GST CMP-01 or GST CMP-02 are the Forms, supposed to be filed by the dealers in order to make the Government aware of his/her opting the Composition Scheme.

Latest Update

- The CMP-02 form is now available until 31st March 2026 for FY 2026–27 for regular taxpayers who opt for the Composition Scheme. They can navigate to Services → Registration → Application to Opt for Composition Levy.

- The CBIC notification no. 07/2025 relates to revising GST rules to improve compliance for composition taxpayers via the GST CMP-02 form. Read PDF

- 55th GST Council Meeting – There is a new amendment in the ‘category field of registered person’ for the assessee who has selected the composition levy via GST FORM CMP-02. read more

GST CMP-01

CMP-01 is the Form which is designed to facilitate the Migrated taxpayers who wish to opt for Composition Scheme. The due date for filing the form was 1st August 2017 (1 month from July 2017).

GST CMP-02

- In case any taxpayer wants to go for the Composition Scheme under GST for a financial year or during the middle of a financial year, he is required to inform the Government regarding the same and thus, he is required to file GST CMP-02 form.

- If the CMP-02 form is filed in the middle of the FY, the rules to the scheme would be applicable from the month succeeding the month in which the form has been filed.

Understanding with the Help of An Example

- Suppose a taxpayer files CMP-02 in the month of December 2022, as per the rule, the Composition Scheme would be applicable from January 2023.

Both the forms, CMP-01 and CMP-02 are available and could be filed online on the GST Portal/ GSTN.

Latest Update on GST CMP 02 by the CBIC

The registered person opting tax payment under section 10 of FY 2020-21 requires electronic filing of intimation in form GST CMP-02 duly signed verified on the portal directly or facilitation center by the commissioner on or before 30th June 2020 and also furnish Form GST ITC 03 as per sub-rule (4) of rule 44 up to 31st July 2020. Download and view official notification No. 30/2020 in PDF.

Note: Taxpayers are requested to file GST CMP 02 on or before 30.09.2019 to get registered under Composition scheme for FY 2019-20.

CBIC Advisory for the GST Composition Scheme

Finally, the CBIC has issued the advisory for the composition scheme option filing form GST-CMP-02.

Who can Opt for the GST Composition Scheme?

All the eligible registered taxpayers can opt for the composition, for the FY 2020-21. when they file the GST CMP 02 and it will be effective from 1st Apr 2020.

The eligible enrolled assessee who wants to opt-in for composition policy for the Financial year 2021-22, is needed to furnish the FORM GST CMP-02 application, on or before 31st March 2021, post login on GST portal. The assessee can navigate it as:

Log-in>Services > Registration > Application to opt for Composition Levy>Filing form GST CMP-02>File application under DSC/EVC

- Once the Form GST CMP-02 application has been furnished the composition policy will be open for the assessee which starts from 1st April 2021.

- There is no need to opt-in again if the assessee has previously opted for the composition policy for FY 2021-2022.

- There is a need to file Form GST ITC-03 for reversal of ITC on stocks of inputs, semi-finished goods, and finished goods available with the taxpayers who were regular assessee before FY but are opting-in for composition policy in 60 days from the date of incorporation of opting-in.

How to Pick up the Composition Scheme Under GST?

Here are steps to apply for the composition after the login for the registered taxpayer:

- Log in at the taxpayer’s interface

- Now click on Services > Registration > Application for opting composition scheme

- Now fill the form as required by the rules and submit it For further details visit – link: https://tutorial.gst.gov.in/userguide/compositionpoc/index.htm?key=toc1&ref=

Who are Eligible Taxpayer for Composition Scheme?

The registered taxpayers with average annual domestic PAN-based turnover lesser than required from the dept can opt for composition.

Let us check out in detail

- Possess the average turnover (at PAN level) upto Rs. 1.5 Crore in the previous FY.

- Possess the average turnover (at PAN level) upto Rs. 75 lakh in the previous FY and are enrolled in Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura & Uttarakhand.

- Possess average turnover of before FY upto Rs 50 lakhs in supplying services and/or mixed supplies.

Who are Not Eligible Taxpayer for Scheme?

The said taxpayers cannot opt for the composition:

- certain supply of goods under the act

- Inter-state outward supplies of goods

- Assessee supplying goods via e-commerce operators who are needed to obtain tax beneath sec 52.

- Manufacturer of good such as Ice cream and other edible ice, whether or not containing cocoa

- A casual dealer

- A Non-Resident Foreign Taxpayer

- A person registered as Input Service Distributor (ISD) a person registered as TDS Deductor/Tax Collector

Stock Intimation Details Submission

All the registered taxpayer under composition scheme are required to file stock intimation details – https://tutorial.gst.gov.in/userguide/compositionpoc/index.htm?key=toc4&ref=

GST CMP 08 Return/Payment Form

The registered taxpayer under composition are required to file Form GST CMP 08 quarterly – https://tutorial.gst.gov.in/userguide/returns/index.htm#t=Manual_CMP02.htm

Step-by-step Guide to File GST CMP-02 on GST Portal

Step 1: Login to GST Portal.

Step 2: Go to ‘Services’ > ‘Registration’ > ‘Application to choose for composition scheme’.

Step 3:

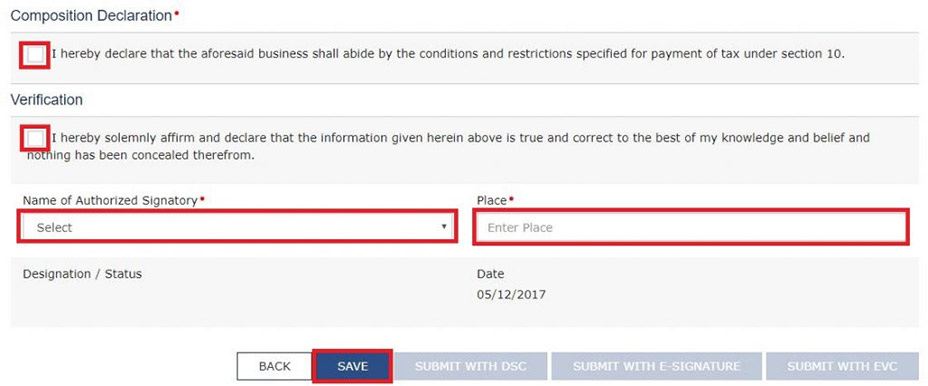

- On this window, carefully read the ‘Composition Declaration’ and ‘Verification’. The checkbox on this window should be Ticked.

- Choose the ‘Name of Authorized Signatory’ from the drop-down. Also, mention the ‘Place’ by typing and click on ‘SAVE’.

Step 4: In case the dealer is a Company or an LLP, the application could be submitted by him only with DSC. Other registrants( other than Company or an LLP) can use any of the three methods to submit the return.

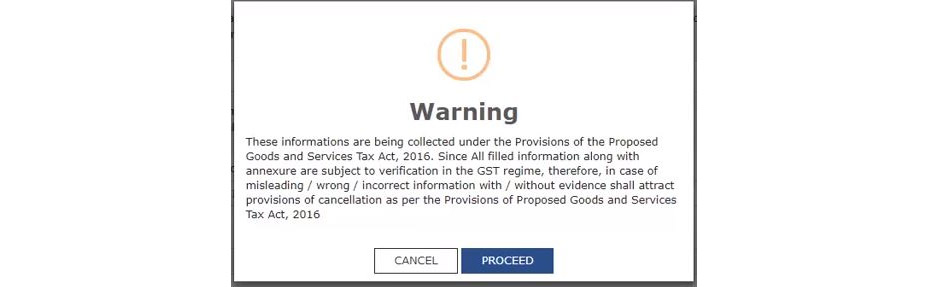

Step 5: A pop up for the warning would open. Here, we need to click on ‘PROCEED’.

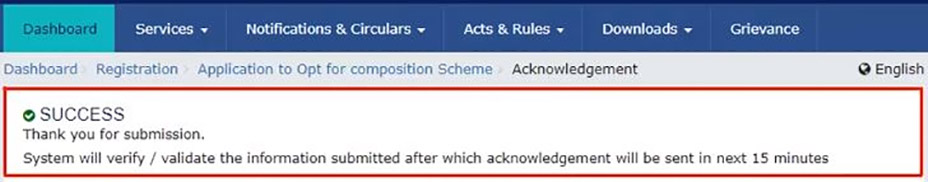

Following the above procedure, the form gets submitted and once the application is submitted a success message is displayed. Following this, an acknowledgement is sent to the dealers’ registered email id and mobile.

Again after getting this file filed, a Composition Dealer has to file GST CMP-03 within 90 days.

Recommended: View & Download PDF Format of GST Sahaj & Sugam Return Forms

General Queries on CMP-02 Form

Q.1 What is the method to choose the composition policy in GST?

You can choose for the composition levy beneath GST if you pose with the regular assessee with the average yearly domestic PAN-based turnover as shown with time.

But you cannot choose for the composition levy if you are or you develop:

- The supply of goods that are not entitled to be taxed beneath the act

- Inter-state outward supplies of goods

- Supplies via electronic commerce operators who are needed to collect tax beneath section 2 52

- The manufacturer of the mentioned goods.

- Casual dealer

- The nonresident foreign assessee

- The person enrolled as – inter-state outward supplies of goods

- An individual enrolled as a TDS deductor or a tax collector.

Q.2 – What is the method to apply for the composition scheme if I am enrolled as the regular assessee?

To choose for the composition levy execute the mentioned steps on the GST portal:

- Log in to the Taxpayers’ Interface

- Go to Services > Registration > Application to Opt for Composition Levy

- Complete the form according to the form features guidelines and furnish

Q.3 – What is the process to transform from regular to composition policy in GST?

Any assessee who is enrolled as a normal assessee beneath GST urged to furnish the application to choose for the composition levy in Form GST-CMP-02 at GST Portal before the start of the fiscal year to which the option to file the tax beneath the mentioned section is practiced

Q.4 What is the time to choose for the composition levy?

So to claim the policy you need to furnish the online application to choose for the composition levy through the tax council. The assessee who can choose for the policy can be defined under:

- New taxpayer: beneath the GST act any individual who is eligible to enroll, post the appointment day is required to furnish his option to file the composition amount in the application for new enrollment in Form GST REG-01.

- Existing assessee: Any assessee who is enrolled as the normal assessee beneath GST is urged to furnish the application to choose for the composition levy in Form GST-CMP-02 at GST portal before the start of the fiscal year towards which the choice to file the tax beneath the mentioned section is practiced.

Q.5 Does there any need to file a new application to choose for the composition policy as I am an enrolled assessee claiming for the composition policy beneath the GST portal?

Towards those assessees who had previously claimed the composition policy, there is no need to file for the new application choosing for the composition policy with respect to the compliance of related conditions or restrictions in this concern.

Q.6 – Is it necessary to furnish the stock Intimation? What is the method to furnish the stock Intimation?

Yes, it is necessary to file a Stock Intimation.

So to furnish the application to choose for the composition levy you will indeed need to furnish the stock intimation to file the information towards the stock consisting of inward supplies of goods from the non-enrolled individual, owned by you upon the previous day from the date where you choose to pay the composition amount. You are needed to furnish the stock intimation information within 30 days of the date where the composition levy is asked.

The application to choose for the composition levy is not for permission through the tax council. On furnishing of the application, you are said to be a composition assessee on the platform and subsequent changes are developed for the platform. But for the case, it is found that you are not entitled to the composition levy or possess not to furnish stock intimation you will be mandatorily forced to the composition levy through beginning the suitable proceedings.

The stock intimation furnished through is not towards the process through states and center tax authorities. But for the event, if it is revealed through the tax council that details regarding the stock as well as ITC reversal filed in the stock intimation are not right, the tax counsel can do the proper demand proceedings from the back office with respect to you.

Q.7 – Is there any possibility that I save the application to opt for the composition levy?

Yes, the application which you can protect for 15 days from the date of incorporation post to which it is eliminated through the system. A saved application can be accessed through My saved applications functionality open in the network of the taxpayer.

Q.8 – Can I choose the composition levy if I have a deal in the services?

Yes, you can choose-out the composition levy despite you have a deal in the services from FY 2019-20.

Q.9 – Can I deal in the services from 1/04/2019 to 31/07/2019 and have furnished the application to choose for the composition levy. Why has my application been refused?

The application you filed to opt for the composition levy will not be accepted if you had furnished Form GSTR-1 or Form GSTR-3B for April/ May/ June 2019 against any GSTIN registered on your PAN across India for FY 2019-20.

Q.10 – What are the returns to be furnished through the composition assessee?

The composition assessee is urged to file the tax and furnish the statement every quarter according to the scenario in FORM GST CMP-08.

Subsequent to that he needs to file the return for every fiscal year or its part in FORM GSTR-4.

NOTE: if you want to know the current applied timelines then you can see it on the link https://www.gst.gov.in/ for important dates.

The above action is not working, if we have already filed GSTR-3B

now, a normal taxpayer is not able to opt for a composite scheme as the facility stands disabled. Time is ticking away, even though extended. Gst helpdesk is of no use. Can you give an example for this category?

Hello mam

But i am not getting this option but it showing cmp02 disabled for 2018-19

Is this option not enabled or i am getting error