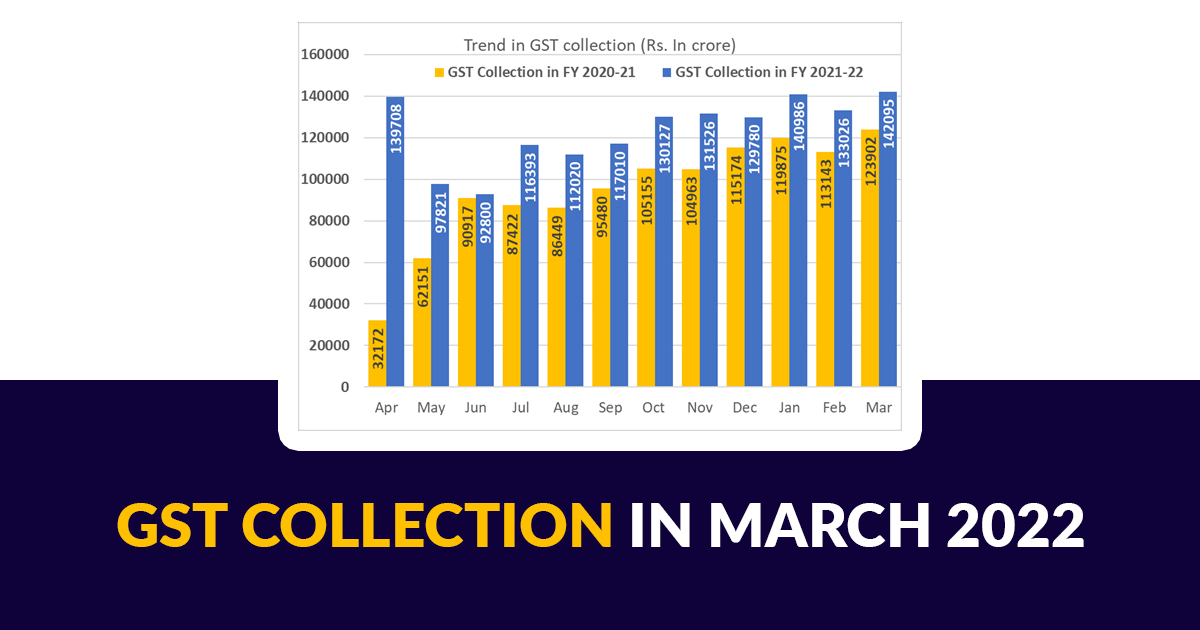

Recently the GST revenue has been collected for March 2022 month with a superb collection of INR 1,42,095 crores under which CGST is ₹ 25,830 crore, SGST is ₹ 32,378 crore, IGST is ₹ 74,470 crore (including ₹ 39,131 crores collected on import of goods) while the amount of cess is around INR 9417 crores which also including ₹ 981 crores collected on import of goods.

One of the facts is that the overall GST collection is much higher than the previous one i.e INR 1,40,986 crore submitted in the Month of January 2022.

The settlement amount of INR 29,816 crore for the CGST and the ₹ 25,032 crores to SGST from IGST being a regular settlement is also done. While the settled amount of Rs. 20,000 crore of IGST on an ad-hoc basis in the ratio of 50:50 has also been done by the central within the Centre and States/UTs in this month of March.

The final settlement after the regular and ad-hoc settlements is ₹ 65646 crore for CGST and ₹ 67410 crores for the SGST for the month of March 2022.

The revenues are in the top bracket with 15 percent more than the previous GST revenue for the last year and are also 46% higher than March 2020. The domestic transactions are 25% higher and the import of services for the sources in the same month is also 11 percent higher.

The e-way bills generated are 6.91 crores for the February month and the same compared with January 2022 it stands at 6.88 crores. The gross average monthly collections for the last quarter us also on the higher side with 1.38 lakh crore for the FY 2021-22. The average monthly collections standing at 1.10 lakh crore and 1.15 crore and 1.30 lakh crore for the first, second, and third quarters respectively.

Also, the collection may also be higher due to the strictness of provisions and rate rationalization. Here below is the chart for the monthly gross revenue collection from March 2022 to March 2021.