DIVISION CODE AND RANGE CODE.

PLEASE HELP ME

I have got the migration done, but am not able to see the returns tab/option in the dashboard for filing the returns.

Contact department for assistance

Ok fine thank you for the prompt reply. And how to file the nil returns in gst is there any provision for that?

Hi,

we have TIN number registerd in Jan2016 and PAN is updated in the TIN telangana.

So far we have not issued the GST Provisional ID.

in the delar login showing this as will get in next phase.

Provisional ID is issued by the concerned department. So contact department for assisstance

Good Morning Mam,

Plz tell me what will be my jusrisdiction when i am applying for New GST no it is asking me for Jurisdiction what jurisdiction i have to select for my given address my company is deals in Electronic goods FLAT NO. 204, PLOT NO. 89/90/91, SHUBHAM ROYAL APARTMENTS, FRIENDS COLONY, PUPPAL AGUDA HYDERABAD Rangareddi TG 500075 IN

You have to select the jurisdiction under which your registered address of company falls.

“Provisional ID will receive in next phase” displaying in VAT Login…. now what to do… how can i migrate it to GST although previously it was showing the Provisional ID but now It is Showing that Provisional ID will receive in next phase… Kindly Suggest

Contact to your sales tax department.

I HAVE TO EDIT THE ENROLL MENT PROCESS

I HAVE TO ATTACHE EXCISE REGN COPY – I GOT PROVISIONAL ID – HOW CAN I EDIT THIS – EDIT OPTION IS NOT ENABLE IN THEPORTAL

PL. GIVE REPLY

REGARD

There is no such option given for edit under migration process.

Hi !

I’m existing registered VAT dealer, Yet to migrate to GST..

I’m not getting provisional id and password for GST registration on VAT login.

Have to get migrated by July1st.

Can you suggest how to get GST provisional id and password.

Provisional ids and passwords are provided by only the concerned department under which the person has been registered. So contact the department for assistance.

we are looking to take the contacts work in Telangana government department and for the same they asking vat registration in Telangana

now we having in Karnataka vat and we migrated to GST ALSO can we still need to get registered in Telangana also please confirm this

You have to take registration in that state only from which you are providing services.

Still now I didn’t revived any gst portal and not showing in my VAT login page.

Now what I should do to migrate into GST

sir

in our gst login legal business name and pan number are wrong how to change them

We have Business in Hyderabad location and we have got/migrated GST# for Andhra Pradesh when submitting documents, which is wrong and we need to surrender this # to respective department,

But problem is now ho we can get GST# with Telangana State, Could you please me on this.

I have still received PROVISIONAL ID/ACCESS TOKEN .

is there something to worry about ???

I contacted VAT Customer support through email and requested me to wait.

Please check the GST portal for your application status. If there is final submission done by you then there is no issue.

Have received on 1st of June and migrated to GST.

Thanks for your reply

Hi Sir,

I have completed the GST enrollment process. Now when i login to the TGCT website to login, the error message says ” Urgent Notice: If you have already received Provisional ID & Password, please complete your Enrolment process on GSTN portal at GST . Else access to your login will be blocked.” As i have already done this i dont know why i am getting this message again.

So next i try resetting my password. I select the dealer option. But after putting the TIN number and the email id when i click ENTER, it says, USER ID DOES NOT EXIST.

I am really not understanding how do i handle this issue and what is the solution to this issue. I have tried it in all browsers still the problem persists.

Kindly request your help.

Thanks.

First of all, log in on gst.gov.in official site. Enter your user id and password, if it is submitted then there will be an acknowledgment number displayed on screen and also you can’t edit your application details. But if the application is open for editing, it means the application hasn’t been submitted yet.

how do i register DSE

i am a regular vat dealer .

my user id and password has been allotted recently

i am unable to go migration process.

they put the timing 1/1/2017 to 15/1/2017

how to go migration

PROVISIONAL ID You will receive in the next phase.

This is what is still showing. You mentioned that those registered after August 2016 will get it from Feb 1st, but still didn’t receive. Kindly suggest.

Kindly contact on the helpline number, provided on the website in this regard.

Dear Sir,

I am from Sangareddy, Telangana State and I am a sole proprietor.

On the basis of my turnover, I have registered under TOT and paid taxes for the past three years and now need to migrate to GST.

1. How do I get my temporary ID and password to upload documents in GST as when I enter my TOT number and email ID, it says invalid ID.

2. I am planning to start my e-commerce site for the same shop, should it be registered separately.

3. Since I am a sole proprietor, it shows that my personal PAN is also the PAN for my business, is this correct?

pls tell me last date of gst migration & dsc is required or not

I have uploaded all the information and documents by 2nd week of Jan 2017.

It is showing 100% complete, but e-sign is not enabled by that time.

When I contacted GST help desk, they said there are some issues to be sorted out with Aadhar.

Now last week, when i tried to e-sign with aadhar, it says that Aadhar number is not verified. Then I approached AAdhar centre for verification. After submitting relevant documents there, they are saying it takes 15 days for the Aadhar to be linked to Mobile number.

Now the question is as per GST guidelines, the last date is 31st Jan 2017. but since there were issues for the GST department with Aadhar, Is the last date extended ?

Please advise.

hello,

I have a different question than GST.

I am a having a registered partnership firm and i want to change some criterias in our partnership deed.

is it possible to change terms and conditions of deed without dissolving partnership deed.

if yes kindly guide me with the procedure. and also let me know that whether i have to update the same with GST.

There is no specified procedure for changing terms and conditions. You can amend the same by drafting a new amended agreement by taking approval of all the partners.

i dont Have show GSTN Portal

This Tin No :-24131100204

First get provisional ID and password from your existing VAT site and then get enrollment in GST.

Validation error occur only using other than google chorme. if you logging GST ID in google chrome , this problem will not happened.

Sir, this type of error not faced by anybody in our knowledge might be in internet explore there are some setting issues. Please check.

PROVISIONAL ID You will receive in the next phase. ACCESS TOKEN when i am login in commercial tax website with tin no. the above sentence is showing on the page ,how should i migrate from vat to gst can you guide.

Thanking you,

Sir are you registered in VAT after August 2016. In that situation the provisional ID will be available from 1st Feb. 2017

GST.GOV.IN, Error shows “Validation Error ” , how to find out what is the issue.

The website is running.

anybody have a solution for ‘Validation error’ , This happens once all uploaded with DSC . In status shows “Validation Error”. I need to understand which is points to check and fix.

We are having our manufacturing unit at Medak district and our company name got changed during 2015 November. We have incorporated the change of name in all departments including PAN.

Now while registering in GST it is appearing new name (Legal name as per PAN) old name ( Legal name as per act)

Now we have stopped registering as no changes are entertained till April 2017 as per the screen scrolling.

Kindly advise.

Regards,

Emani Srinivas

The department might not have updated your new name in their records that’s why this type of problem has been generated. Now you can do one thing. You can enter your new name of business in trade name column.

I cannot see or receive any provisional ID when I login with my TIN how shall I get the provisional ID

hi, GSTN Provisional Id and Temporary password on screen to enroll on GSTN Portal is not displayed in after I logged in. What to do next ?, how can i get the temporary password

how to get existing vat dealer provisional id and access token ?

Assessee is Partnership Firm. One of the partner is HUF. How to update the details of HUF in the application. (father name, photo,etc….)

Hi Ms Tawari,

I am providing US Citizens living in India Tax services from our office in Chicago. We do US taxes only.

I presume GST will not apply to our CPA firm. Thanks

Dipak D Lyall, CPA

I have two businesses with two different TINS registered with VAT department for one PAN. I have updated PAN for one TIN in the department website and while updating PAN for the other TIN, i am getting error message that, PAN is already registered.

How to overcome this issue.

Sir, might be some validation updated by the VAT department only. For this, please concern from your state Vat department.

We are having Vat & CST both Registrations Under Telangana State as Single TIN No.

Pl.explain the migration Process ?

And also we are going for obtain Service Tax Registration from the FY 2017-18. What is the Registration Process in FY 2017-18 ? pl. explain

You can enroll yourself for VAT and CST both from one provisional id from VAT. Secondly if you want to register yourself in service tax then currently you can’t directly register yourself in GST. You have to first register in service tax then you can migrate yourself in GST.

please go to the GST portal sign in as a new user and create new log in ID and password by giving necessay details.

after that log in as Existing user and give the asked details and upload the documents

Web site is : services.gst.gov.in