Under the Goods and Services Tax (GST), a business entity can claim a refund of unutilized Input Tax Credit (ITC) even after it has been terminated. The court has ordered a refund of the unused GST ITC amounting to ₹4.37 crore.

The bench of Justice Meenakshi Madan Rai observed that “in the instant matter there is no express prohibition in Section 49(6) read with Section 54 and 54(3) of the CGST Act, for claiming a refund of ITC on closure of unit. Although, Section 54(3) of the CGST Act deals only with two circumstances where refunds can be made, however the statute also does not provide for retention of tax without the authority of law. Consequently, I am of the considered view that the Petitioners are entitled to the refund of unutilized ITC claimed by them and it is ordered so.”

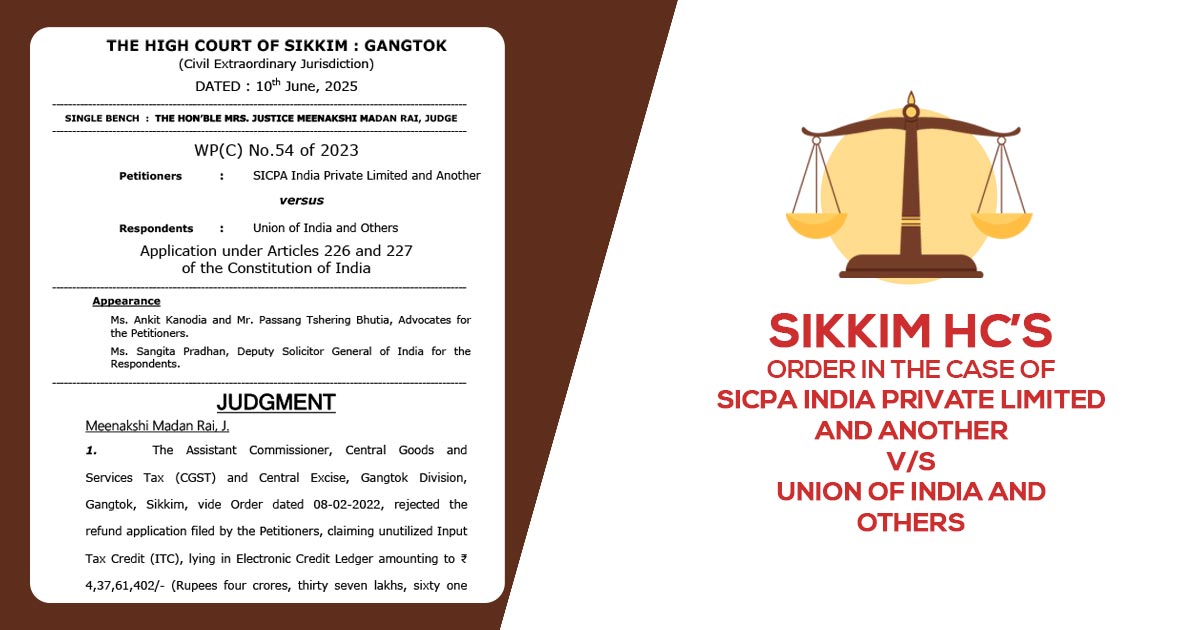

The applicant, SICPA India, has submitted the petition after their refund application was rejected by the Assistant Commissioner of CGST and Central Excise, Gangtok Division, on 8th February 2022.

Appellate Authority on March 22, 2023, kept the same decision, which reasoned that Section 54(3) of the CGST Act, 2017 allows the ITC refund merely in two cases (i) zero-rated supplies made without tax payment, and (ii) accumulation due to the inverted duty structure. The refund was denied as the business closure was not specifically listed.

Section 49(6) of the CGST Act authorises a refund of the balance in the Electronic Credit Ledger after the payment of tax, fee, or penalty, SICPA India, while contesting these orders cited. As per the general provisions of Section 54, the same refund must be processed and should not be confined merely within the particulars specified u/s 54(3), the applicant stated.

Company, refund denying is directed to the unfair enrichment of the exchequer, as the ITC legally accrued to them was not being returned even after the closure of the business.

The claim of the revenue was rejected by the court because the applicant has another appellate remedy under section 112 of the CGST Act, specifying the precedent from the Apex court which authorises the HC to exercise jurisdiction under Article 226, particularly where questions of law are engaged and facts are not disputed.

In conclusion, the Sikkim High Court specified that Section 49(6) or Section 54(3) of the CGST Act does not prohibit the refunds.

The Karnataka High Court’s ruling in Slovak India Trading Company Pvt. Ltd. permitted the CENVAT credit return on business closure. It specified that the government could not maintain the taxes without statutory authority.

As per that, the impugned appellate order has been set aside by the court and asked the authorities to process and refund the unused GST ITC of Rs 4.37 crore to the applicant.

| Case Title | SICPA India Private Limited and Another V/S Union of India and Others |

| Case No.: | WP(C) No.54 of 2023 |

| Counsel For Appellant | Ms. Ankit Kanodia and Mr. Passang Tshering Bhutia, Advocates |

| Counsel For Respondent | Ms. Sangita Pradhan, Deputy Solicitor General of India |

| Sikkim High Court | Read Order |