In Dec 2020, GST revenue has received gross Rs 1,15,174 crore where Rs 21,365 cr is from CGST, 27,804 cr from SGST, Rs 57,426 cr from IGST and other includes Rs 27,050 cr received from the import of goods and Rs 8,579 crore on cess along with Rs 971 cr received on the import of goods. 87 lakhs is the figure which shows the total number of GSTR-3B Returns furnished

As a regular adjustment, the government has settled Rs 23,276 crores to CGST and Rs 17,681 crores to SGST from IGST. Rs 44,641 crore for CGST and INR 45,485 crores for the SGST is the total revenue which is collected by the Central Government and the State Governments post regular settlement for the month of Dec 2020.

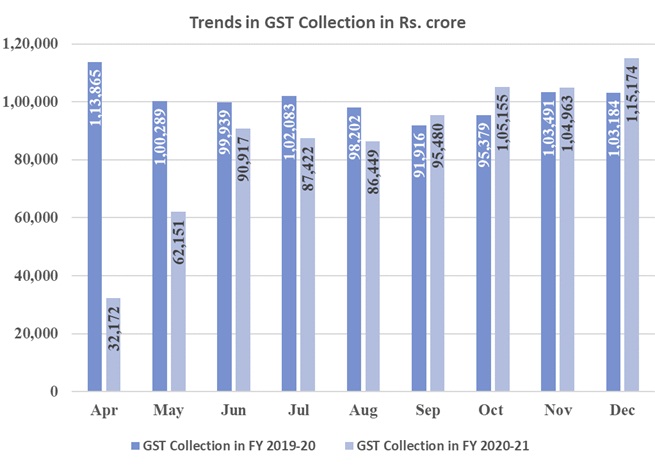

With context to the recent trend of the recovery in GST revenue, there is 12% higher revenue received in Dec 2020 month with respect to the same month in the last year. A 27% higher revenue record from the import in this month along with 8% higher revenue from the domestic transaction (including import of services) that the revenues from the sources in the similar month last year.

In December 2020 GST revenues were the highest since the incorporation of GST and for the 1st time, the GST has crossed Rs 1.15 lakh cr. the highest collection GST recorded was Rs 1,13,866 crore in the month of April 2019. The revenues of April were higher since they thought about the returns of March, which displayed the end of the fiscal year. The December 2020 revenues were higher as compared to last month’s revenuesRs of 1,04.963 crore. Also, it is imposed as the highest growth with the revenue received in the months since the last 21 months.

GST revenues crossed Rs 1.1 lakh crore which is thrice since the initiation of GST. it is the sign which indicates the recovery as this is the 3rd month in a row in the present fiscal year post to the economy that is GST revenue which is higher than Rs 1 lakh crore. The average rise in GST revenues while the last quarter has been 7.3% with respect to (-) 8.2% in the 2nd quarter and (-) 41.0% in the 1st quarter of the fiscal year.