Comparing with the numerals of January 2019, a clear hike of 12% is witnessed in the gross collection of GST for January 2020 month. The administration was able to accumulate a total of Rs. 1,10,818 crore in the very first month of the year, as declared by Union Finance Ministry on Friday.

It is for the second time in the GST ruling span that the overall GST collection for a single month has grossed beyond Rs. 1.1 Lakh Crore earlier to this it happened in April 2019 when the national collection grossed Rs. 1.13 Crore. And for the sixth time the collection has grossed above Rs. 1 Lakh Crores.

The January month national revenue comprised of central GST (Rs 20,944 crore), State GST (Rs 28,224 crore), integrated GST (Rs 53,013 crore) and cess (Rs 8,637 crore).

The contribution to the national treasury from the domestic transactions has shown a commendable hike of 12% during January. To this, the government claimed that the collection was Rs. 1.02 lakh crore in January 2019.

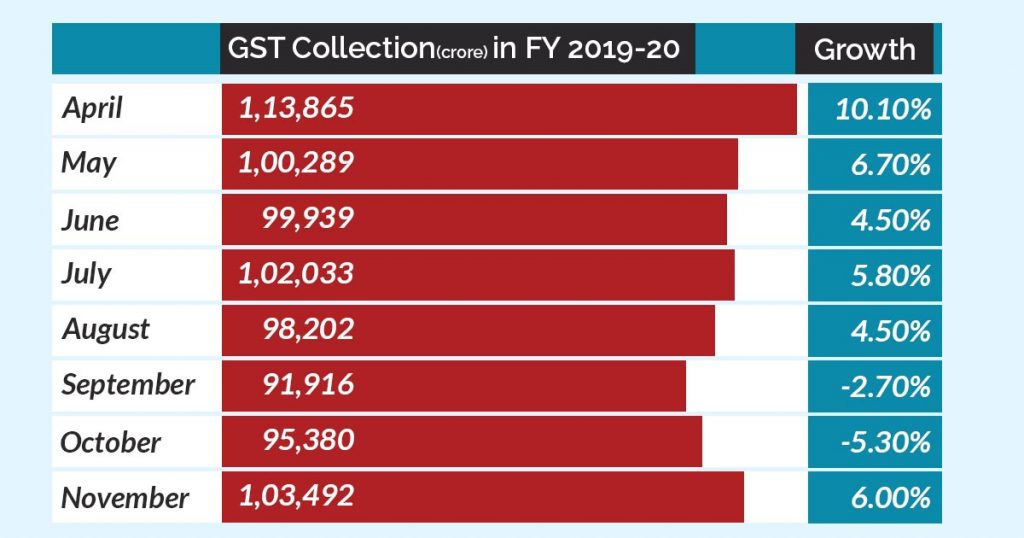

November, December, and January have proven to be fruitful in terms of GST (Goods and Services Tax) collection that was steeping down consistently prior to the said three months. The prior year’s September collection was Rs. 91,916 crore – the lowest since February 2018. At last, the administration took a sigh of relief when the GST collection of November

1,03,492 crore and Rs. 1,03,184 crore respectively.

The administration has a pre-set collection target of Rs. 3.5 lakh crore starting from January to March 2020. For the prevailing month, the administration has a challenging collection target of Rs. 1.25 lakh crore, derived from the sources of the Hindustan Times.

It was on 07 December 2019 that the Union Finance Minister Nirmala Sitharaman stated that the national collection being low the Central Government is unable to compensate to the states under the Goods and Service Tax regime. She further claimed that the bond between the Centre and State is prevalent and that will be honored. In the same month on 16th, the Centre released compensations for States and Union Territories worth Rs. 35,298 crores as per the protocols of GST. the said compensation was released 2 days prior to the GST council meeting

The GST figures shown in your blog are not matching

Kindly rectify your figures,

IGST -53013

CGST -20944

SGST- 28224

CESS – 8637

Hence the total came 1,10,818 not 1,10,828

Figures are taken by official government portal: https://pib.gov.in/PressReleasePage.aspx?PRID=1601435