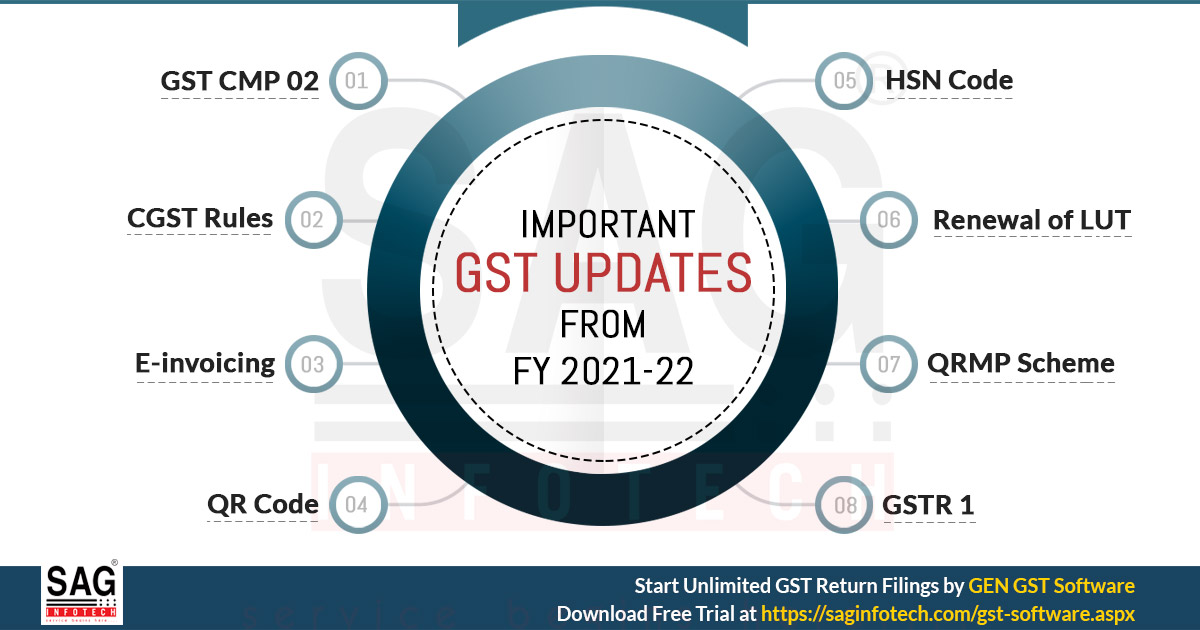

It is important to file the returns for every trader who used to import or export their things manufactured or non-manufactured. There are some of the objectives and guidelines are given by the government which everyone needs to learn on the behalf of filing the taxes. The GST assessee is needed for various objectives in mind at the start of FY 2021-22:

Latest GST Changes for Taxpayers in FY 2021-22

- “CBIC has implemented the new Rule-59(6) for the registered taxpayers to resolve restrictions in certain cases while filing GSTR-1 on the official portal.”

- “New functionality on AATO (Annual Aggregate Turnover) for taxpayers”

- “New functionality to discharge GST Liability for GSTR 9C”

- “Applicability of Dynamic Quick Response (QR) Code on B2C invoices”, get more

- “GSTIN new facility is available on GST portal for different modules such as registration, returns, advance ruling, payment and other miscellaneous topics”. know more

- “The Government of India has given relaxation for the time period of GST return filing due dates along with a late fee to the taxpayers due to the second wave COVID-19”. more details

- “Auto-generation in GSTR 2B and Auto-population of ITC in GSTR 3B form for the QRMP taxpayers”

Some Other GST Changes in FY 2021-22

Change 1: The functionality to choose down for the composition policy has been executed for the FY 2021-22 inside the assessee’s name on GST common portal. The subject assessee who wants to claim the composition scheme from FY 2021-22 might take in for the composition through furnishing form GST CMP 02

Change 2: According to rule 46(b) of CGST rules, a new series of invoices is to be urged for the financial year 2021-22 so that there is no similarity in the invoices through the previous FY.

Change 3: E-invoicing is developed important for the assessee who has the turnover of Rs 50 cr and will come into force from 1/04/2021. Moreover, the team will engage the turnover of all the GST numbers beneath the single PAN (Permanent Account Number)

Change 4: The QR Code is important upon the invoices urged through the enrolled individual whose turnover exceeds Rs 500 cr effected from 1/04/2021.

Change 5: HSN code is been important for all the assessee disregard to the turnover which gets starts from 1/04/2021 as mentioned:

Moreover, 4 digit HSN code is an option with respect to the supplies filed to the non enrolled people which is B2C for the enrolled individual people posing the average turnover of Rs 5 cr in the before financial year.

Change 6: Every enrolled exporter who has the desire to export the goods and services excluding the IGST will apply for the renewal of LUT in the finish of the financial year, for the next FY 2021-22 so to continue the exports excluding the payment of IGST lastly by 31/03/2021. The person who exports is needed to file the bond or LUT to the jurisdictional Commissioner prior to effecting the zero-rated supplies for supply excluding any IGST payment.

Change 7: The facility to choose the opt-in or opt-out of the QRMP Scheme

Change 8: Towards furnishing the GSTR 1 prior to the filing of the first return for the prevailing year the assessee who has an average turnover of Rs 5 cr in the previous fiscal year is needed to execute the periodicity (quarterly or monthly) basis. The period for furnishing the return is to be deemed to be monthly towards all the assessee’s until the quarterly filing of return is chosen.

SIR

When I log in GST portal, FY -2021-22 not shown in Return option. do you help me to solve it.

What kind of issues you are facing right now?