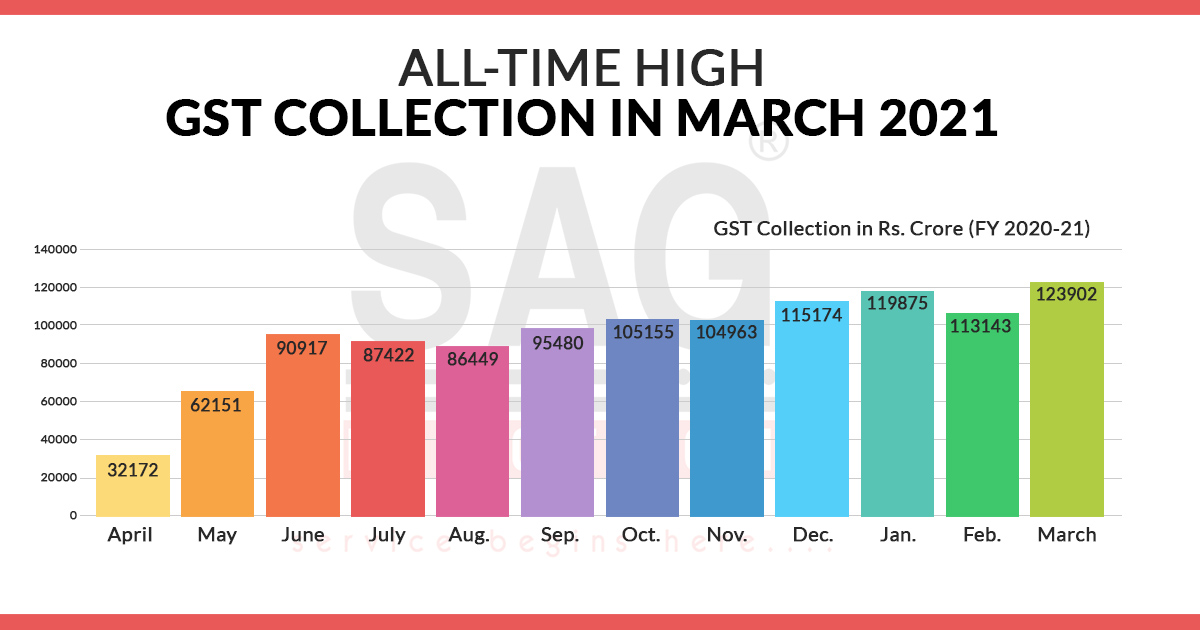

The government exchequer collected from Goods and Services Tax (GST) has been on the peak/pinnacle since its journey started in July 2017 across the entire nation. The revenue collection from GST was a whopping Rs 1.24 trillion in a single month of March 2021 — a historical and a mammoth figure in the history of “revenue from tax collection in India”. Furthermore, the collection gained a momentum of 27 per cent while compared with the figure year-ago in the same period.

The aforesaid figure is the result/consequence of the high volume of transactions that will have a positive impact on the Gross Domestic Product of India

“GST revenues during March 2021 are the highest since the introduction of GST. In line with the trend of recovery in the GST revenues over the past five months, the revenues for the month of March 2021 are 27 percent higher than the GST revenues in the same month last year,” the ministry of finance said in a statement.

“Closer monitoring against fake-billing, deep data analytics using data from multiple sources including GST, Income-tax and Customs IT systems and effective tax administration have also contributed to the steady increase in tax revenue over the last few months, it said.” The Segregation of the above-mentioned figure is as follows:

GST Revenue

- IGST is Rs 62,842 crore (that includes Rs 31,097 crore collected on import of goods),

- CGST is Rs 22,973 crore,

- SGST is Rs 29,329 crore, and

- Cess is Rs 8,757 crore (that includes Rs 935 crore collected on import of goods).

Moreover, as a part of the regular settlement, the Government of India has settled Rs 17,230 crore to SGST from IGST and Rs 21,879 crore to CGST. Thereafter, the Central government settled Rs 28,000 crore as an ad-hoc settlement of Integrated GST

Coming to revenue from Import, it is 70 percent higher from the same month in the last month. And revenue from the domestic transaction is 17 percent higher as compared to the aforesaid month of last year. In essence, Post-Pandemic Economic recovery is accelerating/gaining momentum at a very fast pace.