The GST collections for September are likely to be higher than Rs 95,000 crores for the first time this fiscal year. The amounts are registered to be published on Thursday.

The figure might nearer to Rs 1 trillion. The GST collections prove to be the best economy for recovery.

September results for the transaction were revealed in August. For the 6th month a figure of 8.5% has been contracted in August compared to 8% in July resembles the economic recovery has slowed on a regular basis.

Latest Update

Goods and Services Tax (GST) collections for September stood at Rs 95,480 crore, the highest on a monthly basis since the lockdown began in March this year.

Post economy incurred a report of 23.9 per cent in the 1st quarter, many economists have re-assessed their previous projections. Majority of them now seem at undergrowth with twice digits for the current financial year.

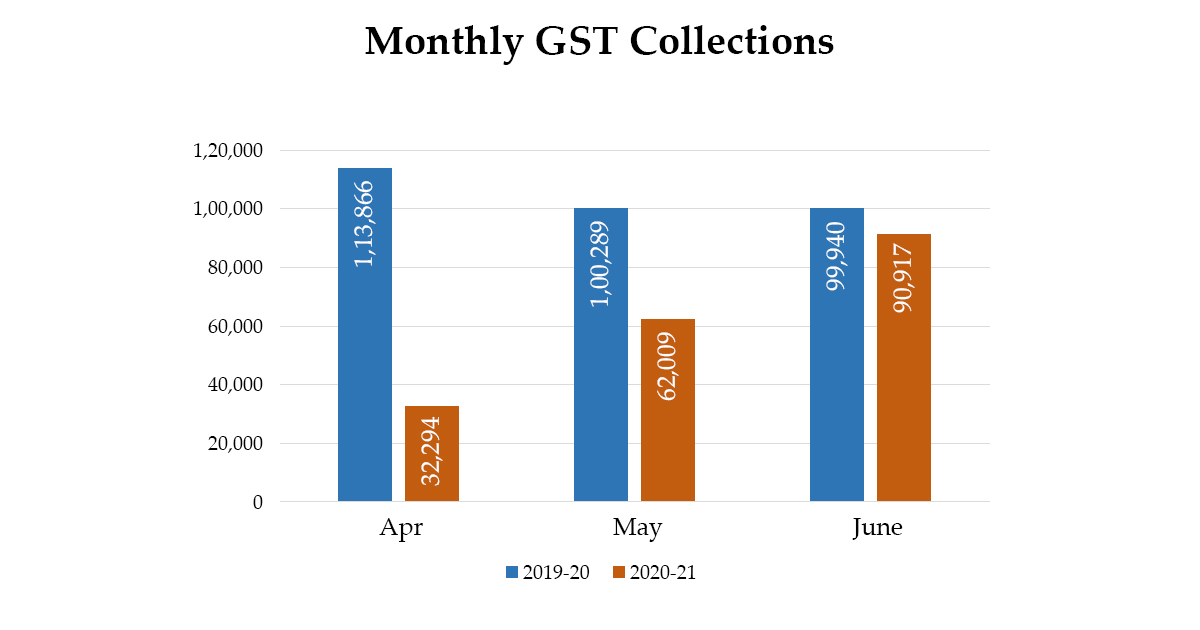

The highest GST collections were at Rs 90,917 crore in June

The Collection in July stood at Rs 87,422 crore which then slipped to Rs 86,449 crore in August. For August the GST revenue

The GST collection figures for September will come a few days preceding the crucial GST official meeting on Monday. The meeting usually is for the compensation of the states. As the consideration for cess collection rose for the 1st time in 5 months with 6% which is good news.

There is a gap of Rs 2.35 trillion between the compensation on cess collections and the compensation claim of states in the current financial year, said the finance ministry.