E Form MGT-7 & E Form MGT-7 A is the mandatory form that is required to be filed by all the companies, whether it’s a small company, other than a small company or an OPC. In E Form MGT-7/MGT-7. A companies are required to file its annual return, its shareholding details and other details. It is needed to furnish the form according to the rules and guidelines of the MCA.

Why Choose Gen CompLaw with XBRL Software for E-form MGT 7 Filing?

Gen Complaw with XBRL poses to lead the software and proves to be effective in furnishing the software towards the solution of ROC e-forms, XBRL, Resolutions, Minutes, Registers and various MIS reports. Provide features like an automated register, like a shareholder register, a share transfer register, etc. This product from SAG Infotech is used to perform all XBRL e-filings on time without any errors.

It is just effective in assisting the statutory compliance under the Companies Act, 2013, which consists of the maintenance of the fixed assets register. It performs faster response in a shorter time and is reliable in giving the performance for filing.

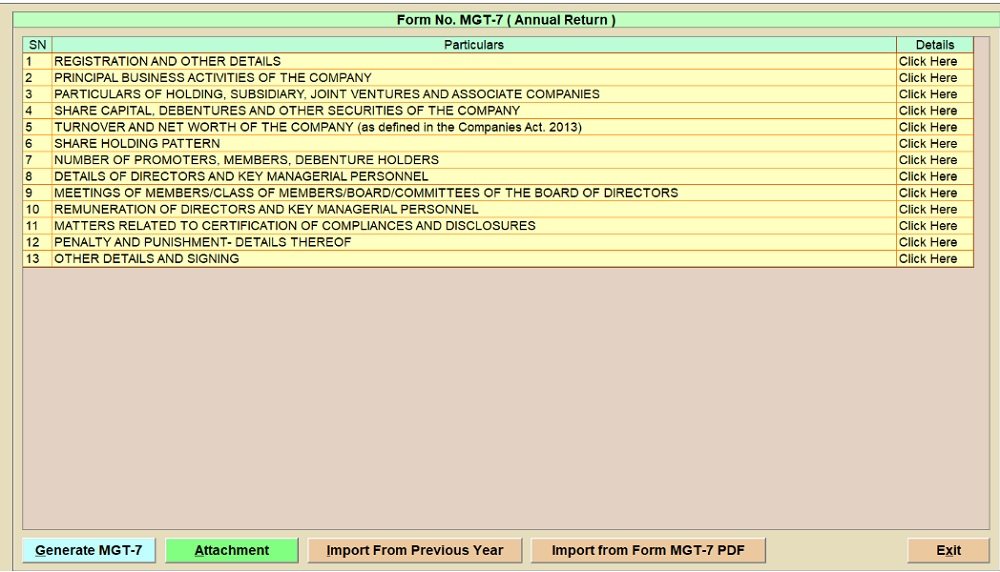

Steps to File E-form MGT 7 & 7A via Gen Complaw Software

Step 1: Install the setup of Gen Complaw with XBRL Software on our desktop.

Step 2: Post installing the software, just open the software dashboard.

Step 3: Now select the ‘E-form’ option from the dashboard.

Step 4: Post to selecting the ‘E-form’ tap on the ‘Annual Return form’ from the dashboard.

Note: Kindly ensure that the proper Financial year has been selected and the AGM setup option given in Company tab has been filled.

Step 5: Then, choose the E form MGT 7 (in case the company is a company other than a small company or a one-person company).

or

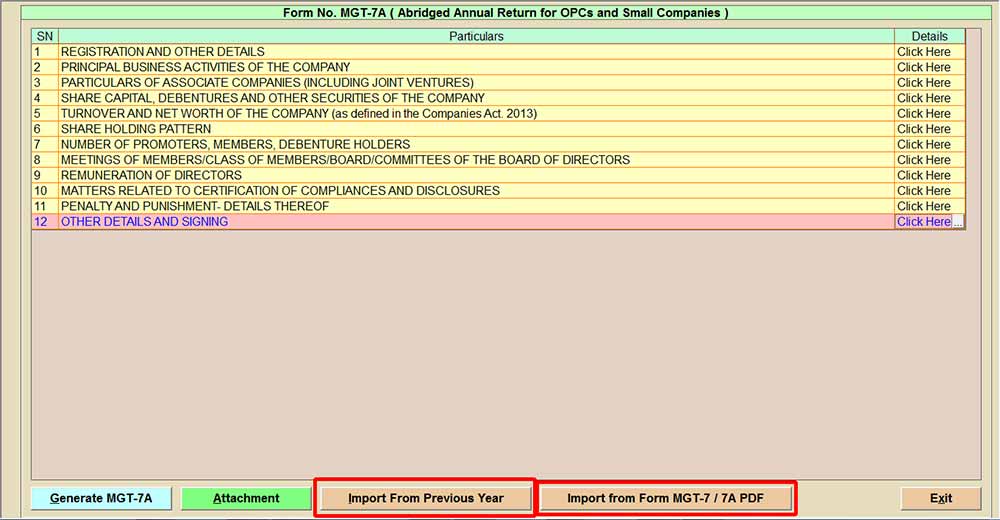

MGT-7 A (If the company is a small company or a one-person company), from the Annual filing form option.

Import Option is given to import details in the form from the option “Import from the previous year” (Previous year details will get imported if provided in the previous year in the software), Import from E Form MGT-7/MGT-7A ( You can import the details from the already prepared previous year or current year form the form as well). You can generate E form MGT-7A and also import data from the previous year and from the Excel or previous filled-up form.

Step 6: Post clicking the E Form MGT 7, ‘Registration and Other Details’ page will open, in which details are auto-filled from Company Master/ AGM setup details, and you can edit the details given manually if required.

- (i) For MGT-7/7A: Now select the ‘Registration and Other Details -1’ option to furnish company-related details like CIN number, name, address, company type, category, etc. This information is auto-filled from the software’s company master records.

- (ii) Form MGT-7/7A: After that, move the cursor to ‘Registration and other details.-2’, in this step fill in the FY and last date of AGM. Furthermore, the client has also clicked the AGM set-up to import the former year’s features of the AGM. All the details are provided in the form as it will be imported in the form by selecting the import option.

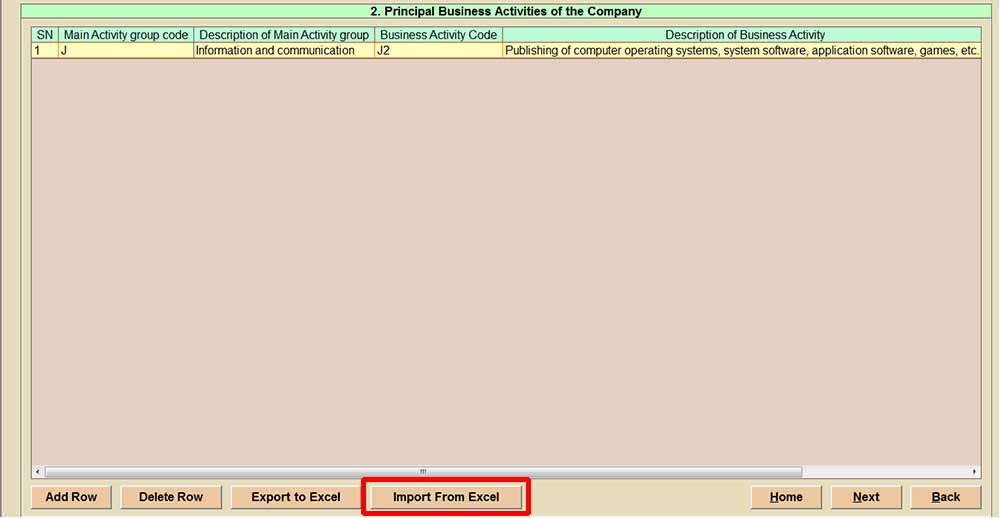

Step 7: Post to the furnishing of the information, choose the next button or the home button of the main window of the E Form MGT 7/7A, now move the cursor to the main Principal business activities of the company. In the current step, the customer can add information such as the activity of the group code through the description and the business activity code through the description. Externally, you can import the information through Excel. All the details are provided in the form, as it will be imported in the form by selecting the import option. Also, you can edit the details given or manually enter all the details.

Read Also: Annual Form AOC-4 Filing Via Gen Complaw with XBRL Software

Step 8: Choose the next option stating :

- (i) Holding, subsidiary, joint ventures, and associate companies – For MGT-7

- (ii) Particulars Of Associate Companies (Including Joint Ventures) (not applicable for OPC): For MGT-7A

In this step, the client can add the company’s name, CIN number, and several existing shares. All the details are provided in the form as it will be imported in the form by selecting the import option, also you can edit the details given or manually enter all the details.

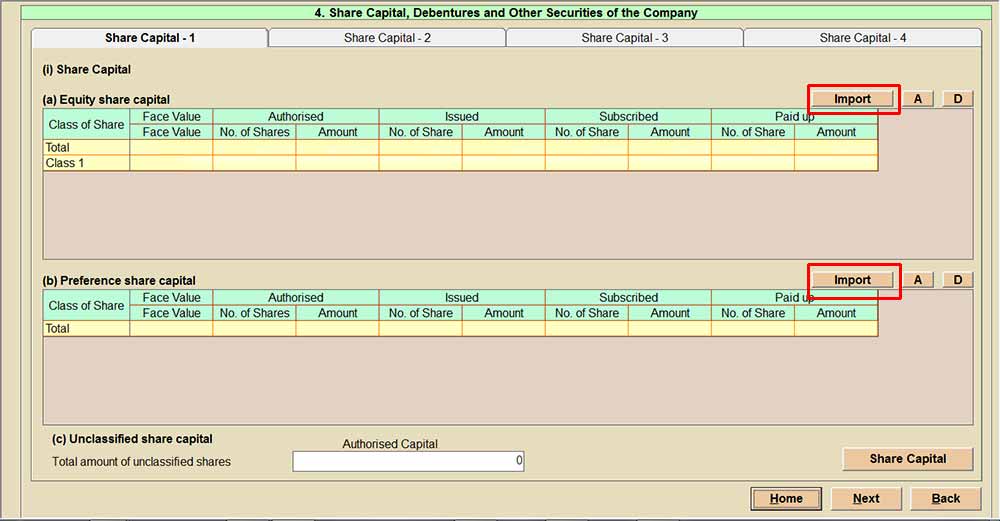

Step 9: Move the cursor on the share capital debenture & other securities of the company. The same can be divided into 4 parts. In this segment, the client enters the face value provided, authorised, issued, subscribed and paid-up equity, and the preference share capital. Provide the break-up of paid-up share capital along with the details of stock split consolidation during the year, details of share and debenture transfer during the year, if any. Furthermore, details of debentures issued, if any. This information should be uploaded using the prescribed Excel format. All the details are provided in the form as it will be imported in the form by selecting the import excel option, also you can edit the details given or manually enter all the details.

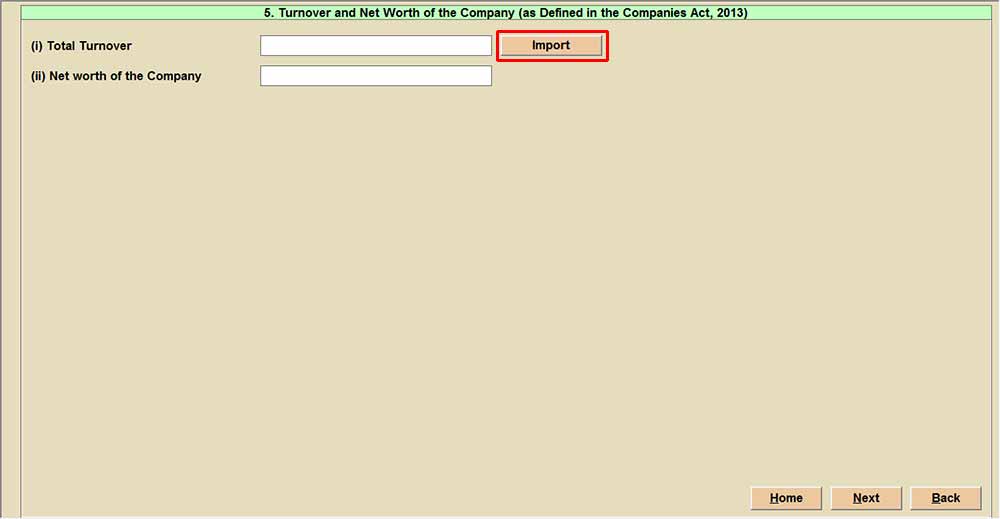

Step 10: Go to the subsequent step ‘turnover and net worth of the company’. In the particular field add the summed turnover and the net worth of the company. All the details are provided in the form as it will be imported in the form by selecting the import option, also you can edit the details given or manually enter all the details.

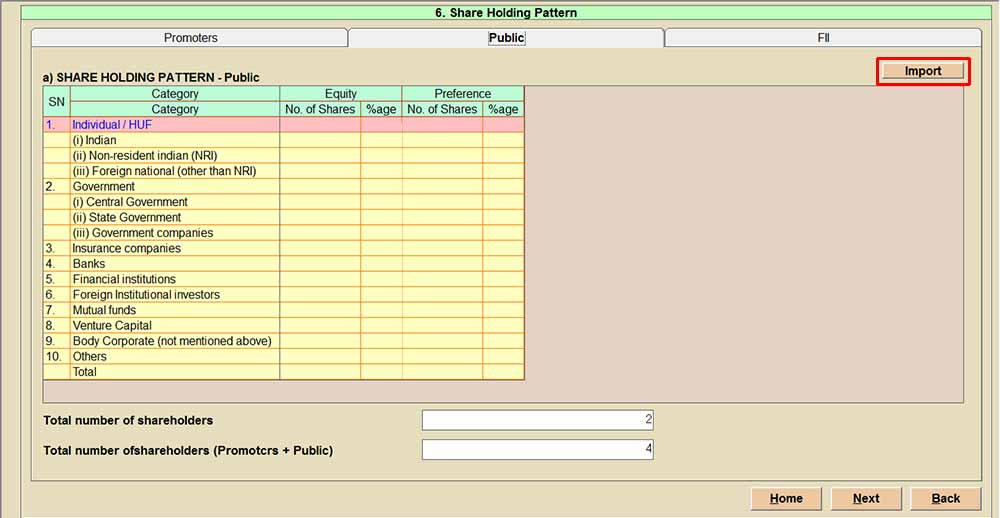

Step 11: Move the cursor to the subsequent choice to fill in the information of the shareholding pattern of promoters, public and others, details such as whether the shareholder is male, female, transgender or other than an individual. The customer needs to go to the number of shares holding with the percentage and the segment in this field. All the details are provided in the form, as it will be imported in the form by selecting the import option also, you can edit the details given or manually enter all the details.

- (i) For MGT-7

- (ii) For MGT-7A

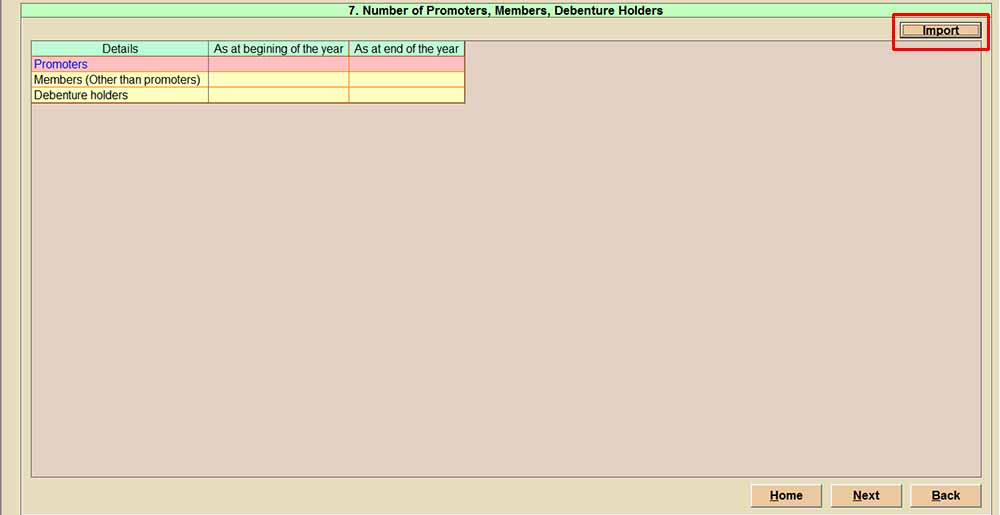

Step 12: Choose the option the ‘number of promoters, members and debenture holder’. Details of the member, promoter, etc, can be made by the client at the start and at the end of the year. The customer can import the information of the members promoter from the software. All the details are provided in the form as it will be imported in the form by selecting the import option, also you can edit the details given or manually enter all the details.

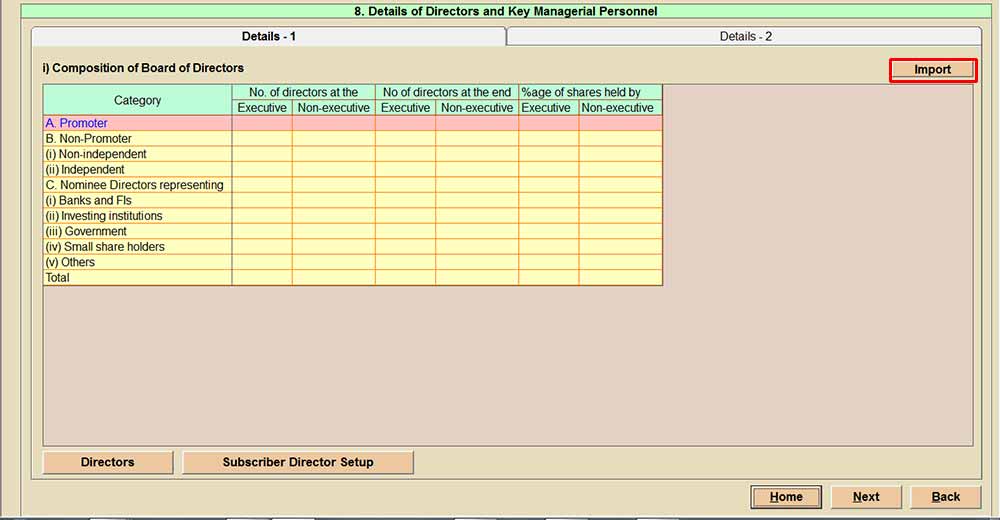

Step 13 i: (This step is applicable only for Form MGT-7) Now you can move the cursor on the information of the director and the key managerial personnel. For the same field, the customer can add the information of the directors at the start and at the end of the year. All the details are provided in the form as it will be imported in the form by selecting the import option, also you can edit the details given or manually enter all the details.

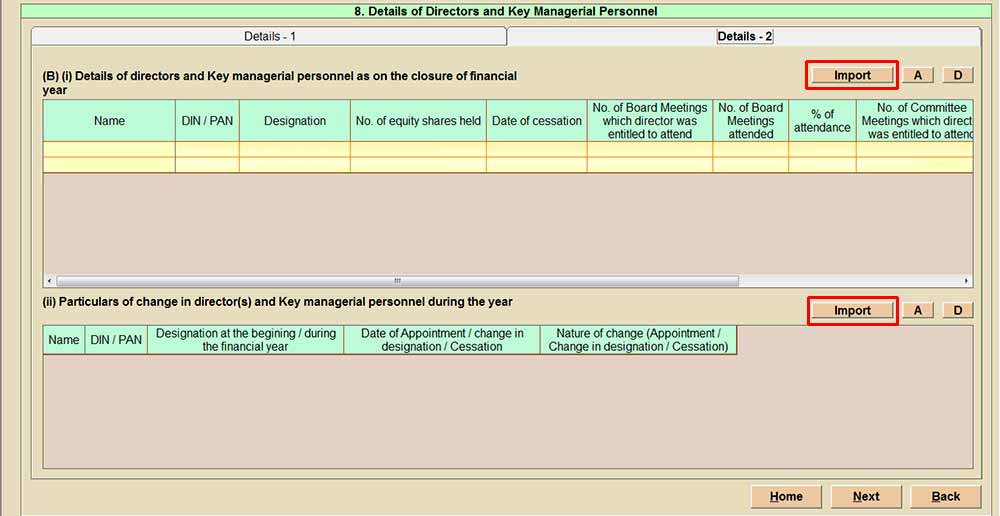

Step 13 ii: Move the cursor on the subsequent tab information of the director and the key managerial personnel information 2 with the information choice of the person name, DIN/PAN, designation, number of shares, board meeting, etc.

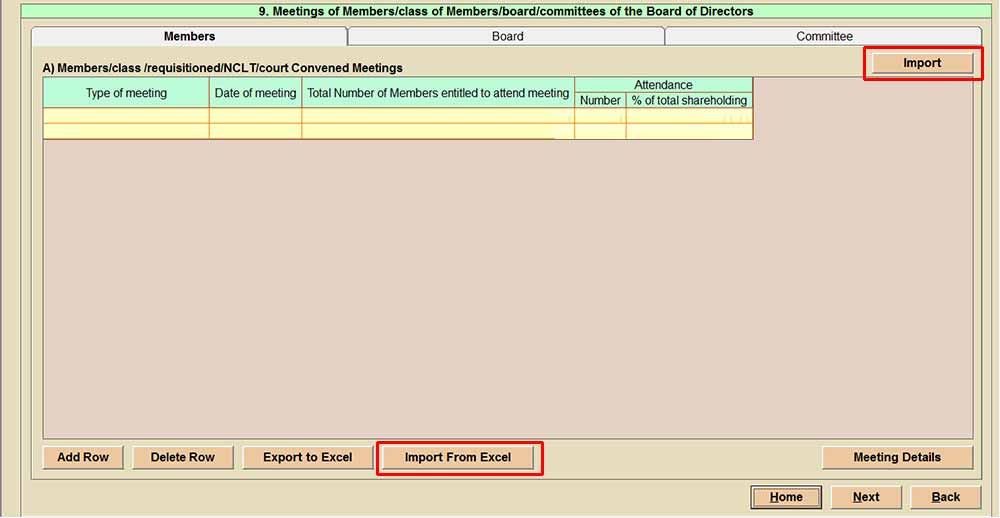

Step 14: Choose the subsequent option, meeting of members, class of members, board and committees of the board of directors’ for the class and the date of the meeting, the total number of meetings and attendance number, and the total percent of shareholding. The customer might import the information of the director through Excel. Additionally Meeting details option is also available to add any relevant meeting information. All the details are provided in the form as it will be imported in the form by selecting the import option, also you can edit the details given or manually enter all the details.

- (i) For MGT-7

- (ii) For MGT-7A

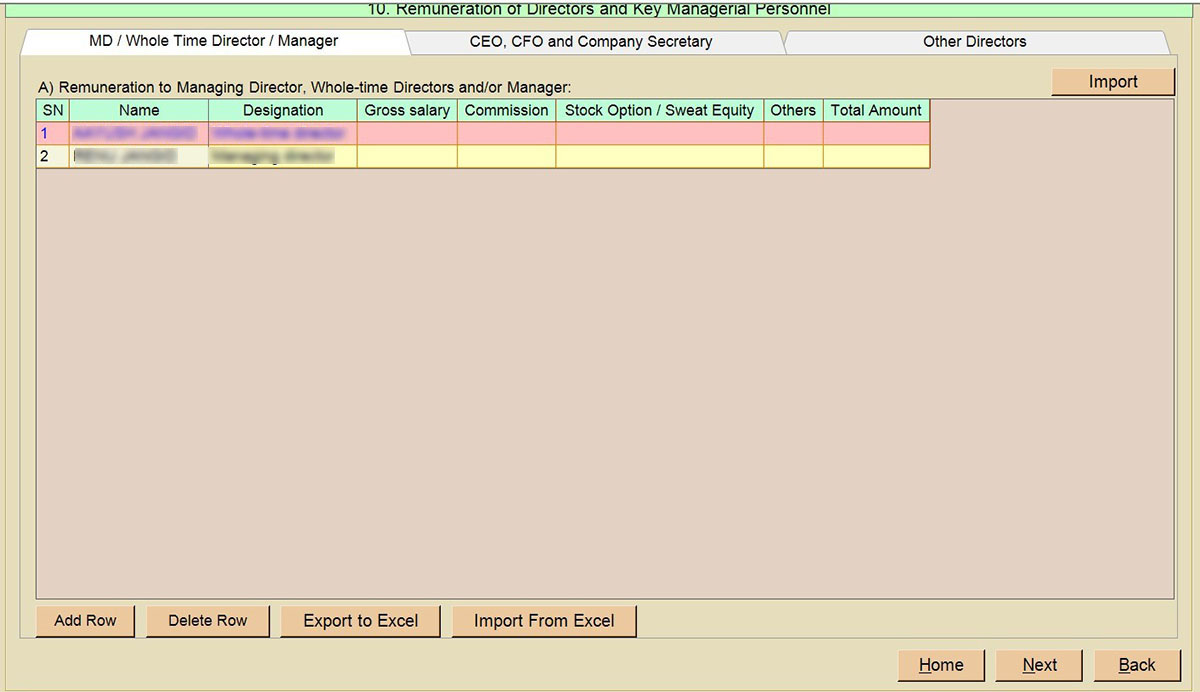

Step 15: Mention the remuneration of directors and Key Managerial Personnel. Details can be imported from the master data or from MGT-9 or can be enter manually. A user can also import the remuneration details through excel.

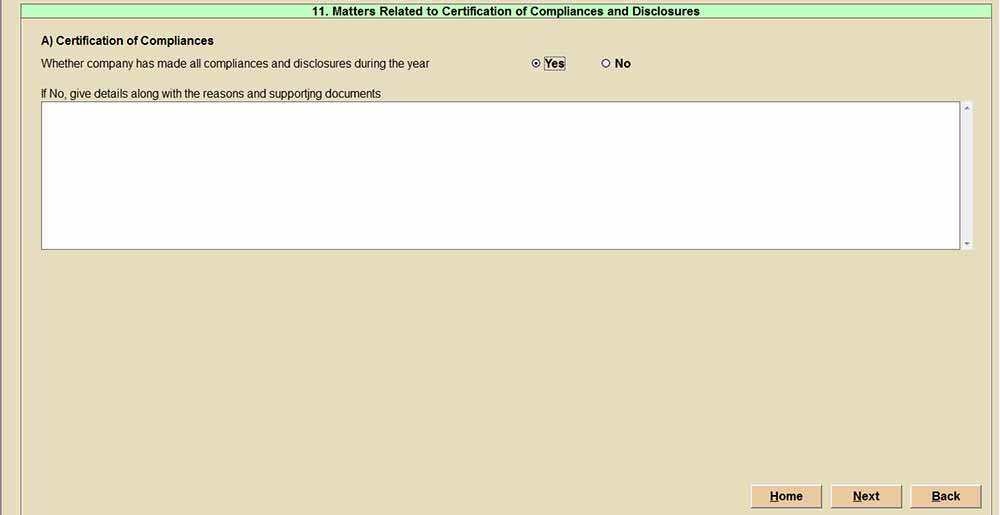

Step 16: Go to the cursor on the concern which is relevant to the ‘certification of the compliance and disclosures’

Step 17: Furthermore, for the current step, fill in the information of the ‘penalty and punishment’ forced on the company, and on the directors or on the officers. In this concern, the customer can fill in the name, company, court, date of order, name of the act and section, penalty, and punishment of the business. If the scenario is not like that then you can import the information of the penalty through the excel sheet. All the details are provided in the form as it will be imported in the form by selecting the import option, also you can edit the details given or manually enter all the details.

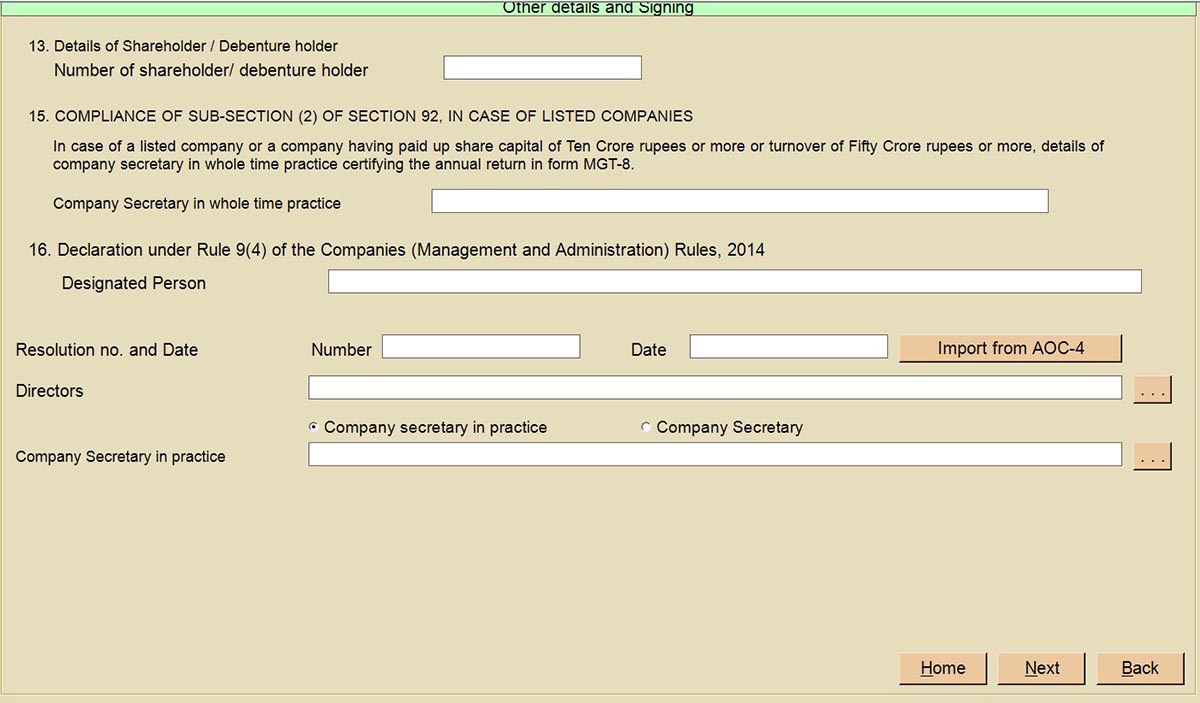

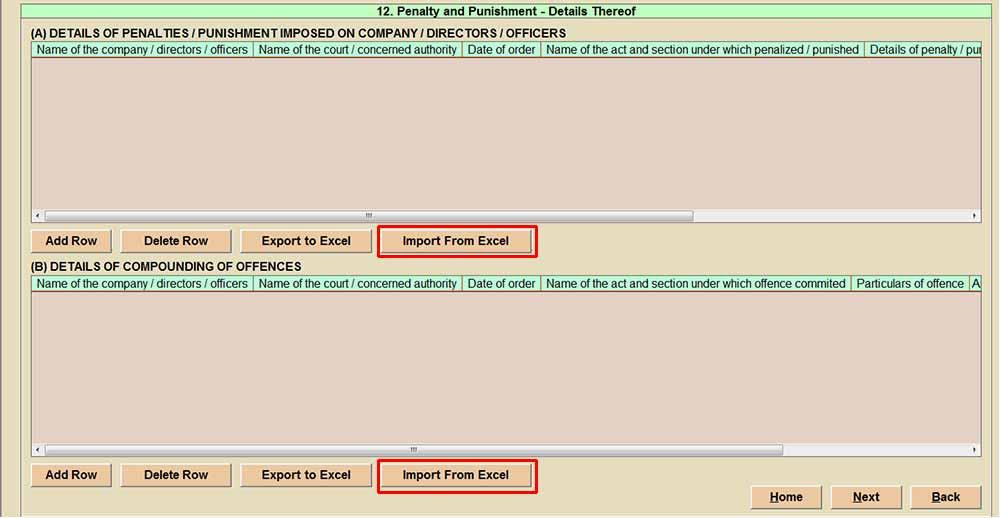

Step 18: This step requires the filing person to add the stakeholders in the statement as well as compliance of Section 92 of listed companies. And finally, the details of the director and CS in practice.