Once logging to the GST portal, the taxpayer is facilitated by TDS and TCS credit received which could be filed by all the taxpayers who are successful in making a specified limit of sales on the e-commerce platforms and not necessary but are indulged in any kind of works contract with Government departments.

Latest Update

- The taxpayers can download the offline utility for TDS & TCS credit received at the official portal. Download now

The Form to avail of this facility is just like the GSTR-2A form and the details get auto-populated from GST returns like the GSTR-7 form and GSTR-8 form together. Any taxpayer could avail of this facility by just logging in to the GST portal and clicking on ‘TDS and TCS credit received’ present on the return dashboard.

There are options available to either claim or reject the credit of TDS and TCS deducted or collected at source by their respective Government deductor or e-commerce operator.

Form: GST Software Demo For ITC Compliance

This TDS and TCS credit received on the GST Portal article covers the following :

- Purpose of form & who must file

- the due date for filing

- Pre-read to declare details

- Steps to file

- FAQs Filing GST TDS and TCS Credit

Purpose of the form TDS and TCS Credit Received & for Who Must File

TDS/TCS credit received is a facility which is provided to all such taxpayers from whom tax is either deducted or collected at source by the respective registered TDS deductor or TCS collector.

Now, after deduction or collection, the deductor or collector is supposed to file the GSTR-7 form or GSTR-8 form respectively before the 10th of the succeeding month. In the next step, the deductee is required to accept or reject the TDS/TCS credit on the GST portal by just filing the TDS/TCS Credit Received tab.

Thus, to get the benefit of GST, the deductee is required to file the ‘TDS/TCS credit received’ tab on the GST portal. The portal is designed such that the deducted amount gets reflected in Cash Ledger which could be further used for the payment of the balance amount of tax after the ITC has been cleared.

Last Date for Filing TDS and TCS Credit Received on GST Portal

The Government has been liberal at this point and has not kept any due date or late filing fees for filing TDS/TCS credit received.

But, it would be best if filed before the deadlines when the tax payment is due:

- 10th Day of the Next Succeeding month for GSTR-7 Or the Same as it is for GSTR 8

The strict rule is that It can be filed only once a month and only online. The TDS and TCS credit received form could be filed before the filing of the form GSTR 7 / GSTR 8

Pre-read to Declare Details under TDS and TCS Credit Received

As discussed earlier, the ‘TDS/TCS credit received’ tab gets auto-populated with details from the GSTR 7 or GSTR 8 which is filed by the deductor/collector respectively. The deductee is supposed to crosscheck all the details which is entered in the GSTR 7 or GSTR 8 with his records or the bills raised and accept or reject the record accordingly because once ‘TDS/TCS Credit received’ is filed on the GST portal it cannot be reversed as there is no such provision to till date.

The ‘TDS and TCS Credit received’ form cannot be filed without taking action on all the auto-populated records in all the tables.

Steps Involved in Filing TDS and TCS Credit Received on GST Portal

Step 1: Log in to the GST portal

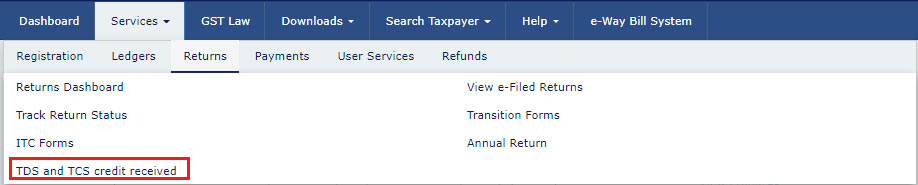

Step 2: Go to ‘Services’ > ‘Returns’ > ‘TDS and TCS Credit Received’

File returns dashboard appears.

Step 3: Select the return period and proceed to the ‘TDS/TCS credit received’ tile.

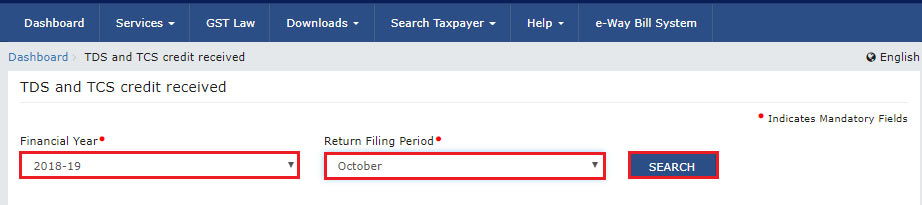

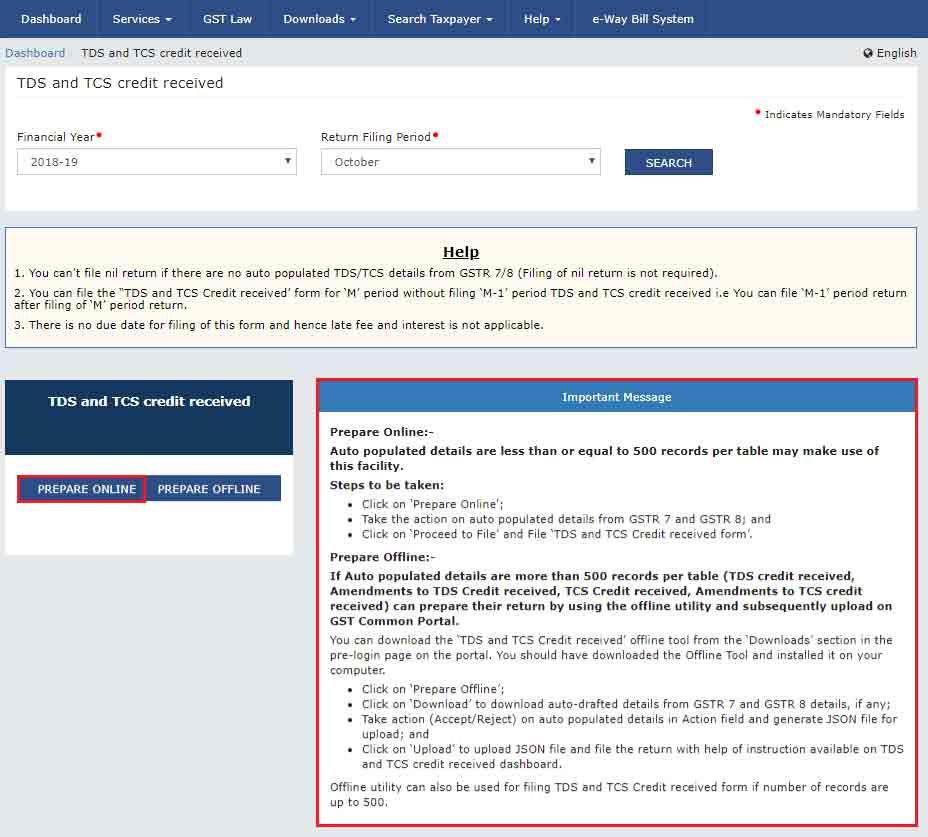

Choose the Financial Year & Return Filing Period for which the return has to be filed and then click on SEARCH.

Various returns would be displayed. Select the file ‘TDS and TCS credit received’ by clicking on the button prepare online and offline.

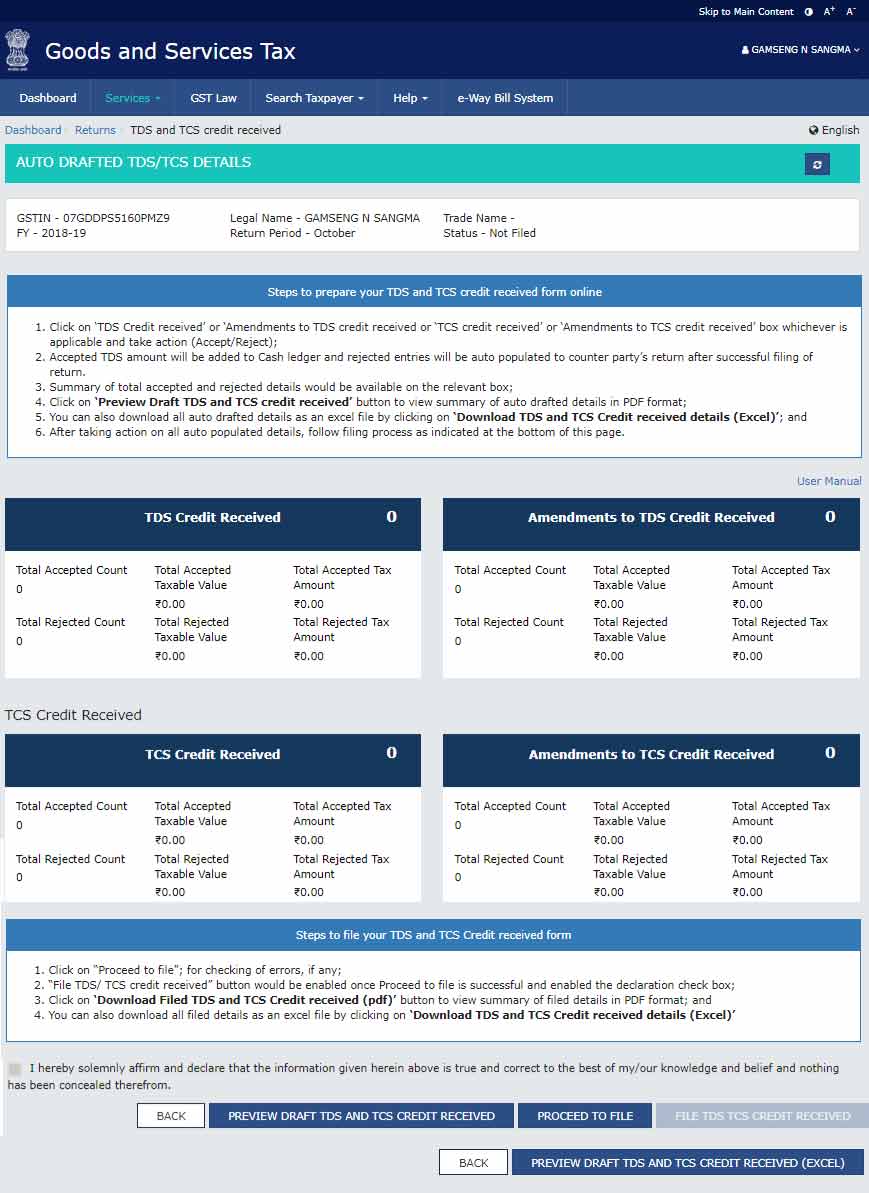

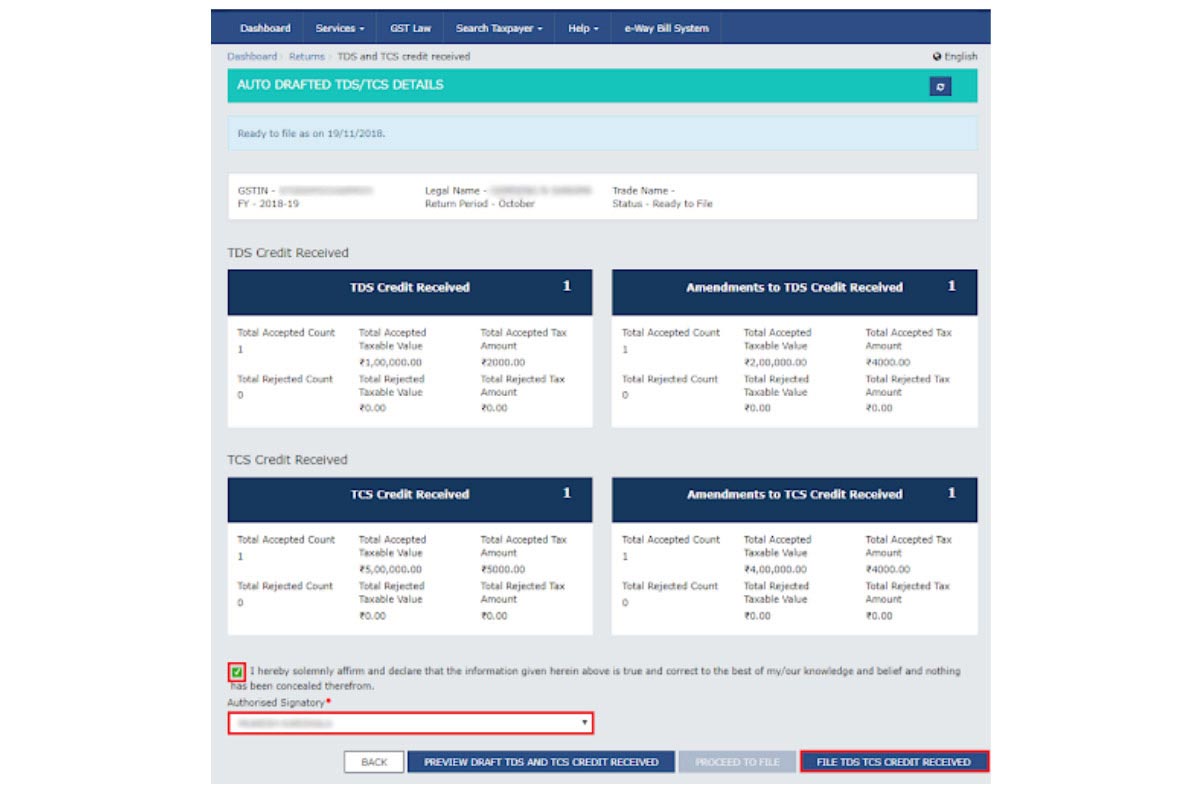

Four tables would appear on the page auto-drafted TDS/TCS details:

- TDS Credit Received: This is to accept/reject TDS Credit Received details populated from Form GSTR-7 of all the deductors.

- Amendments to TDS Credit Received: for accepting/rejecting, any amendments later made to the TDS Credit Received details by the deductor, that had been earlier accepted by the taxpayer.

- TCS Credit Received: This is to accept/reject TCS Credit Received details populated from Form GSTR-8 of all the collectors.

- Amendments to TCS Credit Received: To accept/reject, any amendments later made to the TCS Credit Received details by the collector, that were earlier accepted by the taxpayer.

Note: The procedure between Step-4 to Step-6 -to accept or reject records remains the same across the four tables.

Step 4: Take action by accepting or rejecting each record, in order to take the credit of TCS or TDS, allocated to your GSTIN, into the Electronic cash ledger. Full Procedure to File TDS & TCS Credit Received on GST Portal

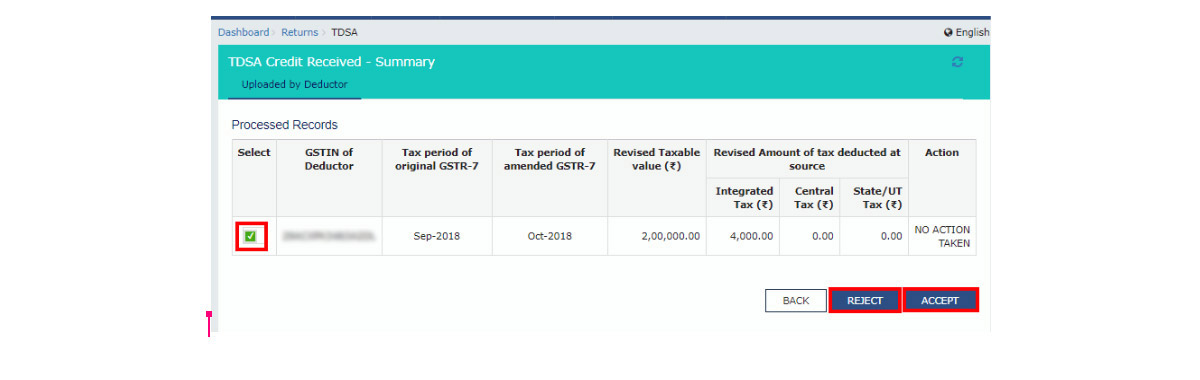

Choose any table and a summary page with records is displayed under it. Select the relevant records using the checkboxes -against the GSTIN of the Deductor or Collector. After selecting record/s, Click on either the ‘ACCEPT/REJECT’ button to accept/reject the record/s.

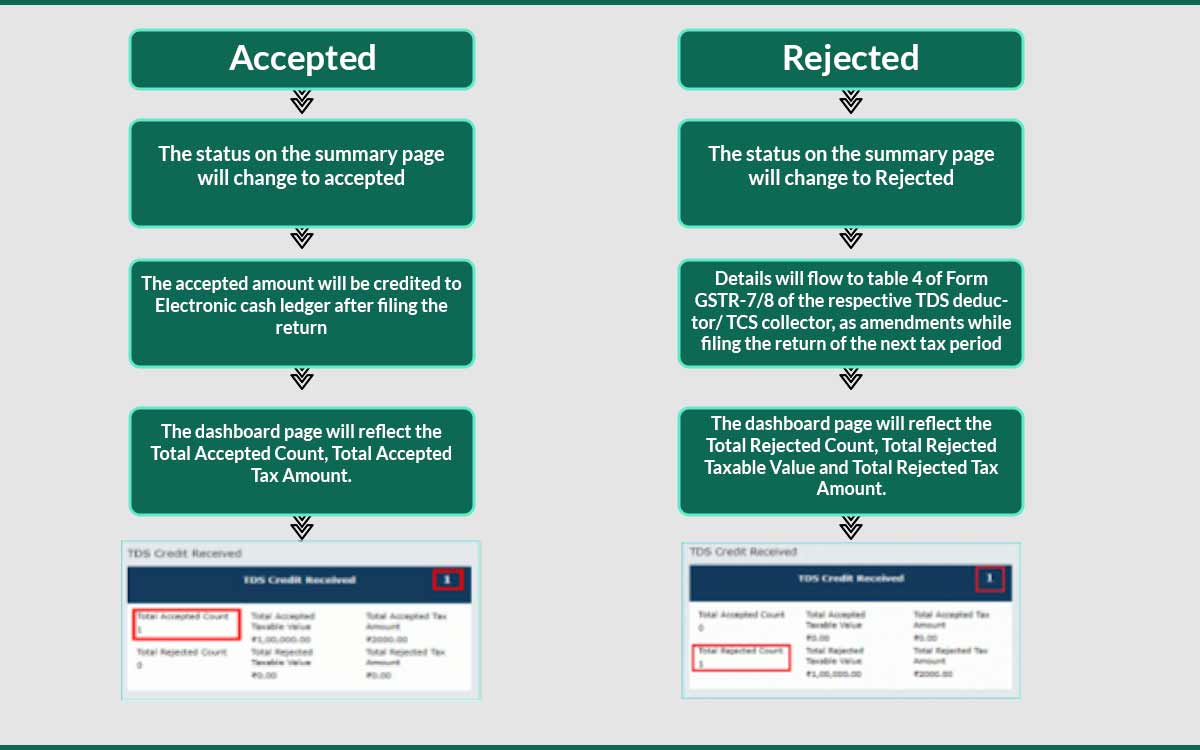

Following is the result if you accept or reject a record:

Note: A person can ‘undo’ the action (Accept to Reject or Reject to Accept). But this can be done only until he actually files the form. Once the form is filed, the action cannot be revised.

Step 5: Preview, cross-verify the draft form and proceed to file the details.

After filling in the details, click on the PREVIEW DRAFT TDS AND TCS CREDIT RECEIVED button. Cross-check the draft summary in PDF for the correctness of data. Note that once filled, the details cannot be changed.

Click on the PROCEED TO FILE button to continue with the submission. It takes some time for the request to be processed. A message is displayed on the top of the page confirming this. Submit the declaration and select the Authorized Signatory from the drop-down list.

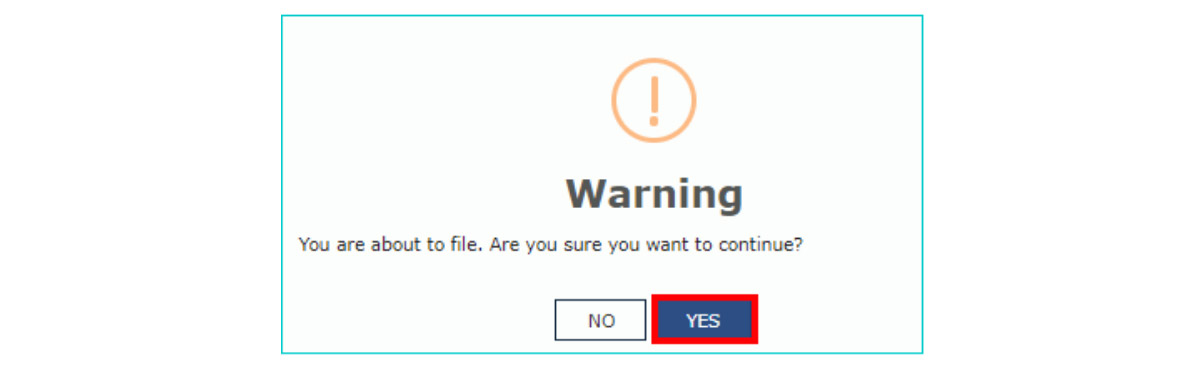

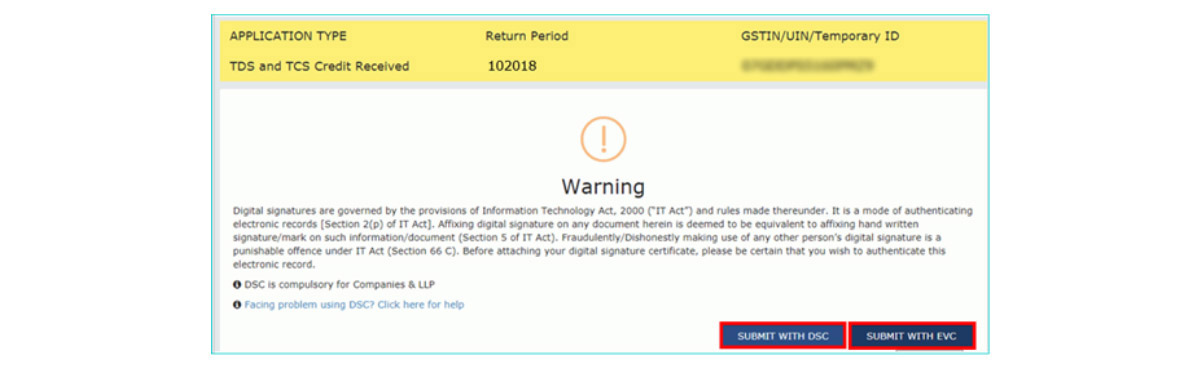

Click on the FILE TDS TCS CREDIT RECEIVED button that gets enabled and click Yes on the warning message that appears on the screen.

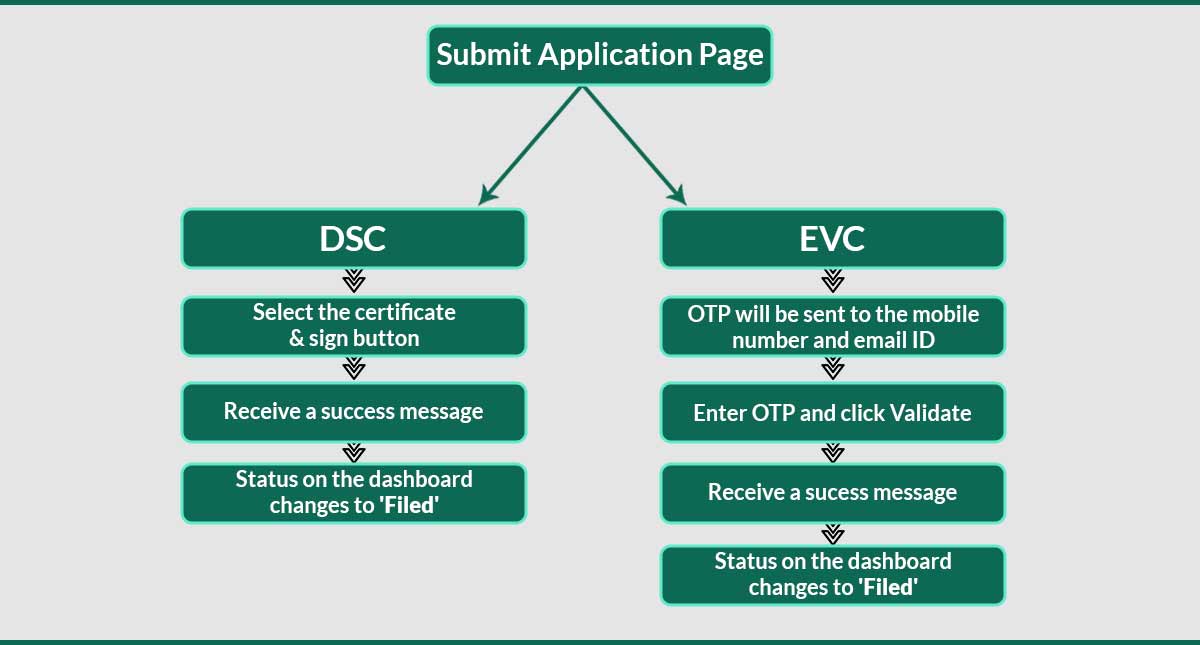

Step 6: Submit the form either using the Digital signature or the Electronic Verification Code.

Follow the steps mentioned below to submit the form:

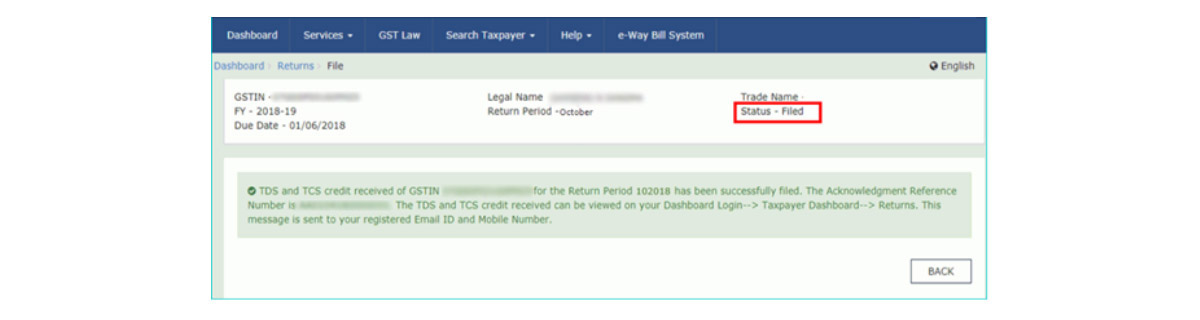

The status of the submission turns to ‘Filed’.

Note: The taxpayers also check the TDS/TCS credit online and offline process through the GST portal official PDF file, download here

FAQs Related to Filing GST TDS and TCS Credit

The article contains all the Frequently Asked Questions related to Filing Details in TDS (Tax Deducted at Source) and TCS(Tax Collected at Source) Credit of the Goods and Services Tax (GST).

Q.1 What is “TDS or TCS Credit Received” under the return filing dashboard?

An amount of TDS or TCS Credit is provided to the respective assessees if an excess amount is deducted or collected by the respective party responsible for the deducted or collection for the assessee. The TDS or TCS received tile can be used by an assessee as indicated under form GSTR 7 or GSTR 8 accordingly for that assessee.

- Taxpayers opting composition scheme

- Casual Taxable Person

- Non-resident taxable persons

- Persons paying TDS

- Input service distributors

Q.2 – Which kind of tables are included in the TDS or TCS Credit Received Tile?

Some corresponding tables are included, for the auto calculation of TDS or TCS Credit Received given in form GSTR 7 and GSTR 8, according to form GSTR 2A/GSTR 2 or GSTR 4 for the normal assessee or composition assessee respectively. The Credit received consists of the following tables:Some corresponding tables are included, for the auto calculation of TDS or TCS Credit Received given in form GSTR 7 and GSTR 8, according to form GSTR 2A/GSTR 2 or GSTR 4 for the normal assessee or composition assessee respectively. The Credit received consists of the following tables:

- TDS Credit Received: Accept or reject TDS Credit Received details

- Amendments of TDS Credit Received: Accept or reject amendments to TDS Credit Received details

- TCS Credit Received: Accept or reject TCS Credit Received details

- Amendments of TCS Credit Received: Accept or reject amendments to TCS Credit Received details

Q.3 – Which assessees are required to file TDS or TCS Credit Received?

All the assessees from which the TDS or TCCS is deducted or collected are required to file the credit received under form GSTR 2A/form GSTR 2 or form GSTR 4 for the normal assessee or the composition assessee respectively.

Q.4 What are the compulsions on filing the TDS or TCS Credit Received for each of the tax periods?

It is not compulsory for the assessee to file the TDS or TCS Credit Received for each of the tax periods.

Q.5 What is the source to file the TDS or TCS Credit Received?

The assessee can file the TDS or TCS Credit Received under the Returns Dashboard available on the GST portal. On the GST portal go through Services > Returns > Returns Dashboard.

Q.6 – Which of the options are available on the action field?

Two options are available on the action field viz. Accept and Reject.

Q.7 – What are the consequences if the TDS or TCS Credit Received is rejected by an assessee?

The rejected amount details will be adjusted through form GSTR 7 or GSTR 8 accordingly for the purpose of amendments but only after filing the TDS or TCS Credit Received forms. The person deducting or collecting the taxes will take the necessary actions on the rejected amount.

Q.8 – What are the consequences if the TDS or TCS Credit Received is accepted by an assessee?

The respective amount of TDS or TCS Credit Received will be credited into the electronic cash ledger of the assessee but only after filing the TDS or TCS Credit Received forms. The amount of credit can be either used to pay the future tax liabilities or refunded by the assessee.

Q.9 – Is it possible to change the accepted records?

The records accepted by the assessee can not be changed once they have been filed.

Q.10 – What are the consequences if the TDS or TCS is filed by an assessee without considering the tables of TDS or TCS Credit Received?

The amount unconsidered by the assessee at the time of filing the TDS or TCS returns under the form GSTR & or GSTR 8 respectively, will be transferred to the next tax period. The amount will be credited to the Electronic Ledger of the respective assessee same with Electronic Verification Code (EVC) or Digital Signature Certificate (DSC).

Q.11 – What is the time of updation of the summary tile?

The summary tile will be updated automatically after considering the auto-populated record inside data of each tile.

Q.12 – What are the cases under which the TDS or TCS Credit Received will be credited to the deductor or collector?

All the amounts of TDS or TCS Credit Received rejected by the assessee will be flown to form GSTR & or GSTR 8 accordingly after filing the TDS or TCS Credit Received and will be available under table 4. The deductor or collector can make the amendments in the records after the transfer.

Q.13 – can the assessee file the TDS or TCS Credit Received form without considering the auto-populated records of all kinds?

No, the assessee can not file the TDS or TCS Credit Received form without considering the auto-populated records of all kinds.

Q.14 – What is the source form which an assessee can check the amendments made by the deductor or collector under form GSTR 7 or GSTR 8 respectively?

All the records of amendments made by the deductor or collector can be checked by the assessee in the tables of the assessee file the TDS or TCS Credit Received form.

Q.15 – Is there any way through which the action of accept or reject can be changed?

The assessee can change the answer until the actual filing of the TDS or TCS Credit Received form but after that, he can not do so.

Q.16 – Is there any way through which the assessee can change or amend the TDS or TCS Credit Received auto-populated in the TDS or TCS Credit Received form?

No, the assessee can not change or amend the TDS or TCS Credit Received auto-populated in the TDS or TCS Credit Received form. Only the deductor or the collector can do so.

Q.17 – Is there any way through which the assessee can add a new record in the table of TDS or TCS Credit Received form?

No, the assessee can not add a new record in the table of TDS or TCS Credit Received form.

Q.18 – What is the last day to file the TDS or TCS Credit Received form?

The Central Board of Direct Taxes (CBDT) has not fixed any last date to file the TDS or TCS Credit Received form and no late fees are charged by them.

Q.19 – Is an assessee allowed to file the TDS or TCS Credit Received form multiple times in a month?

No, the assessee can not file the TDS or TCS Credit Received form multiple times in a month. He can only do so once every month under the specific tax period.

Q.20 – Can the assessee file the TDS or TCS Credit Received form offline?

No, the assessee can not file the TDS or TCS Credit Received form offline. He can file the form online only.

Q.21 – How to preview the TDS or TCS Credit Received form before filing?

The assessee can download a preview of the TDS or TCS Credit Received form before filing through the ‘PREVIEW DRAFT TDS AND TCS CREDIT RECEIVED’ tab on the GST portal.

Q.22 – Is it compulsory for the assessee to file the TDS or TCS Credit Received form before filing the GSTR-1/3B?

No, it is not compulsory for the assessee to file the TDS or TCS Credit Received form before filing the GSTR-1/3B. He can file the form later too.

Q.23 – What is the time when the ‘File TDS or TCS Credit Received’ button is enabled?

The ‘File TDS or TCS Credit Received’ button will be enabled after clicking on the ‘Proceed to file’ Button on the GST portal.

Q.24 – How can the assessee sign the TDS or TCS Credit Received form?

The assessee can file the TDS or TCS Credit Received form through DSC or EVC

- Digital Signature Certificate (DSC): Digital Signature Certificate (DSC) is the electronic form of the physical signature of the assessee. The government has allowed to apply the DSC in order to sign the digital and other documents. The Certifying Authorities issue the DSC in India. GST portal accepts the DSC of the PAN-based Class II and III DSC only.

- Electronic Verification Code (EVC): Electronic Verification Code (EVC) can authenticate the id of an assessee with the help of a One Time Password (OTP). The OTP is sent to the registered mobile number of the assessee.

Q.25 – What will happen after filing the TDS or TCS Credit Received form?

After the assessee files the TDS or TCS Credit Received form an ARN is generated containing that the form is filed by the assessee. Then the amount of the TDS or TCS Credit Received will be credited to the electronic cash ledger of the assessee and an alert id dent to the registered mobile number and email id of the assessee.

Hi

Can I paid the late fee & interest vide tds/tcs received in my cash ledger

Kindly suggest.

Prabin

No

We paid TDS online, through payment gateway option, selection Canara bank and then other bank credit card. Paid facilitation fees and GST on this. I need input of GST paid from Canara bank,how will I get the invoice having GST breakup on TDS payment?

How to take 2019-20 F.Y. TDS Credit Received present days.

WHILE TDS TCS CREDIT RECEIVED AFTER ACCEPTING PROCEEDING TO FILE SHOWING ERROR MESSAGE IN STATUS “PROCEED TO FILE HAD SOME ERROR”

ERROR CODE SHOWING : RET2X91230

“Please contact to GST portal for the same”

sir ….. I am registered under section 51 so I deduct GST TDS on the taxable amount and file the gstr7, but how to issue gstr7a?

It will be visible on deductee login under services–> return–> tds & tcs credit received

Any option add next month TCS return

nope

Sir,

I had filed a November TCS return. But after filing i will get another TCS credit. Now, how to add that new credit?

Just File GSTR 7A

Can i Take TCS credit after filing GSTR9 and 9C

There is no connection between filing GSTR 9 & 9C and taking TCS credit

Sir,

How can i get GST TDS Credit in GSTR-3b??? I have filed TDS received credit Return.

Sir, it will be credited in your cash ledger, hence you can use it for offsetting the existing liabilities

Can i claim a refund of GST TCS in my current a/c?

It will be credited into the account which you provided to the GST portal

Now TCS amount credited in my electronic cash ledger. next how to to get the amount to refund to my account

by filing a refund form on the GST Portal.

Dear Sir,

I done wrong might be (TCS credit is taken directly in GSTR3b and seeing into GSTR2a) What I can do now please help me out.

thanks and regards

Girisha H K

What wrong have you done? Please clarify this first

GST TDS consider in the input column as a credit in FY 2018-19 due to a misunderstanding

Reverse the same in the Next tax period

Hy. I would Like to know. After the deductor file, gstr7 on October 2020.how will the deductee (contractor) accept the detail or rejected on that month since his TCS received not auto-populated in his GST account. Plz help

Please goto Services–>Return–>TDS and TCS credit received, there you can accept/reject the TDS credit amount

I am a normal taxpayer,

I have doing govt work contractor

I have received TDS 2% I have to file gstr7?

Yes

Proper details given for tds/tcs received nice good article

SIR

TDS (IGST) DEDUCTED BY THE CONTRACTOR ON MAY20 THIS AMOUNT IS REFLECTED IN GSTR2-A. I FILED TDS/TCS RECEIVED RETURN IN JULY20

THE AMOUNT IS CREDITED IN THE CASH LEDGER. I WANT FILE GSTR3B FOR JULY THERE IS LIABILITY I EANT TO SETOFF WHILE FILING IT IS NOT SETOFF, PLEASE ADVISE

WHAT I HAVE TO DO WHETHER I HAVE TO FILE PMT09

REGARDS

if sufficient balance in your cash ledger then no need to file pmt06

ITC due to TCS is filed then under which head it is to be mentioned in Table 4 of GSTR3B. If not mentioned in the table then there is a liability mismatch in GSTR2A and GSTR3B.

Yes

We have no TDS in the month of April’20 but in May’20 TDS is deducted by the deductor. Pl, advise whether we file TDS and TCS credit received return of April’20.

In a scenario there are 2 deductors A and B.

C is a supplier.

A deducted TDS of C and file his GST R7 for March 2020. C accepts it and file the return and get in his cash ledger in March 2020.

But what if deductor B file his GST R 7 for TDS deducted of C in March 2020.

Will C have options to file TDS TCS Credit received for the month March 2020 again?

C can take the same credit in next month

HOW HE CAN CLAIM …..YOU SAID ONE CAN ACCEPT TDS ONCE AND CAN FILE RETURN ONLY ONCE FOR MONTH

It will be credited in your cash ledger

Sir,

Can we take input on TCS credit auto-populated on 2A (part C) and the amount credited to the cash ledger when we accept the TDS or TCS return on the return dashboard both?. (This reflected on 2A and cash ledger)

Yes

With reference to your article on Claiming TDS credit, you have rightly mentioned said that deductee is supposed to crosscheck all the details which are entered in the GSTR 7 or GSTR 8 with his records or the bills raised and accept or reject the record accordingly because once ‘TDS/TCS Credit received’ is filed on the GST portal it cannot be reversed as there is no such provision to till date.

I have to file a return for the month of October 2018 and in this month at least three persons have deducted TDS under GST and one person has filed the return whose credit is being reflected.

Can I accept that TDS credit and file my return and for others, can I take credit in the month of November 2018) later on when they file the TDS Return or

I have to wait for filing the return for the month of October 2018.

Or what is the solution to the problem where few of deductor failed to file TDS return?

Since your TDS has been deducted and you can claim only that credit which is reflected in your return, you can lodge a complaint against GST portal who failed to file TDS return

Dear Sir,

I have entered wrong GSTIN number while filing GSTR-7 and the party have wrongly accepted the credit. Now the party can not reject that because the party has already accepted. How to correct this entry?

Sir, the TDS credit received the return of aug.2019 is rejected by me wrongly please help me

Please clarify your query.

hi brother same happened with me I filled 0 TCS return of October 2019

and TCS will reflect after 20 days

did u get any solution?

Good article 👌👌