In a Controversial issue Authority Advanced Rulings (AAR) Karnataka Bench comes up with a ruling on 4th May and it states that The salary of a director in a company is not liable to be taxed under GST. However, This ruling by AAR Karnataka is opposite to a ruling given by the Authority of Advance Rulings (AAR) Rajasthan which came last month in a similar matter. The Applicant is Anil Kumar Agarwal and filed an application as an unregistered person to know whether salary to directors of a company attracts Goods and Service Tax (GST) or not. The applicant received a salary from a private company as a director of the same company, and that’s why seek clarification.

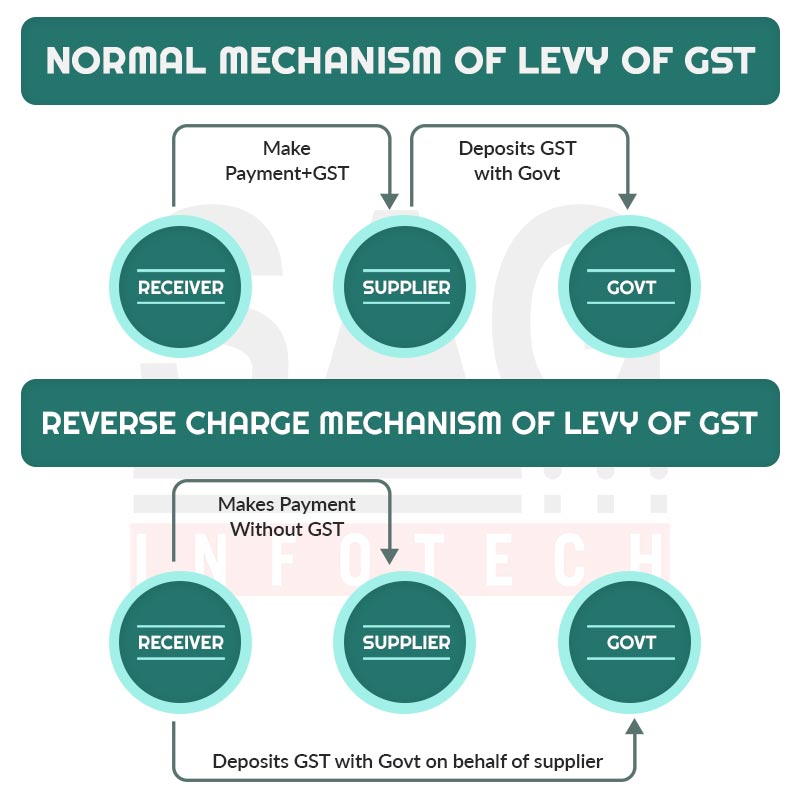

The AAR said in this matter that The GST can’t be levied when the director is an employee in the company however in the case of a non-executive director who is providing services to the company then the salary will attract GST. The ruling further added that in these types of cases RCM (Reverse Charge Mechanism)

AAR rulings are helpful in similar cases and this particular ruling will ensure that GST does not arise where salary paid to a full-time director, who plays an important role as a head managerial personnel in a company. In this matter, Sunil Gabhawalla, CA, and GST expert said, “Schedule III clearly excludes services by an employee from the purview of the GST. A long time ago, the Supreme Court has laid down the test of what constitutes an employer-employee relationship. It is heartening to see that this advance ruling, respects this test.”

Meanwhile, The bench also mentioned that there was a lack of documents from the applicant which was non-committal with respect to the specifics of Aggarwal’s case. The missing documents are any agreement between the applicant and company, appointment order, provident fund deductions details, etc. Thus, it is not being clarified that whether the applicant is receiving the salary as an independent director or as an employee. Authority of Advance Ruling (AAR)