The income of the taxpayer company emerged in India, as the payer, Genpact India, was also located in India. Hence, under the source rule u/s 5(2), the income obtained via the taxpayer company accrued or emerged in India. The method of furnishing technical services via the taxpayer and getting the payments that have the source in India under the aforesaid norms is obligated to tax.

The taxpayer, a UK company, furnished a cloud-based e-invoicing software solution and pertinent services. Genpact India allotted the authority to use this cloud-based service’s utility and paid the taxpayer Rs 3,31,98,980.

The taxpayer’s income was reported to be the receipt of subscription fees. The taxpayer’s Hungarian PE on 13th January 2009 entered into a Master services agreement with Genpact International Inc, a US company. Authority was granted to the taxpayer from the Master Service Agreement to assign or sub-contract the powers and obligations of the agreement to any affiliate of Genpact.

Therefore Tungsten entered into a statement of work (“SOW”) with Genpact India Pvt. Ltd. to deliver an exclusive e-invoicing portal license. The license allowed the e-invoices generation for a particular customer of Genpact India, Glaxo smith Kline Services Unlimited (“GSK”,) which operated outside of India.

For GSK the invoices generated by Genpact India are related to several European countries except India. The question is whether the income taxability of the taxpayer for furnishing the license for the right to use the cloud-based platform e-invoice portal.

The taxpayer a non-resident that has the income in India was obligated to tax if the source was in India. If the case and the sourced income in India were not categorized beneath the heads furnished in the DTAA, then the income shall levied to tax under the residual clause furnished taxing authority was provided to the source country in this matter to India under the pertinent DTAA.

It was carried out by the assessment order that the income obtained via the taxpayer company via Genpact India Pvt. Ltd. was taxed as fees towards the technical services in India being the income leviable to tax both as per the provisions of the income tax act and under the provisions of India-UK-DTAA.

As all the DRP objections were rejected the assessment order was passed. Apex Court in GVK Industries case (332 ITR 130) explained the source rule where in the Apex court it carried that the receipt income to be assessed or leviable in the country where the payment source was specified to clarify where the payer was located.

As per that the taxpayer’s company income has emerged in India as the payer i.e. Genpact India was too located in India. Hence the income received by the assessee company accrued or arose in India under the primary source rule under section 5(2).

Consequently the additional reference to considering the provisions u/s 9 was unwarranted for finding the changeability of income of the taxpayer under the provisions of the Income-tax Act. In another way just if the main sourcing rule u/s 5(2) is unable to prove the chargeability, a reference to considering rules u/s 9 was required.

As per the above principles, tax must be imposed in the aforesaid view of the material facts i.e. the process of providing technical services by the assessee and receiving payments having source in India.

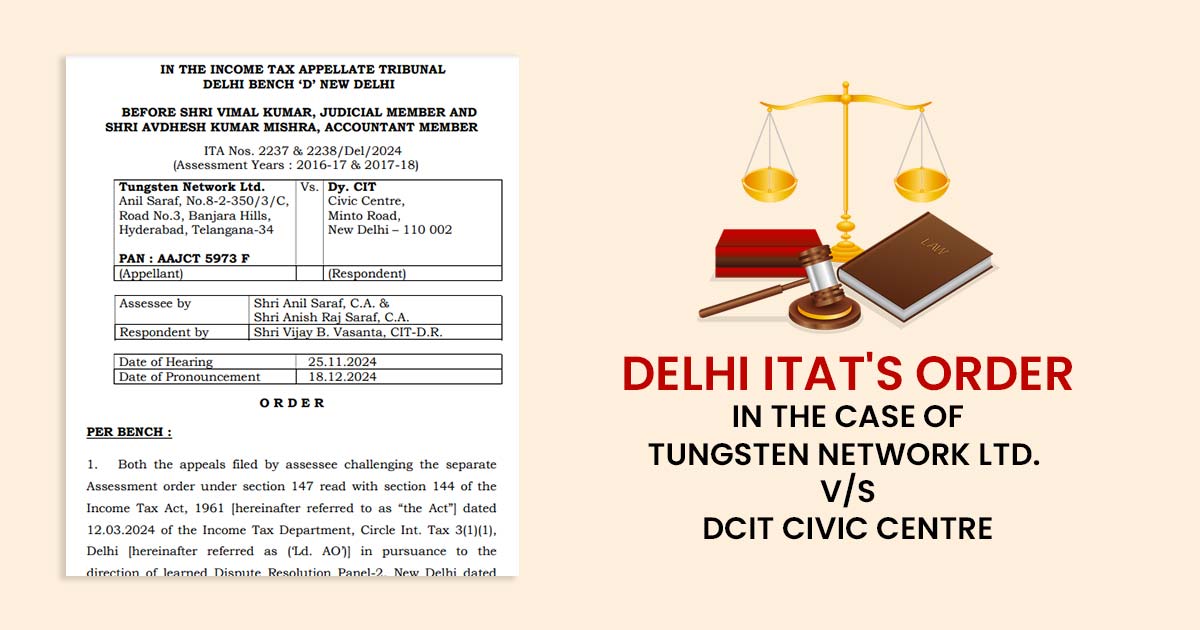

| Case Title | Tungsten Network Ltd. vs. DCIT Civic Centre |

| Citation | ITA Nos. 2237 & 2238/Del/2024 |

| Date | 18.12.2024 |

| Assessee by | Shri Anil Saraf, and Shri Anish Raj Saraf |

| Respondent by | Shri Vijay B. Vasanta |

| Delhi ITAT | Read Order |