GST, which has been implemented from 1st July 2017 has stressed out most of taxpayers and dealers due to its compliance requirements. How it affects the taxes in real estate sector got different views from industry experts. Beginning the article, it will try to point out the issues involved which will help in a better understanding of the different views.

In the earlier tax regime, when property under construction was purchased, the purchaser was subjected to the payment of VAT, service tax, stamp duty, and registration charges. Property purchased after completion were exempt from VAT and service tax, and only stamp duty and registration charges were payable.

Latest Update in Real Estate Sector

- 53rd GST Council Meeting: “To clarify, statutory collections made by the Real Estate Regulatory Authority (RERA) are exempt from GST as they fall within the scope of entry 4 of No.12/2017-CTR dated 28.06.2017.”

- Madhya Pradesh High Court demands BDA to review the 12% GST levy on plots for the sale of developed land. Read more

- Authority for Advance Ruling (AAR) of Karnataka state has held that 18% GST (Goods and Services Tax) rate on supply of lease or letting out of building for business or commerce. read more

- Tamil Nadu GST AAAR has circulated the judgment for the Erode City Municipal Corporation. The judgment said there was no GST levy on rent for the bus stand locker. Read Order

- Authority of Advance Ruling of Telangana state ordered that GST will be paid from the transfer date of possession regarding building construction. Read More

- Maharashtra AAAR declared 18% GST is applicable on the sale of Transferable Development Rights (TDR) and Floor Space Index (FSI). Read more

As we know the real estate industry contributes about 7.8% to India’s GDP and it is the second-largest employment generator after the IT industry. The enactment of this tax law will alone solve the challenges faced by the real estate sector and help the sector to come out of its long slumber.

GST brings transparency in the functioning of the real estate sector, the overall increase in price for new residential properties could be lower than that for new commercial properties.

Read Also: What Does GST Rate Cut Means For Properties After Council Meeting?

It will reduce the cost of buying houses for buyers as in the previous tax regime, they had to pay Service Tax and VAT on the purchase of residential unit when booked prior to their completion, developers had to pay excise duty, customs duty, CST, Entry tax which is non-creditable tax cost, on their professional side, which is included in the price of units. With the uniform tax rate, developers will have input credits on GST paid for services and goods purchased by them which will reduce the cost for them and can be passed on to the buyers.

Now coming to the point of value-added tax (VAT), after the implementation of GST, the tax structure is under the simplification process. After GST implementation, the government has not included the stamp duties under it.

All under-construction properties will invite a GST of 5 per cent with no input tax credit. However, GST will not be applicable to ready-to-move-in properties. In this category, the actual GST rate is 18 per cent. But one-third of this 18 per cent is deemed as the value of land or an undivided share of land supplied to the buyer of the property. Hence, the GST rate lowers down to 5 per cent on under-construction flats, properties or commercial properties with the full input tax credit.

The carpet area of a property in the metro city up to 60 square metres (around 650 square feet) and in the non-metro i.e. 90 square metres (970 square feet) condition is included in the affordable housing scheme. The affordable house will be considered if the value of the property is less than 45 lakhs and would accrue 1 percent GST and more than that would levy the 5 percent GST rate.

The GST regime has replaced the multiplication of taxes and the builders now have to pay a higher amount in the 4-tier taxation but would get input credits eventually. Now, the burden of the higher taxes will be passed over to the home buyers. The home buyers will end up paying GST apart from those who are linked under the CLSS scheme.

Applicable GST Rate on Affordable Housing Units

Towards the aim to address the housing necessities of the lower and middle-class people the government of India (GOI) has provided the affordable housing policy in June 2015. With respect to the common residential housing which shall be cost-effective is subjected towards lower goods and Service Tax (GST), which gives relief to the affordable people who buy home during the period of purchasing the home. As per the tax and investment experts, the home buyers are required to furnish GST during the time of purchasing, besides that they just have to understand what an affordable house means as per the GST.

12% GST on Construction Services Low-cost Housing Units Flood-affected Individuals in Kerala

The state Kerala has seen the damage due to the flood comes in the year 2018. The Habitat Technology Group is the non-governmental organization that provides shelter in developing the solutions. The society gives services for the construction of houses and advisory services for the architecture. M/s. Sri Sathya Sai Trust, Kerala a charitable organisation engaged in providing the shelter who has affected from the flood.

GST Rates on Purchase of Flats, Property & Home Under CLSS

For Resale Flats or Property: According to para 5(b) of Schedule II of CGST Act, 2017, there will be no GST on resale, completed property or flats.

For Homes Purchased Under CLSS: In the 33rd GST council meeting

Real Estate Ranking Affected After GST & Demonetisation

The GST along with demonetisation has hit the real estate ranking due to its liquidity crunch and compliance addition. The effects have also reached the boundaries of developments prospects and investments in the cities. All these factors lead to the ranking impact towards lower than before according to the reports by Urban Land Institute and consultancy PwC.

The report is based upon the comments and actual siting of 600 professionals from real estate in the report named ‘Emerging trends in real estate–Asia Pacific 2018’. According to the reports, Mumbai has fallen to 12th rank in front of it’s earlier 2nd ranking while Bangalore and Delhi met the same fate as drowned from 1 and 13 to direct 15th and 20th respectively in the investment destination graph.

There is an average increase in the rentals which is around 8 to 10 percent per annum while the office segment is near to 5 to 7 percent growth per annum. The issues are raised due to the luxury residential extra supply which is taking away the foreign investors from the sector.

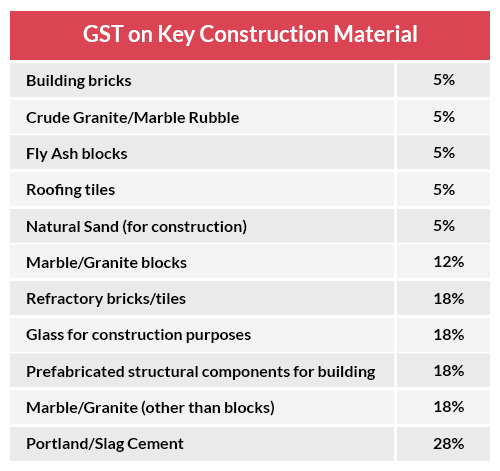

Rates of GST for Different Construction Materials

There are two types of GST on real estate in india that are applicable in the construction industry, taxes on Goods and taxes on Services. Taxes on Goods are the taxes levied on the procurement of construction material and taxes on services are the taxes levied on the service of construction itself. Different rates are applicable to different types of goods and different types of services. These taxes sum up to be an addition to the total cost of construction for the owner. The total liability of GST is calculated by adding the State GST (SGST) and Central GST (CGST) equally. For Example Total GST 18% = SGST 9% + CGST 9%. This applies to every rate of GST.

GST Rate on Construction Material

The following table lists the GST effect on real estate with GST applicable to different construction materials:

Note:- These rates are suggestive. These are appropriate as of 27 December 2018. These rates may be different from the actual rates as they are subject to periodic change. You can check the correct rates online in case of any doubts.

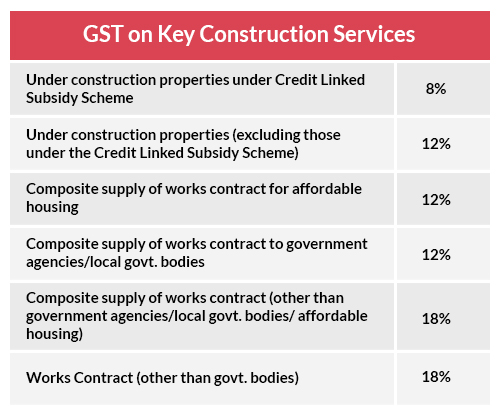

GST Rate on Construction Services

The following table lists the various rates of GST applicable to different construction services:

Note:- These rates are suggestive. These are appropriate as of 27 December 2018. These rates may be different from the actual rates as they are subject to periodic change. You can check the correct rates online in case of any doubts.

The rates of GST services are not applicable in the case of Ready-to-move-in flats’ sale, property resale, and land resale.

Read Also :- 5% GST Rate Suggested on the Under Construction Houses

Registration and Stamp Duties

The collection of registration and stamp duties is the responsibility of the State. The rates of registration and stamp may be different in different states and may be different in different circles of the states too. The registration and stamp duties are applicable in case of every infrastructure-related transactions whether sale/resale of property or construction of new properties while GST is applicable to supplied Goods or Services of under-construction buildings.

Input Tax Credit

The GST impact on real estate sector is that the real estate developers can claim the Input Tax Credit (ITC) on construction inputs like labor, cement, bricks, etc. under the GST regime. The ITC was brought to avoid the tax on tax positions. Under ITS, the tax charged on GST will be credited back to the developers. It was expected that the ITC will motivate the developers to revet back the benefits of credit to new homeowners. Some problems are faced by the developers while claiming the ITC:

- The receipt of each input is to be properly analyzed to submit estimates of GST.

- The input prices can change over time, making it hard to provide accurate estimates.

- No provision to set-off the increase in price is there to claim ITC.

Conditions of Claim

Under the following conditions, ITC can be claimed by the real estate developers:

- The developer has to provide the invoices/receipts for claiming the ITC.

- The goods/services are received by the developer.

- No claim on goods/services of personal use

- All previous dues are paid

- A correct GST has been filed by him.

GST & RERA Leads Cheap Homes

Goods and services tax has made the housing affair cheap as the tax chaos impacted the sales of real estate. According to the reports, the prices of the properties fell on an average 3 percent in which the Pune saw the highest decline of 7 with Mumbai at 5 percent in the year 2017. While the prices in Delhi NCR had got a lower 2 percent value than before.

The demand is said to be poor thus bringing the prices at a lower level. The sales figure was down in the cities like Bengaluru, NCR Delhi and Chennai with a lower 26%, 6% and 20% down respectively. However, after the implementation of RERA in Mumbai and Pune there is slight growth by 3 percent and 5 percent respectively.

Also, the launch of any new project saw a downward as it was recorded 56 percent less new launches while in the Bengaluru it was seen around 41 percent slow growth in the new project launch. The Delhi NCR recorded lower 6 percent sales at 37,653 units while the prices were lower by 2 percent due to GST impact and RERA.

My home loan sanction under CLSS MIG II & my under construction house size is 123 sq mtr.

please tell me @ what rate i have to pay GST 12 % / 8 %

THANKS & REGARDS.

Can I claim a refund of GST charged by the promoter on the cancellation of the booking of a flat? How can I know that the GST charged by the promoter from me is actually paid to the government?

If Promoter shown it in Advance received in their Respective GST return then only you can claim ITC, otherwise not

I wish to purchase a residential house from the Builder with land and have offered price of residential house with land but sale deed of land and construction agreement will be made separately. Now in this case on Construction Agreement at how much rate of GST will to be paid by me. The cost of Land & Construction (for 90 sq. meters and in the non-metro city) Appx. comes to Rs.12.50 Lacs

“Most of the services under works contracts are taxed either @ 12% or @ 18%. If it’s a works contract which the service provider is undertaking (he will be considered as the supplier) for a private party (who will be considered as the recipient) the GST rate will be levied @ 18%.”

I need your expert advice. I had booked under construction unit on June 2017 and my loan was disbursed on Sep 2017. I am taxed sales tax of 5% for the booking amount while for the remaining amount I am taxed GST 12%. I have not yet got possession of the flat yet and it is planned to be done by the end of March 2019. When I inquired about the input tax credit, I was advised its not applicable for my unit. Can you please help me understand if I am being taxed correctly? Will be grateful to you for your guidance.

Would like to know how the new GST applies (5%) to the customer who had already purchased and paid some amount to the Builder for the Under Construction property.

It is applicable from 1/04/2019 & further information is not provided from CBIC in this regard.

Hi,

I read your article it’s very helpful for us and this blog contains all the details.

Whether GST is applicable on gift deed of an immovable property?

If the gift is not in the course of furtherance of business, no GST would be applicable.

Nice blog thanks

you article is very informative , thanks