The new e-assessment scheme has been initiated by the Income Tax department and many e-notices have been sent to the assessees whose case has been selected by the IT officials for the scrutiny.

The new e-assessment scheme 2019 is in its first phase and the notices were sent before 30th September 2019. So, the taxpayers must check their registered e-filing accounts and email ids because notice receivers have to respond within 15 days of receiving such notices.

58,322 is the total number of cases selected for the scrutiny by the income tax department under the new e-assessment scheme, so the taxpayer needs to check registered emails as well as their registered accounts on the e-filing portal www.incometaxindiaefiling.gov.in, as he can be one among them whose cases have been selected for scrutiny.

SMS alerts, spelling out the issues because of which their cases need to be investigated, will also be sent to the taxpayers on their registered mobile number. The response to which can be submitted online on the e-filing portal by the taxpayers along with the documents or attachments needed.

Read Also: Solved! How to Check Income Tax Notice Fake or Genuine?

The new and faceless e-assessment scheme was launched by the income tax department in the 2nd week of October this year to completely eradicate the physical scrutiny and interface between the assessing officer and the assessee. This is a major tax reform which will allow the online submission of documents by the taxpayers whose case has been selected for scrutiny which means the taxpayer will have to upload all the required documents on the e-filing portal. The assessing officer will also be selected randomly.

Income Tax departments have high hopes with this new e scheme, notified on 12th September 2019. It is expected that the new scheme will help taxpayers easily adhere to the rules & regulations and would lead to fast disposition of cases.

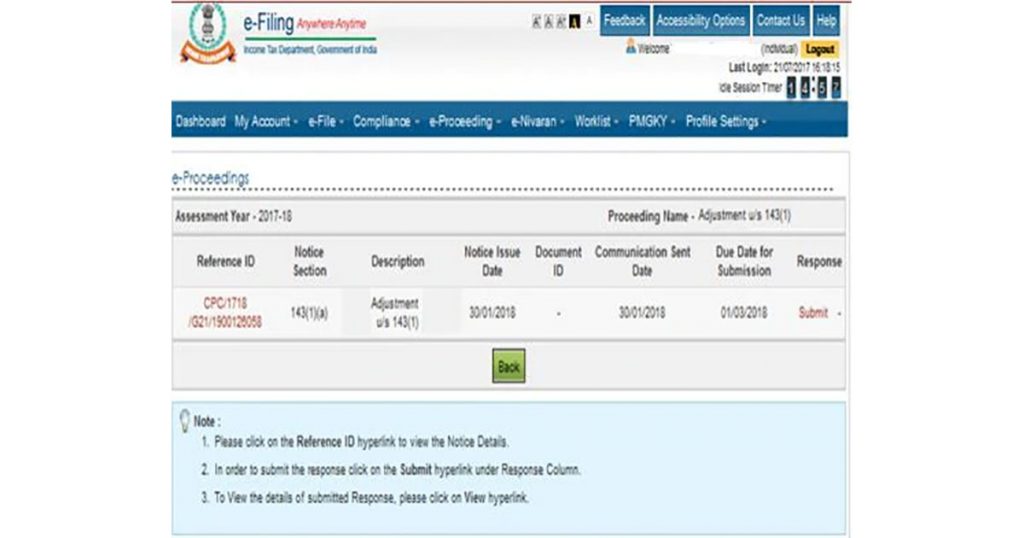

Steps to See the Tax-related Notice and Respond to It

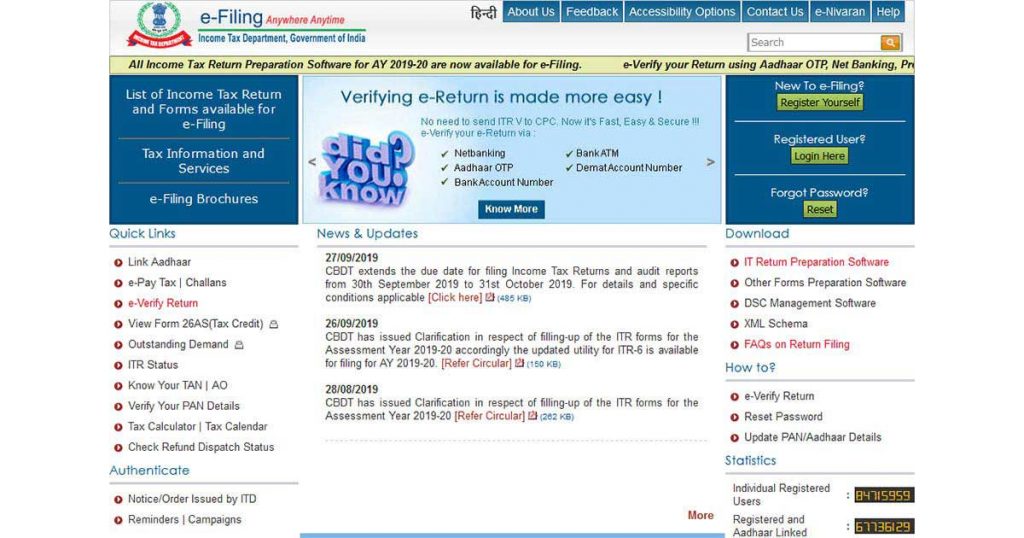

- Step 1: Visit the e-filing Portal www.incometaxindiaefiling.gov.in

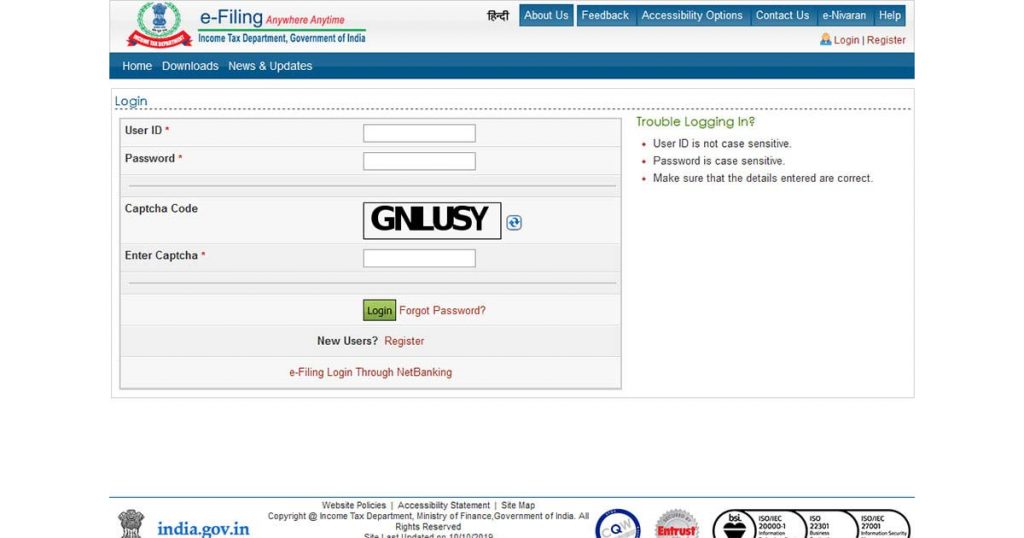

- Step 2: Click→’Login Here’ button, present at the right side of the Home Page.

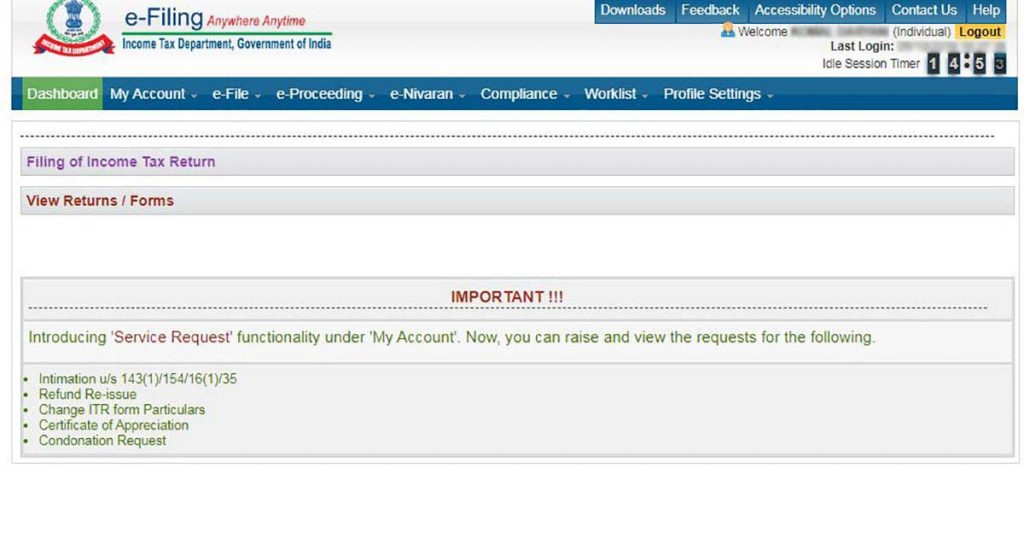

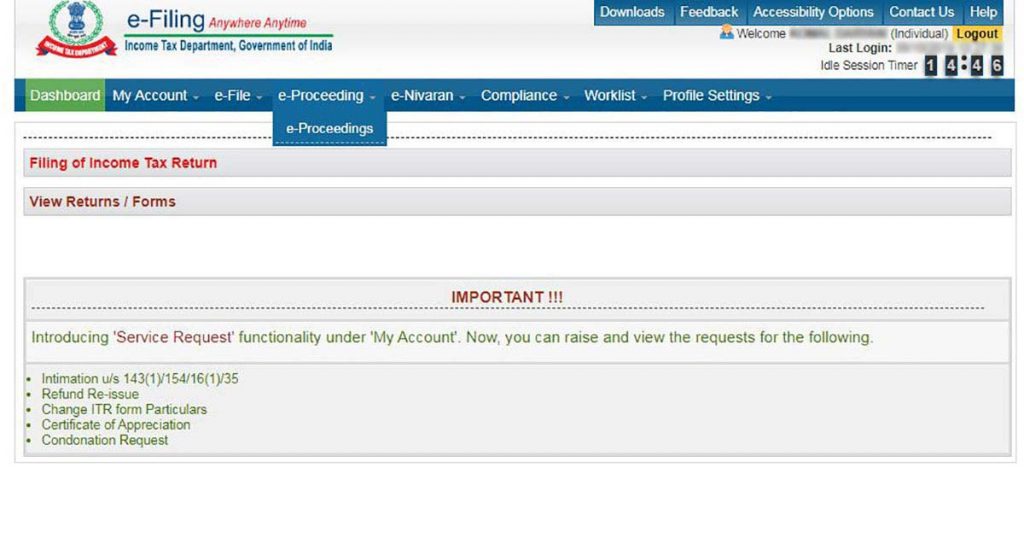

- Step 3: Click on a link →”e Proceeding” which is available under the e-Proceeding tab. Now you will be redirected to e-Assessment/Proceedings.

- Step 4: Click on the link → “Proceeding Name”. This step will take you to the next screen.

- Step 5: Click on the →”Reference ID” to access the details of the notice.

- Step 6: Click on the →”Submit” hyperlink present under the Response column.

- Step 7: Click on the →”View” hyperlink to view the details of the response submitted by you.

Note: The notice can be downloaded in PDF format by clicking on the link present under Reference ID.

Recommended: How to Reply Income Tax Compliance Notices?

Total of 8 regional e-assessment centres has been established in different cities that include Mumbai, Delhi, Kolkata, Chennai, Ahmedabad, Bengaluru, Pune, and Hyderabad. The principal chief commissioner of Income Tax will lead the National e-Assessment Centre which has been established in Delhi.