After record collection in December, it is expected that the Goods and Services Tax (GST) revenues will cross INR 1.20 lakh crore in January 2021. It indicates that the efforts of the government are now paying off.

According to Soumya Kanti Ghosh, Group Chief Economic Adviser of State Bank of India, GST collections will be between INR 1.21-1.23 lakh crore and it may go even further.

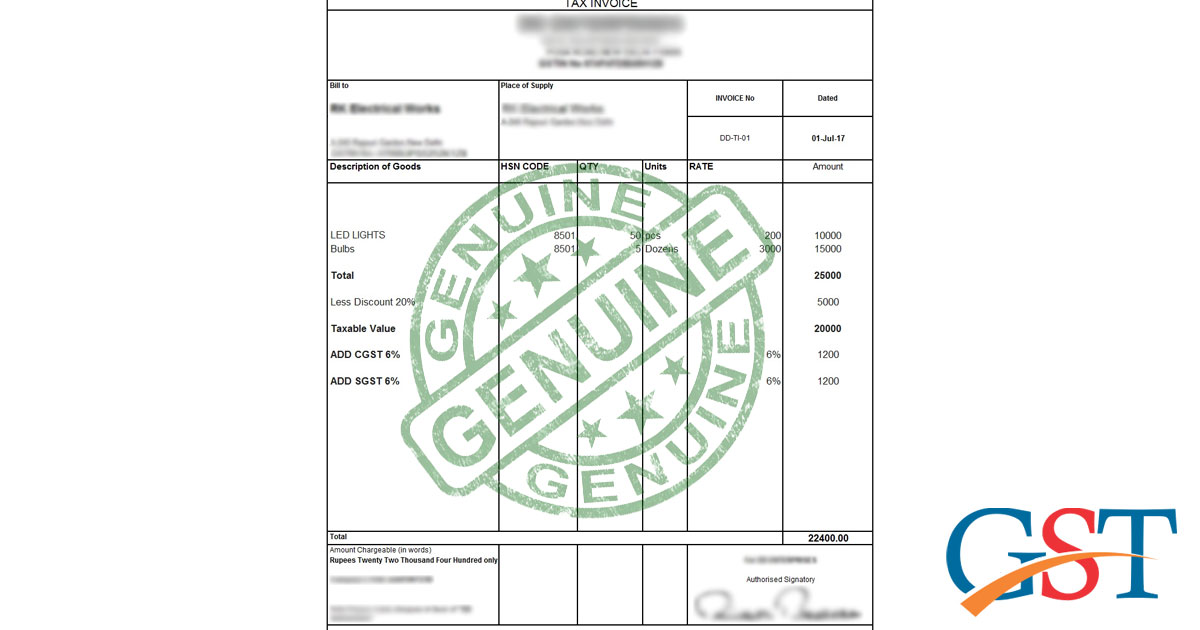

The monthly GST collection is showing year-on-year growth since September 2020, which indicates the economy is coming back on track again. It reached a record level of INR 1.15 lakh crore, the highest ever collection since the countrywide tax (GST) came into effect in July 2017. The previous record of INR 1,13,866 crore collection was reported in April 2019.

‘Ecowrap’ which the research report of SBI, states that “The Government’s ongoing efforts are bearing fruit in the form of GST collections. After clocking record collections in December 2020 month

The report also stated that After this record collection, if the government distributes around 50% of the revenue collected from IGST to the states by March 2021, the state GST shortfall will be reduced to only 11,000 crores considering the full compensation cess. However, if government keeps 60% of UGST collection then the State GST shortfall will remain at ₹ 67,000 crores.

The SGST collection was 12% lower at INR 1.87 lakh crore in April-December 2020, compared to the same period last year, While the allocated IGST was reduced by 13 percent lower at INR 1.26 lakh crore. Meanwhile, Cess collection reported at INR 60,312 crore, which is 17 percent lower than the previous year.

The sum of SGST allocated IGST, and cess stands at INR 3.73 lakh crore, which was 13% lower compared to the previous year, which was equal to 58% of the state’s budgeted SGST which reaches INR 6.49 lakh crore.

The report also stated that the government had borrowed INR 11.46 lakh crore (as of January 22, 2021) in this financial year and the remaining gross borrowing which is equal to INR 1.6 lakh crore is expected to be as per the calendar. Thus, the total gross borrowing to ₹ 13.03 lakh crore which is INR 0.07 lakh crore lower than earlier.

The Government surplus cash balances have also increased to INR 3.34 lakh crore on January 28, 2021, the same was INR 1.08 lakh crore in September 2020. It shows that the government is collecting huge amounts of tax and they are not even able to spend.

The report further added that “This, in turn, means that the government will have to borrow less next year than our earlier anticipated gross borrowing of INR 11.5 lakh crore. Thus, the market perception of upward pressure on bond yield due to increased borrowing next fiscal or even this fiscal is not correct,”.

The Ecowrap suggested that The surplus cash balance can be used to finance a large portion of the fiscal shortfall in FY22 to continue to increase the interest rate and further accelerate the recovery speed.

According to the report, the other option is also to use a portion of the cash balance to spend and pay all FY 21 dues, such as outstanding SME payments from government departments, pending GST bills