To facilitate and enhance GST data, the Goods and Services Tax Network (GSTN) has divided Table-12 of the GSTR-1 form into two parts: one for business-to-business (B2B) sales (Table 12A) and one for business-to-customer (B2C) sales (Table 12B), starting with the May 2025 tax period.

The amendment introduces obligatory HSN-wise reporting, but in a warning mode, at present, permitting the taxpayers to submit the returns even without complete entries.

What is Its Importance?

The tax administrators, through the bifurcation and enhanced reporting, can do effective enforcement, cross-verification, and classification of supply data.

Policymakers shall get an advantage since the same shall assist in performing the sector-oriented analysis based on the actual trade volumes and HSN classifications.

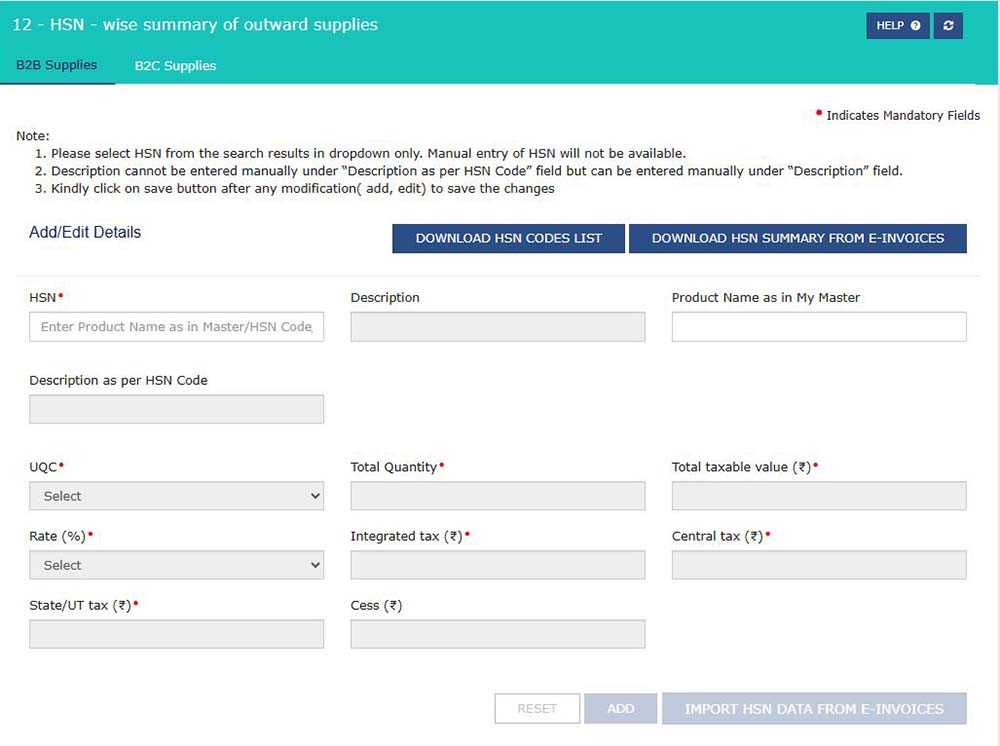

Concerning the businesses and traders, the same actions shall assist them by making the return filing facilitated via auto-population of HSN data from GST e-invoices.

The same measure is within our move for data transparency and plug-and-play compliance. Classification disputes and litigation shall be reduced from the appropriate HSN data, allowing effective tax policy decisions.

Updates GSTR-1 Table-12 Format

Table 12A is a mandatory HSN-wise summary for B2B supplies

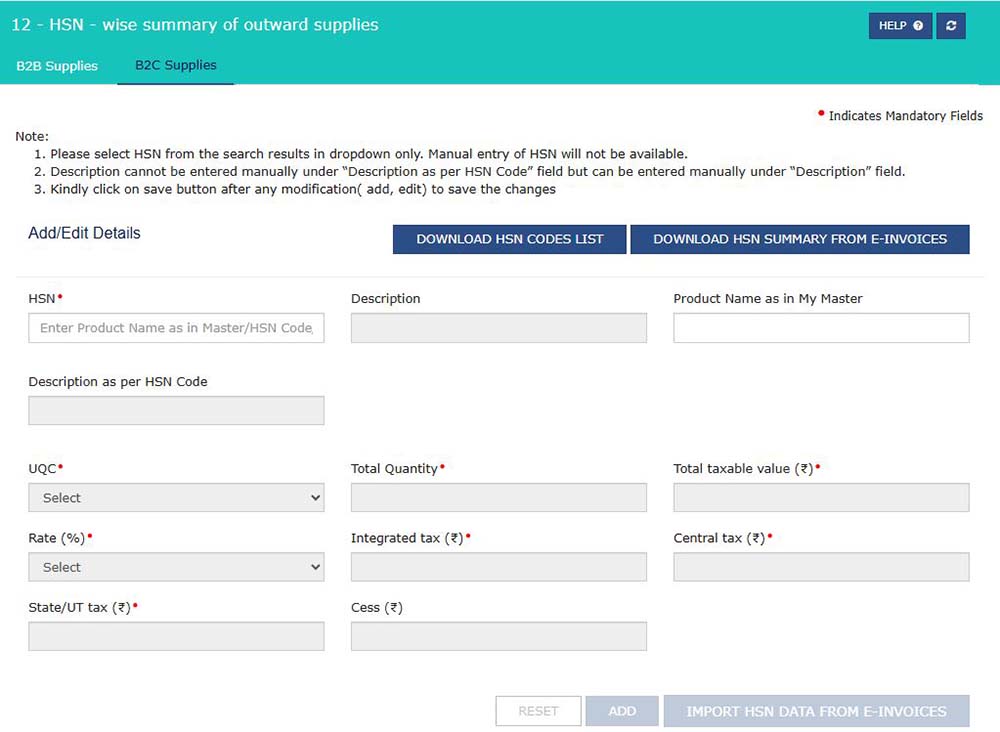

And Table 12B is an Optional HSN-wise summary for B2C supplies (as of now)

Till now, the government has not made 12B obligatory; the anticipation is towards the fact that the businesses voluntarily started categorising B2C supplies to make the data capacity across the ecosystem.

Taxpayer Issues and Technical Challenges

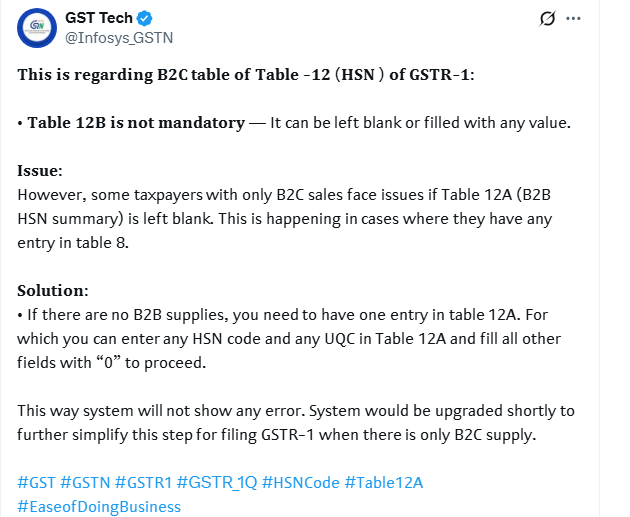

Even after these forward-looking amendments, small retailers and service providers, merely in the B2C supply, have reported that the GSTR-1 summary furnishes an error till they also enter the data in Table 12A, which is meant for B2B transactions.

The same peculiarity has arisen confusion in between the filers who have zero B2B supplies to report.

Read Also: GST Filers (1 and 1A) Must Now Report B2B and B2C HSN Data Separately

A resolution has been furnished by the GSTN in the same concern specifying that the taxpayers encountering the same problem are recommended to enter their HSN code and UQC (Unit Quantity Code) in Table 12A, at the time of filing all value fields with “0”. The same workaround fulfils the validation checks of the system and enables return submission.

Impact on Industry

As per the industry experts, the structured HSN data shall enhance e-invoice to return reconciliation, audit trail accuracy, and trade benchmarking across regions and sectors.

As the nation is relying more on data-driven tax legislation therefore the same amendment is discovered as a foundation for future upgrades in the GST intelligence and fraud detection systems.

It lessens the classification disputes and surges the confidence of taxpayers, particularly as the GST system of India becomes automated and predictable.

Similar: Important FAQs on Goods and Services Taxes (GST)

The industry has become more transparent, standardised GST reporting future with the groundwork now laid through bifurcation and import-ready formats, but its compliance remains voluntary till now.