In this post, the discussion will be in the direction of the GST Forward charge mechanism, analyze its working, and discussion of its related advantages. Moreover, we shall discuss the FCM impact on small businesses and find out the methods to resolve the cost of compliance.

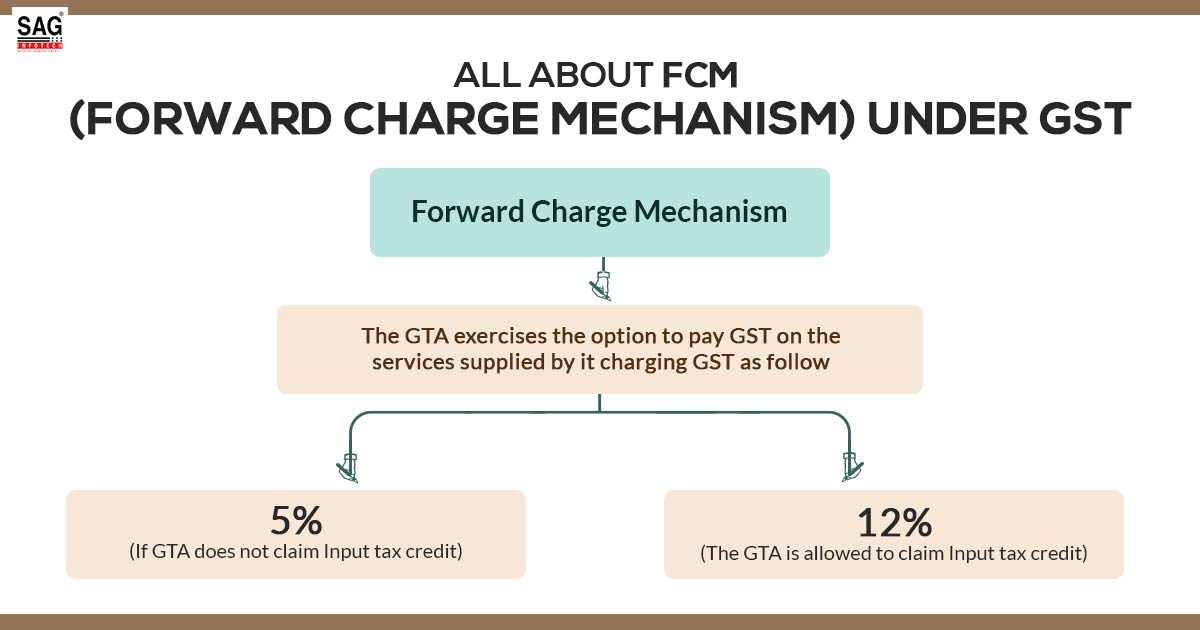

The execution of the Forward charge mechanism (FCM) would be the major part of the GST system that puts the obligation of tax collection and payment on the supplier.

Latest Update

- 09th October 2023: Indian Railways will be required to tax all goods and services that it supplies under the Forward Charge Mechanism (FCM) in order to qualify for ITC. As a result, Indian Railways will be able to reduce its costs.

What is Forward Charge Mechanism (FCM) under GST

FCM would say to be the process where the goods or services supplier would assign with the chores of tax collecting via recipient and remitting the same to the government. Beneath the same process, the supplier would have the liability of filing the tax to the government, and the recipient would ease the load of directly filing the taxes. The forward mechanism or normal charge mechanism are other names for the FCM.

Obligation of the Tax Payment in the GST FCM

It is the supplier of goods or services that has the liability of the tax payment beneath the forward charge mechanism stated under the Goods and services tax act. The supplier would have the liability to collect the tax via the recipient and assure remittance to the government within the stipulated time.

In order to follow the same procedure when the supplier’s yearly turnover would be more than the limit of Rs 40 lakhs (Rs 10 lakhs for the north-easter states) then the suppliers should register for the GST and receive the Goods and Services tax identification number (GSTIN).

How does the GST Forward Charge Mechanism Works?

Read below to see how the GST forward charge mechanism functions:

Firstly, the supplier generates an invoice that includes the applicable tax amount for the supply of goods or services.

Subsequently, the recipient of the goods or services pays the invoice amount to the supplier. Tax is also included in this.

The supplier receives the tax as they are responsible for collecting the tax amount from the recipient. This collected tax is then submitted to the government by filing a GST return.

If the supplier has properly paid the taxes to the government and the recipient is registered under GST, the recipient may be eligible to claim an input tax credit (ITC). With the use of this credit, they can reduce their own GST burden by the amount of tax they paid when purchasing goods or services.

Advantages of the Forward Charge Mechanism under GST

The Forward Charge Mechanism (FCM) in taxation offers a range of advantages, contributing to a more streamlined and efficient tax system. Let’s explore some of the key benefits:

Following Tax Laws: The FCM plays a crucial role in promoting compliance with tax laws. Under this mechanism, the responsibility for tax payment rests with the supplier. By shifting this responsibility to the supplier, the likelihood of tax evasion is reduced, and overall adherence to tax laws is enhanced. This creates a more level playing field and contributes to a fairer and more equitable tax system.

Simpleness and Clearness: The FCM simplifies the tax system, making it more accessible and easier to comprehend for taxpayers. Removing the intricacies of multiple tax systems, significantly decreases the compliance burden, allowing businesses to navigate the tax landscape with greater clarity.

Effective Tax Collection: The implementation of FCM streamlines the process of tax revenue collection by the government. With the supplier being responsible for tax payments, the government can collect taxes more efficiently and effectively. This leads to a smoother flow of tax revenue, enabling the government to allocate resources toward important public initiatives and services.

Greater Transparency: With the implementation of FCM, transparency in the tax system has significantly improved. The tax amount is distinctly stated in the supplier’s invoice, providing better visibility into the tax obligations. This transparency fosters accountability and ensures a clear understanding of the tax liabilities for all parties involved.

Impact on Small Businesses and Resolving Strategies

Apart from the benefits of the forward charge mechanism, the same can include issues for small businesses. The major load to such businesses would be the compliance cost like taking the Goods and Services tax identification number (GSTIN) and handling the tax filings. Small businesses may acknowledge the methods mentioned below in order to get rid of the impact.

- For automating the procedures of tax compliance opting the solutions that are driven by technology.

- For navigating the complex GST statutes and ensuring precise record keeping taking professional support.

- For an increase in knowledge of GST needs and compliance process participating in the training programs.