In accordance with Notification No. 13/2017, Central Tax (Rate), dated June 28, 2017, which provides details on the services liable for tax under the Reverse Charge Mechanism of the CGST Act, services rendered by directors of a company or a body corporate situated in a taxable area to the said company or body corporate will be subject to reverse charge.

Due to the ambiguity surrounding the applicability of GST liability on the director’s remuneration under reverse charge, the Central Board of Indirect Taxes and Customs (CBIC) received numerous requests for clarification. In response, the CBIC issued Circular No. 140/10/2020-GST, dated 10-06-2020, to address the concerns and provide clarity on the matter.

Guidelines that Confirms No GST on Remuneration Given to Directors of a Company or a Corporate Body:

To make sure that no GST on the remuneration provided to directors of a company or a body corporate, the following streamlined guidelines, must be adhered to, as stated in the notification:

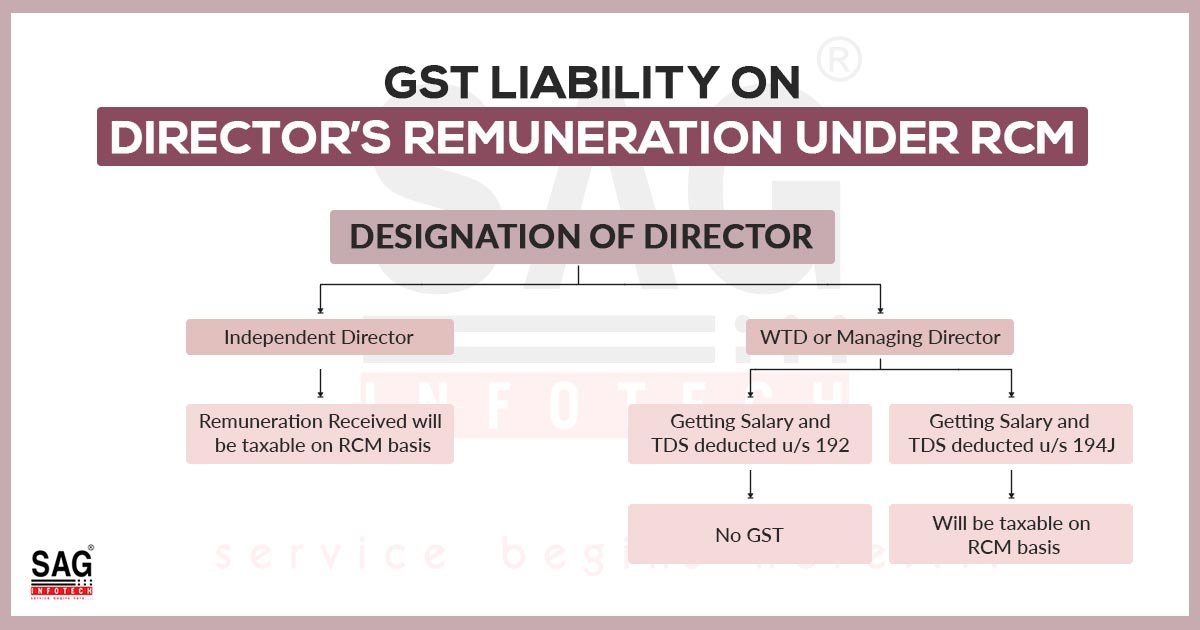

Independent Director Status

It must be confirmed that the director meets the definition of an independent director as per Section 149(6) of the Companies Act of 2013. Any remuneration paid to such directors will fall under supply and subject to reverse charge and business or corporate bodies are liable to pay GST for being recipients of the services.

Non-Executive Director Status

It should be verified whether the director in question is a non-executive director, who serves on the board on a part-time basis and is not an employee of the company. Services provided by non-executive directors, for which they receive remuneration, are subject to GST on a reverse charge basis.

TDS Obligation

It is important to note that any remuneration, fees, or commission paid to independent or non-executive directors, irrespective of the nomenclature used, are subject to Tax Deducted at Source (TDS) under Section 194J(1)(ba).

Executive Director Status

The employment status of the director should be confirmed, specifically if they hold the position of an executive director, such as a managing director or a full-time director. The definition of an executive director can be found in Rule 2(k) of the Companies Rules of 2014.

Dual Capacities of the Director

If the director is an employee of the company and also acts based on a contractual arrangement, this distinction should be made.

Identification as per Income Tax Act

The CBIC GST circular refers to the Income Tax Act of 1961 to make such an identification.

GST Exemption on Salary

Section 192 of the Income Tax Act imposes TDS on salaries paid to executive directors. Therefore, as per Schedule III of the CGST Act of 2017, remuneration is designated as “salary” in the books of the company, subject to TDS under Section 192, and provided by an employee to the employer during or in connection with employment. So the salary is not taxable under GST.

Reverse Charge Obligation

Following the 28.06.2017 notification, the recipient of the services, i.e., the company or body corporate, is responsible for discharging the GST on a reverse charge basis. This applies to remuneration, fees, or commission by whatever name is called, declared separately and other than “salaries” in the company’s books, subject to TDS under Section 194J.

GST Under the RCM

It is imperative to bear in mind that the application of GST under the reverse charge mechanism is contingent upon the services being rendered by directors in their official capacity as directors, rather than in any other individual capacity. Examples of such individual capacities include-

- Providing commercial properties on rent to the Company

- Offering professional services or director holds positions as per profession’s needs as per the Nomination and Remuneration Committee or the Board of Directors

- Sale of goods

- Receiving commissions for promoting investment

- Receiving a guarantee commission from a financial institution in exchange for a term loan.

GST Payable Under FCM

In these aforementioned scenarios, if the director’s total annual revenue exceeds the registration threshold, they would be responsible for paying GST under the forward charge mechanism. In such cases, the director would be regarded as the supplier of the taxable supply.

TDS on Sitting Fees U/S 194J(1)(ba)

As per the announcement and circular, sitting fees paid to directors in accordance with Section 197(5) of the Companies Act, 2013, are liable to GST under the reverse charge mechanism. This liability arises due to the fact that these fees are also subject to TDS as per Section 194J(1)(ba).

It is customary for executive directors to typically not receive additional meeting fees. On the other hand, non-executive directors, including independent directors, are compensated for attending meetings. Although the Companies Act lacks clarity on this matter, it is common practice to include a provision in the contracts of executive directors at the time of appointment that prohibits the payment of sitting fees.

To ascertain whether a director holds the position of an executive director or a non-executive director, one can refer to the Spice Part-B form submitted to the Registrar of Companies (ROC) during the company’s incorporation process, as well as the DIR-12 form submitted when the director was appointed. These documents provide valuable information for making the determination.