The long-awaited Multi-Vehicle option for the e-Way bill has been finally introduced in the GST Portal. An E-way bill is now mandatory for vehicles transporting goods worth more than Rs. 50,000 in value. The new option on the ewaybillgst.gov.in portal is a welcome relief for those transporters wherein the consignment of one e-way bill has to be moved in multiple vehicles post reaching a transhipment place.

The government has also included some of the required featured on the e-way bill portal, namely Preview of EWB is now enabled which will display the e way bill prepared before printing. While another feature is Personalised Dashboard which will give certain personalized user interface to the taxpayer and supplier.

An important point to consider in this is that the Multi-Vehicle option must be used upon reaching the transhipment place in between the source and destination. Transporters need to generate the standard e-way bill for the entire journey (including the source and the destination) as the document and invoice. Later upon arriving at the transhipment place, the Multi-Vehicle Option for e-Way Bill must be used.

The following steps further explain all the procedures involved in the generation of a Multi-Vehicle e-Way bill :

- Generation of the standard e-Way bill with proper source and destination details as mentioned in invoice and documents.

- Completion of the first stage of consignment delivery up to the transhipment place where the default mode of transportation is unavailable of the terrain is too small for bigger vehicles used for shipment.

Upon reaching the transhipment place, the following update has to be done to the e-way bill for multi-vehicle movement.

- Go to Menu and select ‘Change to Multi-Vehicle’ option.

- Enter e-way bill number for which multi-vehicle movement permission is required. The system will automatically display the e-way bill details.

- Remember to enter the total quantity of the goods being transported as well as the details of movement from the transhipment location and to the destination. Information about multiple vehicles requirement has to be entered.

As seen in the image above, fill in the details of the text boxes labelled with a red asterisk (*). Enter the details in text boxes with label:

- ‘from the place’,

- ‘to place’,

- the quantity of the consignment and

- reason to go for multi-vehicle.

- Press Submit to change the standard e-way bill to the multi-vehicle e-way bill.

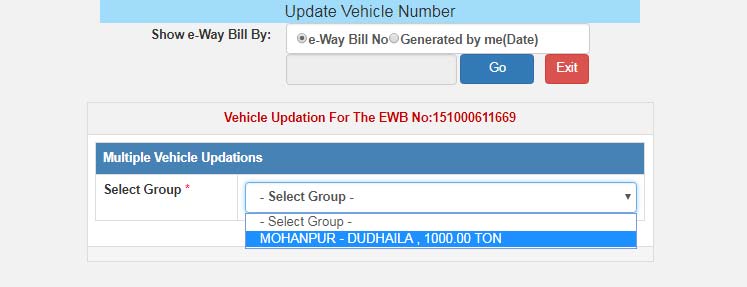

- Next select Update Vehicle option and select the group as shown in the picture below.

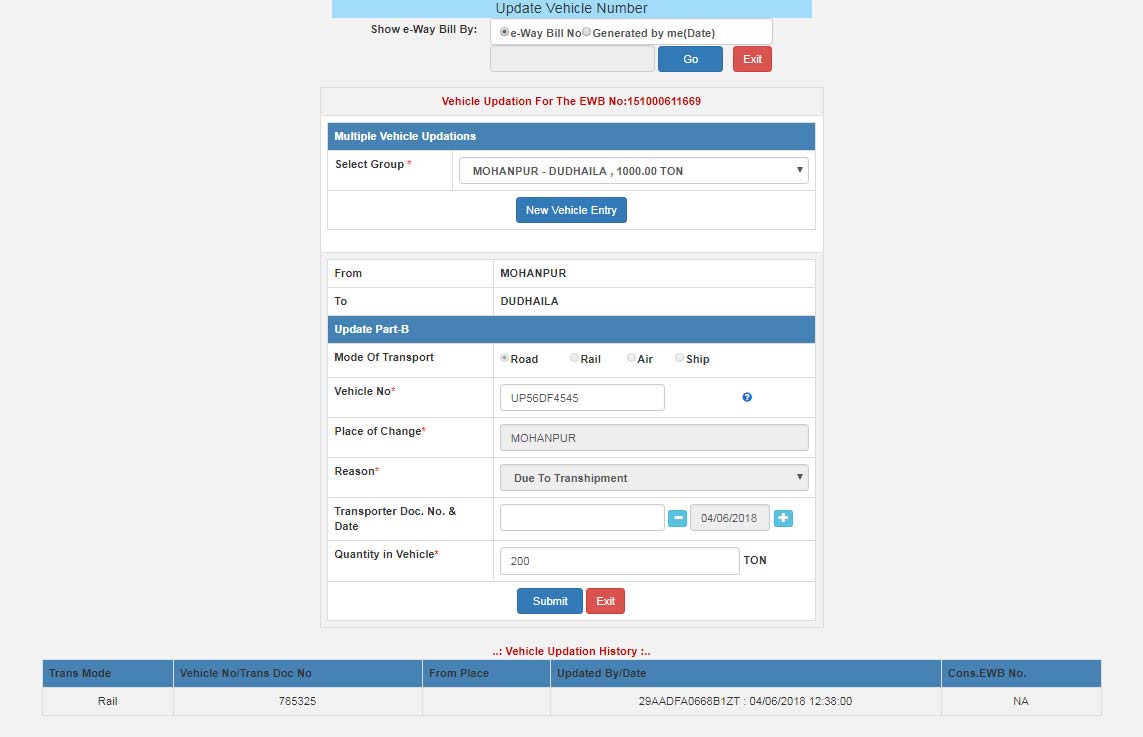

- In the last and final step, enter details of the vehicles. This is similar to the details mentioned during standard e-Waybill filing procedure. Also, mention the quantity being carried, Click or press submit to complete the Multi-Vehicle Option for the e-Way bill.

- Post loading the consignment into a smaller vehicle, update the ‘Part B’ of the e-way bill with information about the time when the consignment has been loaded to the smaller vehicle, the vehicle number and the quantity of the consignment. You can now move your consignment to the destination.

IMPORTANT: The e-Way Bill system will never allow more quantities to be shipped in multiple vehicles more than what was declared in the first place. Repeat Step 8 and Step 9 until all goods have been transported.

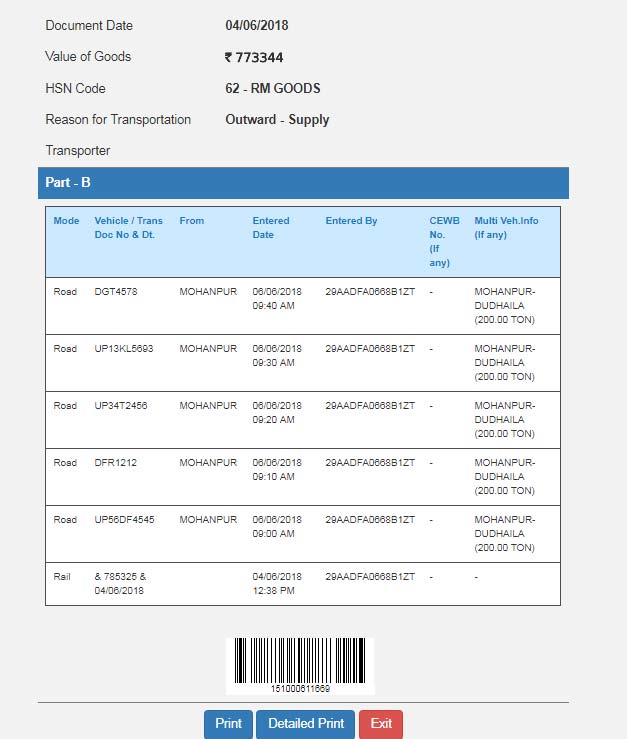

The above image is a print out of the Multi-Vehicle Option e-way bill. In the image above, ‘Valid until’ column refers to the Multi-vehicle whereas Part-B contains the ‘from place – to place’ details along with the quantity being moved. In this way, one can use the multi-vehicle option in the e-Way bill to transport consignments which require multiple vehicles and modes of transportation.

Recommended: How Gen GST E Way Bill Software Works for Transporters & Suppliers?