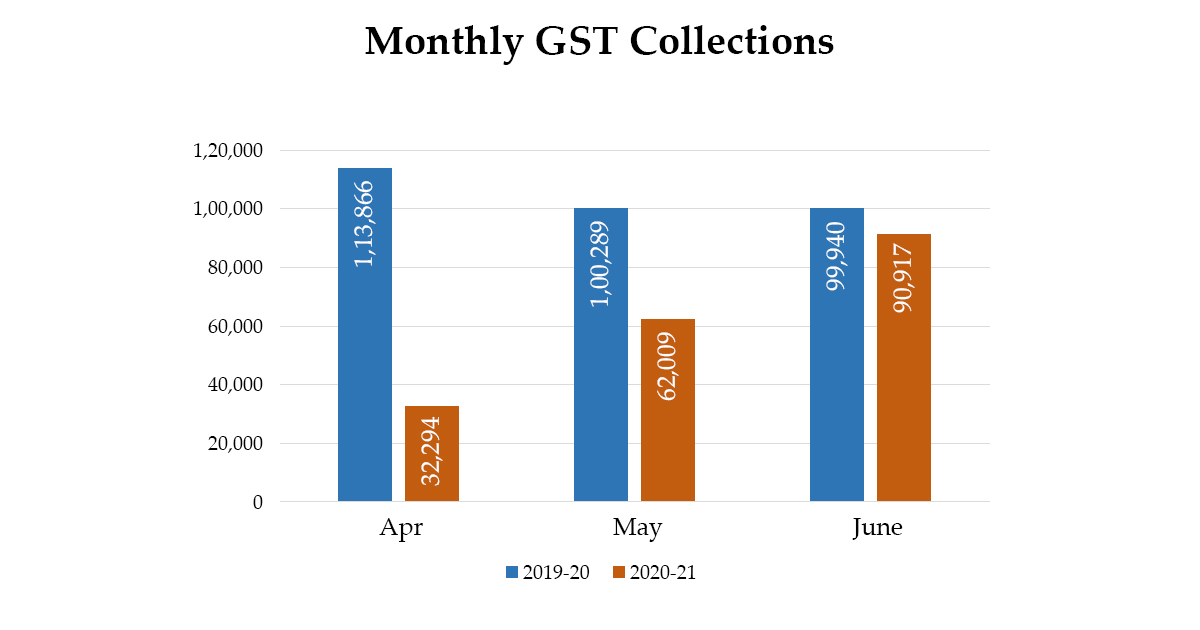

The collection of Goods and Services Tax (GST) for June 2020 has seen a downfall as compared to that in June 2019. The GST collected for June, amounted to ₹ 90,917 crore (CGST- ₹ 18,980 crore SGST- ₹ 23,970 crore IGST- ₹ 40,302 crore Cess- ₹ 7,665 crore)the departments have already settled ₹ 13,325 crore to CGST and ₹ 11,117 crore to SGST from IGST collections. The total revenue of the State and the Central government is ₹ 32,305 crore for the CGST and ₹ 35,087 crore for the SGST.

The Ministry of Finance issued a notification that read, “The revenues for the month are 91% of the GST revenues in the same month last year. During the month, the revenues from import of goods were 71%and the revenues from domestic transaction (including import of services) were 97% of the revenues from these sources during the same month last year. During the month of June, returns of February, March, and April 2020 have also been filed in addition to some returns of May 2020 since Government has allowed a relaxed time schedule for filing of GST returns

The outbreak of coronavirus is still impacting the revenue collections of the government. All the relaxations provided by the government to support the taxpayers has also affected the collections. However, the collections of the month has shown an increase as compared to that in the preceding months. The department is still waiting for several taxpayers to file the return. The notification also read, “The GST collections for the month of April

GST Collections in Top 10 States

| Sr. No. | States | June 2019 (₹) | June 2020 (₹) | Year Growth 2020 (%) |

|---|---|---|---|---|

| 1 | Maharashtra | 15,143 | 14,987 | -1 |

| 2 | Karnataka | 6,659 | 6,710 | 1 |

| 3 | Gujarat | 6,424 | 6,025 | -6 |

| 4 | Tamil Nadu | 5,881 | 4,976 | -15 |

| 5 | Uttar Pradesh | 5,366 | 5,194 | -3 |

| 6 | Haryana | 4,889 | 3,697 | -24 |

| 7 | Delhi | 3,595 | 3,249 | -10 |

| 8 | West Bengal | 3,514 | 3,128 | -11 |

| 9 | Telangana | 3,166 | 3,276 | 3 |

| 10 | Odisha | 2,923 | 2,694 | -8 |