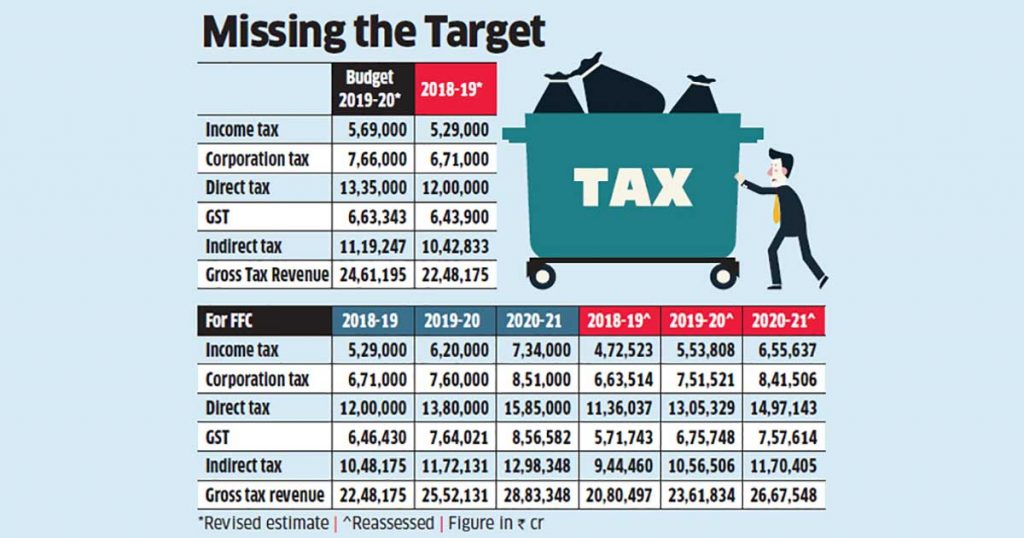

The tax revenue target of the next five years’ seems to be going beyond the fetching point, considering the statistics of targets achieved till yet. The same gloomy news was conveyed to the 15th Finance Commission (FFC) in June by the Government of India that the gross tax revenue (GTR) growth in the next five years could not meet the estimated one in the budget.

Like, the Growth Revenue Target for the year 2019-2020 was estimated to be INR 25.52 lakh crore, however, when calculated on the basis of provisional accounts for 2018-19, it came out to be INR 23.61 lakh crore.

As per the calculations, the shortage may vary between INR 2.16 lakh crore in 2020-21 to INR 3.70 lakh crore in 2024-25. So, the GTR in the next five years is anticipated to be approx INR 15 lakh crore lesser than the initial estimate submitted to the FFC.

Initially, the estimates were figured out on the basis of the interim budget. In July, these estimates were brought down by the finance ministry, however, they were still much greater than those estimates which were submitted to the Finance ministry in the reassessment. The FM, individually, prepared itself for another loss of INR 1.45 lakh crore in revenue after subtracting the corporation tax

FM and cabinet ministry did not respond to the questions sent to them because of the non-presentation of the report by them before the parliament.

Bills of food, petroleum subsidies and fertilisers were also anticipated to rise higher by the government. The government expects the fertiliser subsidy to get double to INR 1.42 lakh crore, food subsidy to get higher by approx INR 90,000 crores to INR 2.61 lakh crore and petroleum subsidy to go up than treble to INR 90,000 crore in 2020-21, as in comparison to the amended estimates for the year 2018-19.

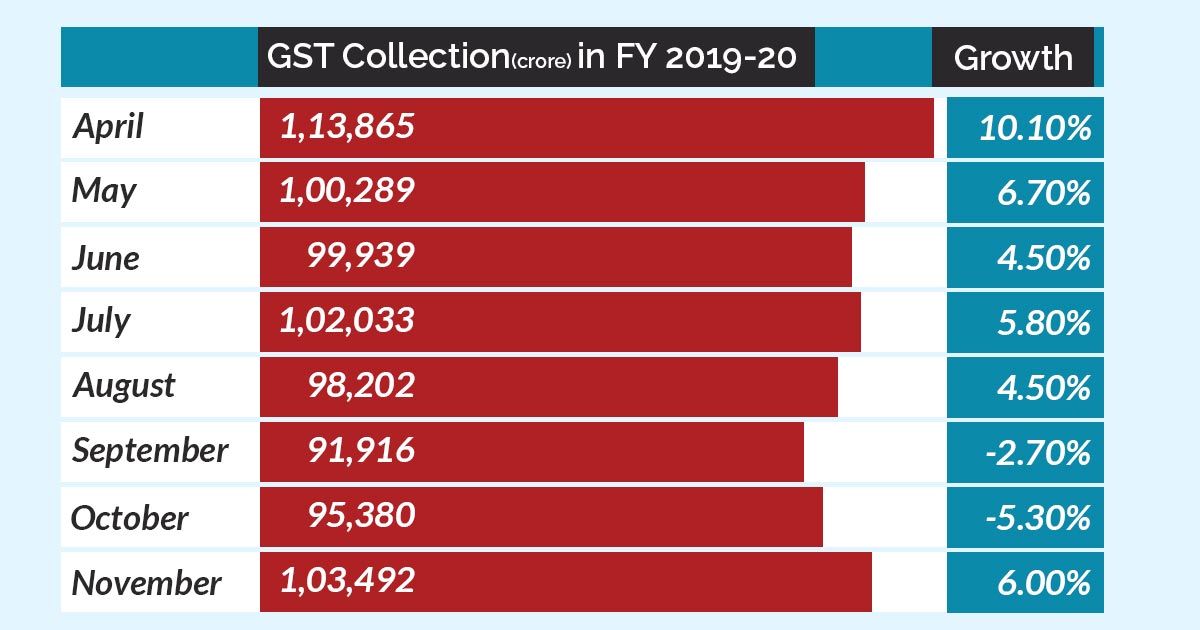

Read also: 6% Rise in GST Collection in November Shows Signs of Economic Recovery

“These estimates need to be tempered with an element of caution. However, as per the provisional accounts for 2018-19, it can be seen that the actual collection from various taxes is lower than the revised estimates. Based on this recent development, if the base year estimates are reassessed keeping the same growth and buoyancy assumptions as adopted during the presentation of the budget for the year 2019-20, the estimates for the gross tax revenue would get reduced ranging from Rs 2.16 lakh crore in 2020-21 to Rs 3.70 lakh crore in 2024-25,” the government wrote to Finance Panel.