What is the ITR 2 Form?

The ITR-2 is filed by individuals or HUFs not having income from profit or gains of business or profession and to whom ITR-1 is not applicable. It includes income from capital gains, foreign income, or any agricultural income more than Rs 5,000.

- What is ITR 2 Form

- Eligibility File ITR 2 Online AY 2020-21

- File ITR 2 Via Gen IT Software

- ITR 2 Due Date for AY 2024-25

- Structure of ITR 2 Filing

- ITR 2 Form Filing Online and Offline Mode

ITR 2 Filing Start Date for Taxpayers

The Income Tax Department launched an online filing for the ITR-2 form on July 18, 2025.

Eligible Taxpayers for Filing ITR 2 Online AY 2025-26

The taxpayers who are eligible for filing the ITR-2 form are the persons whose source of income is as mentioned below:

- A resident having any asset located outside India or signing authority in any account.

- A non-resident or not-ordinary resident.

- Taxpayers who earn agriculture income above Rs. 5000/-.

- Income from winnings of a lottery, horse race, gambling, etc. under the head of other sources.

- Both short and long-term capital gains/losses from the sale of property/investments/securities. (if there is only long term capital gain exempt u/s 10(38) then ITR-1 can be filed)

The taxpayers who do not require to file the ITR-2 form are as follows:

- Taxpayers who earn from business or profession

- Taxpayers who are eligible to file Income Tax Return 1.

Latest Update

- ITR-2 Excel-based utility and JSON schema (V1.1) are now available for filing on the e-filing portal. Download Now

- An Excel-based ITR-1 and ITR-2 utility for Assessment Years 2021-22 and 2022-23 has been launched on the Income Tax Department portal. Check here

File ITR 2 Via Gen IT Software, Get Demo!

Due Date for Filing ITR 2 Online FY 2024-25

- FY 2024-25 (AY 2025-26) – 31st July 2025 | 16th September 2025 (Revised)

- FY 2023-24 (AY 2024-25) – 31st July 2024

- FY 2022-23 (AY 2023-24) – 31st July 2023

- FY 2021-22 (AY 2022-23) – 31st July 2022

- Every year on or before 31st July is termed as the last date for filing ITR 2.

Structure of ITR 2 Filing for AY 2025-26 Online

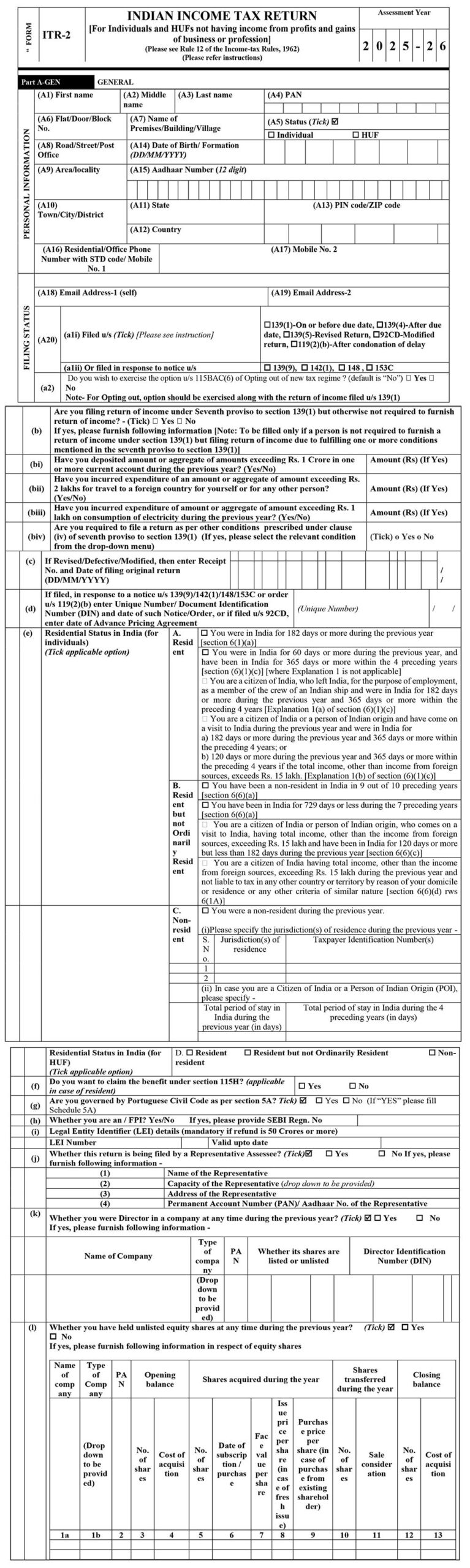

Part A: General Information

The general information is enclosed with the following details of the taxpayer to furnish with:

- Name

- PAN number

- Status: Individual or HUF

- Flat/Door/Block No

- Name of Premises/Building/Village

- Road/Street/Post Office

- Area/Locality

- Aadhar number

- Town/City

- State

- Country

- PIN Code/ZIP Code

- Residential/Office Phone Number with STD code/ Mobile No. 1

- Mobile No. 2

- Email Address 1 (Self)

- Email Address 2

Filing Status

- A20 – Filed u/s

- (a1i) Filed u/s (Tick) [Please see instruction]

- 139(1)-On or Before Due Date

- 139(4)-After Due Date

- 139(5)-Revised Return

- 92CD-Modified Return

- 119(2)(b)-After Condonation of Delay

- (a1ii) Or filed in response to notice u/s

- 139(9)

- 142(1)

- 148

- 153C

- (a1i) Filed u/s (Tick) [Please see instruction]

(a2) Do you wish to exercise the option u/s 115BAC(6) of Opting out of new tax regime ? (default is “No”)

Note: For Opting out, option should be exercised along with the return of income filed u/s 139(1)

B – Are you filing a return of income under the Seventh proviso to section 139(1) but otherwise not required to furnish a return of income? Yes or No

If yes, please furnish following information [Note: To be filled only if a person is not required to furnish a return of income under section 139(1) but filing return of income due to fulfilling one or more conditions mentioned in the seventh proviso to section 139(1)]

- B.i- Have you deposited an amount or aggregate of amounts exceeding Rs. 1 Crore in one or more current accounts during the previous year? (Yes/No)

- B.ii- Have you incurred expenditure of an amount or aggregate of the amount exceeding Rs. 2 lakhs for travel to a foreign country for yourself or for any other person? (Yes/No)

- B.iii- Have you incurred expenditure of amount or aggregate of amount exceeding Rs. 1 lakh on the consumption of electricity during the previous year? (Yes/No)

- B.iv- Are you required to file a return as per other conditions prescribed under clause (iv) of the seventh proviso to section 139(1) (If yes, please select the relevant condition from the drop-down menu? (Yes/No)

C – If Revised/Defective/Modified, then enter Receipt No. and Date of filing original return (DD/MM/YYYY)

D – If filed, in response to a notice u/s 139(9)/142(1)/148/153A/153C or order u/s 119(2)(b) enter Unique Number/ Document Identification Number (DIN) and date of such Notice/Order, or if filed u/s 92CD, enter the date of Advance Pricing Agreement

E – Residential Status in India (for individuals)

- Resident

- Resident but not Ordinarily Resident

- Non-resident

(II) Residential Status in India (for HUF)

- Resident

- Resident but not Ordinarily Resident

- Non-resident

F – Do you want to claim the benefit under section 115H? (Yes/No)

G- Are you governed by Portuguese Civil Code as per section 5A?

H- Whether you are an FII / FPI? Yes/No (If yes, please provide SEBI Regn. No)

I- Legal Entity Identifier (LEI) details (mandatory if refund is 50 Crores or more)

- LEI Number

- Valid upto date

J – Whether this return is being filed by a Representative Assesse?

- Name of the representative

- Capacity of the Representative (drop down to be provided)

- Address of the Representative

- Permanent Account Number (PAN) of the representative

K – Whether you were Director in a company at any time during the previous year? (Tick) þ o Yes o No If yes, please furnish following information

- Name of Company

- Type of Company

- PAN

- Whether its shares are listed or unlisted

- Director Identification Number (DIN)

L – Whether you have held unlisted equity shares at any time during the previous year?

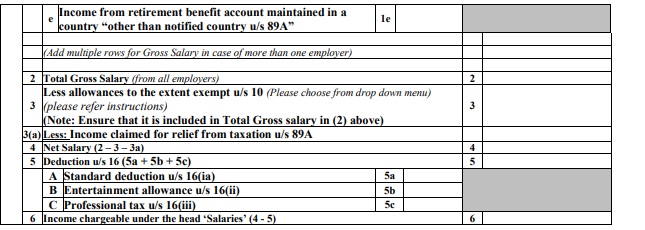

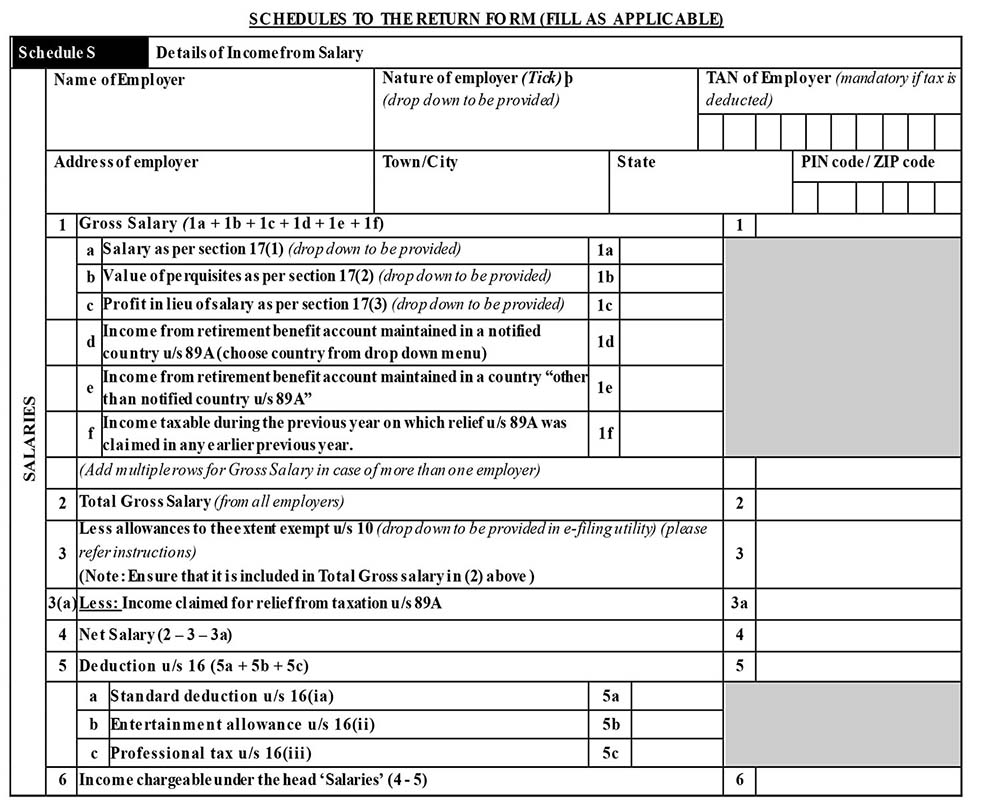

Schedule S: Details of Income from Salary

The information regarding Details of Income from Salary is enclosed with the following details of the taxpayer to furnish:

- Name of Employer

- Nature of Employer

- TAN of Employer

- Address of employer

- Town/City, State, PIN Code

- Gross Salary ((1a + 1b + 1c + 1d + 1e + 1f)

- Total Gross Salary

- Less allowances to the extent exempt u/s 10 (drop down to be provided in e-filing utility) (please refer instructions) (Note: Ensure that it is included in Total Gross salary in (2) above )

- Less: Income claimed for relief from taxation u/s 89A

- Net Salary (2 – 3 – 3a)

- Deduction u/s 16 (5a + 5b + 5c)

- Income chargeable under the head ‘Salaries’ (4 – 5)

Schedule HP: Details of Income from House Property

The information regarding Details of Income from House Property is enclosed with the following details of the taxpayer to furnish:

- Address of property 1

- Town/ City

- State

- PIN Code/ ZIP Code

- Is the property co-owned? (Yes/No)

- Your percentage of share in the property (%)

- Name of Co-owner(s)

- PAN/Aadhaar No. of Co-owner(s)

- Percentage Share in Property

- [Tick the applicable option]

- Let out

- Self-occupied

- Deemed let out

- Name(s) of Tenant(s) (if let out)

- PAN/ Aadhaar No. of Tenant(s)

- PAN/TAN/ Aadhaar No. of Tenant(s) (if TDS credit is claimed)

- a – Gross rent received or receivable or letable value

- b – The amount of rent which cannot be realized

- c – Tax paid to local authorities

- d – Total (1b + 1c)

- e – Annual value (1a – 1d)

- f – Annual value of the property owned (own percentage share x 1e)

- g – 30% of 1f

- h – Interest payable on borrowed capital

- i – Total (1g + 1h)

- j – Arrears/Unrealised rent received during the year less 30%

- k – Income from house property 1 (1f – 1i + 1j)

- Pass through income/loss if any *

- Income under the head “Income from House Property” (1k + 2)

Note:

- Please include the income of the specified persons referred to in Schedule SPI and Pass through income referred to in schedul e PTI while computing the income under this head

- Furnishing of PAN/ Aadhaar No. of tenant is mandatory, if tax is deducted under section 194 -IB

- Furnishing of TAN of tenant is mandatory, if tax is deducted under section 194 -I

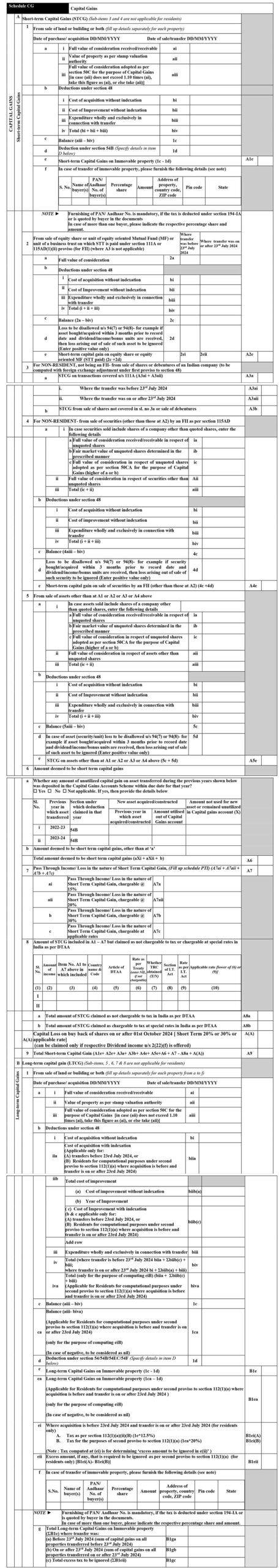

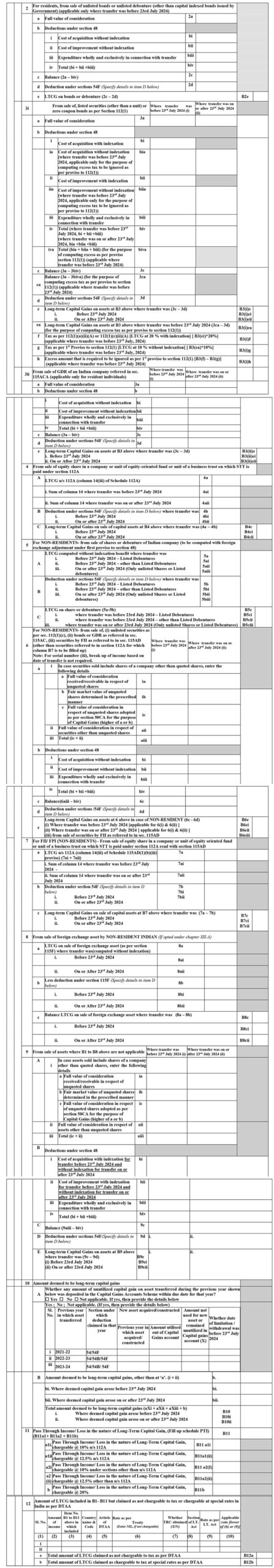

Schedule CG: Capital Gains

The information regarding Capital gains is enclosed with the following details of the taxpayer to furnish with:

A. Short-term Capital Gains (STCG)

1. From the sale of land or building or both

- a

- I Full value of the consideration received/receivable

- II Value of property as per stamp valuation authority

- III Full value of consideration adopted as per section 50C for the purpose of Capital Gains [in case (aii) does not exceed 1.10 times (ai), take this figure as (ai), or else take (aii)]

- b – Deductions under section 48

- I Cost of acquisition without indexation

- II Cost of Improvement without indexation

- III Expenditure wholly and exclusively in connection with transfer

- IV Total (bi + bii + biii)

- c – Balance (a-iii – b-iv)

- d – Deduction under section 54B (Specify details in item D below)

- e – Short-term Capital Gains on Immovable property (1c – 1d)

- f – In case of transfer of immovable property, please furnish the following details (see note)

Note: Furnishing of PAN/ Aadhaar No. is mandatory, if the tax is deducted under section 194-IA or is quoted by buyer in the documents In case of more than one buyer, please indicate the respective percentage share and amount.

2. From the sale of equity share or unit of an equity-oriented Mutual Fund (MF) or unit of a business trust on which STT is paid under section 111A or 115AD(1)(ii) proviso (for FII). (where A3 is not applicable) Data should be entered considering the specific date of 23rd July, 2024.

3. For NON-RESIDENT not being an FII- from sale of shares or debentures of an Indian company (to be computed with foreign exchange adjustment under first proviso to section 48)

- STCG on transactions covered u/s 111A (A3ai + A3aii)

- STCG from sale of shares not covered in sl. no 3a or sale of debentures

4. For NON-RESIDENT- from the sale of securities (other than those at A2) by an FII as per section 115AD

5. From the sale of assets other than at A1 or A2 or A3 or A4 above

6. Amount deemed to be short-term capital gains

7. Pass Through Income/ Loss in the nature of Short Term Capital Gain, (Fill up schedule PTI) (A7ai + A7aii + A7b + A7c)

8. Amount of STCG included in A1 – A7 but not chargeable to tax or chargeable at special rates in India as per DTAA

- a Total amount of STCG not chargeable to tax in India as per DTAA

- b Total amount of STCG chargeable to tax at special rates in India as per DTAA

9. Total Short-term Capital Gain (A1e+ A2e+ A3a+ A3b+ A4e+ A5e+A6 + A7 – A8a + A(A))

B. Long-term capital gain (LTCG) (Sub-items, 5, 6, 7 & 8 are not applicable for residents)

- From the sale of land or building or both

- From the sale of bonds or debentures

- From the sale of listed securities or zero-coupon bonds where proviso u/s 112 is applicable or from the sale of GDR referred to in section 115ACA

- From the sale of equity share in a company or unit of equity oriented fund or unit of a business trust on which STT is paid under section 112A

- For NON-RESIDENTS- from the sale of shares or debenture of an Indian company (to be computed with foreign exchange adjustment under first proviso to section 48)

- For NON-RESIDENTS- from sale of, (i) unlisted securities as per sec. 112(1)(c), (ii) bonds or GDR as referred in sec. 115AC, (iii) securities by FII as referred to in sec. 115AD (other than securities referred to in section 112A for which column B7 is to be filled up)

- For NON-RESIDENTS – From the sale of equity share in a company or unit of equity-oriented fund or unit of a business trust on which STT is paid under section 112A

- From the sale of foreign exchange assets by NRI

- From the sale of assets where B1 to B8 above are not applicable

- The amount deemed to be long-term capital gains

- Pass Through Income/ Loss in the nature of Long-Term Capital Gain, (Fill up schedule PTI) (B11a1+ B11a2 + B11b)

- Amount of LTCG included in B1- B11 but claimed as not chargeable to tax or chargeable at special rates in India as per DTAA

- a. Total amount of LTCG not chargeable to tax as per DTAA

- b Total amount of LTCG chargeable to tax at special rates as per DTAA

- Total long term capital gain chargeable under I.T. Act (B1e+B2e+B3ie+B3iie+B4c+B5c+B6e+B7c+B8c+B9e+B10 + B11 – B12a+B(A))

C1. Sum of Capital Gain Incomes (11ii +11iii + 11iv +11v + 11vi + 11vii + 11viii + 11ix +11x of table E below)

C2. Income from transfer of virtual digital assets (Col. 7 of Schedule VDA)

C3. Income chargeable under the head “CAPITAL GAINS” (C1 + C2)

D. Information about deduction claimed against Capital Gains

E. Set-off of current year capital losses with current year capital gains (excluding amounts included in A8a & B12a which is not chargeable under DTAA)

F. Information about accrual/receipt of capital gain

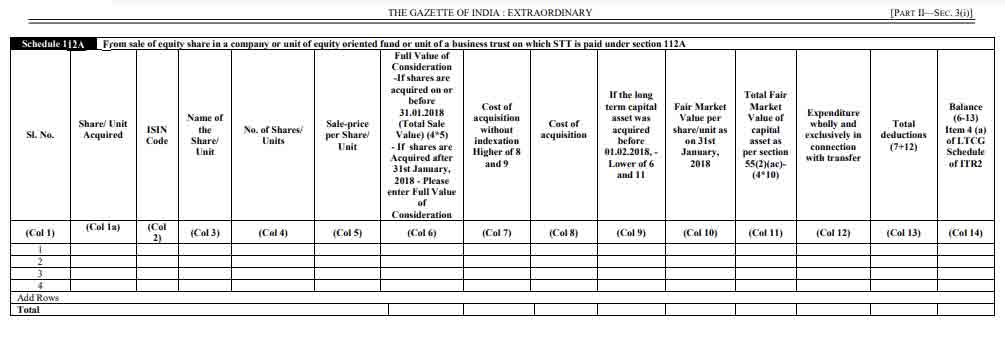

Schedule 112A:

From the sale of equity shares in a company or unit of an equity-oriented fund or unit of a business trust on which STT is paid under section 112A.

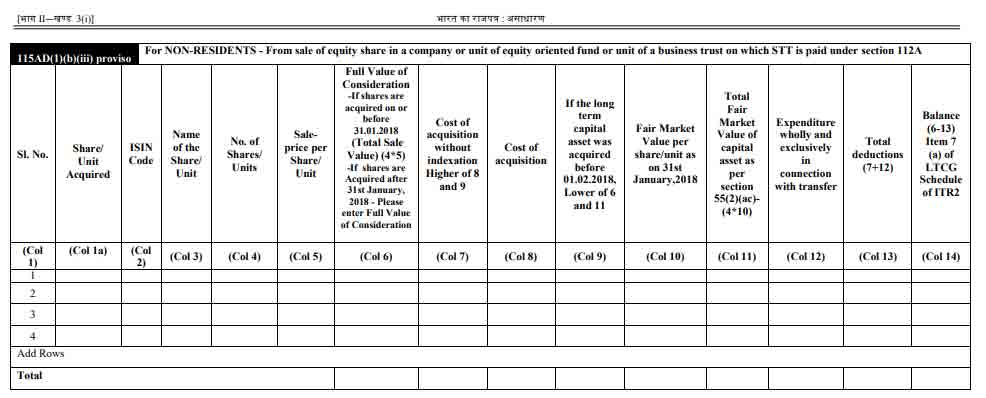

115AD(1)(b)(iii) proviso

For NON-RESIDENTS – From sale of equity share in a company or unit of equity-oriented fund or unit of a business trust on which STT is paid under section 112A.

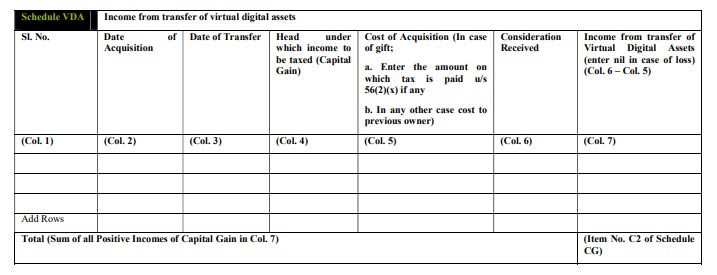

Schedule VDA: Income from transfer of virtual digital assets

- Sl. No

- Date of Acquisition

- Date of Transfer

- Head under which income to be taxed (Capital Gain)

- Cost of Acquisition (In case of gift;)

- a. Enter the amount on which tax is paid u/s 56(2)(x) if any

- b. In any other case cost to the previous owner

- Consideration Received

- Income from transfer of Virtual Digital Assets (enter nil in case of loss) (Col. 6 – Col. 5)

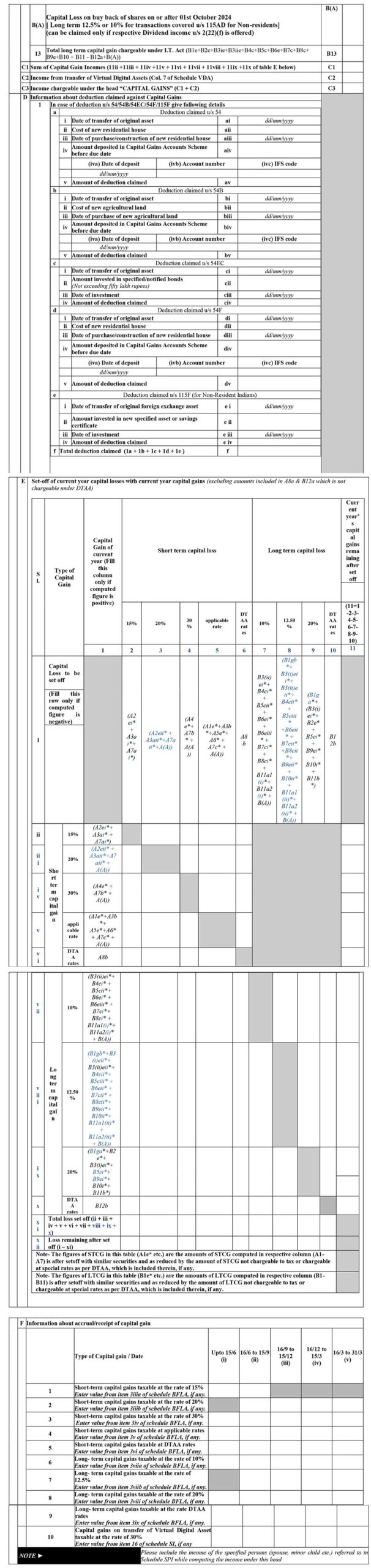

Schedule OS:

- Income from other sources: The information regarding income from other sources is enclosed:

- Gross income chargeable to tax at normal applicable rates (1a+ 1b+ 1c+ 1d + 1e)

- Income chargeable at special rates (2ai+2aii+ 2b+ 2c+ 2d + 2e +2f elements related to Sl. No.1)

- Deductions under section 57

- Amounts not deductible u/s 58

- Profits chargeable to tax u/s 59

- Income claimed for relief from taxation u/s 89A

- Net Income from other sources chargeable at normal applicable rates (1(after reducing income related to 6 DTAA portion) – 3 + 4 + 5-5a )

- Income from other sources (other than from owning race horses)

- Income from the activity of owning and maintaining race horses

- Income under the head “Income from other sources” (7 + 8e)

- Information about accrual/receipt of income from Other Sources

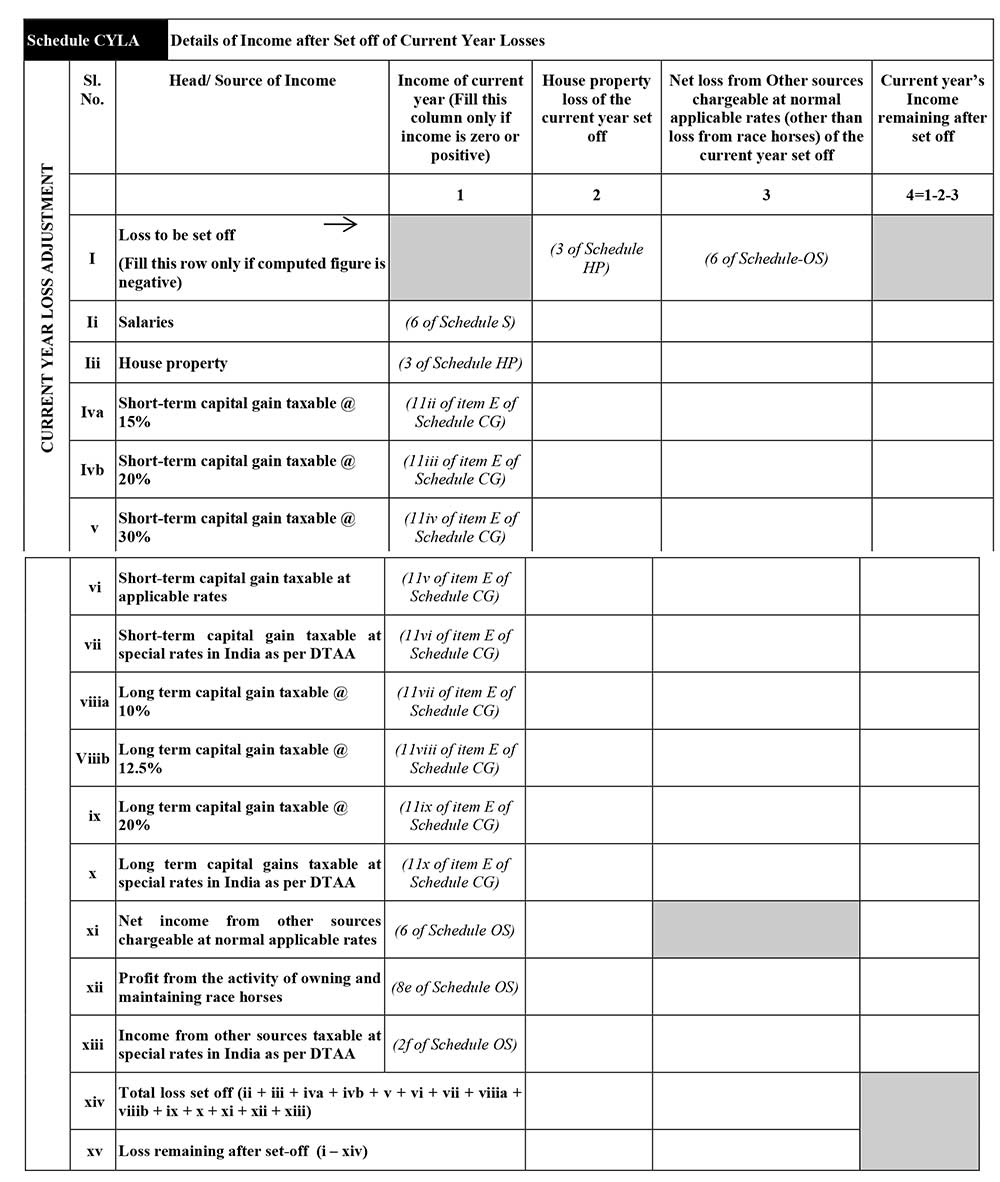

Schedule CYLA:

Details of Income after Set off of Current Year Losses

- Head/ Source of Income

- Income of the current year

- House property loss of the current year set off

- Net loss from Other sources chargeable at normal applicable rates (other than loss from race horses) of the current year set off

- Current year’s Income remaining after set off

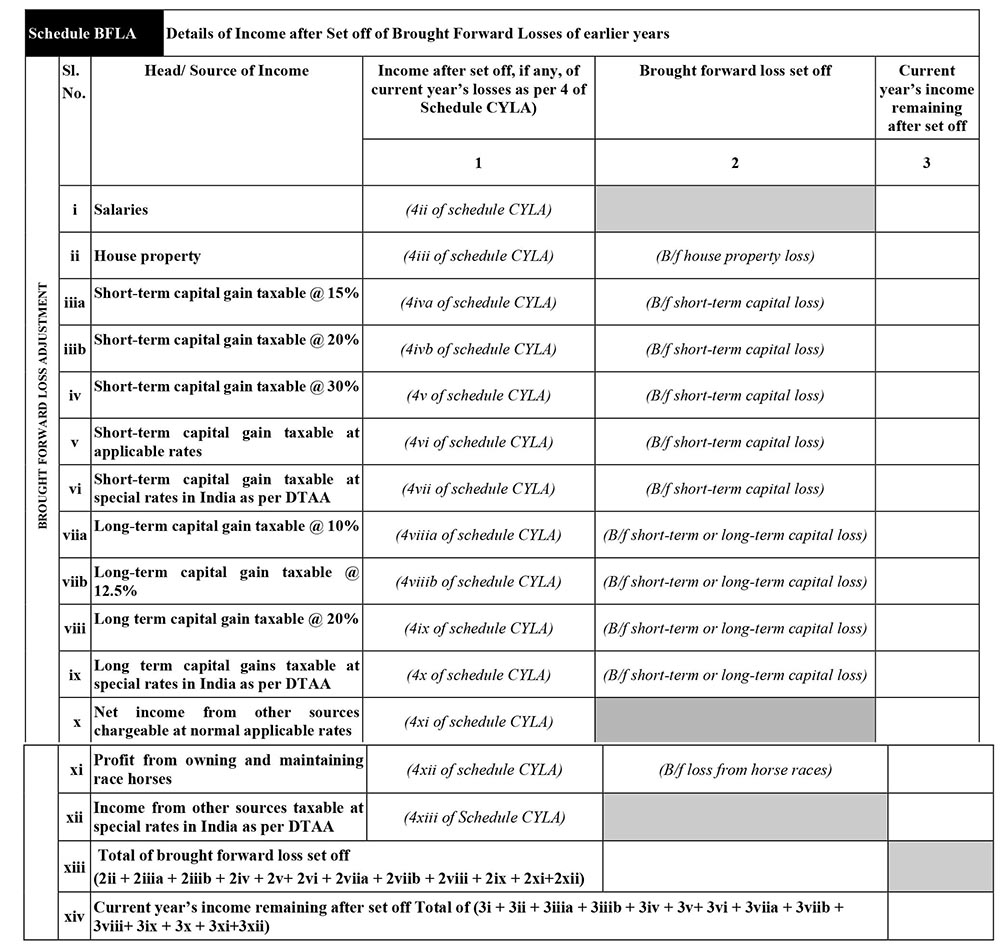

Schedule BFLA:

Details of Income after Set off of Brought Forward Losses of earlier years

- Head/ Source of Income

- Income after set off, if any, of current year’s losses as per 4 of Schedule CYLA)

- Brought forward loss set off

- Current year’s income remaining after set off

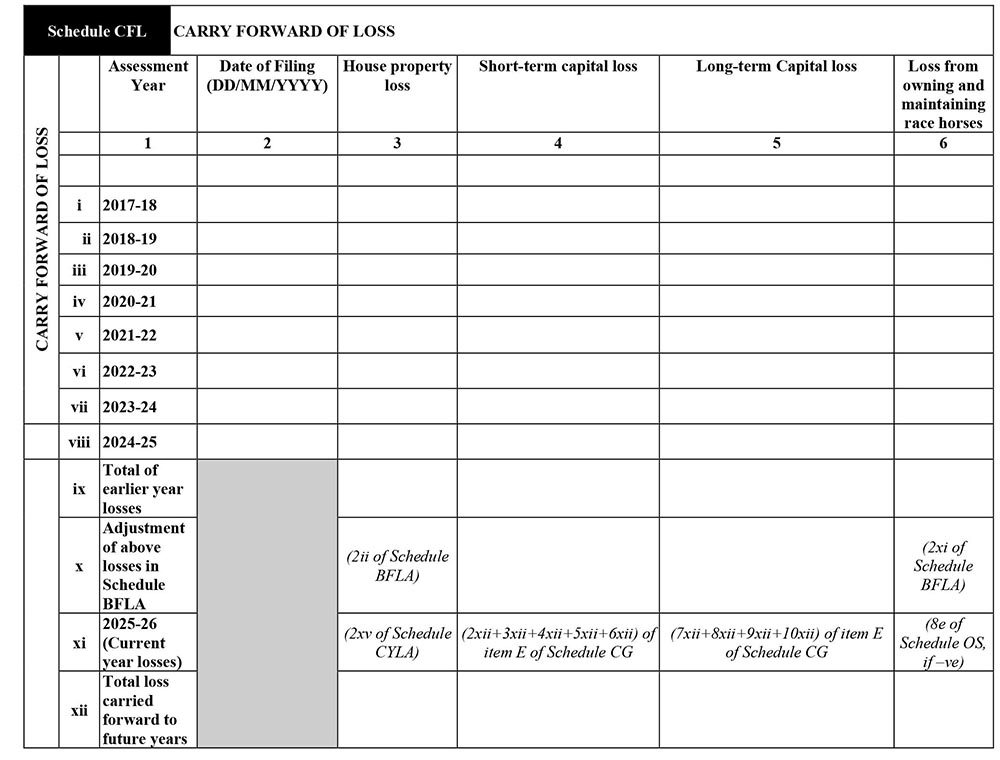

Schedule CFL: Carry Forward of Loss

- Assessment Year

- Date of Filing

- House property loss

- Short-term capital loss

- Long-term Capital loss

- Loss from owning and maintaining race horses

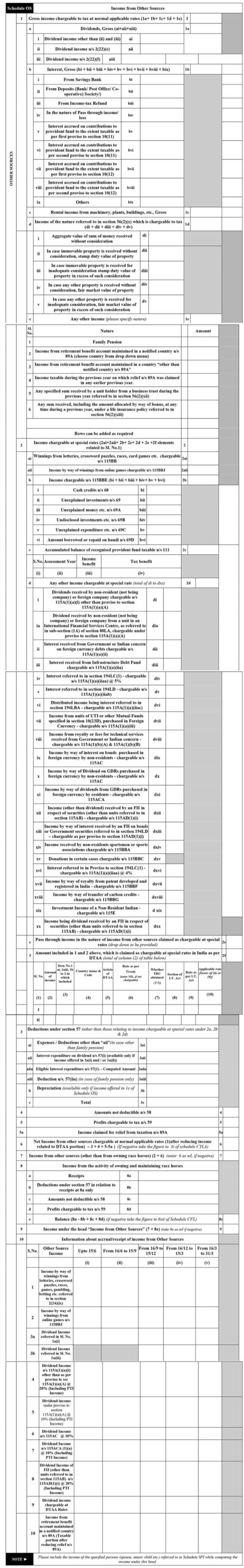

Schedule VI-A: Deductions under Chapter VI-A

Details under this title are enclosed with the following details of the taxpayer to furnish:

1. Part B- Deduction in respect of certain payments

2. Part C, CA and D- Deduction in respect of certain incomes/other deduction

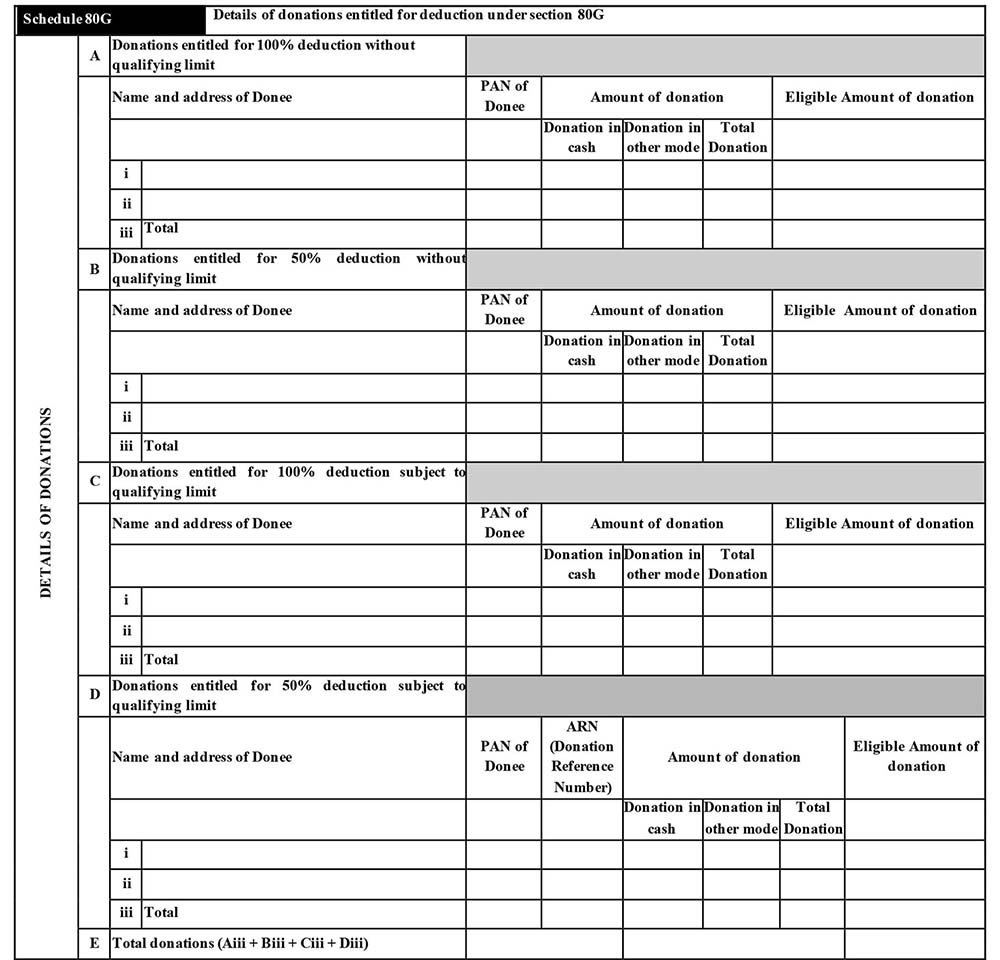

Schedule 80G: Details of donations entitled for deduction under section 80G

- Donations entitled for 100% deduction without qualifying limit

- Donations entitled for 50% deduction without qualifying limit

- Donations entitled for 100% deduction subject to qualifying limit

- Donations entitled for 50% deduction subject to qualifying limit

- Total donations

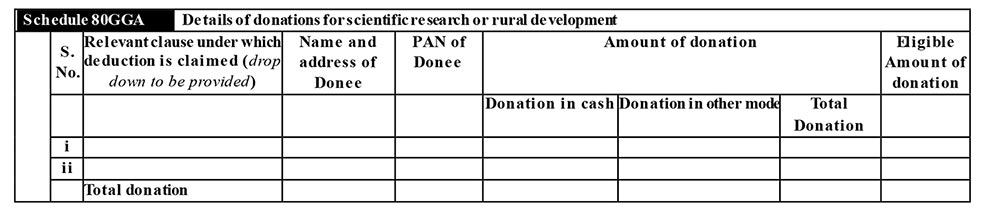

Schedule 80GGA: Details of donations for scientific research or rural development

- Relevant clause under which deduction is claimed

- Claimed Name and address of donee

- PAN of Donee

- Amount of donation

- Eligible Amount of donation

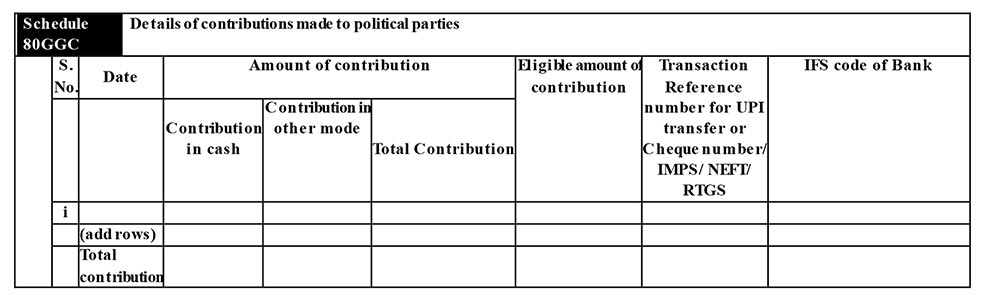

Schedule 80GGC: Details of contributions made to political parties.

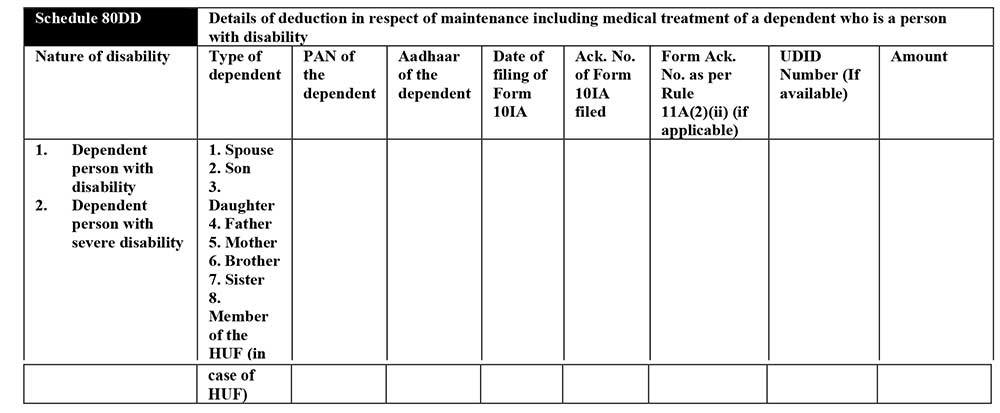

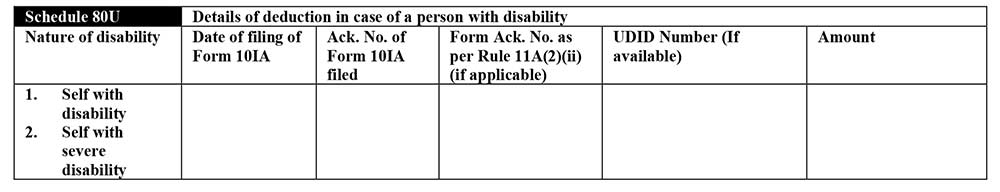

Schedule 80DD: Details of deduction in respect of maintenance including medical treatment of a dependent who is a person with disability.

Schedule 80U: Details of deduction in case of a person with disability

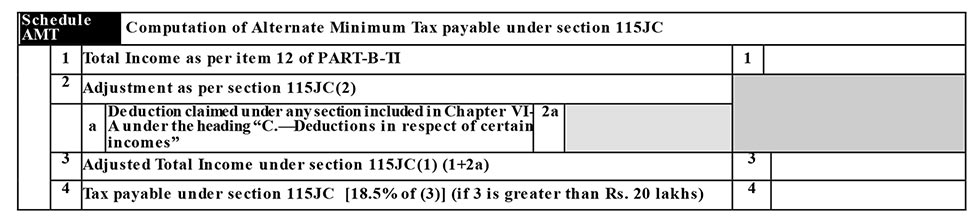

Schedule AMT: Computation of Alternate Minimum Tax payable under section 115JC

- Total Income as per item 12 of PART-B-TI

- Adjustment as per section 115JC(2)

- Adjusted Total Income under section 115JC(1) (1+2a)

- Tax payable under section 115JC [18.5% of (3)] (if 3 is greater than Rs. 20 lakhs)

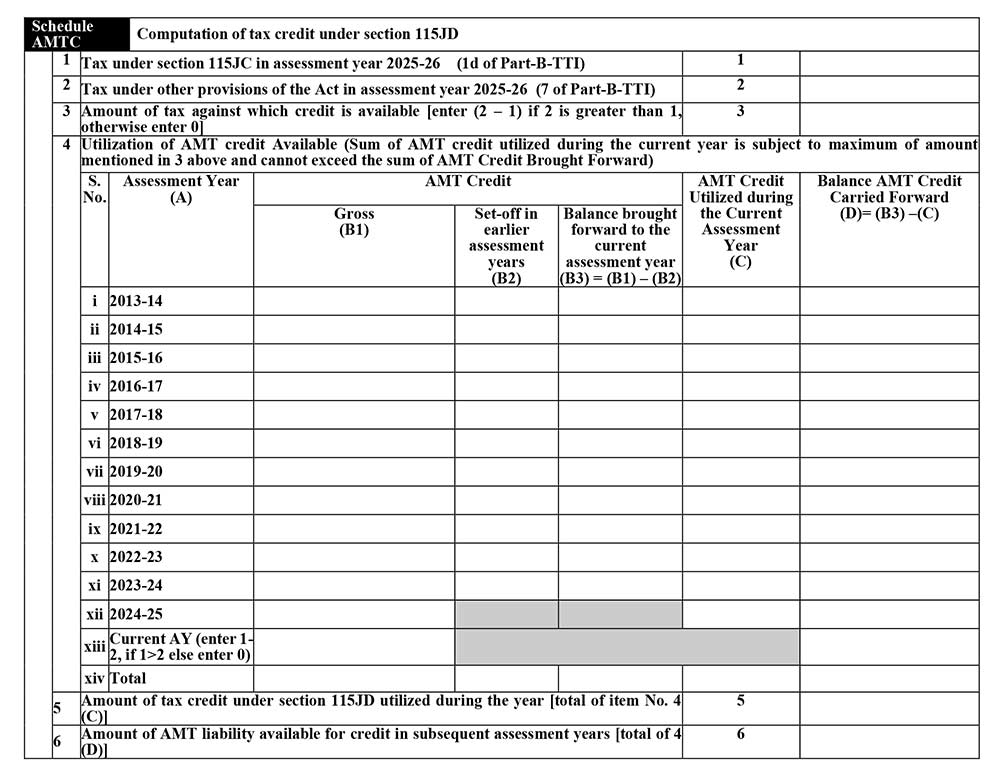

Schedule AMTC: Computation of tax credit under section 115JD

- The tax under section 115JC in the assessment year 2024-25 (1d of Part-B-TTI)

- The tax under other provisions of the Act in the assessment year 2024-25 (7 of Part-B-TTI)

- Amount of tax against which credit is available [enter (2 – 1) if 2 is greater than 1, otherwise enter 0]

- The utilisation of AMT credit Available

- Amount of tax credit under section 115JD utilised during the year [total of item No. 4 (C)]

- Amount of AMT liability available for credit in subsequent assessment years [total of 4 (D)]

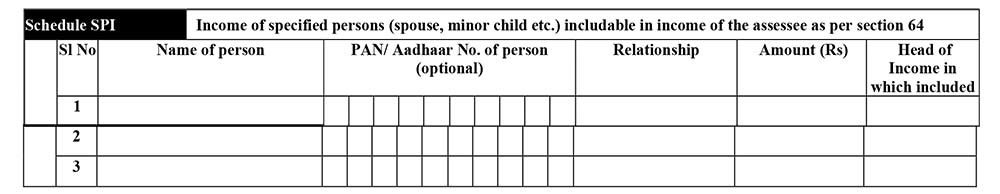

Schedule SPI: Income of specified persons (spouse, minor child etc.) includable in income of the assessee as per section 64

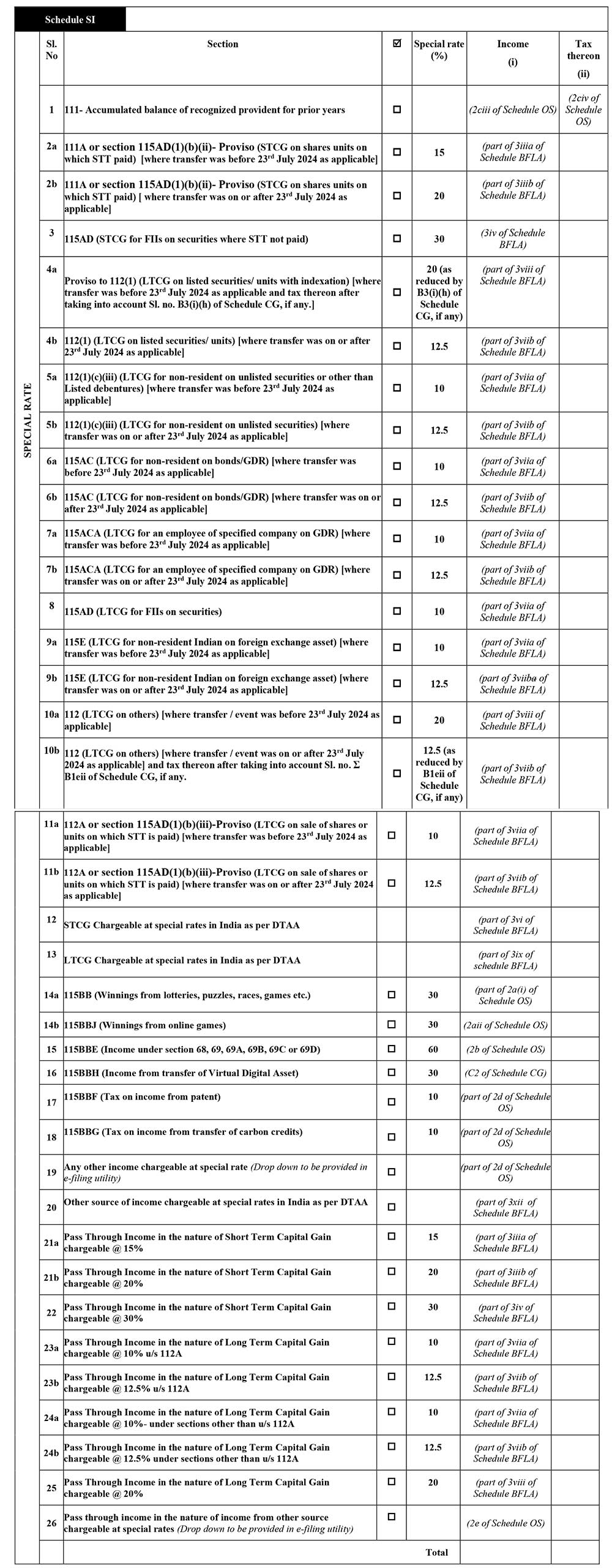

Schedule SI: Income chargeable to tax at special rates

1 111- Accumulated balance of recognised provident for prior years

2 111A or section 115AD(1)(b)(ii)- Proviso (STCG on shares units on which STT paid)

3 115AD (STCG for FIIs on securities where STT not paid)

4 112 proviso (LTCG on listed securities/ units without indexation)

5 112(1)(c)(iii) (LTCG for non-resident on unlisted securities)

6 115AC (LTCG for non-resident on bonds/GDR)

7 115ACA (LTCG for an employee of specified company on GDR)

8 115AD (LTCG for FIIs on securities)

9 115E (LTCG for non-resident Indian on specified asset)

10 112 (LTCG on others)

11 112A or section 115AD(1)(b)(iii)-Proviso (LTCG on sale of shares or units on which STT is paid) 10 (part of 3vi of schedule BFLA)

12 STCG Chargeable at special rates in India as per DTAA

13 LTCG Chargeable at special rates in India as per DTAA

14 115BB (Winnings from lotteries, puzzles, races, games etc.)

15 115BBE (Income under section 68, 69, 69A, 69B, 69C or 69D)

16 115BBF (Tax on income from patent)

17 115BBG (Tax on income from transfer of carbon credits)

18 Any other income chargeable at special rate (Drop down to be provided in efiling utility)

19 Other source of income chargeable at special rates in India as per DTAA

20 Pass Through Income in the nature of Short Term Capital Gain chargeable @ 15%

21 Pass Through Income in the nature of Short Term Capital Gain chargeable @ 30%

22 Pass Through Income in the nature of Long Term Capital Gain chargeable @ 10% u/s 112A

23 Pass Through Income in the nature of Long Term Capital Gain chargeable @ 10%- under sections other than u/s 112A

24 Pass Through Income in the nature of Long Term Capital Gain chargeable @ 20%

25 Pass through income in the nature of income from other source chargeable at special rates (Drop down to be provided in e-filing utility)

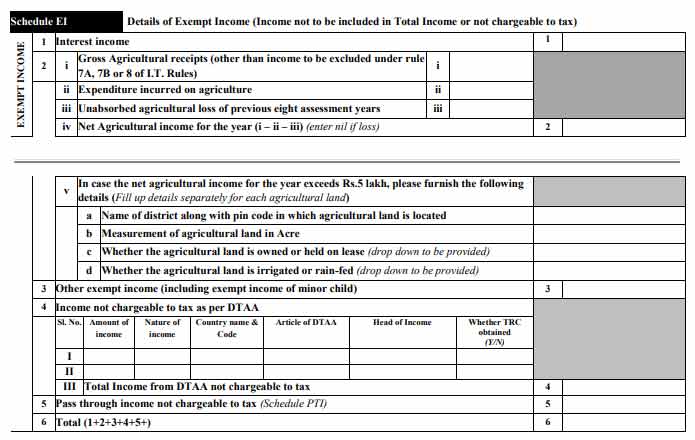

Schedule EI: Details of Exempt Income (Income not to be included in Total Income or not chargeable to tax)

- 1 Interest income

- 2

- I Gross Agricultural receipts (other than income to be excluded under rule 7A, 7B or 8 of I.T. Rules)

- II Expenditure incurred on agriculture ii

- III Unabsorbed agricultural loss of previous eight assessment years iii

- IV Net Agricultural income for the year (i – ii – iii) (enter nil if loss) 3

- V In case the net agricultural income for the year exceeds Rs.5 lakh, please furnish the following details (Fill up details separately for each agricultural land)

- a Name of the district along with pin code in which agricultural land is located

- b Measurement of agricultural land in Acre

- c Whether the agricultural land is owned or held on lease (drop down to be provided)

- d Whether the agricultural land is irrigated or rain-fed (drop down to be provided)

- 3 Other exempt income (including exempt income of minor child)

- 4 Income not chargeable to tax as per DTAA

- Sl. No. Amount of income

- Nature of income

- Country name & Code

- Article of DTAA

- Head of Income

- Whether TRC obtained

- (Y/N) I, II, III Total Income from DTAA not chargeable to tax

- 5 Pass through income not chargeable to tax (Schedule PTI)

- 6 Total (1+2+3+4+5+6)

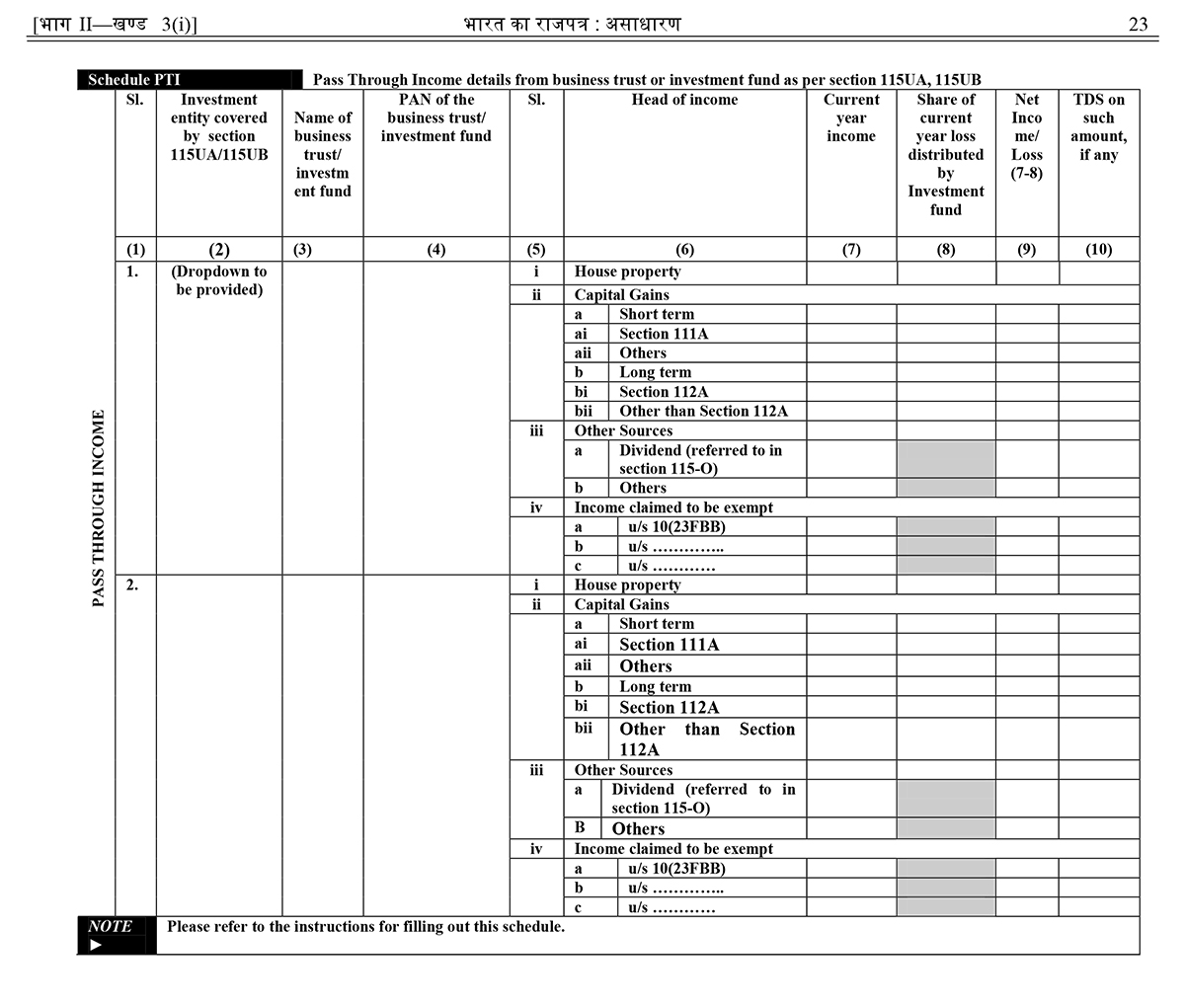

Schedule PTI: Pass Through Income details from business trust or investment fund as per section 115U, 115UA and 115UB

- Investment entity covered by section 115U/115UA/115UB

- Name of business trust/ investment fund

- PAN of the business trust/ investment fund

- SI.

- Current Year Income

- Share of current year loss distributed by Investment fund

- Net Income/Loss (7-8)

- TDS on such amount, if any

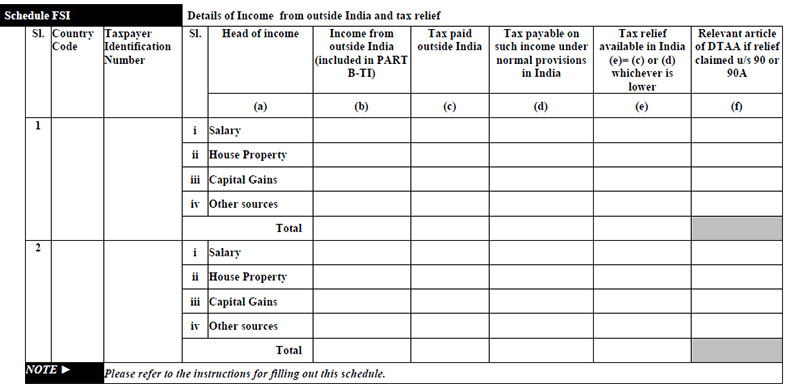

Schedule FSI: Details of Income from outside India and tax relief

- Country Code

- Taxpayer Identification Number

- Head of income

- Income from outside India (included in PART B-TI)

- Tax paid outside India

- Tax payable on such income under normal provisions in India

- Tax relief available in India (e)= (c) or (d) whichever is lower

- Relevant article of DTAA if relief claimed u/s 90 or 90A

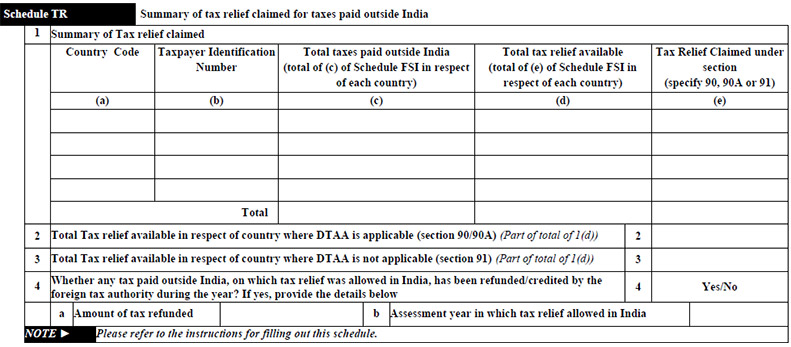

Schedule TR: Summary of tax relief claimed for taxes paid outside India

- 1 Summary of Tax relief claimed

- 2 Total Tax relief available in respect of country where DTAA is applicable (section 90/90A)

- 3 Total Tax relief available in respect of country where DTAA is not applicable (section 91)

- 4 Whether any tax paid outside India, on which tax relief was allowed in India, has been refunded/credited by the foreign tax authority during the year?

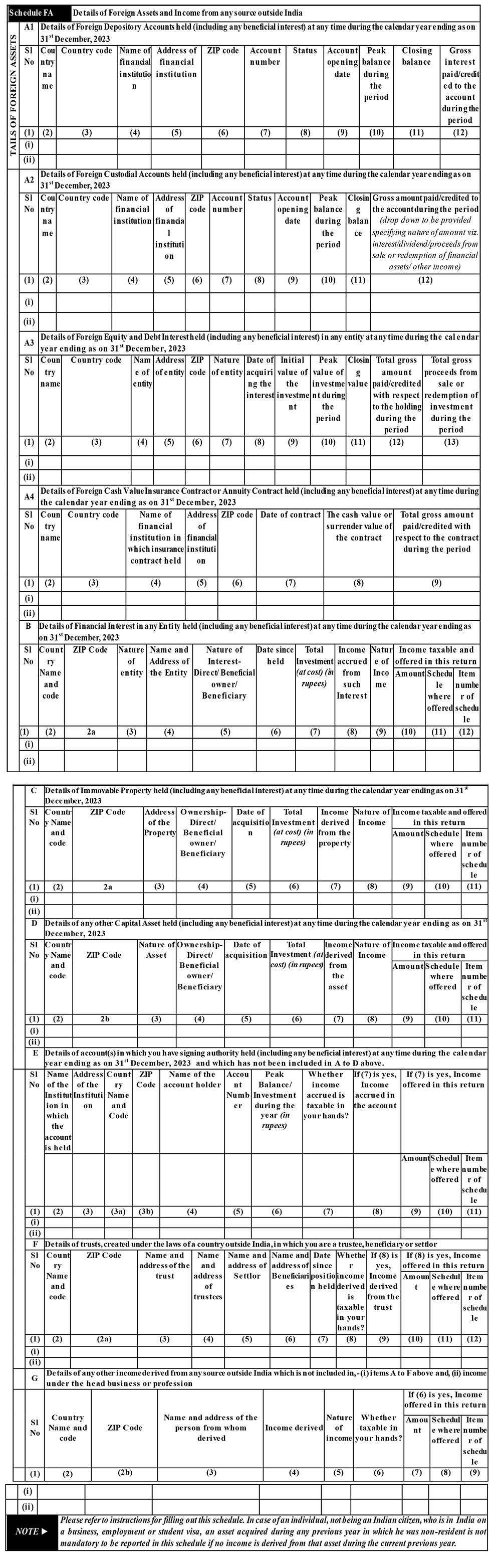

Schedule FA: Details of Foreign Assets and Income from any source outside India

- A1 Details of Foreign Depository Accounts held (including any beneficial interest) at any time during the calendar year ending as on 31st December 2024

- A2 Details of Foreign Custodial Accounts held (including any beneficial interest) at any time during the calendar year ending as on 31st December 2024

- A3 Details of Foreign Equity and Debt Interest held (including any beneficial interest) in any entity at any time during the calendar year ending as on 31st December 2024

- A4 Details of Foreign Cash Value Insurance Contract or Annuity Contract held (including any beneficial interest) at any time during the calendar year ending as on 31st December 2024

- B Details of Financial Interest in any Entity held (including any beneficial interest) at any time during the calendar year ending as on 31st December 2024

- C Details of Immovable Property held (including any beneficial interest) at any time during the calendar year ending as on 31st December, 2024

- D Details of any other Capital Asset held (including any beneficial interest) at any time during the calendar year ending as on 31st December, 2024

- E Details of account(s) in which you have signing authority held (including any beneficial interest) at any time during the calendar year ending as on 31st December, 2024 and which has not been included in A to D above

- F Details of trusts, created under the laws of a country outside India, in which you are a trustee, beneficiary or settlor

- G Details of any other income derived from any source outside India which is not included in (i) items A to F above and, (ii) income under the head business or profession

Note: Please refer to instructions for filling out this schedule. In case of an individual, not being an Indian citizen, who is in India on a business, employment or student visa, an asset acquired during any previous year in which he was non-resident is not mandatory to be reported in this schedule if no income is derived from that asset during the current previous year.

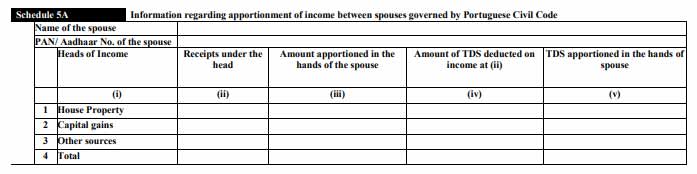

Schedule 5A: Information regarding apportionment of income between spouses governed by Portuguese Civil Code

- Name of the spouse

- PAN of the spouse

- Heads of Income

- Income received under the head

- Amount apportioned in the hands of the spouse

- Amount of TDS deducted on income at (ii)

- TDS apportioned in the hands of the spouse

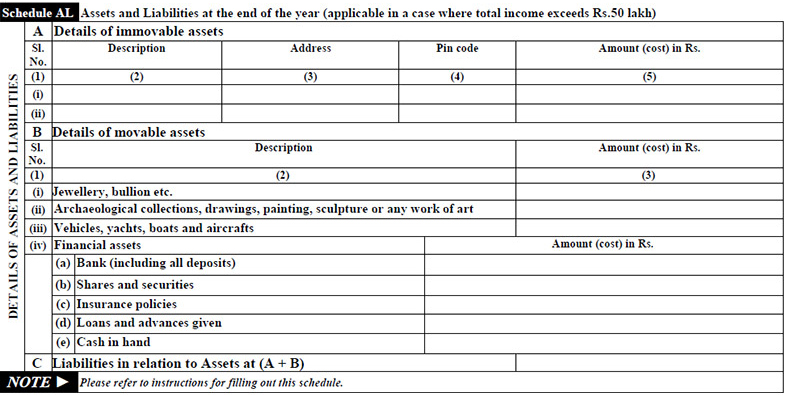

Schedule AL: Assets and Liabilities at the end of the year (applicable in a case where total income exceeds Rs. 1 Crore)

- A Details of immovable assets

- B Details of movable assets

- C Liabilities in relation to Assets at (A + B)

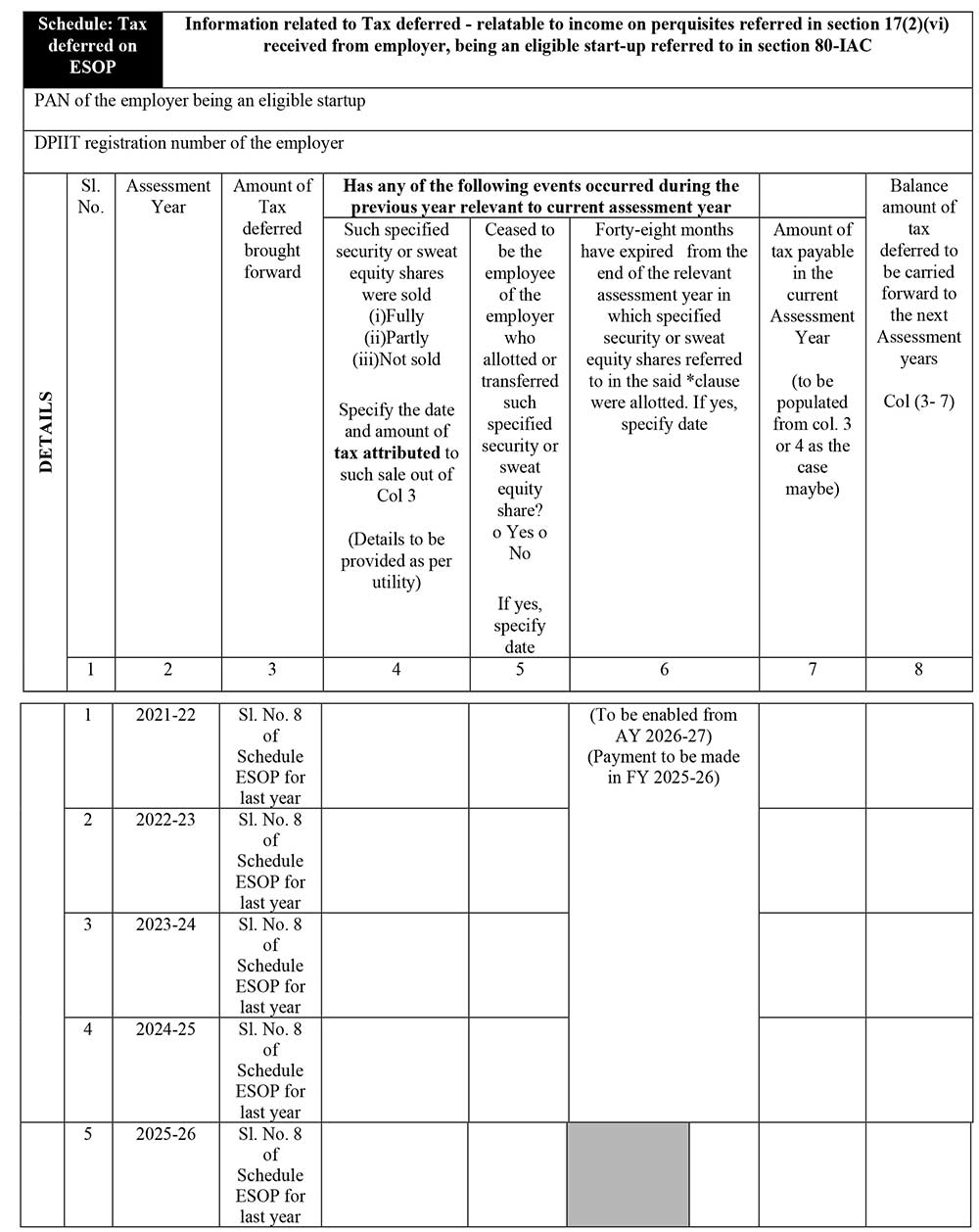

Schedule Tax-deferred on ESOP: Information related to Tax deferred – relatable to income on perquisites referred in section 17(2)(vi) received from

employer, being an eligible start-up referred to in section 80-IAC

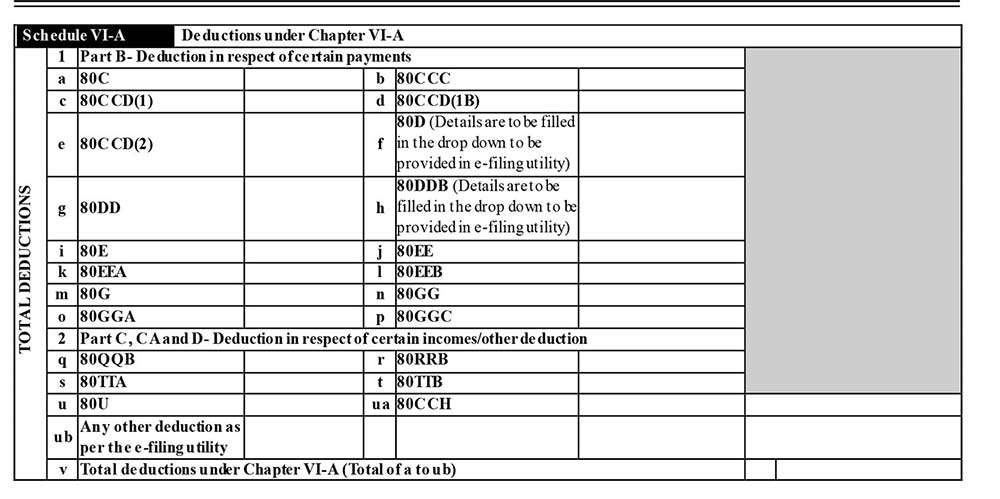

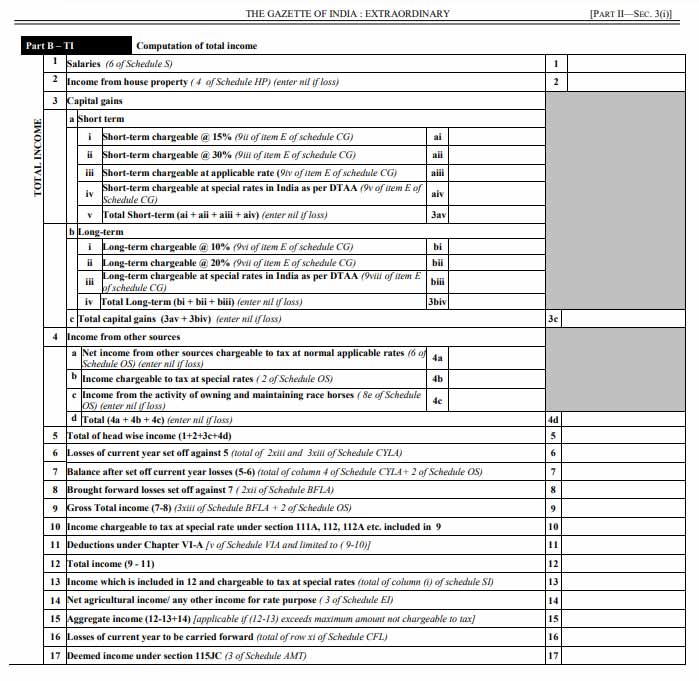

Part B-TI: Computation of Total Income

The information regarding total income is enclosed with the following details of the taxpayer to furnish with:

- Salaries

- Income from house property

- Capital gains

- Income from other sources

- Total of head wise income (1+2+3c+4d)

- Losses of current year set off against 5

- Balance after set off current year losses (5-6)

- Brought forward losses set off against 7

- Gross Total income (7-8)

- Income chargeable to tax at special rate under section 111A, 112, 112A etc. included in 9

- Deductions under Chapter VI-A

- Total income (9-11)

- Income which is included in 12 and chargeable to tax at special rates

- Net agricultural income/ any other income for rate purpose

- Aggregate income (12-13+14)

- Losses of the current year to be carried forward

- Deemed income under section 115JC

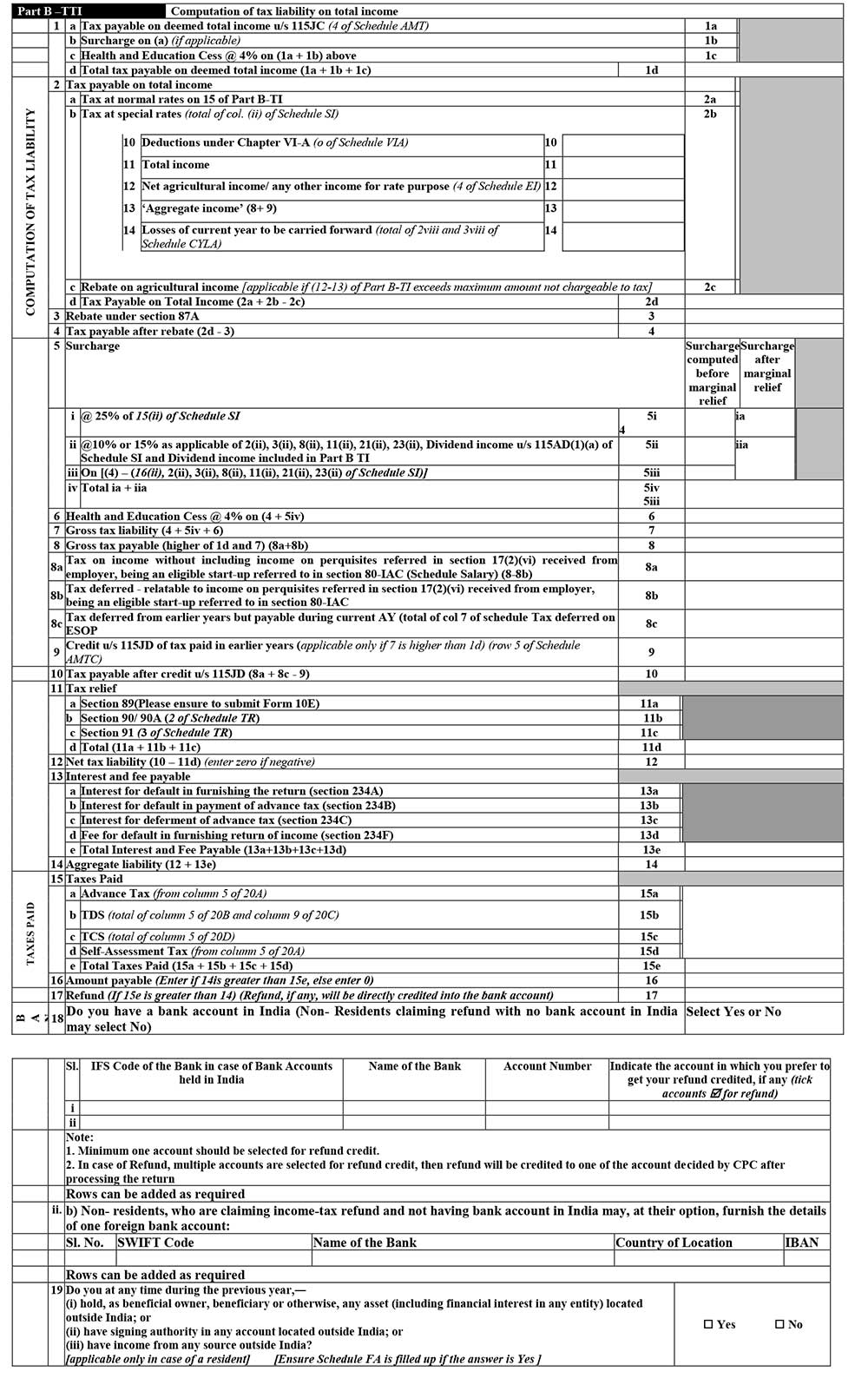

Part B-TTI: Computation of tax liability on total income

The information regarding the Computation of tax liability on total income is enclosed with the following details of the taxpayer to furnish with:

- Tax payable on deemed total income u/s 115JC

- Tax payable on total income

- Rebate under section 87A

- Tax payable after rebate (2d-3)

- Surcharge

- Health and Education Cess @ 4% on (4 + 5iv)

- Gross tax liability (4 + 5iv + 6)

- Gross tax payable (higher of 1d and 7)

- a) Tax on income without including income on perquisites referred in section 17(2)(vi) received from employer, being an eligible start-up referred to in section 80-IAC ( Schedule Salary)

- b) Tax deferred – relatable to income on perquisites referred in section 17(2)(vi) received from employer, being an eligible start-up referred to in section 80-IAC

- c) Tax deferred from earlier years but payable during current AY (total of col 7 of schedule Tax deferred on ESOP

- Credit u/s 115JD of tax paid in earlier years

- Tax payable after credit u/s 115JD (8a +8c – 9)

- Tax relief

- Net tax liability (10 – 11d)

- Interest and fee payable

- Aggregate liability (12 + 13e)

- Taxes Paid

- Amount payable (Enter if 14is greater than 15e, else enter 0)

- Refund

- Details of all Bank Accounts held in India at any time during the previous year

- Do you at any time during the previous year

- (i) hold, as beneficial owner, beneficiary or otherwise, any asset (including financial interest in any entity) located outside India; or

- (ii) have signing authority in any account located outside India; or

- (iii) have income from any source outside India?

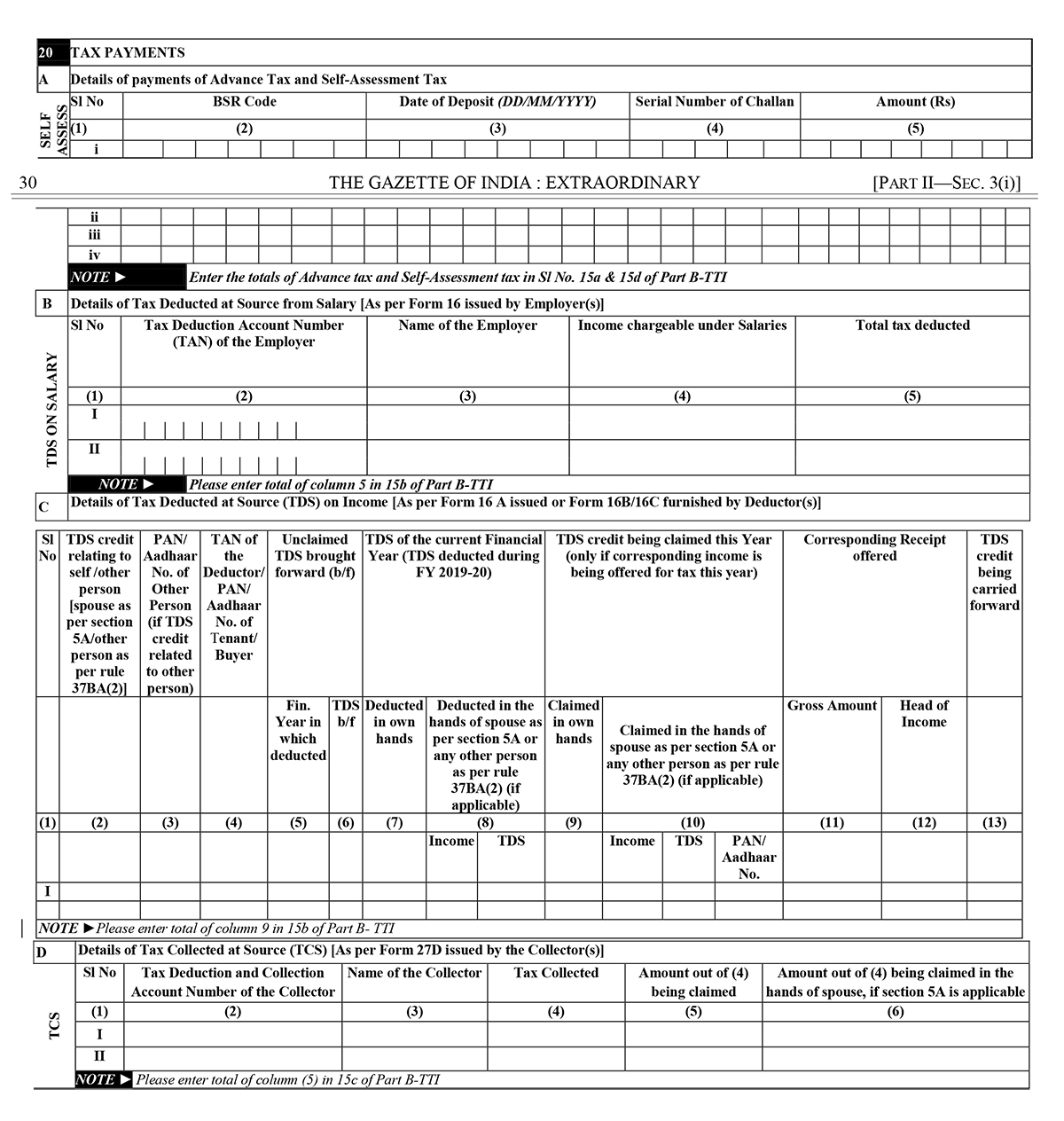

20 Tax Payments

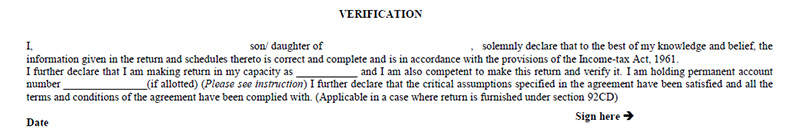

Verification: There will be verification at the end of all the General, Part B TI and Part B TTI ensuring that the details given are factually correct and self-attested by the taxpayer.

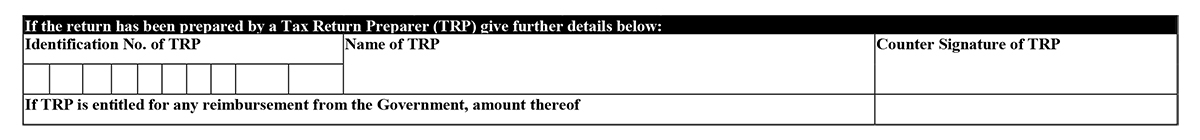

If the return has been prepared by a Tax Return Preparer (TRP) give further details below:

- Identification No. of TRP

- Name of TRP

- Counter Signature of TRP

If TRP is entitled for any reimbursement from the Government, amount thereof 21

A Details of payments of Advance Tax and Self-Assessment Tax

B Details of Tax Deducted at Source from Salary [As per Form 16 issued by Employer(s)]

Income Tax Return 2 Form Filing Mode

An ITR-2 form can be furnished either in online or offline mode. In online mode, either XML needs to be uploaded or client can directly login to income tax portal and select the submission mode as “prepare and submit online”. In the case of online filing, some data can be imported from the latest ITR or form 26AS. Super senior citizens (Age of 80 years or more) are exempted from the online filing of ITR. Offline here means to furnish the return form in paper format.

Online:

- While furnishing ITR-2 online, feed the details and e-verify return using EVC via Bank Account/Net Banking/Demat Account/Aadhar OTP or

- 2. Feed the details using electronic medium and send a physical copy of ITR V to Centralized Processing Centre (CPC), Bengaluru through speed post or normal post. When you furnish the ITR-2 return form using electronic medium, the receipt will be seen in the inbox of the registered email id. It can also be downloaded from the official income tax website manually. After downloading the acknowledgement, you need to sign the form and then send CPC office, Bangalore before completing 120 days counting from the e-filing date. On the other side, it is not required to send the ITR V to the CPC if EVC/OTP option is used

Offline:

- If the age of the person is 80 or more years during the respective tax period or in the previous year, he/she can opt for offline return filing.

ITR 2 Online User Manual Guide

To declare the RSUs under Schedule FA – Section A3, what should we consider the peak value of an investment? Do we need to consider the peak value of the share during the accounting period to arrive at the peak value of an investment? If yes, this is just notional income, only paper. Or the total value of the investment made by you (means initial investment + additional investment during the accounting period). Please clarify. Thanks in advance

You have to consider the peak value of the share during the accounting period to arrive at the peak value of an investment.

While declaring espp in the Schedule FA, what should I consider as the peak value of the investment , closing balance- whether closing balance for the whole year or till now, what should I consider for the total gross amount paid /credited with respect to holding during the period- please clarify. Thanks in Advance

For details of unlisted shares, information is to be given for the number of shares purchased during the year and date of purchase. As there is no purchase during the year, I filled 0 in both the columns but it is giving an error message for date of purchase and asking for a date to be mentioned in dd/mm/yyyy format. As there is no such date in absence of any purchase, how I should fill this column.

Leave the columns blank instead of entering 0.

Sir, I am a pensioner and used to file my income tax ITR 1 but during FY2018-19 I sold some shares incurring a loss. I am told in ITR 1 I cannot show losses due to the sale of shares. Request advise how do I proceed. Thanks

Before saving ITR 2 excel XML file, XML summary is displayed of all the schedules except Part A General, OS and Part B – TI – TTI with the number of entries made and the total amount against each schedule. An amount has been entered as short term loss in CFL schedule for the loss made in 2016-17 and since there is no ST capital gain last FY, set-off is not done.

The XML summary mentions FILLED for no. of entries and NA for the amount against CFL schedule. Whereas for EI schedule, both FILLED and the actual amount are mentioned in the XML summary, Kindly advise if the data as being shown against CFL schedule in the XML summary is okay and the XML file can be saved for uploading.

The XML summary shows a set of selected schedules, except Part A General, OS and Part B TI – TTI, with the corresponding number of entries made and the total amount. For CFL, it mentions FILLED but instead of the amount, it mentions NA. Whereas for EI, both FILLED and the amount are mentioned. Is this okay or corrections needed?

The ITR form is ITR 2.

1. Can I adjust short term capital loss in share transaction with short term capital gains from liquid MF? If so, in which schedule of ITR2 it could be shown?

2. Is dividend from liquid MF taxable?

I am a resident- Indian. I am having income from Salary and capital gain from equity and other sources like FD intt. I filled up ITR 2 all scheduled except HP and AMTC, PTI, FSI, TR-FA, SCH5a, AL. After completion of all, calculate tax button is pressed and no tax liability had come and whatever advances tax had been paid, it’s came as refund as total taxable income ( above 6 L) shown as deemed income under 115JC in PartB-TI-TTI schedule. How it’s happening? It is showing in AMT scheduled automatically.

Yes, the total income automatically gets posted in SCH. AMT. There is no issue in that since no liability will be calculated as long as AMT does not apply.

After generating XML file for ITR2 and further after saving that, when I upload the XML file and submit then one message is coming ” No file is selected” and on top another one message is showing that is “The XML Schema is invalid. Please upload the XML in the correct Schema. At Line Number 303: Invalid content was found starting with element ‘ITRForm:DeductionUs54F’. One of ‘(http:/incometaxindiaefilling.gov.in/master”. ExemptionOrDednUs54)” is expected. This message is showing. So I couldn’t submit the return. Please give useful tips so that I can submit the return. I am having CG loss in both.

Thank you, Sir

if you are filing the return through genius software, then please make sure that your software is updated.

I filled all details in excel format in itr2. Validate all required sheets and calculate tax using calculate tax button. Then generate XML button is pressed. Then a summary of sheets is appearing on the screen and save XML button is visible on the screen. After pressing save XML button file is saved as XML format. Then I am selecting the XML file to browse and submit the same. This time the above-said message is coming. Please guide me how I cam submit the itr2 return.

Thank you

Same thing happening with me. But how can tax liability be zero?

Sir, I am filing ITR2, my STCG for FY 8200( PROFIT= 20000, LOSS- 11800). During filing, we need to submit the quarterly STCG details (under table F(1) of CG schedule).

I made a profit of 20000 in 1st 3 quarters and loss of 11800 in quarter4 so STCG for FY is 8200 only. But table F(1) is not accepting negative values so my profit becomes 20000 for FY. Please suggest me to fill the form

Thank you, sir,

You will have to show the net figures in table F(1) after adjusting the losses.

I read on the internet that if capital gains covered by Sec 10(38) are only there then we can submit in ‘others’ tab in other sources of income.

I have some capital gains from the redemption of equity mutual funds, capital gain from one fixed maturity plan and some capital gain from a liquid fund. Stt was charged on all but the fmp at the time of redemption or maturity.

Can the return be filed in itr1

If you have income under the head Capital Gain, you can’t file ITR 1

Offline form is fine. What about Genius software filing procedure step by step would be advisable. Especially Equity oriented units LTCG is bit tough while filling in Genius software. It asks scrip wise details where as IT dept states it is not required scrip wise. Kindly look into it.

Kindly update the software. Now both the options have been provided in Securities LTCG i.e. scrip wise and without scrip wise.

Which ITR I need to file? I am working in a PSU also I have 4k profit in positional trading of equity shares.

It depends whether you show your share trading as capital gain or business. In the first case, ITR-2 will be applicable while in latter case, ITR-3/4.

Its a capital gain so ITR 2 it is…thanks a lot for your time!

welcome

ITR 2 : 22C(2) – TDS3. Details of Tax Deducted at Source (TDS) on Income [As per Form 16B/16C issued by Dedicator

I have purchased a flat which is above 50L. Seller asked to pay me 1% TDS 26QB and provided 16 B which I did. Now in this ITR-2, 22C(2)

1. what shall I fill. (Self or other person)

2. Column 9 will be the TDS value?

3. Column 11 Gross amount will be value for witch TDS was paid?

4. Column 12 Head of Income will be (Income from house prop or income from Cap. Gains or income for other source or Exempt income??

Please note that this schedule is required to be filled by the person claiming TDS i.e. the seller. So being a buyer, you do not need to fill any of these details.

Sir,

I’m a salaried person and have received small commission/brokerage of Rs 8000 in fy 18-19. Which form should I use and where should I put this figure.

Thanks & Regards

It depends whether you treat your commission income as a business or as income from other sources. In the first case, ITR-3 will be applicable while in later case ITR-1.

I want to club House property income of my spouse in my returns. It is clear how to add this in schedule SPI of ITR 2. But in schedule HP, how do I include clubbed income?

Show the income in relevant head i.e. house property along with disclosure in schedule SPI.

Thank you for the response. I added a row in schedule SPI and selected head of income as House Property. My confusion is about how to include this income in schedule HP. Should it be added in item 1a “Gross rent received or receivable or let able” in HP?

For FY 2018-19, I sold a property that was jointly owned by my father. If I sold the property at Rs. 50L and had purchased at Rs. 46L, should I put “Full value of the consideration received” as Rs. 25L and “Cost of acquisition” as 23L for each of us, assuming we have 50% share each; or, should it be 50L and 46L for these 2 fields for both of us?

Please suggest.

Individual share has to be entered in the relevant fields i.e. 50-50% each in both ITRs.

Thank you! In that case, what should be entered for “Value of the property as per stamp valuation authority” – will it be the full value of the property or 50%? Asking this because the “Full value of consideration adopted as per Section 50C for the purpose of Capital Gains” has to take the higher of “Value of the property as per stamp valuation authority” and “Full value of the consideration received”, as I know it.

Thanks in advance! I am struggling to get an answer to this query.

Again as per our understanding, 50% value should be in filled in “value of the property as per stamp valuation authority”

In this scenario of selling joint property, can you please advise on what is the purchase amount for the buyer that should be provided in Sec.B.1.f (Schedule CG). Here, it asks us to provide buyer details (name, address, PAN, Aadhaar) and buyer purchase amount and percentage share. In this example, should we provide the buyer purchase amount as 25L or 50L? Note: In Form 26AS of each of the sellers, the property value sold is mentioned as 50L.

PLEASE SPECIFY THE QUERY

I have submitted form ITR 2 for my salary income and capital gain income from the sale of flat but in ITR V e verification copy capital gains details are not appearing, what may be the reason?

It might be possible that your overall capital gain income is a negative i.e. loss. You are advised to check your return form schedule CG to verify the same.

Thanks for the prompt reply. There is positive capital gain income & no negative capital gain income. when the capital gain computation is not appearing in ITRV, does it mean that my ITR2 is not properly filed.please advise me how to view schedule CG form? Thanks.

Hi, I am an NRI. I have to file ITR 2. My resident status is of Bahrain, where has Nil Income Tax. I have to provide salary earned in Bahrain under exempt income and foreign income. But as per my understanding, NRI will not cover under DTAA. Is it correct? Then where should we show a foreign salary in ITR 2

If any tax is paid in a foreign country, you will have to show the income in the relevant head along with Schedule FSI. Otherwise, show the income directly under the exempt income schedule.

I have exempt LTCG and taxable STCG. Is it compulsory to fill in the new Schedule 112A?

There is no concept of LTCG exempt from AY 2019-20. It is mandatory to fill details in Sch 112A if the conditions of this section are satisfied.

In my case, I have 25000 LTCG from shares. But up to 1 Lakh is not taxable. In that case, what should I do?

Could you kindly advise where should I fill the details of the Gratuity amount received? In the Exempt Income page on the excel utility file, I’m unable to find Sec 10(10) to fill the gratuity amount received.

Gratuity amount should be shown under Schedule Salary under column Salary as per section 17(1) and exempt amount to be shown under column ” less: Allowances exempt u/s 10″ in other section columns.

hi, I want to file ITR 2 for the first time. I want to know whether tax paid particulars are populated straightaway or I have to type those particulars. And how do I make any payment if there is a short, whether the window will automatically open? thanks

If the details of taxes paid are available in 26AS, then that will be auto-populated in prefilled generated XML and for the short tax payment, you need to enter the entry manually.

In the ITR-2 for excel utility under LTCG section 4a

i A. Cost of acquisition

i B. if the long term capital assets acquired before 01.02.2018 Lower of B1 & B2

Is it correct? Please clarify sir.

As per new changes in LTCG calculation, and insertion of new section 112A and grandfathering provision, details of FMV should need to be entered for arriving at cost of acquisition.

Hello Sir,

In ITR-2 of AY 2020-21 under Schedule 112A it makes “FMV as on 31/1/18” field mandatory & computes LTCG on assets bought after 1/2/18 based on this FMV.

How is FMV as on 31/1/18 relevant while computing LTCG for any asset bought post 1/2/18? Shouldn’t this FMV field be not-applicable in such a case? Isn’t this a bug? OR is there a different Schedule/section in ITR-2 to declare LTCG from assets bought after 1/2/2018?

Please clarify.

If assets purchased after 31st Jan 2018, FMV field be not-applicable

I am residing in the United States and need to fill ITR 2. What will be my Jurisdiction Residency? Is it a Country name, state name or residential address or something else? How to find this information?

Jurisdiction is the State or district of the place of residence.

Hello, I am getting an error on ITR 2 Jurisdiction Residency. I am NRI and filled 2-UNITED STATES OF AMERICA and my Passport no for TIN. Sheet validation shows ok but when I submit XML it shows “at line number 49: the value “2-united states of America” of element ‘ITRform: Jurisdiction Residency is not valid” I have entered different place names still the same error.. can anyone suggest?

The department has now given a dropdown for the jurisdiction of residence in its return filing utility. So select the jurisdiction from dropdown only, do not write it manually.

Dear Sir,

My daughter is staying in the USA and she has only fixed deposit in India. for claiming refund itr-2 to be filled. in address details is she to mention US address or Indian address. for her salary in the US, she pays taxes there. are they to be mentioned in ITR-2 also. please clarify.

Sir, I am a salaried person and used to file my IT returns under ITR 1. During FY 2017-18, I sold my flat. There was a long term capital loss and I have filed my IT returns in ITR 2. Kindly clarify, whether I have to file ITR 1 or ITR 2 for FY 2018-19. I have only salary income for the year.

Thanks.

ITR 1

Dear Sir

Please help me. I am a pensioner and am filling up the offline XML ITR-2 for uploading. I have the Form-16 from my ex-employer as also Form-16A from Banks 2 that has deducted tax from me on account of the interest income from deposits. In the ITR-2 TDS sheet, filling up Table 22B is no problem (TDS deducted by my employer). However, while filling table 22C (1), there are always errors whatever way I fill them. There is no unclaimed dividend brought forward and all the TDS are in my name and for the current year only.

Can you please guide which of the columns in the said Table should be filled by me and how not to get those error messages. Some of these error messages are – “Total in Col 9 cannot be more than total in Col 6 or Col 7, as the case may be”, “Unclaimed TDS brought forward” and details of “TDS of current FY” should be provided in different rows”, “Enter the FY in which TDS was deducted at Sr. No. 1”, etc.

Thanks in advance.

“Dividend” may please be read as TDS and “Banks 2” may be read as 2 banks

Have the same query as above. Do you send a reply on mail? If so pl send me a detailed reply.

Thanks

SK Goel

please let me know if u got solution to this

Thank you so much for your detail steps. I was able to follow your step by step guide and able to file my returns. Appreciate your time in putting it together.

Sir,

ITR-2 online version is not available. My question is whether will it be available after some days or we have to prepare and submit the XML file. Please clarify.

Thanks.

ITR-2 has to filed via XML only.

Sir, I am a resident senior Indian and filing ITR2 since I have a small Capital Gain from equity shares. I also earn a pension, house rent besides interest income. After completing all ITR2 schedules, PartB T-1 shows my net taxable income at Rs490000, which should be taxed say app at INR 9500. Instead, it leads me to Schedule 115jc (AMT), min alternate tax and arrives at Zero tax. Please guide.

Income will be reflected in Schedule AMT since the amount is auto-filled from Part-B BTI. but tax will be calculated only if AMT is applicable.

The option to fill and submit ITR 2 online is currently not available on the e-filing site, it cannot obviously be done now. It asks to upload XML file? However, my query is whether we can expect that option to become available anytime before the last date of filing returns, viz. 31.7.2019? And was this option available in the past? How we can prepare the XML file and upload it?

THANKS

ITR 2 cannot be filed online like ITR 1 or ITR 4. You have to go to Incometaxindia site, you can upload this XML file to file your IT return.

Hope this will resolve your problem.

Sir

I have two queries:

1. I have sold some listed shares during the year, which were held for long. But the sale consideration of all of them (individually and collectively)is less than the closing price of the share as on 31.01.18. As such, I feel that there is no long term capital gain. In this case, please inform whether I have to fill up this column “Long term capital gain” or not.

2. House property is owned jointly by me and my wife. In this case, for interest paid on borrowings for the house purchased, whether I have to give the full amount of interest paid or only the proportionate amount according to my share of the property (50% or 60% as the case may be)

Kindly clarify the above points

1. Yes you need to show the details.

2. If the interest is fully paid by you, you can claim the whole amount of interest as a deduction.

For AY 2019-20, ITR-2 is not available online. when it will be available?

It is now available, you can file it now.

SINCE THE OPTION TO FILL AND SUBMIT ITR-2 ONLINE IS CURRENTLY NOT AVAILABLE ON THE E-FILING SITE, IT CANNOT OBVIOUSLY BE DONE NOW. HOWEVER, MY QUERY IS WHETHER WE CAN EXPECT THAT OPTION TO BECOME AVAILABLE ANYTIME BEFORE THE LAST DATE OF FILING RETURNS, VIZ. 31.7.2019? AND WAS THIS OPTION AVAILABLE IN THE PAST?

THANKS

ITR-2 is available now for e-filing on the income tax portal.

BUT IT IS NOT THE SAME LIKE ITR-1, WHICH YOU CAN FILE ONLINE. IN ITR-2, YOU ARE ASKED TO DOWNLOAD FORM TO FILL UP ONLINE OR OFFLINE, AND THEN UPLOAD XML.

THANKS ANYWAY.

I AM TRYING TO FILL THE ITR-2. I HAVE INCOME ONLY FROM (a) INTEREST, (b) ABOUT RS. 2,000 FROM DIVIDENDS, AND (c) FROM LONG TERM CAPITAL GAIN FROM SALE OF RESIDENTIAL LAND. NO INCOME FROM SALARY. BUT THE SOFTWARE INSISTS ON PROVIDING DETAILS OF EMPLOYER AND WOULD NOT ALLOW ME TO MOVE TO CALCULATION OF TAX ETC. WITHOUT THIS. ANY ADVICE ON THAT.

There is no such validation of providing employer details mandatorily in ITR-2 if you don’t have any salary income.

There is such validation in the Java tool, it doesn’t allow you to calculate tax until you fill Employer details in the Income from Source section. And we add income details earned outside India then it calculates heavy taxes on the same. Can you check and let us know how to file it?

Dear Manjit,

If you have got the solution then pls let me know as I have the same issue….thanks

Hi Manjit, did you get any solution for this issue on Income from the source? I am also not able to file ITR2 because of the same issue.

FOR AN NRI, ITR 2 ASKS FOR TAXPAYER IDENTIFICATION NuMBER. USA does not give Tax Identification number like PAN in India. But in the USA they give Social Sec Nr. ( SSN ) . However since ITR2 specifically asks for Tax Identification Nr for NRI, can the NRI provide his Indian Passport number as the PP nr is more identified with any person. Pls, advise. Thanks

Taxpayer identification number represents any kind of identification number allotted by foreign tax officials for identifying the taxpayer. So whatever kind of identification number provided to NRI, same should be mentioned under the TIN tab.

In ITR 2 AY 2019-20, details of unlisted shares held are required to be mentioned. Many companies whose shares were issued in IPOs in the past are now not listed, and their whereabouts are not known. How can anyone give details of PAN nos. of such companies in ITR 2? Further, would it not be adequate for the Govt. to call for the information on unlisted shares only where such shares were either purchased during FY 2018-19 and/or were sold during FY 2018-19? Sale of unlisted shares is, in any case, required to be reported under Sch. CG (Capital Gains) on ITR 2. Kindly guide in this matter. Thank you.

You can raise this issue in the grievance portal provided by the department. As of now, the department has mandated such details in ITR-2.

ITR 2 Long term capital gains. I have sold some shares bought after 01 Feb 2018 and some bought before this date. How to show both in capital gains statement. Further, the software is taking as income even when the same is less than RS one lakh

There is no separate column provided in the |ITR form to show LTCG on shares bought before 01/02/2018 or after 01/02/2018, only in case of shares bought before 01/02/2018 additional info of FMV as on 31/01/2018 is required. Further as per new schema changes in ITR 2, Rs 1 lakh exemption in LTCG now reduced from the total income of assesee rather than from Capital gain i.e. 1 lakh exemption now allowed at the time of calculation of tax on LTCG.

Hello Sir,

Please note that the FMV field can’t be left blank. If left blank it gives validation error.

What should be entered in the FMV field for assets that were bought after 1/2/2018 and sold thereafter one year of holding period?

If we enter FMV as on 31/1/2018 then the Gain is computed based on this FMV and actual COA i.e., grandfathering clause is applied which I believe is incorrect.

And if we don’t enter FMV as on 31/1/2018 then it gives validation error.

Please clarify…

If assets purchased after 31st Jan 2018, FMV field be not-applicable

DO NOT MIX UP WITH UNLISTED WITH DELISTED SHARES. UNLISTED SHARES MEANS PRIVATE CO SHARES ALLOTTED ON PVT PLACEMENT BASIS AND IF NOT LISTED THESE ARE CALLED UNLISTED SHARES. DELISTED SHARES ARE SHARES ARE EITHER DELISTED DUE TO NON COMPLIANCE WITH SEBI REGULATIONS OR DELISTED AS THESE CO HAVE BECOME DEFUNCT AND NOT TRADEABLE IN THE BOURSES. SO THESE SHARES DO NOT HAVE A VALUE AND SO NO NEED TO REPORT UNDER UNLISTED SHARES AS THESE HAVE LOST ITS INVESTMENT VALUE.

I am a senior citizen getting EPS-95 pension and having some mutual fund exposure. I am filing ITR-2 in excel format. Since my pension is coming under salary income I have some queries :

1) What should I write in place of employer name? Shall I write my old employer name or EPS95?

2) Since I am getting only pension and no other allowance or deductions, how do I furnish other details in this new 2019-20 format? I am not able to leave blank those things because it is not validating

I will be grateful if anyone could answer my queries.

1) You can enter ex-employer details therein.

2) You need to select the option “whether pensioner” as yes and then need to enter pension amount under “Salary as per 17(1)” column.

Step by step ITR 1 Procedure on salaried person

Get here: https://blog.saginfotech.com/file-itr-1-online

I WANT TO KNOW THAT WHILE FILING ITR 2 IN CASE OF NRI WHAT IS TAXPAYER IDENTIFICATION NUMBER?

Taxpayer Identification Number will be tax identification number allocated by the country in which assessee is resident or of that country in which income of NRI is taxable.

FOR U.S RESIDENTS SOCIAL SECURITY NUMBER IS TAX IDENTIFICATION NUMBER

under long term capital gains for equity mutual funds where stt is paid, where the long term capital gains are zero after grandfathering, is it required to furnish the original cost of acquisition, grandfathering cost, etc.

All the details i.e. original cost of acquistion, fmv as on 31.01.2018 required to be mentioned in the return for calculation of capital gain liability.

Hello, I am trying to fill ITR 2, but it is not coming as an option when I try to do it online. In the drop-down, I can see only ITR 1 ITR 4. Could you please help

Only ITR-1 and ITR-4 are available for E-filing. Since ITR-2 is not available on the income tax portal, you cannot file ITR-2 now.

Online still ITR 2 For ay 2019-20 is not available when it will be available, for Offline where to download Pre Filed XML file

Only ITR-1 and ITR-4 are available for E-filing. Since ITR-2 is not available on the income tax portal, you cannot file ITR-2 now.

We like your exhaustive article on RCM and infact it solves our query too.

Your work was good..!!!