Usually, companies take the risk of losing the tax credits (TDS and TCS) because of a lack of regular reconciliation between books of accounts and government records Form 26AS. The year-on-year TDS credit lock-up is directed to inefficiencies in the working capital, which would be the major subject to think about for CFOs and tax heads of organisations.

Apart from tax credits, if the revenues reported in the income return as compared to the revenue shown in Form 26AS are lesser and the credits would be availed according to Form 26AS, then the same would become a fit case for the under-reporting of the income in the period of a tax investigation. To the tax officer, it becomes mandatory to file a clear reconciliation with explanations of mismatches and confirm the information of revenue with the correct corresponding year.

The same practice for reconciling the tax credits, along with the revenue reconciliation, is through the zero yardsticks. Some common issues from which the companies suffer are:

- Database Trapping

- Data Monitoring

- Absence of Governance and Control

Understanding the Concept

- The information that has been recorded in ERPs would usually be unable to be completed or corrected, resulting in incomplete results on reconciliation.

- The manual efforts to reconcile bigger data complicate the procedure to determine the cause for matches and consume measures for the outcomes to attain. These types of reconciliation are performed on the Excel files, which become overweight and non-responsive, resulting in the effective processing time.

- Tracking the available credits promptly- According to Form 26AS, most companies take tax credits. While the customer or suppliers successively update their TDS/ TCS returns, this renders regular amendments in Form 26AS, which impacts the tax credit availability. Therefore, the credits claimed in the income return could be revised in the period of scrutiny assessment and need to be monitored within time, along with precise measures.

- Issues in obtaining TDS/TCS return revised via customers or suppliers- The majority of the companies do reconciliation in the period of scrutiny proceedings (3 years post to the finish of the fiscal year of the transaction) during that time the follow-up action of reaching customers or suppliers for rectification of their former TDS/ TCS returns to accurately show tax credits in Form 26AS evolves as a difficult chore.

- Lower visibility and command for the governance results in restrictions on the working capital and expansion of the income in scrutiny proceedings. Below are some important reasons for the mismatches directed to credit leakages or working capital inefficiencies, which would need measures for resolution:

- Because of a wrong PAN or non-reporting in the TDS return, the tax credits get lost.

- The Excess TDS deduction on the total invoice with GST.

- Tax credits claim postponement related to the income that was not being taxed in the present year.

Due to the lower visibility in the above cases, it leads to the credit loss during the scrutiny process, and indeed it arises as a risk area for the levy of interest and penalties.

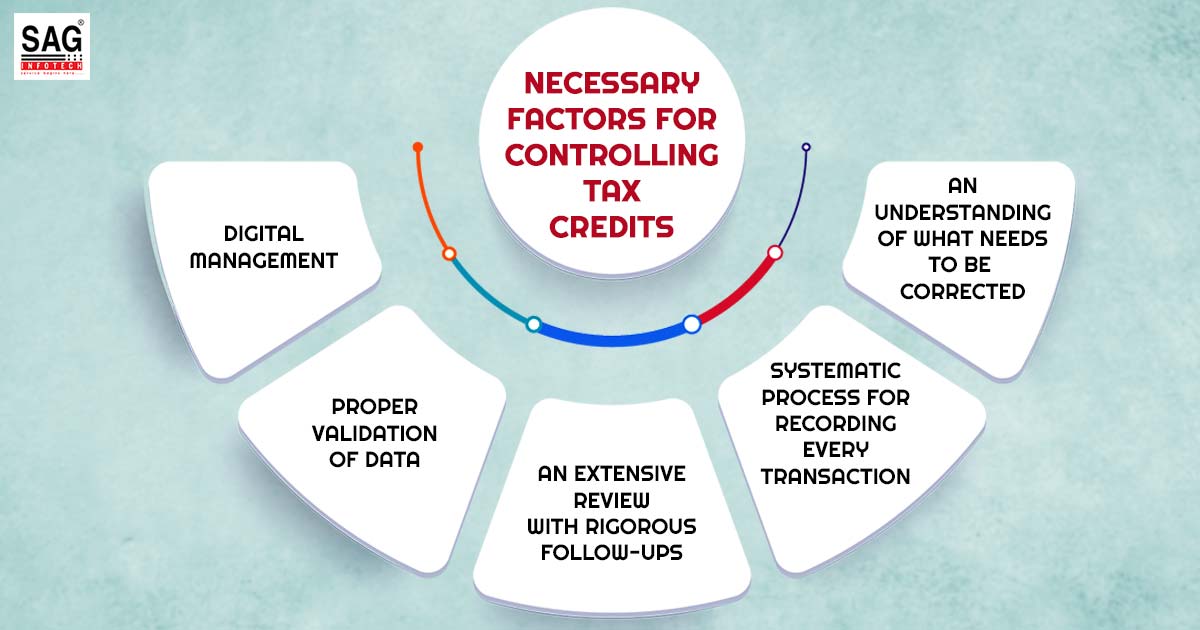

Thus, in what way would the technology support handling the tax credits and revenue reconciliation? Below mentioned would be the five essential elements that contribute to its happening.

- Digital Management

- Proper Validation of Data

- An Extensive Review with Rigorous Follow-ups

- Systematic Process for Recording Every Transaction

- An Understanding of What Needs to be Corrected

The points specified below are to be remembered for explaining this:

- To succeed in any automation, one is required to give complete and correct input.

- It would be effective to choose the technologies that ease the tax credits, including the reconciliation in revenue, on the grounds of automation and support in digitalising the reconciliation procedure.

- This type of technology must comply with data validation rules, and the same must be adaptable for data reconciliation for various years. It comprises in-built parameters for the reconciliation of the data, like one line for many lines and vice versa, for attaining the highest reconciliation on automated grounds. Tax technical knowledge could be leveraged to conceptualise the cases and develop the logical parameters to accomplish automated reconciliations.

- On the reconciliation, along with finding the mismatch causes, the technology platform must have the capacity to share even the small reasons for mismatches with the customers or suppliers. Along with that, it must enable insightful and analytical dashboards that monitor the tax credit leakages because of the wrong entries that are being incurred via suppliers or customers.

- A year-on-year dashboard would be supportive for tax and finance heads to compute if there would be a case for the process rectification for drawing down the lock-up on tax credits. For example, it often learns that the customers deduct TDS on the GST amount on the invoice, while technically, there is no need under the law. By tracking these cases, a person could ask for improvement over time and support in drawing effective working capital efficiency.

- There is a need for digital governance and control, which would enable the complete review of reasons for mismatches, strict follow-ups with customers and suppliers, and finding the scope for operational rectification via deploying an experienced team (internal or outsourced) to handle the complete value of the reconciliation activity. Various companies have taken advantage by focusing on the embedding procedure with technology, and the same solution would be sought after by CFOs or tax authorities to attain effective visibility and control of credit reconciliation.

Adoption of digital governance with the tax technical experienced team to effectively manage the credits, one can undoubtedly achieve increased automation and precision in this crucial reconciliation process to unlock the loss of tax credits and enhance working capital efficiency.