In today’s fast-changing business environment, companies in India must adopt Goods and Services Tax (GST) e-invoicing. It is not merely about compliance; the right e-invoicing software can enhance business operations, improve efficiency, and streamline management.

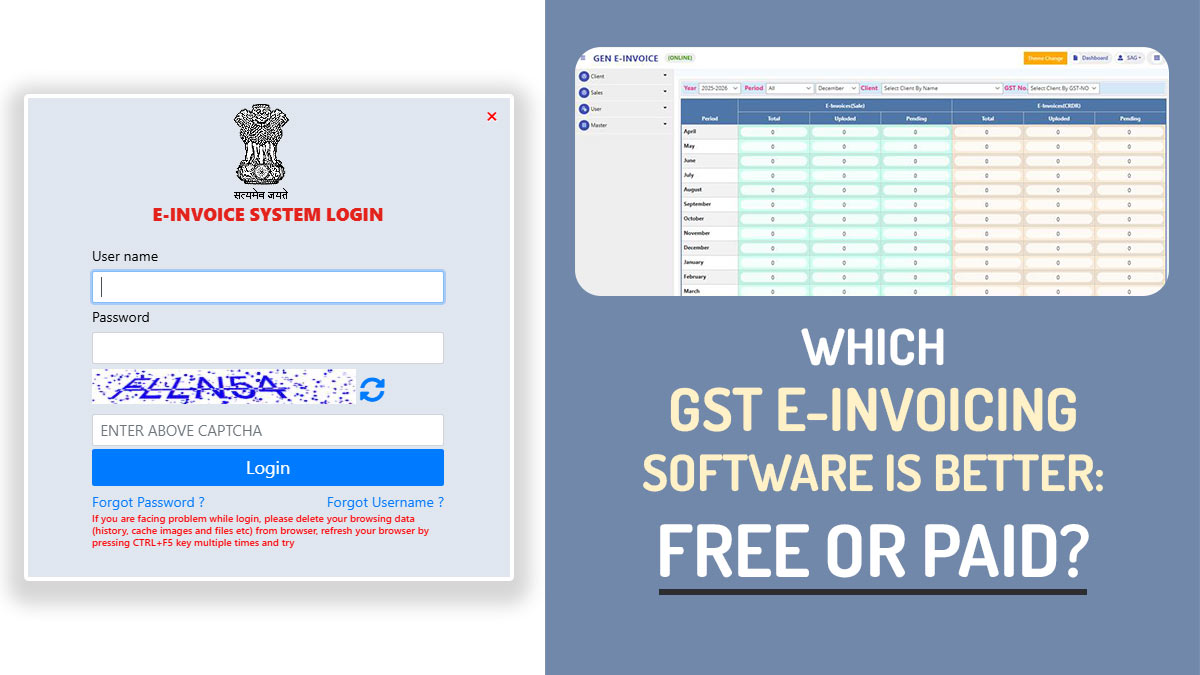

Businesses today face an important decision: should they opt for a free e-invoicing solution or invest in a more advanced paid option? In this article, we will explore both alternatives, highlighting their advantages and disadvantages to help you determine which choice is the best fit for your business.

What is GST E-Invoicing?

GST e-invoicing is the method to create invoices that the government verifies electronically. It eases the reporting process, reduces mistakes, and ensures that invoices are the same across different companies. A unique identification number and a special code are provided to each e-invoice, which makes it simple to check.

Businesses to make these e-invoices perfect require particular software, which can either be available for free or come with a cost. Let us see about these two software and their features.

What Does Free GST E-invoicing Software Propose

Government portals, open-source tools, or basic versions of commercial software propose free e-invoicing solutions. The main attraction is clear: there is no subscription fee.

Benefits of Free GST E-invoicing Software

Zero Cost: Small businesses, startups, and freelancers can generate complaint e-invices without any financial stress.

Basic Compliance Covered: The majority of free tools authorise you to create and upload invoices to the GST portal or generate IRN and QR codes under the regulation of the government.

Easy to Use: With fewer features, these tools secure simpler interfaces. Simplicity could be effective for users with lower invoicing requirements.

Effective for Very Small Businesses: If the volume of your invoice is low and you have confined accounting complexity, then free solutions may be productive to fulfil your needs.

Read Also: How Gen GST Software Makes E-invoicing Easy for Businesses

Free GST Invoice Software Disadvantages

The main attraction is clear: there is no subscription fee.

Lesser Operationality: Only basic e-invoice creation is provided under free tools. There are no advanced features like automated bulk uploads, API integration, multi-user support, or analytics.

Manual Workload: Manual upload/download of invoices or data entry is needed under most free tools, which could take much time and can cause human error.

No Dedicated Support: Support is confined to FAQs, user forums, or basic help pages; there is no dedicated customer assistance to support you in resolving problems immediately.

Scalability Challenges: With the expansion of businesses, free tools cannot provide effective performance with a surge in invoice volumes and intricate needs.

Features of Paid GST E-Invoicing Software

Paid e-invoicing solutions differ from standalone paid tools to comprehensive invoice management software that integrates with accounting systems. The various vendors of software provide such solutions and have subscription plans.

Paid GST Invoice Software Benefits

Advanced Features: Paid software typically includes automation, API integration with ERP or accounting systems, bulk invoice upload, status tracking, error alerts, and more.

Automation and Efficiency: Ignore manual uploads. Paid solutions automate the whole procedure, saving time and lowering errors, particularly for businesses with higher transaction volumes.

Integration With Business Systems: Many paid platforms integrate easily with the current accounting and billing systems. This signifies that invoices can be generated and sent automatically as part of your regular workflow.

Reliable Customer Support: Support teams assist in resolving issues, answering queries, and ensuring seamless operations.

Scalability & Future-Ready: Paid tools update features regularly, whether your invoice volume increases or regulations change.

Considerations Before Opting for Paid Software

- Cost: There are annual or monthly subscription fees for the paid software. It will be an effective factor for the small businesses with confined budgets.

- Learning Curve: Some advanced tools may need time to learn or assistance for initial setup, particularly if they integrate with multiple business systems.

- Feature Overload: For small businesses with lower invoicing requirements, advanced features may not be required, as paying for unnecessary features is not a cost-effective choice.

Free Vs. Paid: A Side-by-Side Comparison

| Aspect | Free Software | Paid Software |

|---|---|---|

| Cost | Free | Paid Subscription |

| Features | Basic | Advanced, Automation |

| Integration | Limited | Seamless with ERP/Accounting Systems |

| Support | Limited | Dedicated Customer Support |

| Ease of Use | Simple | May Need Training |

| Scalability | Low | High |

| Best For | Very Small Businesses | Small to Large Businesses |

Which Option is Effective

Your decision must be based on the needs of the business, invoice volume, budget, and growth plans:

Proceed with the free software when:

- You have low invoicing volume

- Your business is just starting

- Budget constraints make paid tools impractical

- You are okay with manual uploads and limited features

Choose Paid Software If:

- You manage large invoice volumes regularly

- You require automation and integration with accounting systems

- You value time saved via efficiency

- You desire reliable assistance and future-ready compliance

The government proposes free GST e-invoicing software and furnishes merely basic compliance features. To fulfil the gap of advanced features, GST software made by private companies proposes advanced automation, integrations, and dedicated support. Consequently, the paid software is more effective for growing businesses with compliance requirements.

Closure: Concerning GST e-invoicing software, both free and paid options are available, which are appropriate for different types of businesses. Free software is effective for small businesses that have fewer requirements, and the paid software is for larger, growing companies.

Opting for the correct software relies on the business size, the degree of complexity of the procedure, and its future objectives. It’s essential to consider not only your current needs but also the potential growth of your business in the future.

By choosing the appropriate e-invoicing solution, you can ensure compliance with GST regulations while enhancing your financial processes. This will lead to streamlined and more efficient operations within your business.