What is the MCA MGT 7 Form?

The MGT 7 is a web form which is allocated to all companies by the Ministry of Corporate Affairs for filing details of their annual return. The Registrar of Companies maintains this e-form via electronic mode and on the basis of the statement of correctness given by the company.

It is a popular form among companies which are required to file the form as per the norms and regulations of the Ministry of Corporate Affairs.

- Who Needs to File?

- MGT 7 Form Filing Fees

- MGT 7 Late Filing Fees

- Documents Required File MGT 7 Form

- Due Date for Filing MGT 7

- Steps to File an MGT 7 Annual Return Form

- MGT 7 E-forms FAQs

File MGT 7 Form Via Gen CompLaw Software, Get Demo!

Who Needs to File the MGT 7 Form?

All the registered companies in India must file this e-form every year, doesn’t matter if the company is private or public.

- Producer companies

- Section 8 companies (non-profit organisation)

- Foreign companies operating in India

- Every company submits its annual return through MGT-7, except one-person company and small company

MGT 7 (MCA) Form Filing Fees

The fee for the filing of the company’s annual return via MGT 7 is determined by the nominal share capital of a company. The MGT 7 form filing fee starts at Rs. 200 for the company with a Share Capital of less than 1,00,000.

The fee amount increases with an increase in the share capital of the company. You can find the complete list here. The company must pay this fee when filing the annual return MGT 7 with the ROC. For companies not having a share capital, the MGT 7 Filing Fee is Rs. 200.

| Nominal Share Capital | Normal Fee Applicable in Rupees |

|---|---|

| Less than 1,00,000 | INR 200 |

| 1,00,000 to 4,99,999 | INR 300 |

| 5,00,000 to 24,99,999 | INR 400 |

| 25,00,000 to 99,99,999 | INR 500 |

| 1,00,00,000 or more | INR 600 |

Note: “Fee for filing (in case of a company not having a share capital) Rupees 200”

Additional Fees in case of delay in filing of belated annual return or balance sheet/financial statement under the Companies Act, 1956 or the Companies Act, 2013 up to 30/06/2018:

| Period of Delays | Fees |

|---|---|

| Up to 30 days | 2 times of normal fees |

| More than 30 days and up to 60 days | 4 times of normal fees |

| More than 60 days and up to 90 days | 6 times of normal fees |

| More than 90 days and up to 180 days | 10 times of normal fees |

| More than 180 days and up to 270 days | 12 times of normal fees |

MGT 7 Form Late Filing Fees (MCA)

In case of delay in the filing of the MGT 7 annual company return, a company is required to pay an additional fee as a penalty along with the normal fee. The MGT 7 late filing fee is INR 100 per day.

What’s the Objective Behind Filing the e-Form MGT 7?

The Form MGT 7 is filed for annual return however, it contains all the particulars as similar to appear in the closing of the financial year. These particulars hold details of :

Read Also: ADT-1 Form Due Date and E-Filing Documents for First Auditor

- The registered office, primary business activities, details of its holding, subsidiary and associate companies

- The shares, bonds and other securities and shareholding pattern of the company, financial obligations of the company

- The members and debenture holder along with changes associated with them, since the end of the last financial year

- The promoters, directors, and key managerial personnel, along with changes associated with them since the end of the last financial year;

- Meetings of members or a class thereof,the Board and its various committees, along with attendance details

- Remuneration to directors and key managerial personnel;

- Details of penalty or punishment imposed on the company, its directors or officers and facts of the composition of offences and appeals made against such penalty or punishment

- The issues related to certification of compliance and disclosures as may be specified

- Such other matters as may precribed

What are the Needed Attachments to File the MGT 7 Form?

One can file this e-form by attaching the scanned copy of documents under the attachment head. This attachment section is provided at the end of the form, which requires given below following attachments:

- List of holders, if applicable

- Approval letter for the extension of AGM

- Photograph of the registered office, which includes an outside view of the building and a prominent sign showing the company’s name.

- List of shareholders, list of transfers of shares during the year to be attached via Excel.

- Details about Shareholders, Board, and Committee meetings—including dates and attendance is collected via downloadable Excel templates that must be uploaded.

- MGT-8 certification, if applicable, is now a linked form to MGT-7. Optional remarks can be added in the optional attachment.

- Optional Attachment(s), if any

What is the Due Date for Filing the MGT 7 MCA Form?

The company is required to file the form MGT 7 within 60 days of the Annual General Meeting date.

- The due date for filing MGT-7 is 29th November 2026 for the FY 2025-26.

- The last date for conducting the annual general meeting is on or before the 30th day of September after the closing of every financial year.

Steps to File an MGT 7 Annual Return Form

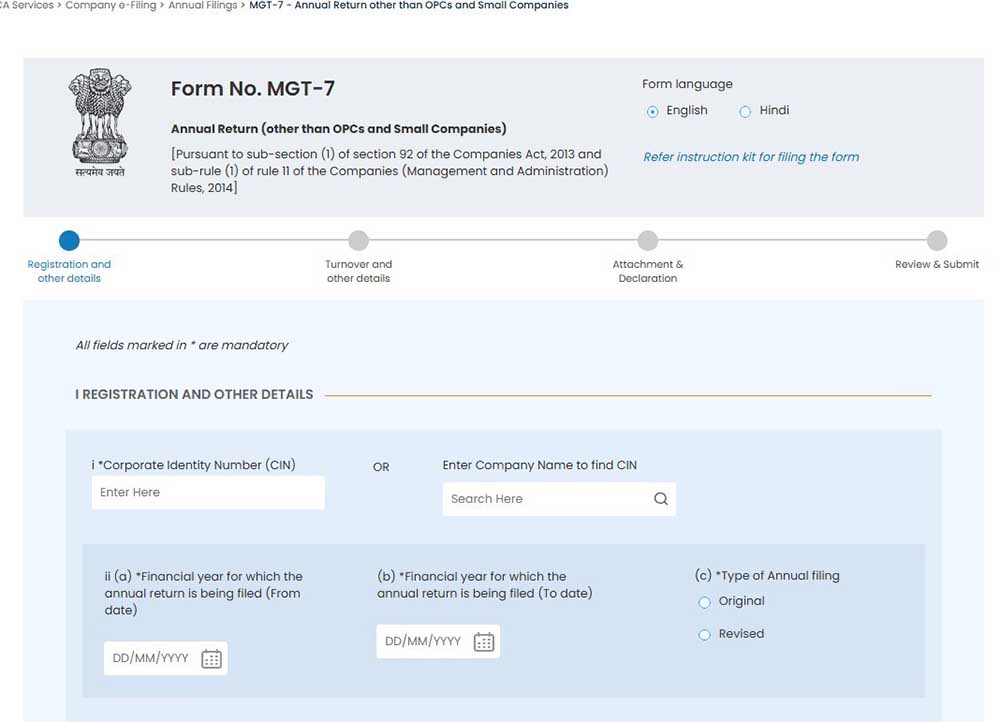

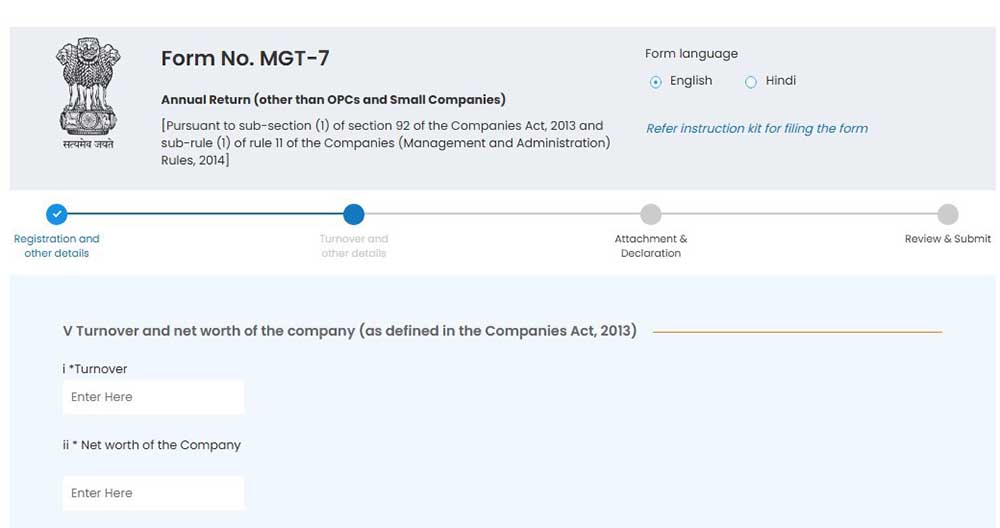

Step 1 Log in to the MCA V3 portal ⏩ Navigate to MCA Services ⏩ Company e-Filing ⏩ then select form MGT-7 Annual return other the OPCs and small companies under the annual filing category. Now V3 portal allows the web-based annual filing directly online or offline, a utility in which download the Excel template, fill in the data and upload it back to the form.

Step 2 In the web form, fill in the basic details of the company, such as:

- (i) CIN Number of the Company

- (ii)

- a. Financial year for which the annual return is being filed (From date) (DD/MM/YYYY)

- b. Financial year for which the annual return is being filed (To date) (DD/MM/YYYY)

- c. Type of Annual filing

- Original

- Revised

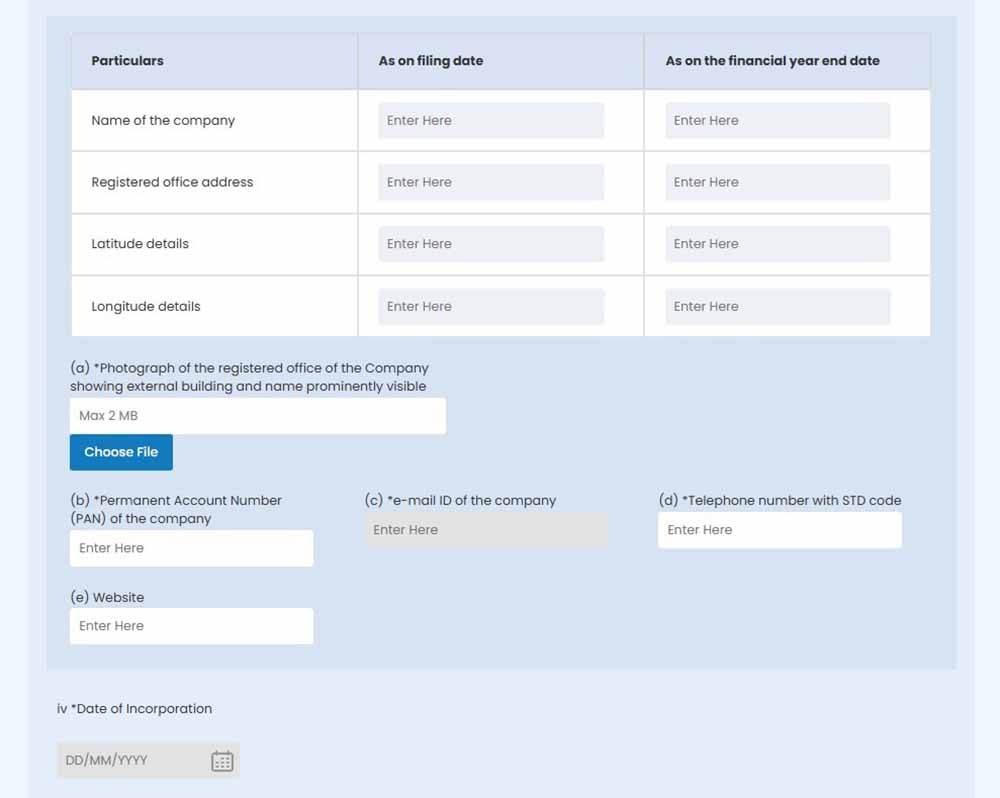

- d. Furnish latitude and longitude details as on the filing date and as on the financial year-end date.

- (iii) Attach a photograph of the registered office of the Company showing the external building and the name prominently visible

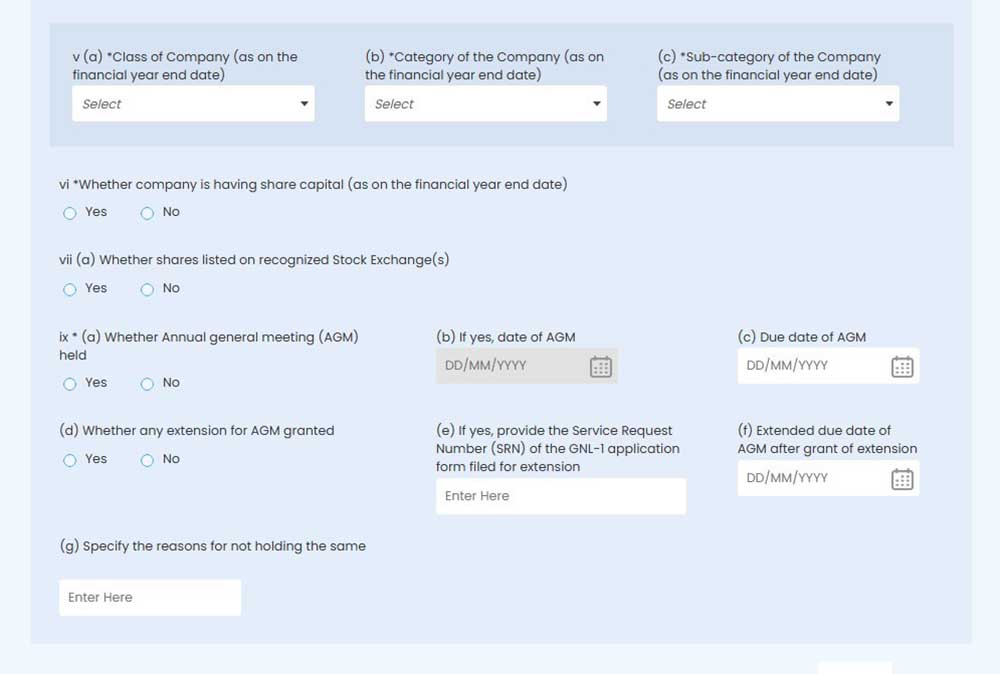

- (a) Furnish whether the Annual General Meeting (AGM) held

- (b) If yes, date of AGM

- (c) Due date of AGM

- (d) Whether any extension for AGM granted

- (e) If yes, provide the Service Request Number (SRN) of the GNL-1 application form filed for extension

- (f) Extended due date of AGM after grant of extension (DD/MM/YYYY)

- (g) Specify the reasons for not holding the

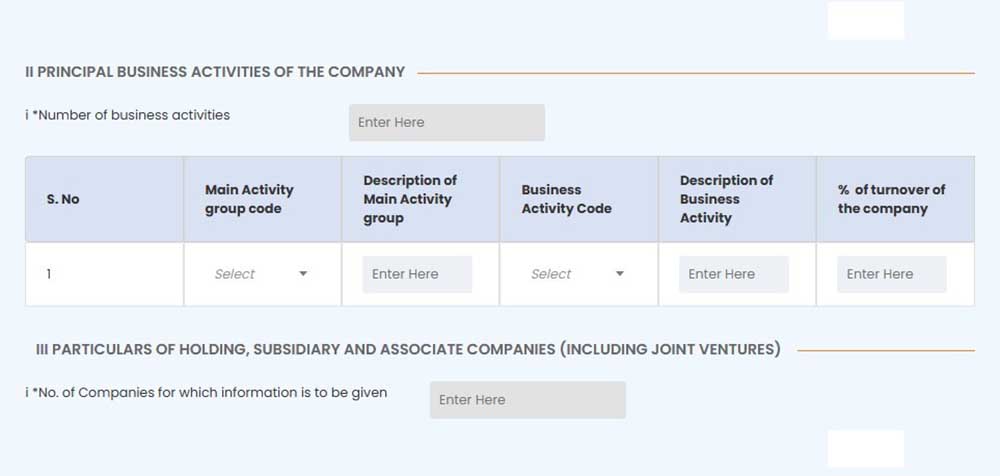

Step 3: Enter Principal Business Activities of the Company

- S.No

- Main Activity Group Code

- Description of Main Activity Group Code

- Business Activity Code

- Description Business Activity

- Company Turnover in Percentage

- Furnish Particulars of Holding, subsidiary and associate companies (including joint ventures) through the Excel template provided in the form. The prescribed Excel template will be downloaded, all required information will be filled in accurately, and the completed Excel file will be uploaded accordingly.

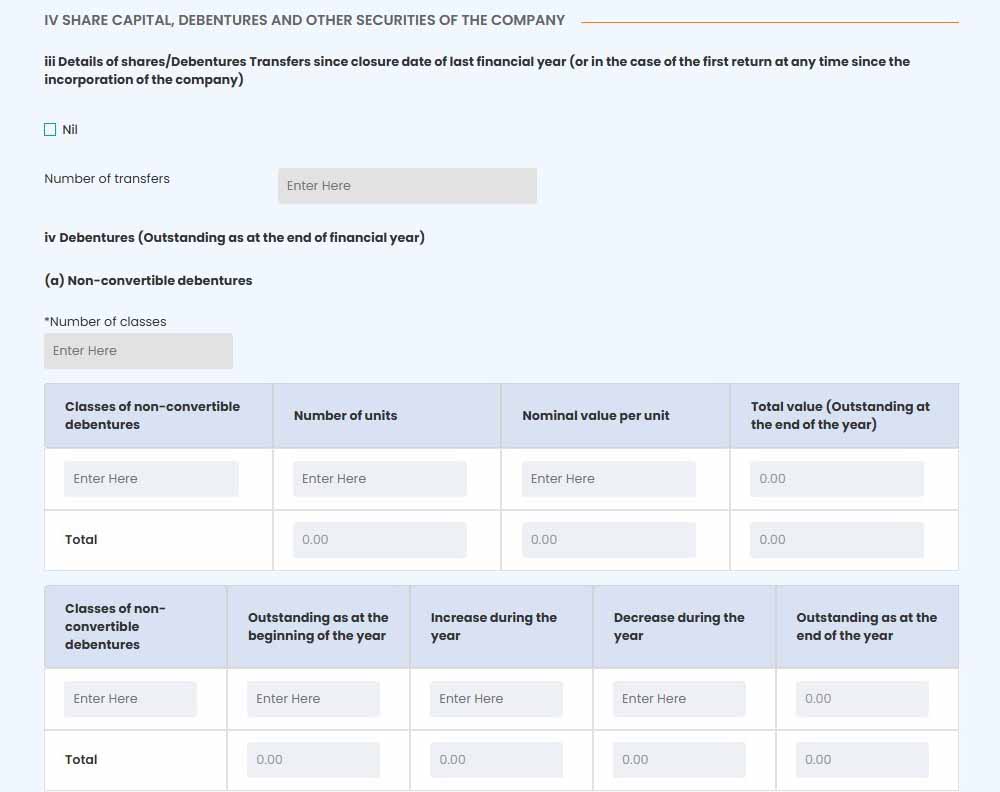

Step 4: Enter details of Share Capital, Debentures, and Other Securities of the Company

(i) Share Capital

- A. Equity share capital

- B. Preference share capital

- C. Unclassified share capital

- D. Break-up of paid-up share capital

- (i) Equity shares

- (ii) Details of stock split/consolidation during the year (for each class of shares)

- (iii) Details of shares/Debentures Transfers since the closure date of the last financial year (or in the case of the first return, at any time since the incorporation of the company) have been furnished using the prescribed Excel template. The template has been downloaded and all relevant information has been accurately filled in, and the completed Excel file has been uploaded as an attachment in the form.

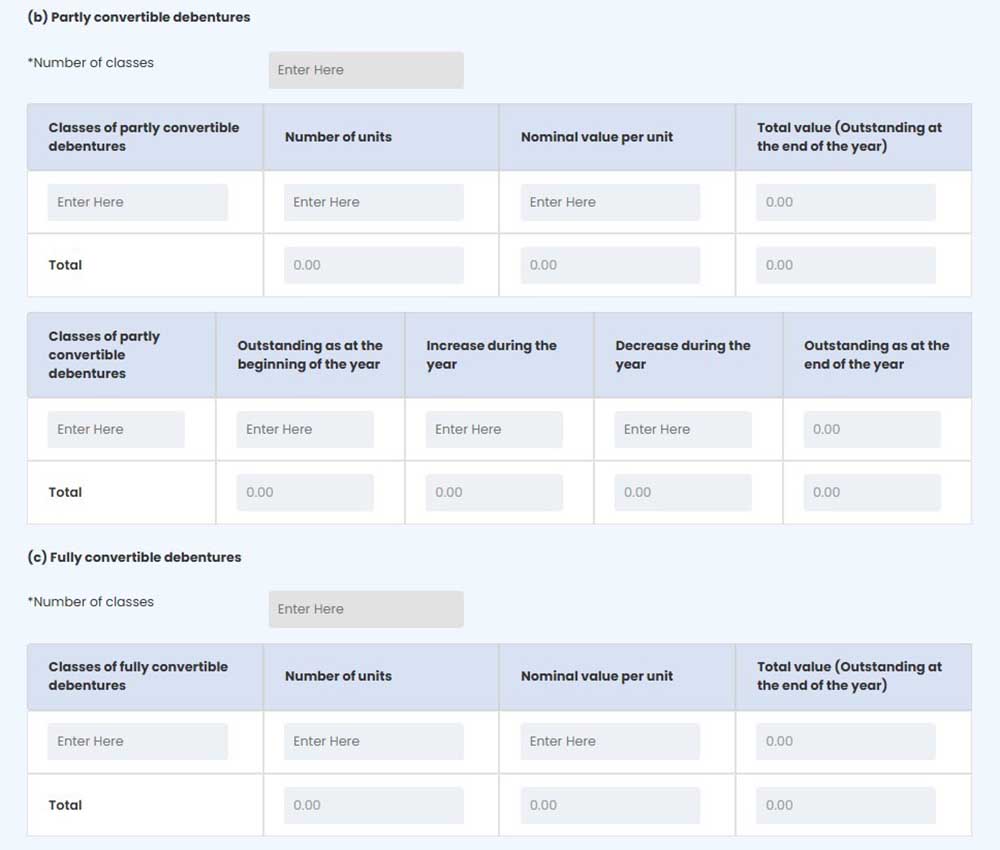

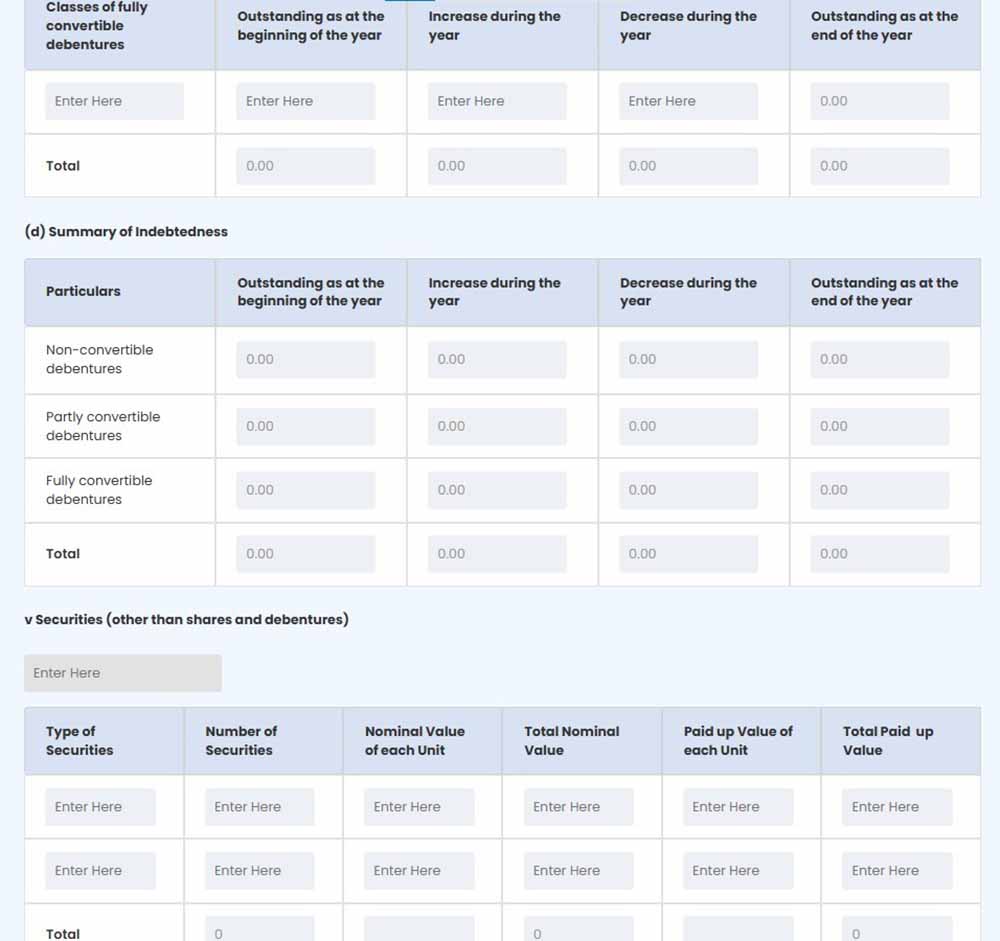

- (iv) Debentures (Outstanding as at the end of the financial year)

- (v) Securities (other than shares and debentures)

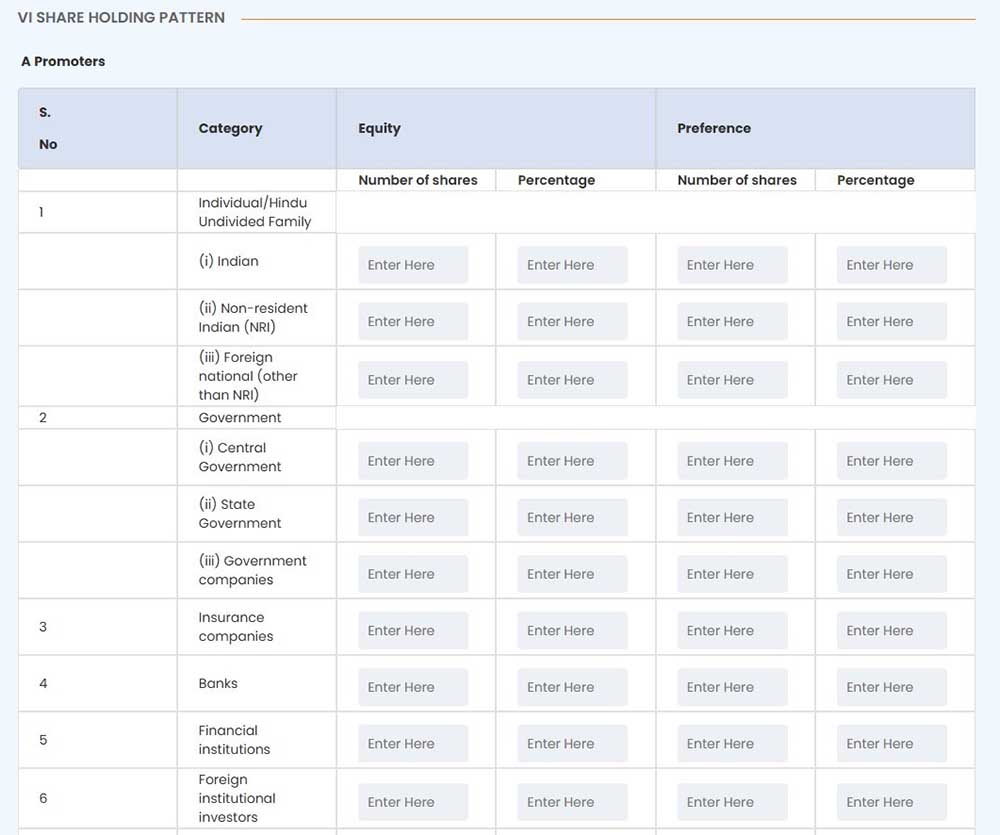

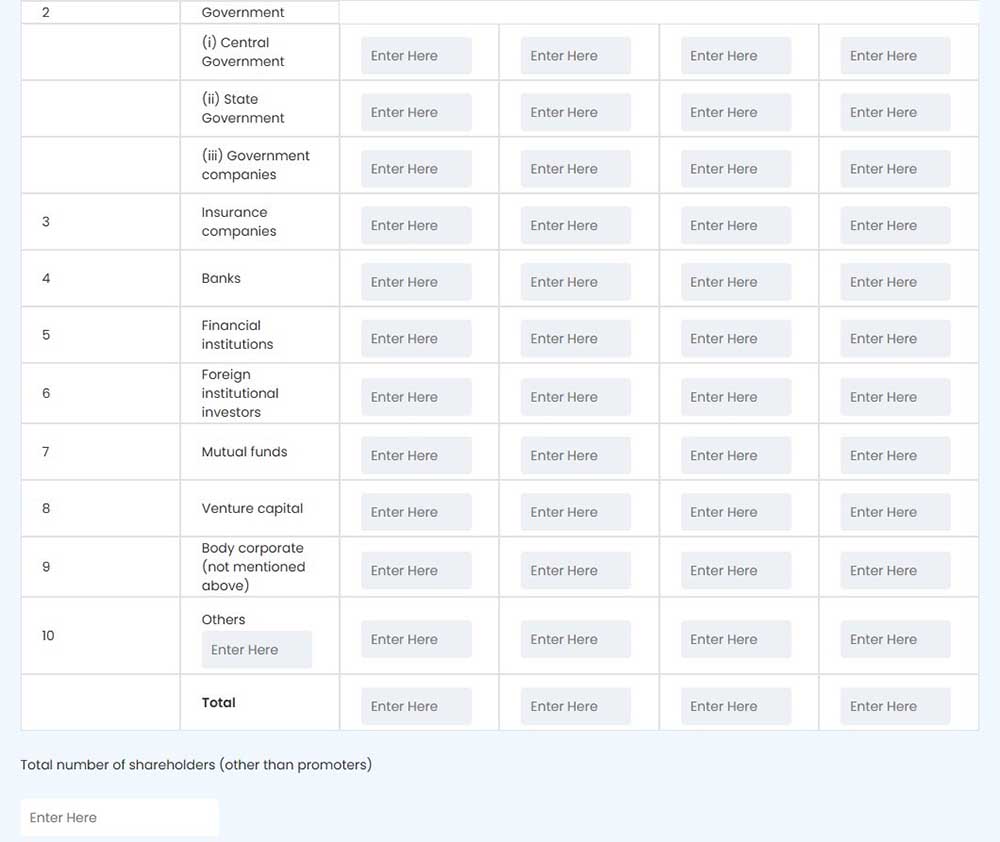

Step 5: Enter the turnover and net worth of the company. Next mention the shareholding pattern whether the shares are held by promotor shareholders or public other than promoter shareholders. Enter the details separately for Equity and Preference shareholders.

- Furnish details of foreign institutional investors’ (FIIs) holding shares of the company

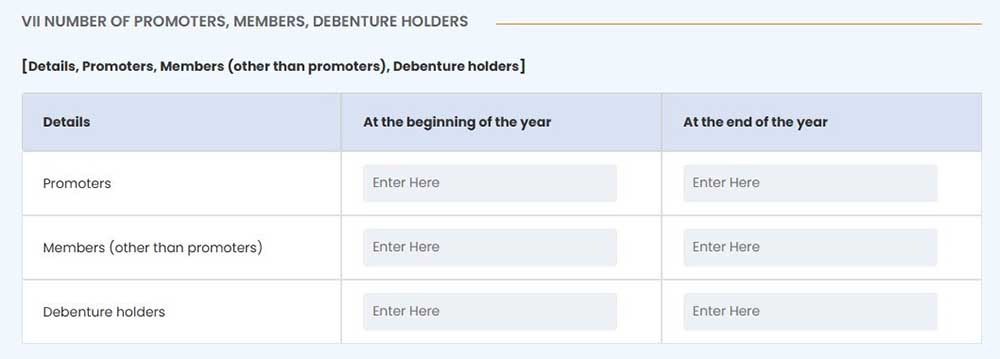

- Further mention Number of Promoters, Members, and Debenture Holders

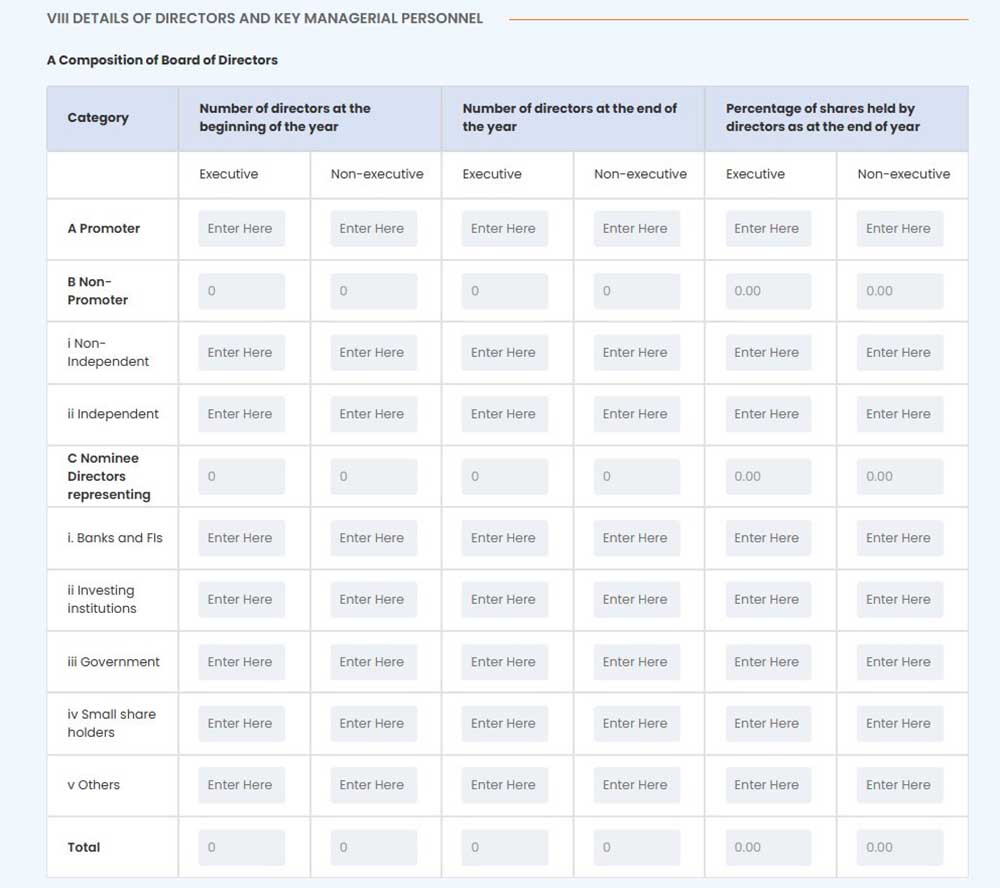

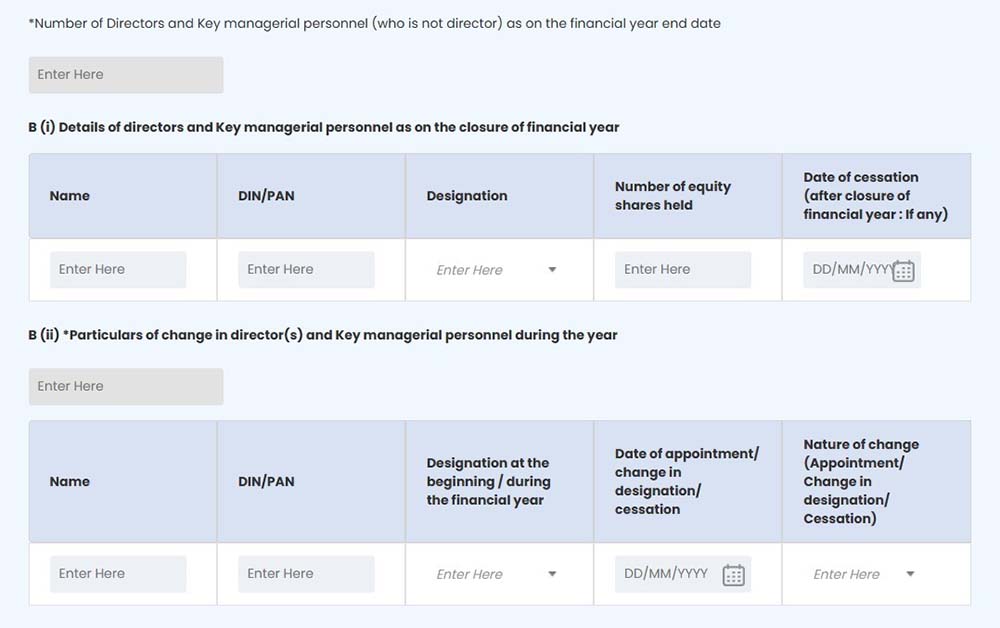

Step 6: Furnish details of directors and key managerial personnel, such as Composition of Board of Directors, Details of directors and Key managerial personnel as on the closure of the financial year and Particulars of change in director(s) and Key managerial personnel during the year.

Afterwards user needs to report details of meetings of members/class of members/ board/ committees of the board of directors via an Excel template that accompanies the form.

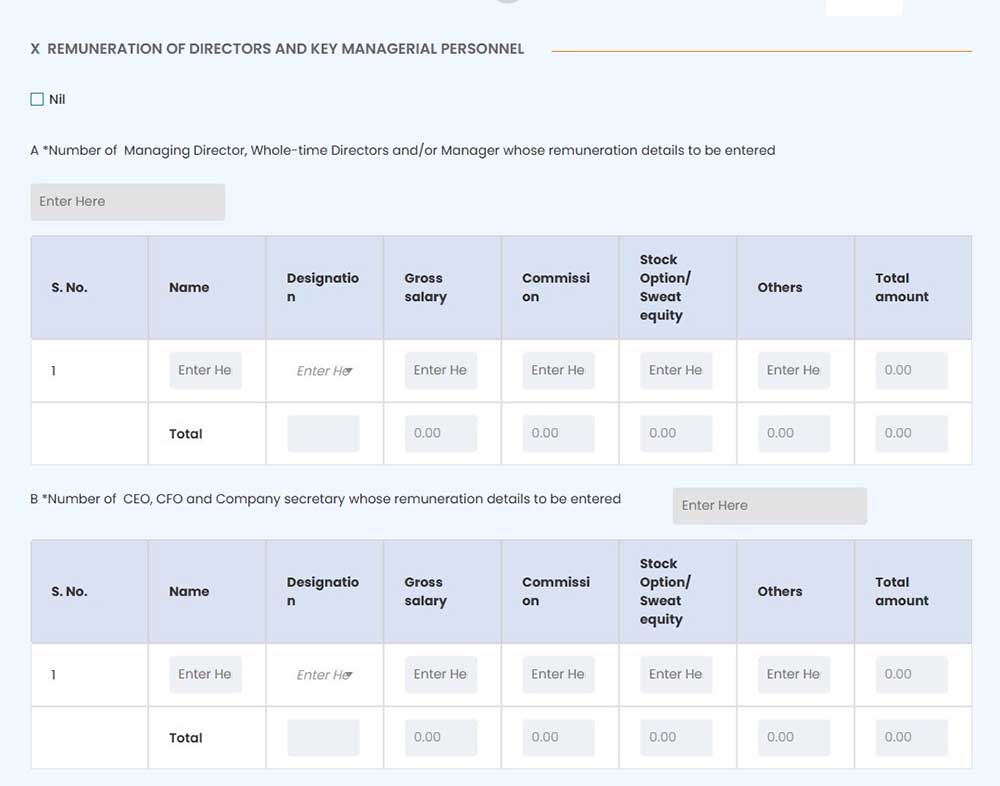

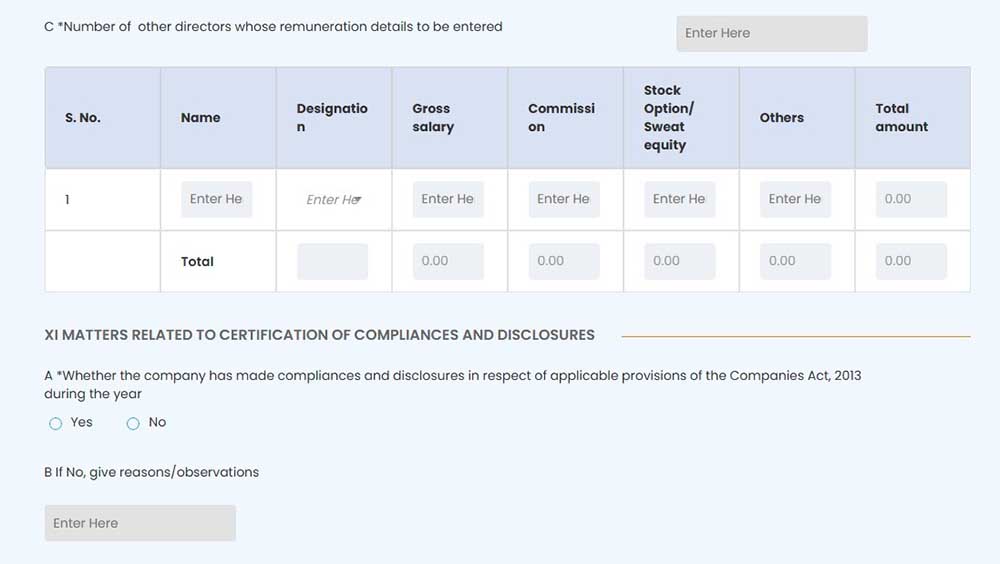

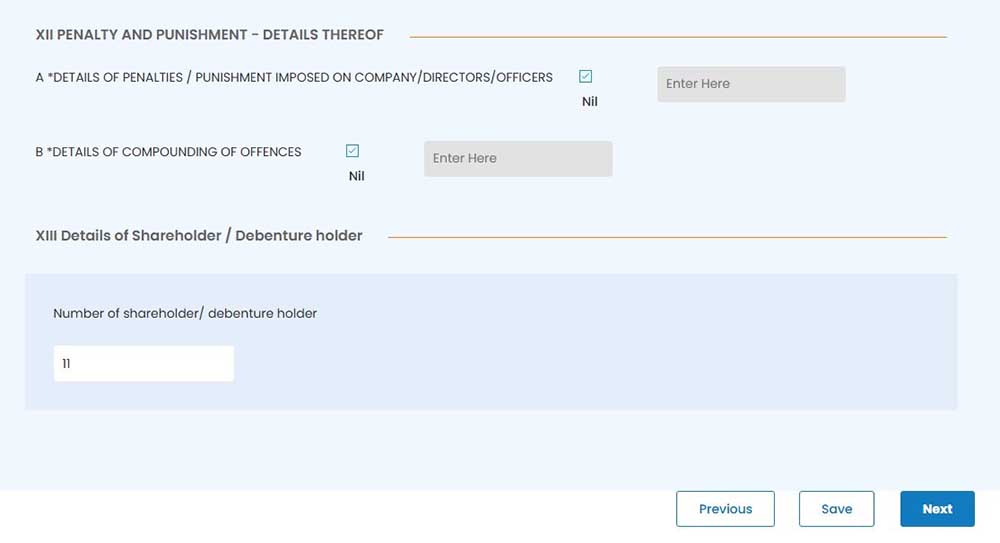

Step 7: Enter details regarding the remuneration of the director and Key Managerial Personnel. Furnish details of penalties /punishment imposed on the company/directors/officers, if any; otherwise, select the NIL option if there is no penalties /punishment imposed on the company/directors/officers. Next, enter the details of the shareholder/debenture holder.

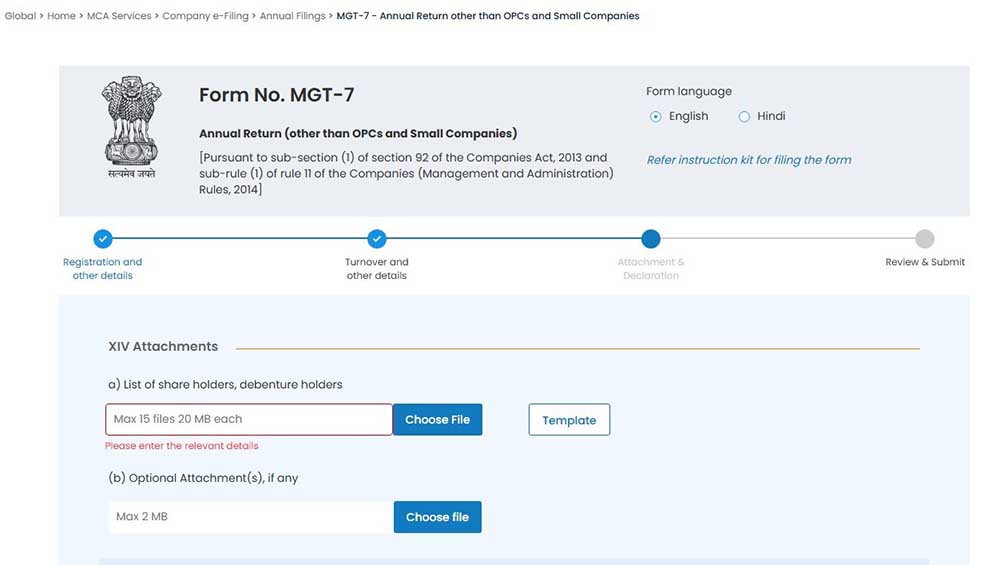

Step 8: The list of shareholders, debenture holders has been prepared using the prescribed Excel template. The template was downloaded, relevant details were filled in, and the completed file is attached as required.

Optional attachment: Any additional information that the user wants to provide can be provided through an optional attachment.

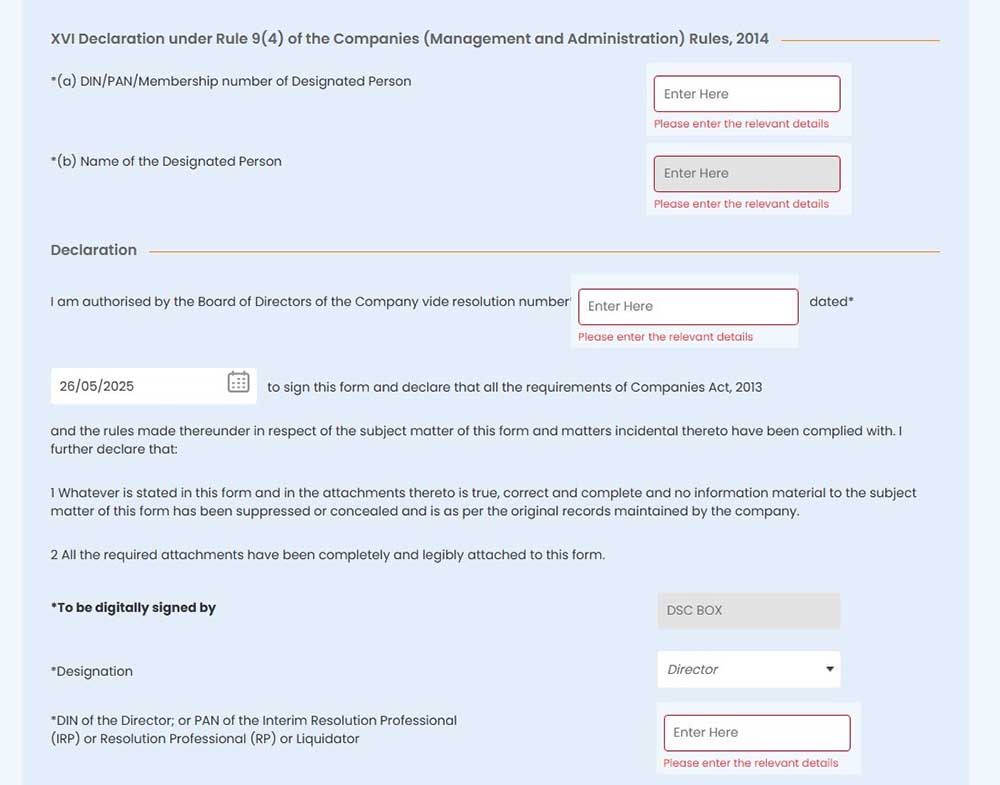

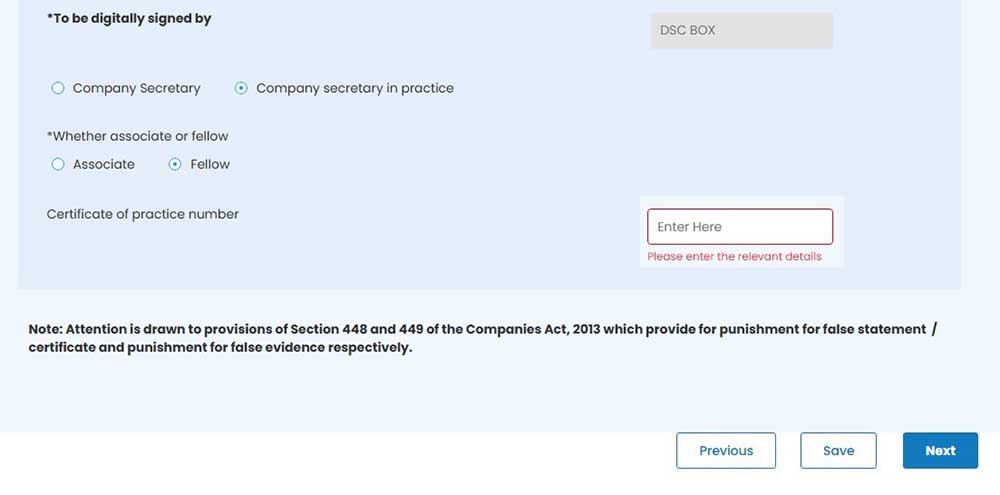

Step 9: Web form shall be digitally signed by the director, Liquidator, Interim Resolution Professional (IRP), or Resolution Professional (RP), as applicable. After completing all the required steps successfully, submit the form.

Mentioned Below Some FAQs Related to MGT 7 E-forms:

Q.1 – About the MGT 7 e-form?

The Company’s Annual Return form or MGT 7 form is required to be filed by every company. The form comprises of the company’s financial and non-financial details which are needed by the authorities.

Q.2 – When does the form need to be filed?

MGT-7 must file within 60 days from the date of the Annual General Meeting (AGM), or if the company does not hold the AGM, within 60 days from the last date by which the AGM was required to be held (typically September 30th). If the company doesn’t hold an AGM, form must be file within 60 days from the date the AGM should have been held (typically September 30th of the financial year).

Q.3 – How much fee is to be deposited along with Form MGT 7?

Mentioned below is the table presenting the amount which is to be paid to legal authorities along with form MGT 7:

| Nominal Share Capital | Normal Fee Applicable in Rupees |

|---|---|

| Less than 1,00,000 | INR 200 |

| 1,00,000 to 4,99,999 | INR 300 |

| 5,00,000 to 24,99,999 | INR 400 |

| 25,00,000 to 99,99,999 | INR 500 |

| 1,00,00,000 or more | INR 600 |

To be noted: For the companies not falling under any of the above-mentioned criteria, the fees along with MGT form is Rs. 200.

Q.4 – What is the penalty for the late filing of MGT 7?

As declared by Companies (Registration Offices and Fees) Second Amendment Rules 2018, the late filing of form MGT 7 will invite penalty of Rs. 100 per day of delay counted from the expiry of the due date of filing MGT 7.

Q.5 – What is the aftermath of not filing MGT 7 within the prescribed time period?

If the company is found guilty of not filing MGT 7 within the designated time limit then the company along with its key officials will be liable for paying Rs. 50,000 as a penalty. However, if the delay continues then the penalty of Rs. 100 per day will be payable until the amount reaches the maximum of Rs. 5,00,000.

Q.6 – What documents are required along with form MGT 7?

List of documents needed adjacent to form MGT 7:

- Approval letter for the augmentation extension of AGM, if applicable

- Photograph of registered office which includes an outside view of the building and a prominent sign showing the company’s name.

- List of shareholders, list of transfer of shares during the year to be attached via excel.

- Details about Shareholders, Board, and Committee meetings—including dates and attendance is collected via downloadable Excel templates that must be uploaded.

- MGT-8 certification if applicable, is now a linked form to MGT-7. Optional remarks can be added in the optional attachment

Optional: MGT-8 is a certificate given by Company Secretary in practice where the company is listed or its paid-up share capital is INR 10 Crores or more or Turnover is INR 50 crores or more.

Q.7 – Whose signatures are required to authenticate MGT 7?

When OPC is concerned – the signature by the company secretary on Form MGT 7 is required and if there is no company secretary for the firm then the signature is required by the director of the company.

When companies other than OPC are concerned – Form MGT 7 needs signatures from the director and the company secretary of the firm, if there is no company secretary then signature is required by the company secretary in practice.

Q.8 – Link to download form MGT 7?

E-form MGT 7 is available to download from MCA’s official website.

Solution for e-Filing MGT 7 Form

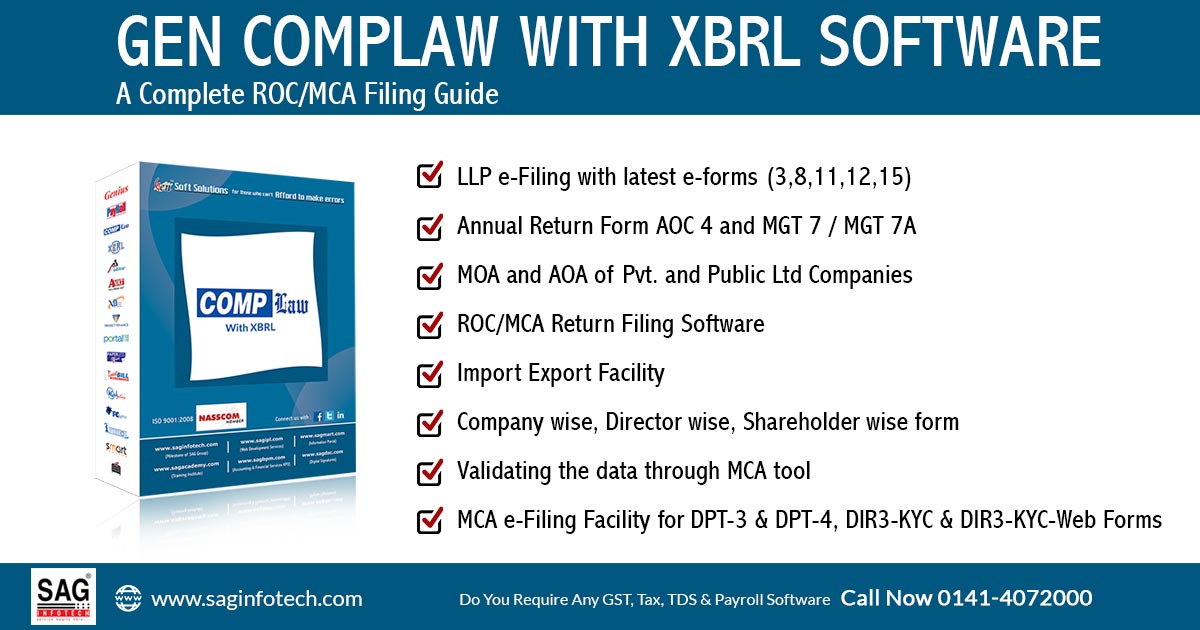

For all your filing-related compliance for the MGT 7 for MCA, the SAG Infotech is readily available to cater for you with the best of ROC/MCA filing software i.e. Gen CompLaw which is used by thousands of tax professionals across India. The Gen CompLaw is capable of minutes register and all the relevant ROC filing as per the due date and regulations

File MGT 7 Annual Return Form by Gen CompLaw XBRL Software

Gen Complaw ROC/MCA Software Features

HELP ME MGT FORM FILL UP